ZenLedger touts itself as the #1 cryptocurrency tax software provider.

If you’re a cryptocurrency investor, accurately filing your taxes can be tricky because capital gains (or losses) from your trades, mining income, gas fees, and staking rewards, are all relevant for taxes.

ZenLedger offers free cryptocurrency portfolio tracking, which includes NFTs. For taxes, you can upgrade to a paid plan where ZenLedger generates the required forms for your tax return.

However, ZenLedger plans can be very expensive for anyone with over 5,000 transactions in a year. Follow along with our ZenLedger review to learn about the main features, pricing, and how to decide if this crypto tax software is right for you.

ZenLedger Details | |

|---|---|

Product Name | ZenLedger |

Min Initial Load | Cryptocurrency Tax Software |

Cost | $0 to $999/yr |

Exchange & Wallet Integrations | 400+ |

Promotions | None |

What Is ZenLedger?

ZenLedger is one of the more popular cryptocurrency tax software options with robust tools for crypto tracking and tax reporting. The company was founded during the crypto boom in 2017. According to its website, ZenLedger aims to “simplify DeFi, NFT, and crypto taxes for investors and tax professionals.”

For 2023, we named ZenLedger the Best Value Crypto Tax Software in our annual ranking of the Best Crypto and NFT Tax Software Programs. Here’s a more in-depth look at the 2024 offerings (for your 2023 tax year filings).

What Does ZenLedger Offer?

Like traditional tax software, ZenLedger consolidates your financial data to help you create an accurate tax filing. ZenLedger focuses exclusively on cryptocurrency transactions and performance. Like other crypto tax apps, you’ll also need an accountant or your favorite tax filing software in conjunction with the reports you get from ZenLendger.

If you have capital gains from cryptocurrency sales or want to offset your taxes through tax-loss harvesting, software like ZenLedger is incredibly useful.

Crypto Portfolio Tracker

ZenLedger integrates with over 400 cryptocurrency exchanges, 52 blockchains, and 100+ DeFi protocols. You can import your transaction history and holdings from various exchanges, wallets, and crypto projects into your ZenLedger dashboard.

Some of ZenLedger’s more notable integrations include:

It’s important to note that while ZenLedger works with hundreds of exchanges, you may need to export a spreadsheet with your transactions from your exchange and import it into ZenLedger. However, you can connect with an API key and directly download your transaction data for most of the exchanges I've used.

Your dashboard breaks down portfolio performance and value-per-holding once you import your crypto transactions and holdings.

If you pay for ZenLedger, you can dive deeper into market and portfolio performance across different timeframes. This provides a quick snapshot of how your cryptocurrency investments are doing. However, ZenLedger isn’t the best crypto portfolio tracker for year-round use. If that’s what you’re looking for, check out Koinly or CoinTracker.

Kubera is superior if you’re looking for a comprehensive portfolio tracker for all of your investments, including stocks and crypto.

Related: Best Portfolio Analysis Tools

Downloadable Tax Reports

The main reason to consider ZenLedger is its downloadable tax reports. It can quickly calculate additional income, capital gains, and losses, based on your linked exchanges and wallets.

The primary tax forms ZenLedger offers include:

- IRS Schedule 1(Additional Income): ZenLedger calculates additional crypto income from sources other than wages, dividends, and interest.

- IRS Schedule D (Capital Gains and Losses): With ZenLedger’s crypto tax calculator, you can calculate your capital gains and losses from crypto for the year.

- IRS Form 8949 (Sales & Other Dispositions): This form lets you report the actual date you acquired and sold different virtual currencies. ZenLedger calculates proceeds from sales and if you incurred gains or losses.

ZenLedger also supports three cost basis methods: First In First Out (FIFO), Last In First Out (LIFO), and Highest In First Out (HIFO). Your tax center tab tracks taxable crypto income from a variety of sources, including:

Overall, ZenLedger lets you save time and improve accuracy when filing your crypto taxes. If you’re a beginner crypto investor or don’t trade regularly, ZenLedger is likely a great choice.

However, investors with large portfolios and a variety of cryptocurrency and DeFi activity should still consider consulting a tax professional.

Tax-Loss Harvesting

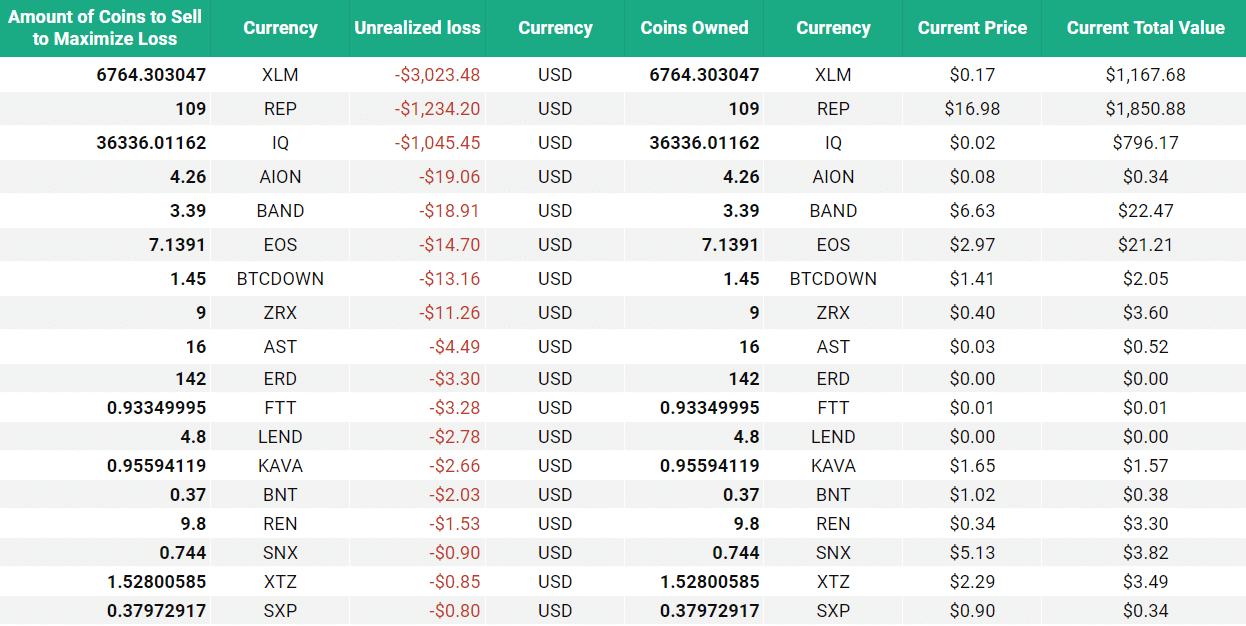

Another useful ZenLedger feature is its tax-loss harvesting tool. Tax-loss harvesting involves selling assets at a loss to offset capital gains. This helps lower how much you pay in taxes. The idea is to replace the assets you sold at a loss with similar assets so your portfolio composition remains the same.

For example, let's say you bought $10,000 of Bitcoin when it peaked at over $65,000. If Bitcoin’s price dropped and you incurred a $4,000 loss, you could sell off your BTC to realize that loss. Then, you’d use the $4,000 to offset other taxes.

The deadline to realize crypto losses is December 31st, so tax-loss harvesting is generally an end-of-year strategy. And with ZenLedger’s tax-loss harvesting tool, you get a complete overview of your unrealized gains, losses, and what amount of coins you need to sell to maximize loss.

Screenshot of ZenLedger's tax-loss harvesting tool

This feature isn’t too useful for small portfolios because you’re going to incur trading fees when you repurchase the crypto you sell off. Ultimately, these fees lessen the impact of tax-loss harvesting and can even cost more than you end up saving on taxes.

But for larger portfolios, tax-loss harvesting can offset up to $3,000 in taxable income per year, which is significant.

Unified Accounting

ZenLedger’s Grand Unified Accounting tool exports a spreadsheet of your transaction history across different exchanges and wallets. This includes a line-by-line breakdown of:

- Transaction dates and which exchange you used

- Cryptocurrencies involved

- Transaction value

- Long-term and short-term capital gains

Your spreadsheet also includes calculated tax. If you’re working with a CPA to file your taxes, sending over this consolidated information is helpful.

DeFi Integrations

One of the main weaknesses of crypto tax software is a lack of DeFi (decentralized finance app) integrations. Yes, crypto tax software covers the most popular exchanges and wallets. But what if you stake, lend, or trade with various DeFi apps and tools?

ZenLedger isn’t perfect on this front, but supporting 100+ DeFi protocols is much better than many competitors. Notable DeFi protocols ZenLedger supports include:

- AirSwap

- PancakeSwap

- ParaSwap

- SushiSwap

- Uniswap

- 1inch

DeFi integrations aren’t as crucial if you solely trade on centralized exchanges like Coinbase or Gemini. But if you’re diving down the DeFi rabbit hole, know that a lot of crypto tax software has some catching up to do.

Professional Tax Help

ZenLedger integrates with TurboTax and TaxAct, so you can import all your transaction information into those programs if you’re filing taxes yourself. You can also invite your accountant to join your ZenLedger account, and there’s a professional tax suite side of the business to help CFAs manage clients.

ZenLedger even offers paid tax professionals if you need assistance. This isn’t something every crypto tax software offers. Here are the three (expensive!) plans and their pricing:

- Consultation: $295 for a 30-minute call

- Single-Year Tax Report: Starts at $3,500 per year

- Multi-Year Tax Report: Starts at $6,500 per two years

NFTs and DeFi support is included with these plans. However, pricing depends on your tax situation, and complex returns are probably higher than these starting prices.

Tax Partnership with April

Starting in 2024, ZenLeder is partnering with a tax prep firm called April to fully prepare your tax return, including your cryptocurrency transaction - all without having to leave the app. Typically, you would have to use a crypto tax software like ZenLedger, then take your 8949 to your tax preparer or tax software program to finish your taxes.

Starting at $3,500 per year, you can have a tax professional fully prepare your entire tax return, including your crypto and NFT transactions.

Are There Any Fees?

ZenLedger’s free plan lets you import and aggregate cryptocurrency transactions. You also get a basic portfolio tracking dashboard. However, viewing and downloading tax reports and using tax-loss harvesting or unified accounting requires a paid plan.

Here’s how ZenLedger’s various plans compare in terms of features and annual pricing:

Free | Starter | Premium | Executive | Platinum | |

|---|---|---|---|---|---|

Annual Cost | $0 | $49 | $149 | $399 | $999 |

Transactions | 25 | 100 | 5,000 | 15,000 | Unlimited |

Downloadable Tax Reports | No | Yes | Yes | Yes | Yes |

DeFi/Staking/ | No | No | Yes | Yes | Yes |

Crypto Income Reporting | No | Yes | Yes | Yes | Yes |

Tax-Loss Harvesting | No | Yes | Yes | Yes | Yes |

Transaction limits and DeFi, staking, and NFTs are the main restrictions with the Starter plan. Beginner cryptocurrency investors can probably stick with Starter, but regular traders or anyone using DeFi protocols need Premium.

How Does ZenLedger Compare?

As mentioned, cryptocurrency tax software still has some catching up to do. This isn’t surprising, given how rapidly the world of DeFi changes. This also means that, right now, it’s hard to pick a clear winner in the crypto tax software market.

ZenLedger stacks up well against the competition due to its number of integrations. Here’s how ZenLedger compares with CoinTracker and CoinLedger, two other popular crypto tax software platforms.

Header |  |  | |

|---|---|---|---|

Rating | |||

Software Pricing | $0 to $999 per year | $59 to $2,999+ per year | $0 to $199+ per year |

Exchange/Wallet Integrations | 400+ | 300+ | 280+ |

Tax Software Integrations | TurboTax, TaxAct | TurboTax, TaxAct | TurboTax, TaxAct |

Free Plan Available | Yes | Yes | No |

Cell |

ZenLedger and CoinLedger (formerly CryptoTrader.Tax) are two of our favorites, especially since both support over a dozen DeFi protocol integrations.

