There's an old aviation joke that asks "How do you make a million dollars in the airline business"? The punchline ("Start with two million dollars") is a bit of hyperbole but there is a kernel of truth to it. Much of the same can be said for investing in Bitcoin and other forms of cryptocurrency.

Unless you got in on the ground floor in the early 2010s or get incredibly lucky, you're unlikely to make any life-changing amounts of money in cryptocurrency.

In this article, we'll take a look at Bitcoin, what it means to invest in cryptocurrency and some alternatives that have a better track record of historical success.

What Is Bitcoin?

Because Bitcoin is the oldest and most popular form of cryptocurrency (introduced in 2009), many people use the two terms interchangeably. But Bitcoin is just one form of cryptocurrency — some other forms are Ethereum, Litecoin or Dogecoin. Cryptocurrency is a form of digital currency that is backed by a form of cryptography often referred to as the blockchain. Because of the way that cryptocurrencies are set up, they are nearly impossible to counterfeit.

There are a few ways that you can invest in Bitcoin and cryptocurrency. The easiest way to invest in Bitcoin is to simply get a Bitcoin wallet and buy Bitcoins. We recommend Coinbase for U.S. investors – it’s the easiest, links to your bank account, and allows you to buy and sell Bitcoins. Plus, if you open an new account, Coinbase will give you a $5 Bitcoin bonus when you make your first trade!

Another way is to If you want to invest in an ETF through your broker, check out the GBTC. This ETF tracks Bitcoin, and you can invest in fractional shares.

Another option is mining for Bitcoins, since as long as the markets remain active you can basically make money for nothing. But the problem is, mining is such a tough gig now that it is hardly worth it. Turning your computer into a miner will likely make it noisy and heat up. It would likely take you a long time to even mine a single Bitcoin, by which time you probably would have spent more on electricity.

Keep in mind that investing in Bitcoin is incredibly volatile. For almost all people, it is not a good idea to invest the majority of your portfolio in any form of cryptocurrency. If you really want to dabble in crypto investing, set aside a small portion of your investments — only enough that you would be comfortable losing entirely.

When You Would Have Needed To Invest in Bitcoin To Be A Millionaire

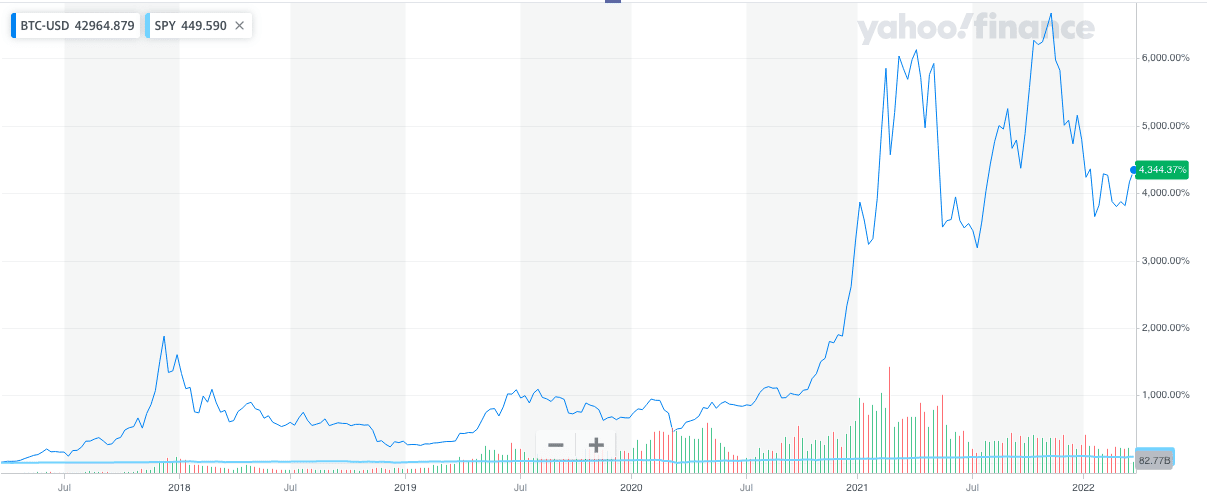

The history of Bitcoin is volatile and turbulent. Long gone are the days that you could make a token investment in Bitcoin and become a bitcoin millionaire seemingly overnight.

To give you a bit of context:

- Investing $10 in Bitcoin in January 2011 would have turned into $1.2 million by March 2022.

- You'd have needed to invest $160 in Bitcoin in January 2012, $440 in January 2013 or $24,000 in January 2014 to have that same amount.

- By January 2018, you'd have needed to invest nearly $450,000 in Bitcoin in order to have $1.2 million today.

Over the last few years, we've seen a smaller and smaller rise in the price of Bitcoin. This doesn't mean that there isn't money to be made, but gone are the chances you can turn $10 into $1,000,000.

The "Risks" Of Becoming A Bitcoin Millionaire

Even if you had invested in Bitcoin way back then, it would have taken nerves of steel to hold onto it through the year. Looking at the historical BTC chart, you'd have had to survive and hold through several periods where your investment lost nearly 50% of its value within the period of a few weeks.

With hindsight, it's easy to say that "it's just $10" if that's all you invested originally. But would you have been willing to not panic when your Bitcoin portfolio had gotten up near $1M and dropped hundreds of thousands of dollars overnight?

Another risk of having all of your money in Bitcoin is finding places that will accept it as payment for goods and services. While it is becoming more and more prevalent to find a business that will accept cryptocurrency as payment, it is still relatively rare. You're not likely to be able to get bread and milk from the corner store by paying with crypto. Instead, you'll have to change your currency, likely incurring additional fees and taxes.

Alternatives To Winning Big In Crypto

If you are an individual of "normal" risk tolerance, Bitcoins probably don’t excite you too much. The risk/reward profile of the Bitcoin market is not going to be very appealing to the savvy investor. This is just a chance to either make a quick buck, or lose everything.

That is one reason why most savvy investors will keep the majority of their money in reliable investments like index funds.

Plus, depending on when you started investing, index funds may outperform Bitcoin anyway.

For example, From March 2021 to March 2022, you'd see the following returns:

- Bitcoin: -21.28%

- S&P 500: +14.49%

You would have done remarkably better investing in simple index funds over the last year than Bitcoin.

The Bottom Line

Any time people see investments with meteoric returns, it's common to try and duplicate what happened in search of the next "home run". This includes investing in Bitcoin, other forms of cryptocurrency or "meme stocks" like Gamestop or AMC.

It's a much better financial strategy to try for "singles" or "doubles" with the majority of your portfolio with things like index funds that have reliably given solid returns.

If you have the majority of your portfolio in index funds or other similar investments, that can give you peace of mind to know that the majority of your funds are enough for your retirement. Then you can invest a small portion of your portfolio in riskier investments like cryptocurrency, meme stocks, risky real estate ventures or other high risk/reward plays. Just don't risk more than you're willing to lose completely.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller