Save And Pay For College

Learn How To Save For College And Pay For College.

56% of American families save for college, and even more put a high value on their children going to college. But saving and paying for college is complicated.

Before your child reaches college-age, you might want to save money for them to use for education. There are a lot of ways to go about doing this - and each has its pros and cons.

Then, you transition to college admissions, where there is a whole series of event that takes place - from college tours, to admissions testing, to accepting an admissions offer.

Finally, you have to figure out how to pay for it all - from grants to scholarships to student loans.

We have resources that covers each of these areas, and some are more in-depth than others.

College Savings Facts

Before we dive in to everything about saving and paying for college, let's cover some basic facts about financial aid in the United States:

- Number of 529 Plans: 16.41 Million

- Average 529 Plan Balance: $28,681

- Total Saved In 529 Plans: $471 Billion

- Total Invested In Coverdell ESA Plans: $7 Billion

- How Many Students Receive Need-Based Aid: 85%

- Average Need-Based Aid Awarded: $14,080

Saving For College

The majority of Americans want to save for college. The average 529 plan balance is $28,681 in 2024. Saving for college is a fantastic way to reduce the amount of student loans a family may need to cover the costs of college.

But there are a lot of variables:

- How much should you save for college?

- What if my child doesn't go to college?

- What types of account should I use?

The simple truth is that college is an investment - one that costs both time and money. The goal of this investment is to earn more over your lifetime than if you didn't go to college. But what if you spend too much, and those future earnings don't outweigh the alternative? That's a problem.

But if you save money and don't need to borrow to pay for that investment - it can be a worthwhile endeavor. Here are our main guides to saving for college:

Other College Savings Tools

College Admissions

When your child is in high school, it's time to start thinking about college admissions. We have an entire section dedicated to college admissions, but here's a resource guide.

College admissions starts with planning. Where should you go to college? What do you want to do? What can you afford?

Then you move into the college application process. This also includes college admissions testing (which is making a comeback).

