Copper is a banking platform built for kids and teens.

Teaching teens financial management is an area we often come up short in the U.S. While the education system has made recent strides, it's still relatively uncommon for personal finance skills to be taught in high school.

This leaves it up to parents to ensure their children can successfully manage money. To help with that task, Copper has created a mobile app that allows parents to monitor their teens' spending and saving.

With Copper, parents can also easily move money back and forth between their own account and their teen's. Let’s took a closer look at what Copper has to offer. Check out Copper here >>>

Editors Note: Copper recently announced that it is discontinuing the deposit and debit card products it offered on the Copper platform, effective May 13, 2024. The accounts of affected customers would also close on this date. In a blog post on its website, Copper communicated that they will either transfer client funds to their linked external bank account, or issue and mail a check to the address on file.

Why did this happen?

In a letter to the Copper community, dated May 12th, 2024, co-founder and CEO Eddie Behringer explained that the decision to no longer offer bank deposit accounts and debit cards was tied to Copper's banking partner suddenly sunsetting it's services. Copper is not a bank - it's a financial technology company and relied on a banking partner to delivery deposit accounts to its customers.

What happened to Copper's banking partners?

While there are conflicting details, here is what we do know. Copper had a relationship with Synapse Financial Technologies, Inc. Also, Copper-branded debit cards were issued by another partner, Evolve Bank & Trust, which is an FDIC-member. Synapse had claimed bankruptcy but was on the verge of being purchased by TabaPay, an instant payments company. In early May, 2024, TabaPay made the decision to withdraw its intent to purchase Synapse. According to Synapse's CEO, Sankaet Pathak, the deal fell apart because it's banking partner, Evolve Bank & Trust, had failed to meet a key condition for the acquisition to go through.

So, what happens now?

It remains to be seen how Copper will respond to this sudden change to their product lineup. However, as of May 13, 2024, they have discontinued their deposit accounts and debit card products. We will provide further updates to this review post as we receive more information.

Copper Details | |

|---|---|

Product Name | Copper |

Min Deposit | $0 |

Monthly Fee | $0 |

Interest Rate | 0.001% |

Promotions | None |

Who Is Copper?

Copper is an all-digital bank designed for teens. It was formed in April 2019 and is based in Seattle, WA. Its founders are Eddie Behringer and Stefan Berglund. Copper has raised $4.3 million through seed funding.

“It became clear that our high school system was failing Gen Z by not equipping them with basic personal finance skills at a critical point before they become adults and can fall victim to predatory credit,” said Behrenger to Tearsheet.

“With fintech and open banking, we realized we could build a financial product that provided tremendous value to teens and their parents and that would drive real positive financial outcomes.”

What Do They Offer?

While it's website may lead you to think differently, Copper itself isn't actually a bank. Copper is a fintech company that uses SynapseFi for the backend technology of its app. SynapseFi is a partner of Evolve Bank & Trust. The relationship between those two entities is what makes it possible for Copper to offer banking services.

Copper is a mobile app that helps teach teens about financial literacy. Many banks don’t have accounts oriented towards teens. With parental oversight, Copper lets teens spend via an included Mastercard debit card. And parents are able to track and monitor their teens’ spending.

Copper makes it easy to send money back and forth between teens and parents. If parents want to send money for an allowance, everything can be done digitally. Given the digital nature of our economy, this makes complete sense.

With their parent’s help, spending and saving habits can be discussed. With assistance from Copper, parents can help their teens take control of their finances and learn to spend responsibly.

Debit Card

Copper accounts include a Mastercard debit card. The card is accepted everywhere that Mastercard is accepted. You don't have to wait for the physical card to arrive before you can use it.

Once a parent funds the account, the virtual debit card can be used. It can be used from the Copper app or added to Apple Pay or Google Pay digital wallets. You can also use the debit card to withdraw cash at over 55,000 ATMs.

Depositing Cash

You may want to avoid this route if possible since it will cost extra. Copper uses the Green Dot network to add cash to customer accounts. That means you have to go to a Green Dot retailer location.

You can find a Green Dot retail here. Note that these retailers often charge a fee, which can be up to $4.95 per transaction. To avoid these fees, try to transfer funds digitally instead.

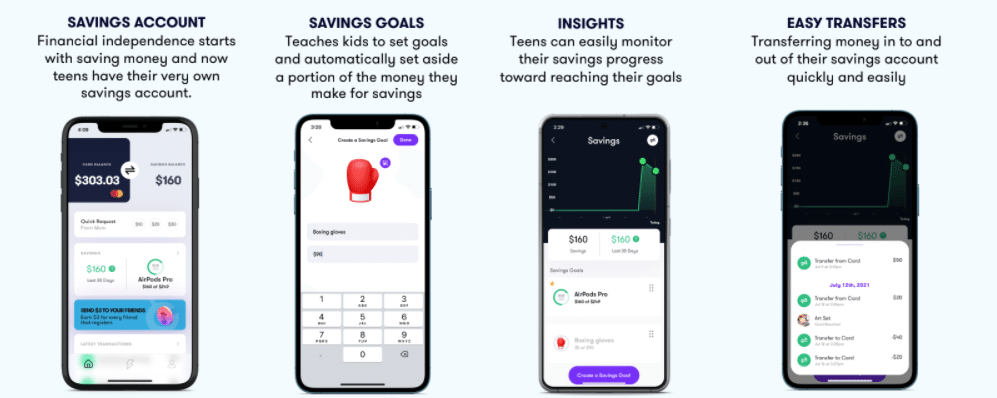

Savings Accounts

Copper recently added savings accounts to its list of features. Now, teens can easily set savings goals and monitor their progress. One-time transfers to savings can be initiated at any time. Or Copper users can set up automated savings schedules.

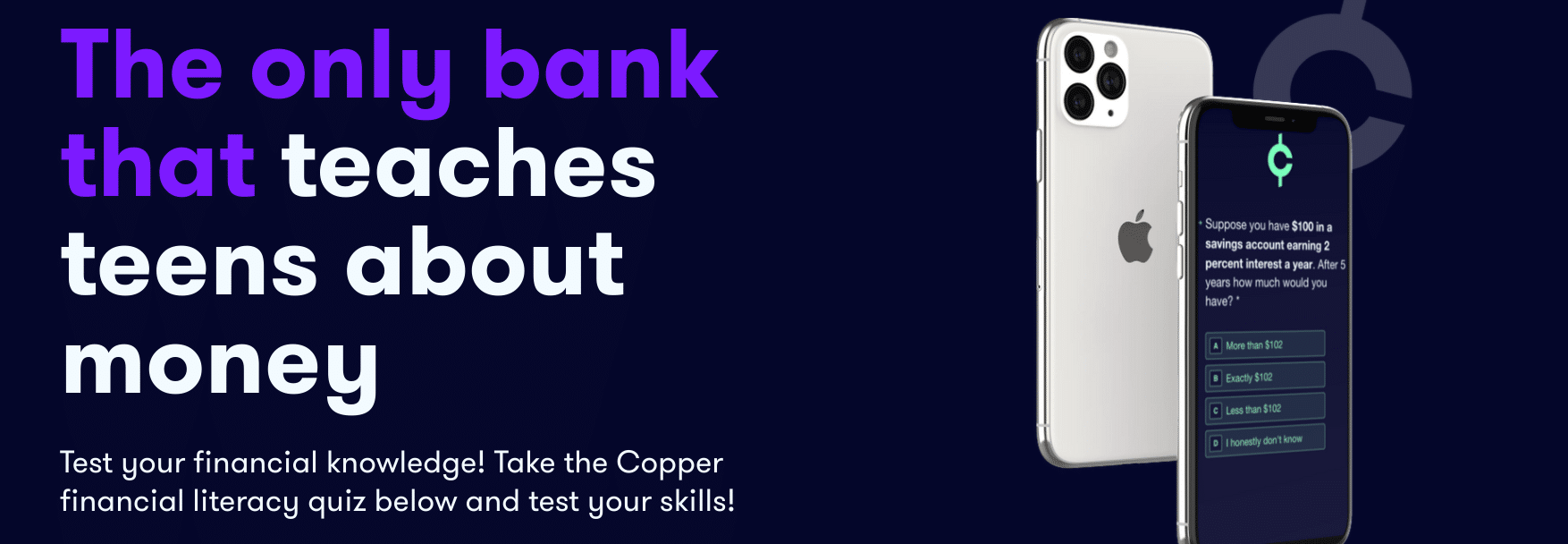

Financial Education

Copper helps teach financial management to teens in two primary ways. First, it offers a financial literacy quiz which allows teens to test their knowledge and learn at the same time.

Second, it provides financial lessons that it calls "Cheat Codes." Copper's financial education department is headed up by Liz Frazier, a Certified Financial Planner and author of Beyond Piggy Banks and Lemonade Stands: How To Teach Young Kids About Finance.

Parental Involvement

Teens can still spend all of their money in one location. The app gives them the freedom to do that. That’s why good parental involvement is essential to getting the most out of Copper.

Parents have certain controls through the app. These include:

Deposit and Spending Limits

There are some limits on depositing and spending funds in your Copper account.

Transferring money into your Copper account through ACH is free. It takes between 3-5 days.

If you use a debit card to transfer money into your Copper account, a small fee will be assessed to cover Copper’s transaction cost. You can also use Venmo, Cash App, or Paypal to transfer funds into your Copper account.

Customer Support

Copper is an online-only bank, so you won't be able to visit any local branches for in-person support. There isn't a publicly-listed customer service phone number either. Support is available only through email at support@getcopper.com.

Are There Any Fees?

There aren't any monthly fees, account maintenance fees, or overdraft fees. There may, however, be fees charged by Copper's third-party ATM operators if you decide to withdraw cash.

If you want to add cash to your account, there may be fees charged by Green Dot retailers. A small fee is charged when using an existing debit card to transfer funds into your Copper account.

Copper Alternatives

Copper is not the only banking platform for kids, teens, and families. In fact, this is a growing space.

First, almost every major bank will offer some type of child checking or savings account. Copper falls into the "starter" checking account category, and you can see other starter checking accounts here.

There are also teen debit cart platforms, like Greenlight, that may be an option for some families.

See this quick Copper comparison here:

Header |  |  |  |

|---|---|---|---|

Rating | |||

Monthly Fees | $0 | $0 | $0 |

Interest Rate | 0.001% | N/A | 0.25% |

Min Deposit | $0 | $0 | $50 |

ATM Access | 55,000+ | None | 91,000+ Free ATMs |

Builds Credit | |||

Cell |

How Do I Open An Account?

You can visit the Copper website to open an account. If you are under 18 years of age, you’ll need a parent or guardian to finalize the account documents. Once you've applied, you'll need to download the app to access your account and there is currently no way to login on a desktop browser.

Is My Money Safe?

Yes, funds are FDIC-protected through Evolve Bank. FDIC insurance protects against the loss of up to $250,000 of deposits in the event that an insured bank or savings association fails.

Why Should You Trust Us?

I have been writing and researching banking and personal finance products since 2009. At The College Investor, we've been comparing and reviewing banks since 2018, and track the best banks for savings and money market accounts daily from a list of over 50 major banks and credit unions.

Plus, we're parents too - and know what to look for when comparing checking and savings accounts for our kids!

Furthermore, our compliance team reviews our rates every weekday to ensure that we are accurately showing the correct rates and terms so you can make an informed decision about where to open a savings account.

Who Is This For And Is It Worth It?

For parents that want to teach their teens financial management, Copper is a great supplement. In addition to providing financial education, it allows teens to use real money rather than being limited to just discussions or a course.

Copper doesn’t cost anything to use if you avoid its usage-related fees, which is fairly easy to do. Overall, it's worth checking out. Check out Copper here.

However, Copper doesn't offer any credit-building tools and pays virtually zero interest on deposits (0.001% interest rate; 0.00% APY). If either of those drawbacks are a deal-breaker for you, you may want to consider alternative teen checking accounts such as Step or Axos First Checking.

Copper Features

Minimum Deposit | $0 |

APY | 0.001% |

Maintenance Fee | None |

Overdraft Fee | $0 |

Card Replacement Fee | $0 |

Branches | None (online-only fintech) |

ATM Availability | 55,000+ |

ATM Fee | None from Copper, but fees may be charged the third-party ATM operator |

Customer Service Options | Email only |

Customer Service Email | support@getcopper.com |

Mobile App Availability | iOS and Android |

Bill Pay | No |

FDIC Certificate | 1299 |

Promotions | None |

Copper Review

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Features and Options

Overall

Summary

Copper is a debit card and mobile app that help parents teach their teens how to make smart financial decisions.

Pros

- No monthly fees

- Instant transfers from parent accounts

- Exclusive financial literacy content

Cons

- Deposits earn just 0.001% (0.00% APY)

- Fees for cash transactions

- No customer service number

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Colin Graves