CoinLedger integrates with TaxAct, but ZenLedger has more exchange and wallet integrations, so review each option to find what’s right for you.

ZenLedger | CoinTracker | CoinLedger | |

|---|---|---|---|

Tax-Loss Harvesting | Yes | No | Yes |

Grand Unified Accounting | Yes | No | No |

Downloadable Tax Forms | Yes | Yes | Yes |

TurboTax Integration | Yes | Yes | Yes |

How Do I Open An Account?

ZenLedger lets you create an account with your email address or connect through Coinbase or Google. The entire signup process takes just a minute or two.

Once you sign up, you have to join a wallet, exchange, or DeFi protocol to your ZenLedger account so it can import transaction data. You can manually add transaction information with a CSV or the manual entry tool if you don’t want to connect ZenLedger with any accounts.

Is It Safe And Secure?

ZenLedger is generally safe and secure to use, as you never provide your private wallet keys when connecting your exchanges and wallets. When creating API keys, limiting them to read-only access to your transactions is critical.

However, the company was hacked in recent years, with customer contact information leaked to the dark web. While transaction data wasn’t included, it’s concerning. The company claims that the issue was due to a third-party vendor and has been fixed.

The company is SOC 2 Certified, which showcases its commitment to providing data security to its customers. SOC 2 is a set of standards developed by the American Institute of Certified Public Accountants (AICPA) that measures an organization's ability to maintain a secure and confidential environment for customer data. In a nutshell, ZenLedger meets the leading industry standards for security, confidentiality, availability, privacy, and processing integrity.

How Do I Contact ZenLedger?

There are a few ways to contact ZenLedger’s customer support. The easiest would be to use the live chat tool located in the bottom right-hand corner of the webpage.

You can also email ZenLedger at hello@zenlegder.io for same-day support for non-urgent questions, or text or call (877) ZEN-TAXS from 9 a.m. to 9 p.m. EST, Monday through Friday.

Is ZenLedger Worth It?

If you own virtual currencies, you’re required by law to report any related income to the IRS. But how complex this reporting is depends on your portfolio, trading style, and record-keeping.

Software like ZenLedger is worth its annual price if it saves time and helps you file taxes accurately. But at the higher transaction tiers, pricing may have you look elsewhere. Furthermore, tools like tax-loss harvesting can help you save money by offsetting capital gains.

If you only have a few cryptocurrency transactions, you can use ZenLedger’s free plan or try filing taxes yourself using software like TurboTax before paying for dedicated crypto tax software.

Final Thoughts:

Ultimately, if you need a helping hand with crypto taxes or regular trading, software like ZenLedger is worth it.

ZenLedger Features

Product Type | Cryptocurrency tax software |

Supported Wallets & Exchanges | 400+ |

Free Plan | Yes |

Software Pricing | $0, $49, $149, $399, and $999 annual plans |

Tax Pro Prepared Plans Pricing |

|

Tax Loss Harvesting | Yes |

Tax Filing Included | No |

FIFO Support | Yes |

LIFO Support | Yes |

HIFO Support | Yes |

Downloadable Reports | Yes |

Revisions | Unlimited |

Audit Trail Report | Yes |

Refund Period | 1 year |

Tax Software Integration | TurboTax |

Mobile App Availability | No |

Custom Support Options | ZenLedger offers support through live chat, email, and phone |

Custom Support Phone Number | 877-936-8297 Extension 1 |

Custom Support Email | hello@zenledger.io |

Promotions | None |

ZenLedger Review

-

Pricing

-

Products & Services

-

Third-Party Integrations

-

Ease of Use

-

Customer Service

Overall

Summary

ZenLedger consolidates all of your cryptocurrency transactions and performance so that you have an accurate picture when filing your taxes.

Pros

- Variety of exchange and wallet integrations plus DeFi support

- Tax-loss harvesting can help you save money when filing taxes

- Paid tax filing support and consultations are available

Cons

- DeFi support is only available in more expensive plans

- The free tax plan is limited to 25 transactions

- Past hacking incident leaked user contact data

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington