Unsubsidized Loans

Definition

Unsubsidized loans are a type of federal student loan where the borrower is responsible for paying all the interest, including while they are in school and during grace or deferment periods.

Detailed Explanation

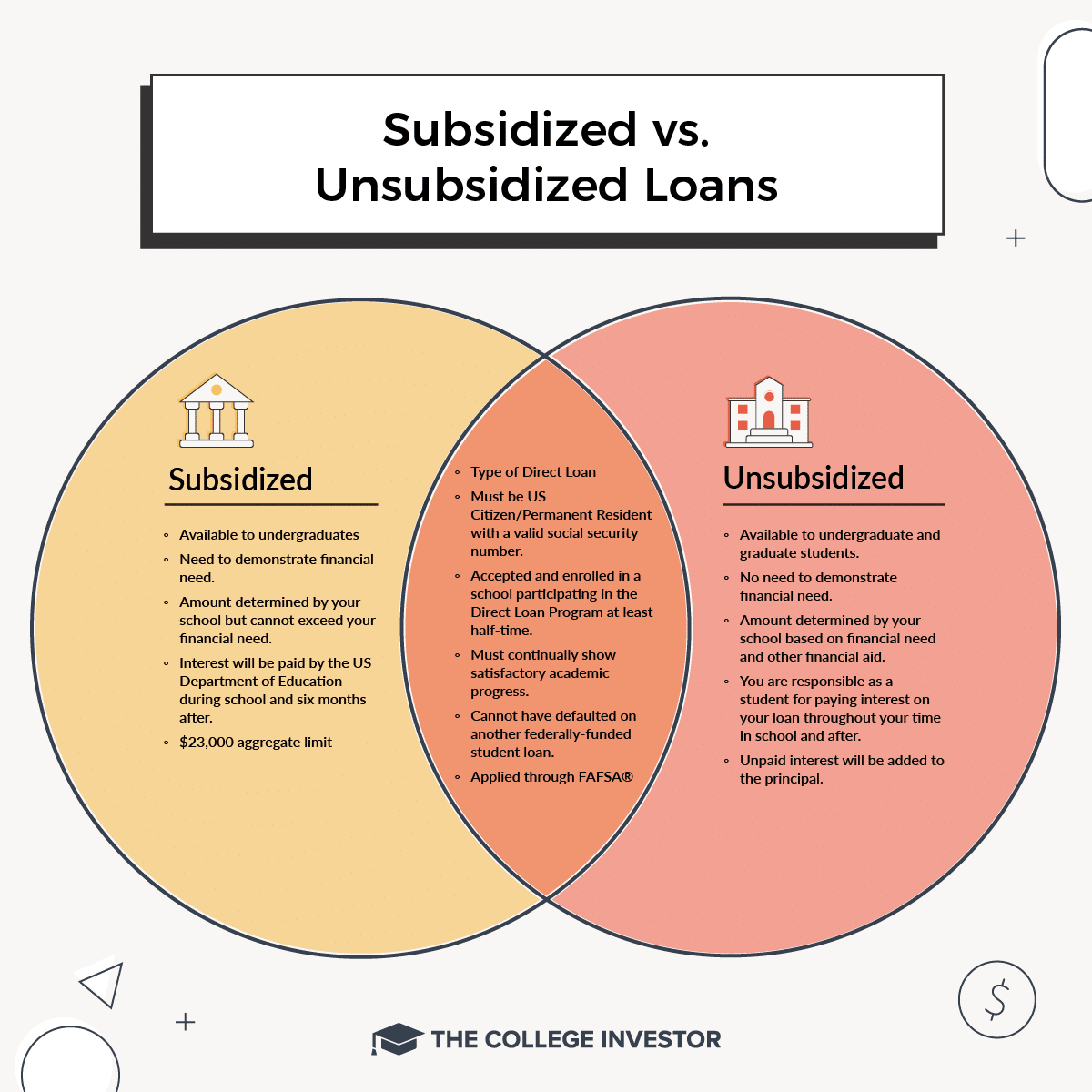

Unsubsidized loans are available to both undergraduate and graduate students regardless of financial need. Unlike subsidized loans, where the government pays the interest while the student is in school at least half-time, during the grace period, and during deferment periods, with unsubsidized loans, the interest begins to accrue from the time the loan is disbursed.

Borrowers have the option to pay the interest while in school or allow it to accrue and be capitalized (added to the principal amount of the loan) upon entering repayment. This can increase the overall amount owed over the life of the loan. Unsubsidized loans offer flexibility in borrowing amounts and are not strictly need-based, but they do require careful financial planning to manage the accruing interest and prevent the total debt from ballooning.

Example

An undergraduate student takes out an unsubsidized loan of $5,000 at an interest rate of 4.53%. If the student chooses not to pay the interest while in school, the interest will accrue and be added to the loan's principal amount, increasing the total amount to be repaid after graduation.

Key Articles Related To Unsubsidized Loans

Related Terms

Subsidized Loan: A federal student loan for undergraduate students with demonstrated financial need, where the government pays the interest while the student is in school and during other deferment periods.

Capitalization: The addition of unpaid interest to the principal balance of a loan, increasing the total amount owed.

Deferment: A temporary postponement of payment on a loan, during which interest does not accrue on subsidized loans but does accrue on unsubsidized loans.

Grace Period: A period, typically six months after graduation or dropping below half-time enrollment, during which borrowers are not required to make payments on their student loans.

FAQs

Can anyone apply for an unsubsidized loan?

Yes, unsubsidized loans are available to both undergraduate and graduate students, regardless of financial need.

How do I apply for an unsubsidized loan?

Students must complete the Free Application for Federal Student Aid (FAFSA) to be eligible for federal student loans, including unsubsidized loans.

Is there a limit to how much I can borrow with unsubsidized loans?

Yes, there are annual and aggregate loan limits, which depend on your year in school and dependency status.

What should I consider before taking out an unsubsidized loan?

Consider your ability to pay the accruing interest while in school to avoid capitalization, which increases the total repayment amount.

Editor: Colin Graves