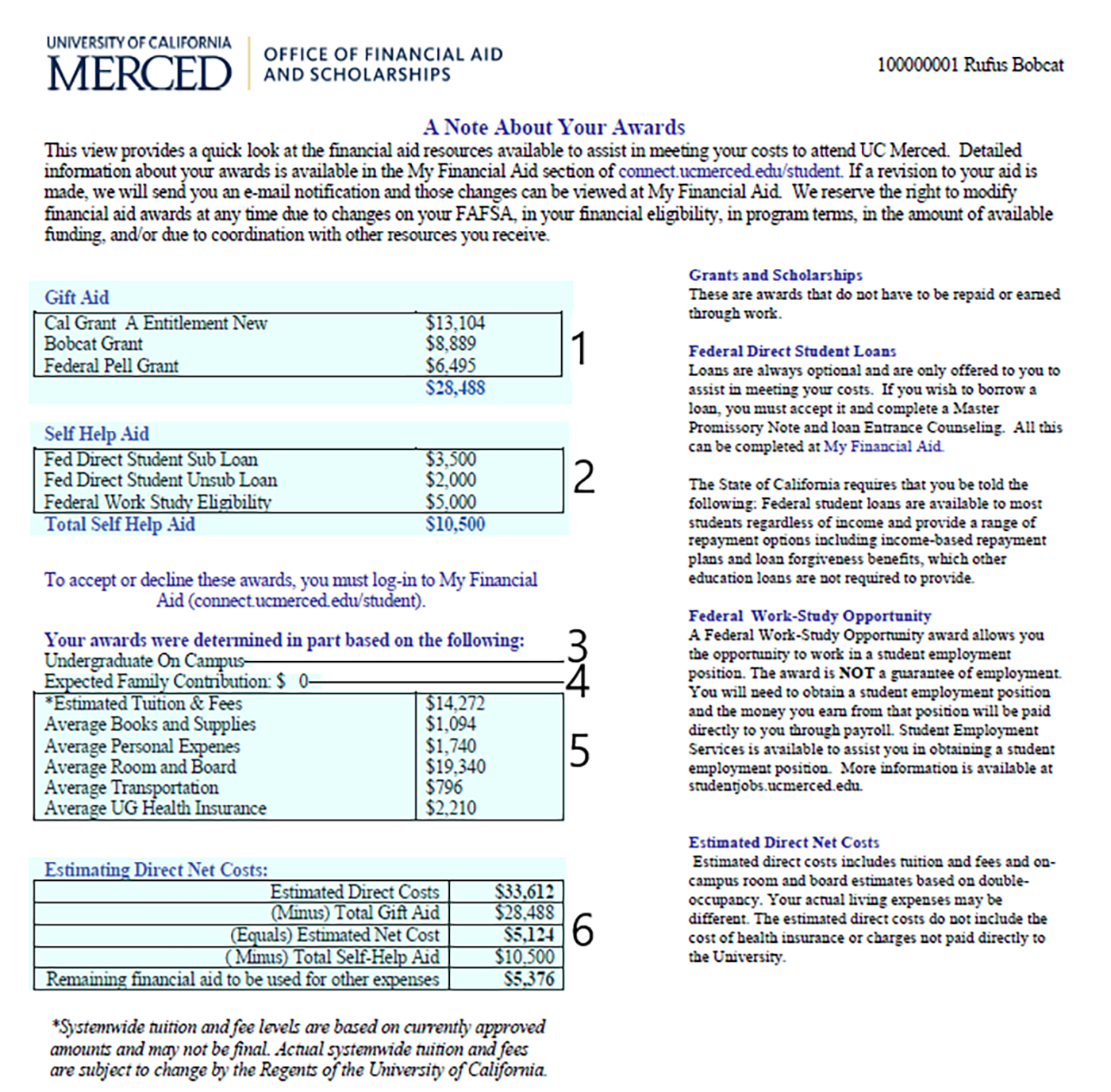

Paying For College And Financial Aid

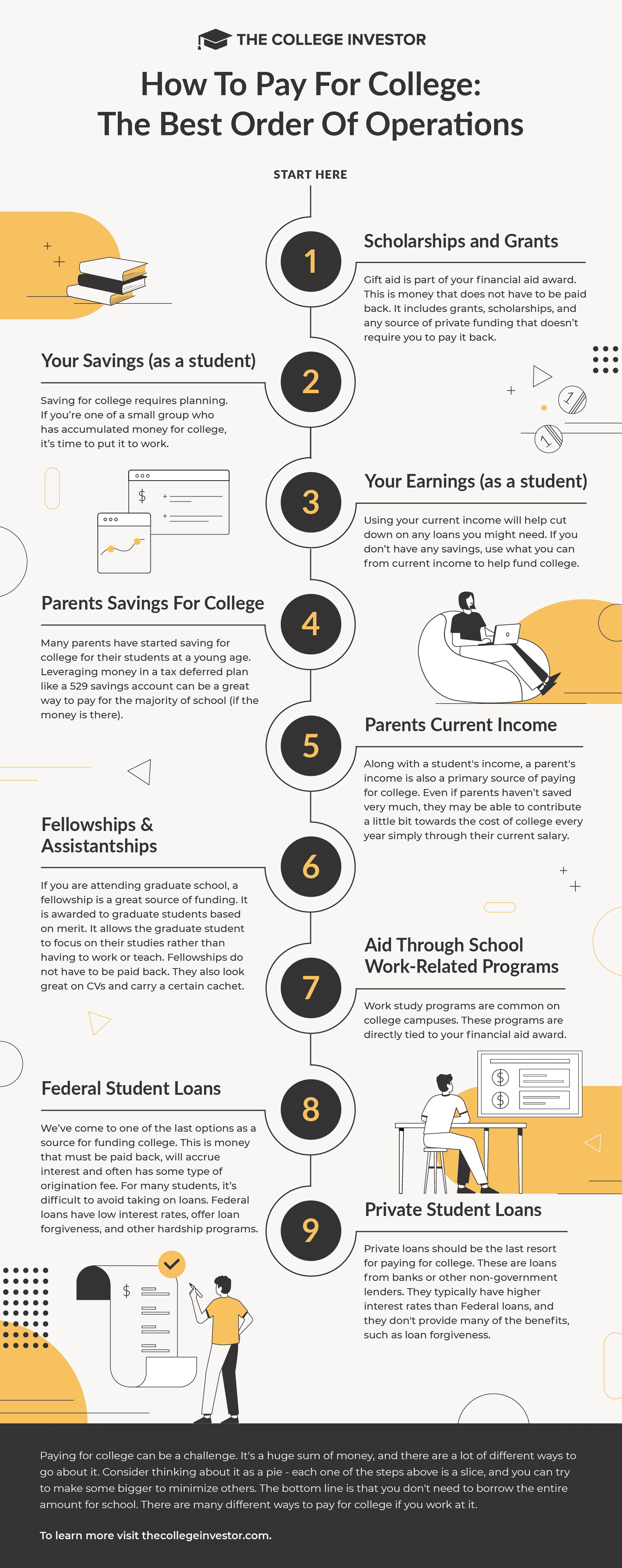

Paying for college is very different from saving for college. It's like the transition from saving for retirement to retirement - you actually have to start using the funds you've saved, and you also need to look at all the options available to you.

Paying for college is like a pie - there are a lot of slices. You want big slices of free money, so you can use little slices of loans.

Here's the best order of operations to pay for college:

Read More Financial Aid

We have many articles related to financial aid. Check out our full financial aid archive here:

Page 1 of 27

Page [tcb_pagination_current_page] of [tcb_pagination_total_pages]

Saving And Paying For College Terms And Definitions

Learn more about what these financial aid terms mean, from A to Z:

#

A

- ACT

- AP Credits

- Academic Scholarships

- Athletic Scholarships

C

- Campus Jobs

- Community College

- Cost of Attendance

- Coverdell Education Savings Account

- CSS Profile

D

E

F

- FAFSA

- Financial Aid

- Financial Aid Award Letters

- Financial Aid Office

- Financial Need

- For-Profit College

G

- Gap Year

- Gift Aid

- Grants

I

- In-State Tuition

- Income Share Agreement

- Interest Rate

L

M

- Merit Aid

- Merit Scholarship

- Military Education Benefits

N

- National Merit Scholarship

- Need-Based Aid

- Need-Blind Admissions

- Net Price Calculator

- Non-Profit College

O

- Out-Of-State Tuition

P

- Parent Loan

- PSAT

- Private Loan

- Private Scholarships

- Private University

- Public University

Q

R

- Residency Requirements

S

- SAT

- Savings Accounts

- Scholarships

- Scholarship Displacement

- Student Aid Report

- Student Loan Debt

- Subsidized Student Loans

T

- TEACH Grant

- Tuition

- Tuition Assistance Program

- Tuition Reimbursement Program

U

- Unmet Need

- Unsubsidized Student Loans

W

Editor: Colin Graves Reviewed by: Ashley Barnett