Tiller Money allows you to budget, tracking your net worth, follow your investments, and more - all in a spreadsheet.

Are you looking for a financial management tool that puts you in control of how you think about, visualize, and categorize your finances? Are you naturally a spreadsheet junkie?

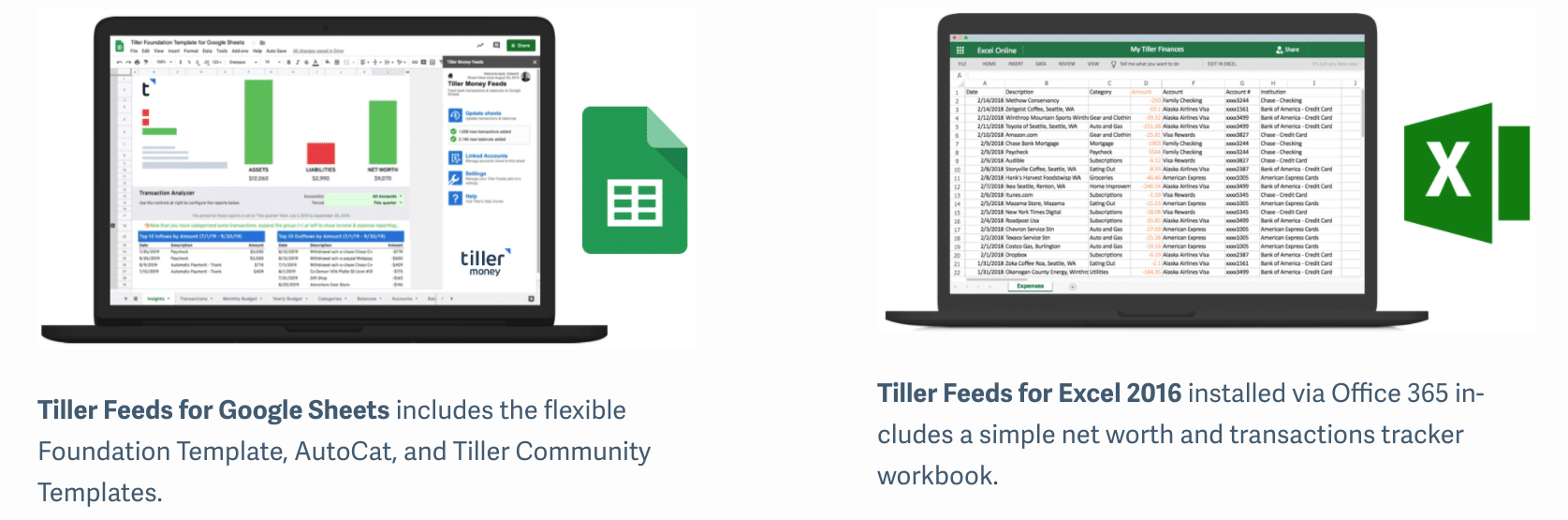

Tiller is that tool. It automatically populates a Google spreadsheet or an Excel workbook with your financial transactions and account balances. Then, as a user, you can manipulate the information any way you want.

Does Tiller sound like the financial “app” for you? Here’s what you need to know about it in our Tiller Money review. See how Tiller compares to the other top money management apps out there.

Tiller Details | |

|---|---|

Product Name | Tiller |

Pricing | $79/year |

Platform | Google Sheets or Excel |

Promotions | 30-Day Free Trial |

What Is Tiller Money?

Tiller Money is a tool that automatically feeds transactions and balances to a spreadsheet (either in Excel or Google Sheets). It allows you to track all parts of your financial life in one place.

Tiller was founded in 2016 and is located in Seattle, WA.

In 2024, we named Tiller as one of our Editor's Picks for Best Budgeting Apps because of how robust and customizable it is for your own budgeting personality.

What Does It Offer?

Tiller Money is a special “app” because it offers users the ability to put their own unique spin on their finances. Are you focusing on reducing your grocery bill? You can make a tab specifically dedicated to tracking grocery expenditures.

Are you figuring out exactly how much money you can send towards your student loan or towards investments? Tiller can help with that.

A lot of people who love to “nerd-out” with finances already put their information into a spreadsheet. Tiller simply makes this process easier by putting all the information in a single place.

Free And Customizable Templates

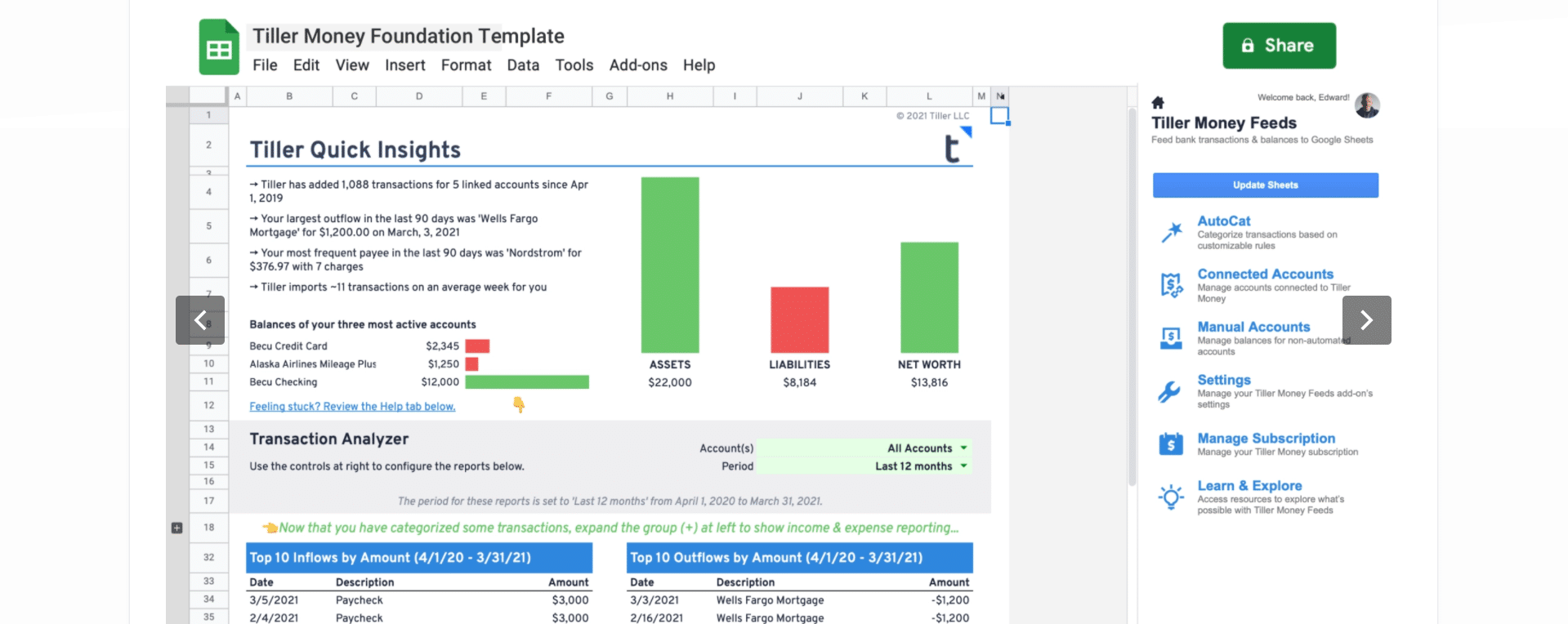

The “basic” installation of Tiller includes a “Foundation Template” which functions like an all-in-one dashboard. You can see your top 10 sources of income, top 10 sources of spending, your budget, net worth, and more. Note that the Foundation Template is only available as a Google Sheet.

On top of the “Foundation” template, Tiller offers supreme flexibility, because you can build or tweak the spreadsheet to your liking. The company also provides access to dozens of templates that have been built by members of the Tiller Community.

Want to track your net worth over time? Tiller can help. Want to make a budget based on your income from last month? You can use Tiller to do that too. In some ways, it's a “build-your-own” tool for people who really like to nerd-out on their finances.

Bank Sync And Transaction Categorization

When most people think of spreadsheet-based budgets, they think "manual entry required" and "labor-intensive." But neither of those things are true with Tiller. Tiller can sync with over 21,000 banks, brokers, mortgage companies, and more to pull all of your financial transaction data in automatically.

To take advantage of this time-saving feature, you simply need to add the "Tiller Feeds" add-on for Google Sheets or Excel. This add-on is pre-installed into the Tiller Foundation template that you can access from your Tiller Console.

Tiller's "AutoCat" feature offers 100% customizable auto-categorization inside Google Sheets. The customization options are really advanced, especially when compared to other budgeting tools. For example, Tiller says that you could have AutoCat file all of your grocery store transactions that are above $10 as "groceries" and under $10 as “Snacks."

Link Up To Five Spreadsheets

Tiller Money has some very high-quality budgeting, debt-payoff, and financial independence sheets. However, I think the best feature is the supreme flexibility. Users can build and connect up to give sheets at a time. For example, you could use one spreadsheet for personal budgeting, another for business budgeting, and another for tracking your net worth.

I use Tiller to track transactions for two rental properties, two small businesses, and my family’s finances. This makes it super easy to prepare profit and loss statements for tax time, budget on a variable income, and plan short-term savings and investments without needing a separate account for every single savings goal.

Painless Budget Collaboration

It's easy to track shared finances with Tiller. This is especially true since it can integrate with Google Sheets which is built from the ground up with a heavy focus on real-time collaboration.

My spouse and I have love using Tiller together. While I had to push him to start using it at first, we now use it collaboratively when making joint decisions. He also uses it independently to run his business finances (he uses the Tiller Business Template for this).

No Mobile App

While both Google Sheets and Microsoft Excel have mobile apps, Tiller itself doesn't. This means that while you can view your Tiller sheets and even manually edit them from your phone, you won't be able to pull in new bank data or run AutoCat.

If you want to view your budgets on a tablet, Tiller recommends that you use the Safari browser instead of the Google Sheets or Excel mobile apps. By doing so, you'll be able to access the Tiller Feeds add-on and the full suite of features that are available on a computer.

How Much Does It Cost?

Tiller costs $79 per year. All users get a free 30-day trial.

How Does Tiller Money Compare?

The thing that makes Tiller great is its flexibility. But this can also be its downfall. If you don’t know what you want out of a personal finance system, you may be overwhelmed by Tiller. And it may not be as intuitive for some people.

If you spend your work life inside of spreadsheets (for example, you work in finance, accounting, or data science), building out a “Tiller” sheet will be easy for you. But if that isn’t your background, Tiller may feel like an over-engineered product.

Also, keep in mind that if you prefer to predominantly manage your finances on the go, you may want to choose a different budgeting platform that offers a full-fledged a mobile app. Here's a closer look at how Tiller compares:

Header |  |  |  |

|---|---|---|---|

Rating | |||

Pricing | $79/yr | $11.99/mo or $84/yr | Free |

Budgeting | |||

Investment Tracking | |||

Retirement Planning | |||

Mobile App | |||

Cell |

How I Open An Account?

You can get started with Tiller Money by visiting its website here. From there, you can sign up with your Google account. Once you've created your profile and started your 30-day free trial, you can launch the Foundation template (or a different template) and begin linking your bank accounts.

Is It Safe And Secure?

Yes, Tiller protects its customer data with 256-bit AES encryption. It also uses Yodlee to pull data from financial institutions. Yodlee is a trusted platform that's used by 15 of the 20 largest banks in the United States.

Tiller doesn't store any of your bank credentials and none of its employees are able to see your transaction or account balance data. It also supports two-factor authentication (2FA) to help keep your account secure.

How Do I Contact Tiller Money?

Tiller Money doesn't have a customer service number. However, it does have a robust Help Center and it offers live chat and email support from 6 AM - 3 PM (PST), Monday through Friday. You can reach out via email at support@tillerhq.com.

Why Should You Trust Us?

I’ve personally used Tiller for my personal and business expenses for over two years, and I continue to pay for it because it gives me exactly what I want in a spending app. It makes it easy for me to make tax reports, to make a household budget for our family that has a variable income, and to track my net worth. But I’m a nerdy person, and getting into the details of my finances works for me.

Combine my personal experience with that of our amazing team of editors and testers, and we have over 100 years of combined experience using, reviewing, and testing budgeting apps and tools!

Who Is This For And Is It Worth It?

If you’re the type of person who gets delight from a beautiful visualization, or who wants to think about their money through different lenses, Tiller is the perfect tool for you. On the other hand, if everything I said makes you feel sick, forget Tiller. Quicken, Monarch, Empower, or some other tool will work better for you.

You can also check out our full list of the best budgeting apps here.

Tiller Money FAQs

Here are a few of the most common questions that people ask about Tiller:

Does Tiller Money have ads?

No, Tiller only makes money by charging its annual subscription fee and never shows ads.

Does Tiller provide credit score monitoring?

No, unlike Quicken, Tiller doesn't show customers their credit scores or provide monitoring services.

Can you import your Quicken data into Tiller?

Yes, you can export your Quicken transactions as a CSV data file which can then be imported into a Tiller sheet.

Does Tiller have a free tier?

No, Tiller has just one plan which costs $79 per year after 30 days.

Tiller Money Features

Price | $79/yr |

Budgeting | Yes |

Income Tracking | Yes |

Expense Tracking | Yes |

Bank Integration | Yes, 21,000+ financial institutions |

Investment Tracking | Yes |

Credit Score Monitoring | No |

Bill Pay | No |

Tax Preparation | No |

Import Bank Data Files | Yes |

Customer Support Options | Email and chat |

Customer Support Hours | Mon - Fri, 6 AM - 3 PM (PST) |

Web/Desktop Accessibility | Yes |

Dedicated Mobile App | No |

Promotions | 30-day free trial |

Tiller Money Review

-

Product Cost

-

Ease of Use

-

Customer Service

-

Tools and Features

Overall

Summary

Tiller is a personal finance program that allows you to create the ultimate budgeting and money spreadsheets. These spreadsheets can be customized, auto-updated, and much more!

Pros

- Customizable spreadsheet-based budgeting and financial planning tool

- Your choice of Google Sheets or Excel

- Can be automatically updated

Cons

- Requires some knowledge of spreadsheets

- $79 per year after free trial

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Clint Proctor Reviewed by: Robert Farrington