Today, most discount brokerages offer free trades on most US-based stocks, ETFs, mutual funds, and bonds. Whether you’re a long-run investor or an active day trader, it's easy to find a platform like Moomoo that offers free trades on most securities and an easy-to-use platform to execute those trades.

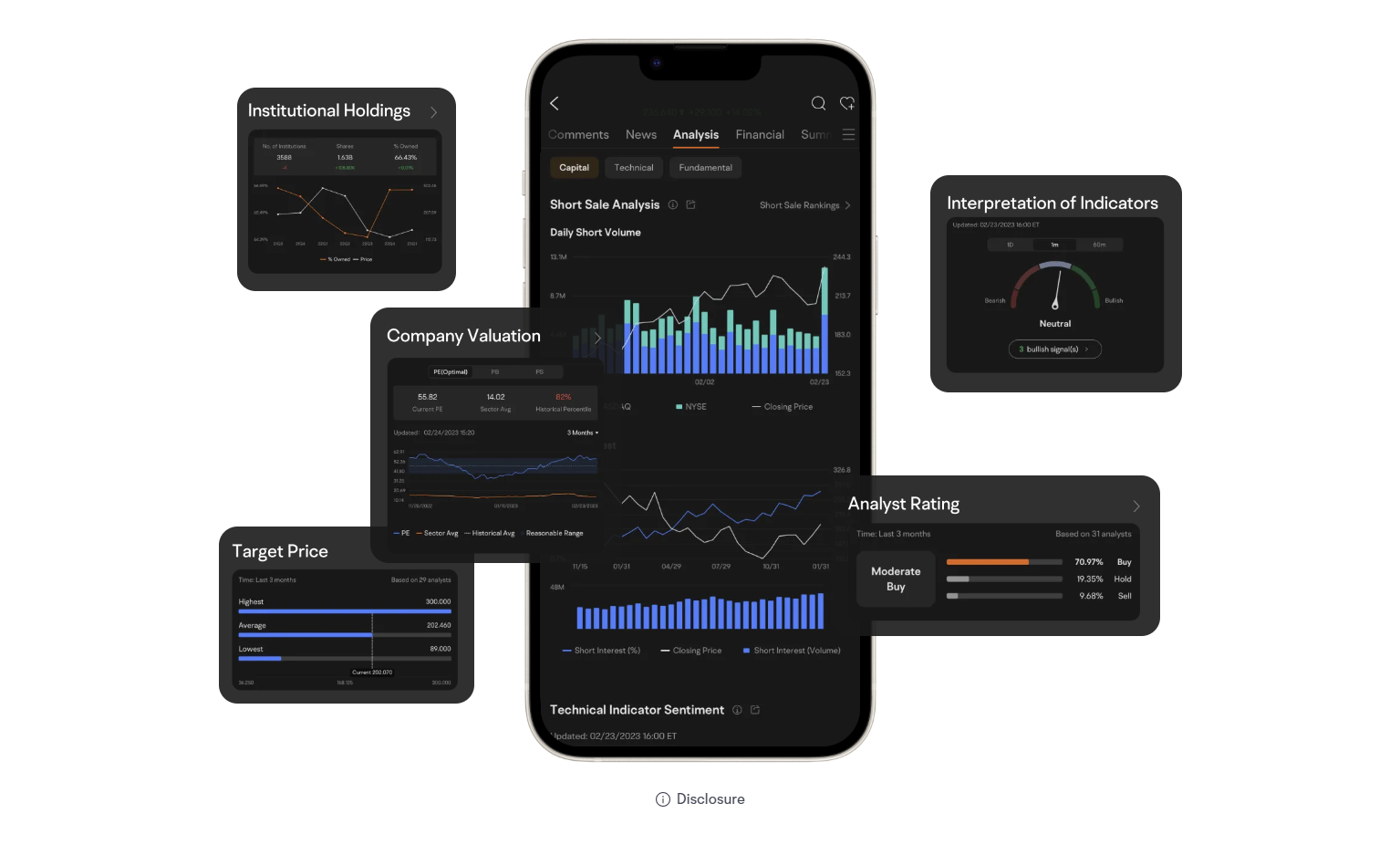

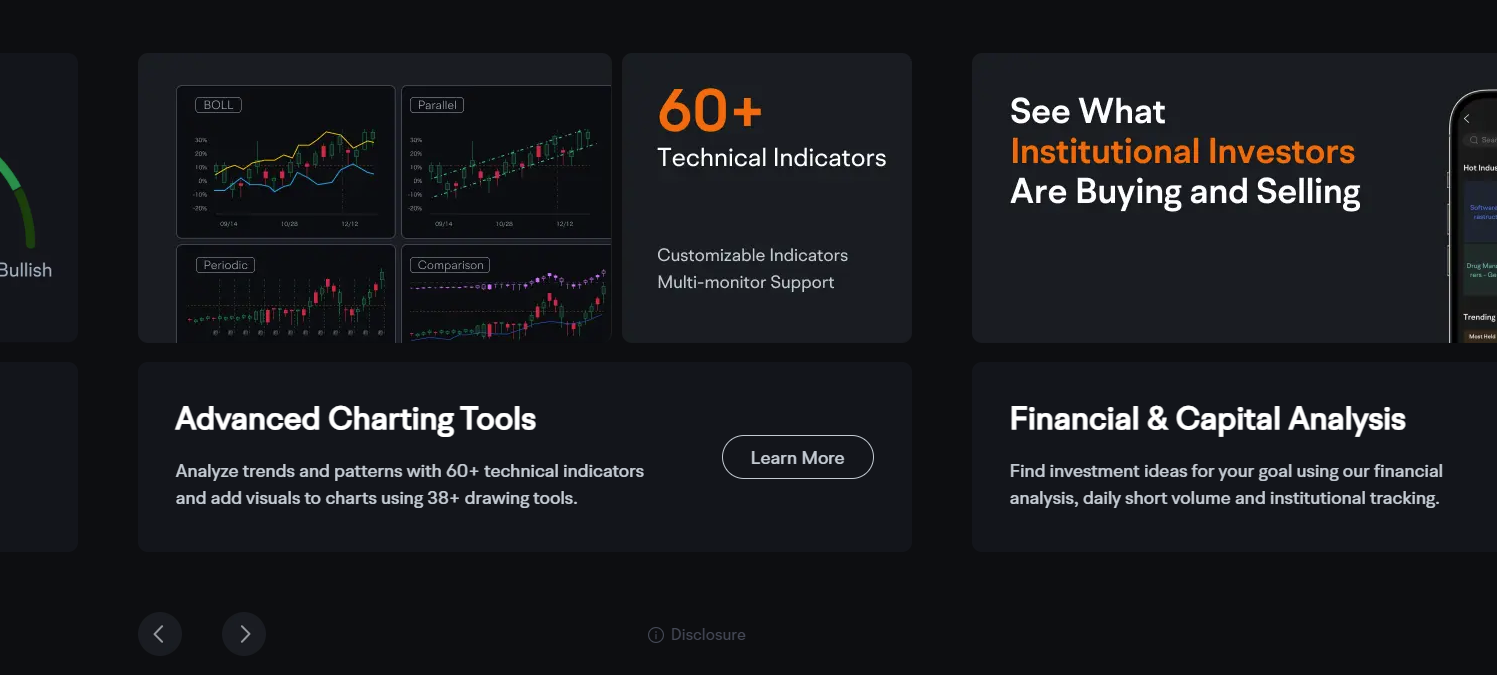

Moomoo offers a huge library of articles that cover the basics of stock trading, and it has great visuals in its app.

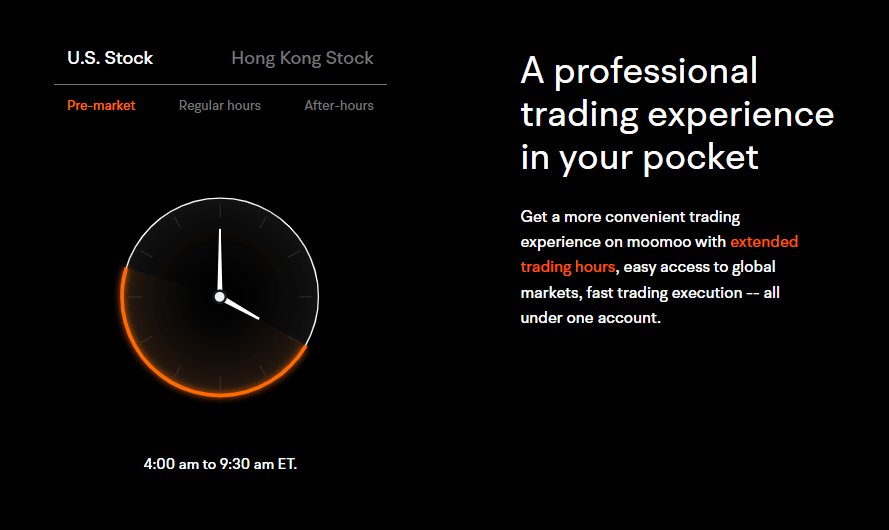

The app got its start in Asia, with a focus on Hong Kong. As it enters the US-market, it not only offers US-based trading, but it also offers low-cost trading in the Chinese Stock Market (A-Share Market) and the Hong Kong Stock Exchange (HK Market). Moomoo is currently available to both US and Australian users.

If you’re looking to trade in an emerging market, Moomoo could be the most cost-effective platform to execute your trades. Here’s what you need to know about Moomoo.

Cash Sweep Promo: Earn Up To 8.1% APY

moomoo is currently offering up to 8.1% APY to new users who sign up for its Cash Sweep Program (for 3 months), deposit cash, and leave it uninvested in their account. This rate is one of the top rates available for cash right now, significantly higher than what you’d earn in most savings accounts.

Moomoo Details | |

|---|---|

Product Name | Moomoo |

Min Investment | $0 |

Commission | $0 |

Fees |

|

Promotions | Get 8.1% APY* on uninvested cash using a 3-month APY Boost, plus up to 15 free stocks with qualified deposits. |

What Is Moomoo?

Moomoo is an emerging trading platform that is growing to be a popular choice for traders in search of a well-regulated place to trade stocks, ETFs, options and more at a low cost. Moomoo Financial is a subsidiary of Nasdaq-listed company Futu Holdings Ltd (Ticker: FUTU), and is regulated by the SEC and FINRA, with investor protection of up to $500,000 under the Securities Investor Protection Corporation (SIPC).

While most free trading apps focus primarily on crypto and the U.S. securities markets, Moomoo takes its low-cost trading technology into other emerging markets. It allows you to make low-cost trades through the Chinese and Hong Kong stock exchanges.

This opens up a whole new world of trading opportunities for those seeking to trade outside of the United States.

What Does It Offer?

Moomoo is a discount brokerage that offers direct access to the Hong Kong and Chinese stock exchanges. Its standout low fees make it a contender for people seeking access to international trading.

Low-Cost Trading In International Markets

Unlike most discount brokerages, Moomoo doesn’t limit trading to US-based stock exchanges. You can trade directly in international stock exchanges including the Hong Kong stock exchange and the Chinese Stock Exchange.

Option To Trade On Margin

Traders, who want to place larger bets than their balances allow, can take on debt (called margin) to make trades in Moomoo. Right now, margin rates on Moomoo start at 6.8% and depend on the market you’re trading in.

While Moomoo offers margin to most users, it is not a suitable tool for most investors or traders. It dramatically increases volatility and could lead you to wipe out your entire portfolio with a few bad trades.

Free Trades On U.S. Securities

You can use Moomoo to place free trades on U.S.-based stocks and ETFs. While compelling, this feature is not unique to Moomoo. Most discount brokerages now offer similar commission-free trades.

No Options Contract Fees

While free trades are common, many companies still charge exorbitant rates to trade options contracts.

However, Moomoo now waives the contract fees on stock and ETF options. All other fees that it charges are mandated by law and don’t vary from brokerage to brokerage.

Index Options

Moomoo now offers index options on its platform, through its partnership with Cboe. Index options give you the right (but not the obligation) to buy or sell the value of an underlying index, such as the S&P 500. Index options offer some potential advantages over single stock options, including taxation, and stronger market liquidity.

Cash Sweep Account

The cash sweep account is the perfect place to keep your uninvested cash. It's free and there is no minimum balance.

You'll earn 5.10% APY on any funds in the cash sweep account. Interest is compounded daily and applied to your account monthly. The account is FDIC insured up to $1 million.

Are There Any Fees?

While Moomoo bills itself as a commission-free trading platform, it charges fees.

- If you want to trade on the Hong Kong stock exchange you’ll pay a 0.03% trading fee plus HK$15 per trade, which is approximately $2 per trade, given current exchange rates.

- Likewise, you’ll pay 15CNH (approximately $2) plus a 0.03% trading fee for all trades made in the A-Shares market.

- U.S. stock and ETF trades are free, as are stock and ETF options contracts if you choose to trade options.

Margin rates on Moomoo fluctuate based on market conditions but are currently 6.8% APR for the U.S. and Hong Kong Markets and 8.8% for trading in the Chinese stock market.

How Do I Contact Moomoo?

To contact Moomoo call cs@us.Moomoo.com or call 650-798-5700. The company is headquartered at 550 S. California Ave. Suite 201 Palo Alto, CA 94301.

It also offers 24/7 in-app customer service chat.

How Does Moomoo Compare?

When it comes to trading U.S. stocks or ETFs, Moomoo is nothing special. Its fees are low, but companies like M1 Finance, Robinhood, and even brokerages like Fidelity match Moomoo on cost but offer more functionality.

Moomoo has detailed graphs and interesting educational articles built into its information library. However, these features may lead novice traders to have confidence that outstrips their competence in the financial space.

Learning to trade involves understanding downside and upside risks. It takes more than a flashy app to be a successful trader. Apps like Moomoo and Robinhood that over-emphasize the trading experience can often lead young investors down the wrong path.

The one thing that Moomoo has that other apps don’t is access to the Chinese stock markets. If you want to trade directly on the Hong Kong or A-Shares exchanges, you can do that through Moomoo. Your likelihood of making money doesn’t increase by using Moomoo, but it is a unique functionality.

Header |  |  | |

|---|---|---|---|

Rating | |||

Commissions | $0 | $0 | $0 |

Min Investment | $0 | $100 | $0 |

Banking | |||

Cell |

How Do I Open An Account?

Download the Moomoo app from the App Store or Google Play Store. The app is available in either English or Chinese.

Once downloaded, provide your name, email address, phone number, physical address, tax ID number, and documents showing your proof of address.

According to Moomoo’s website, it takes the company 1-3 days to verify your identity and give you access to the platform. In reality, it took less than an hour until I was able to fund my account.

Moomoo Bonus And Promotional Offers

moomoo has the following promotions currently:

New User Promo: Deposit $100 and get 5 free shares, Deposit $1,000 and get an additional 10 free shares [totaling 15].

Transfer Promo: Transfer from an existing portfolio and earn up to $300 in cash rewards

Cash Sweep Promo: New users earn an additional 3% APY for the first 3 months, totaling to 8.1% APY on uninvested cash.

Is It Safe And Secure?

Moomoo is a brokerage company with proper registrations with all the major regulatory entities in the United States. It protects user information by using bank-level encryption and requiring multi-factor authentication for login.

Giving out personal information online always presents some level of risk, but Moomoo takes the necessary precautions to keep user information safe.

However, Moomoo can’t protect you from you. Moomoo’s app allows novice traders to use debt which can lead to total portfolio losses. It's easy to get in over your head when debt is involved. Be careful if you decide to use Moomoo and trade on margin, think through using debt instead of wandering into it because it's there.

Is It Worth It?

Moomoo offers unique access to the Hong Kong and Chinese stock exchanges for US-based investors. This access may be exciting for U.S.-based traders who can’t always trade directly in international stock exchanges.

The fact that Moomoo combines access with low fees, makes the opportunity seem compelling. But before you jump into Moomoo, you need to consider whether trading, especially in international markets, is right for you.

Financial professionals spend their working days studying all major markets including international markets. You’re unlikely to have a trading advantage in international markets. You may even be at a disadvantage because you may not fully understand the regulatory and governance structures that are in place abroad.

If you choose to use Moomoo, take calculated risks. Don’t place huge bets on margin that could lead to a total loss in your portfolio.

Moomoo Features

Account Types |

|

Minimum Investment | No |

Management Fees | A-Shares Market: $2 per trade HK Stock Exchange: 0.03% + HK$15 per trade US Stock and ETF Trades: $0 + $0.65 per options contract |

Stock Trades | $0 |

ETF Trades | $0 |

Mutual Fund Trades | N/A |

Trading Activity Fee(TAF) | $0.00013/Share, min $0.01 - max $6.49 (sells only) |

ADR Custodian Fee | $0.01 - $0.05/share |

Access to Human Advisor | No |

Customer Service Number | 650-798-5700 |

Customer Service Email Address | cs@us.Moomoo.com |

Mobile Availability | |

Promotions | Various |

Moomoo Review: An App For Low-Cost Trades In Emerging Markets

-

Commission and Fees

-

Ease of Use

-

Customer Service

-

Products and Services

Overall

Summary

Moomoo is a free online trading app that allows low-cost trading, with access to markets in the United States and Asia.

Pros

- Offers direct access to US, Hong Kong, and A-Shares Stock Exchanges

- Commission-free trading on U.S.-based stocks and ETFs

- Competitive margin rates for traders looking to use debt to enhance returns

Cons

- Novice traders may take on too much debt

- Limited no-fee options trading to specific US equities

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington