Citizens Access Bank is a fully-online bank that offers savings accounts, no-penalty CDs, and CD ladders. With no brick-and-mortar locations to staff and maintain, Citizens Bank has less overhead than banks with physical branches.

And they pass those savings along to their customers in the form of attractive rates and terms. Their savings account and CDs offer rates that are 15 times higher than the national average.

In addition to their high APY, their savings and CD accounts charge zero startup or ongoing fees. Read our full Citizens Access Bank review below to see how they compare with the other top online banks.

Quick Summary

- They offer a high APY savings account.

- Solid rates on CDs for different terms.

- Need $5,000 minimum balance for both products.

Citizens Access Bank Details | |

|---|---|

Product Name | Citizens Access Bank Savings |

Min Deposit | $5,000 |

APY | 4.50% APY |

Account Type | Savings and CD |

Promotions | None |

Who Is Citizens Access Bank?

Citizens Access Bank is a division of Citizens Bank, which has $183 billion in assets as of December 31, 2021. As of October 2023, it was ranked as the 16th largest U.S. bank, according to MX.com. Citizens Bank has been around for over 190 years. It’s headquartered in Providence, Rhode Island. However, Citizens Access Bank is an online-only bank.

What Do They Offer?

Citizens Access Bank is a completely online bank, which helps it to keep its cost low. Rather than raking in all of those savings for themselves, they pass the savings on to customers in the form of high-interest rates for their savings account and CD products.

Savings Account

The Citizens Access Bank savings account is highly competitive, with a top-notch APY. It’s among the top savings account APYs offered across all banks - currently at 4.50% APY. See our full list of the best high-yield savings accounts. There are also zero fees charged on the their savings account.

The drawback is that it does $5,000 to open. If the balance falls below $5,000 after opening the account, you’ll earn a lower APY. And if the balance remains below $5,000 for an extended period of time, your account may be closed.

To get an idea on the return for a 1.85% account, starting at $5,000 and adding $100 every month will result in $758 of earnings after five years. Interest is compounded daily and paid monthly.

Since there are no branches, money can be moved back and forth from your bank using ACH. Check deposits are also available. Wire transfers are not available. The initial deposit must be made within 30 days of opening the account. Per federal regulations, you are limited to six withdrawals per statement cycle.

See how it compares here:

Certificate of Deposits (CDs)

Citizens Access Bank has several high-rate CD options. These also require a $5,000 investment to open.

For the Liquid CD, the rate is 3.25% for a 1-Year CD. You’ve probably caught that’s the same as a savings account. Why lock up your money in a CD when you can stay liquid with a savings account for the same rate? Keep in mind that savings account rates are subject to change, whereas CD rates are locked in for the duration of the CD.

The Liquid CD is an 1-Year CD. After the first seven days of opening the account, there is no penalty for early withdrawal.

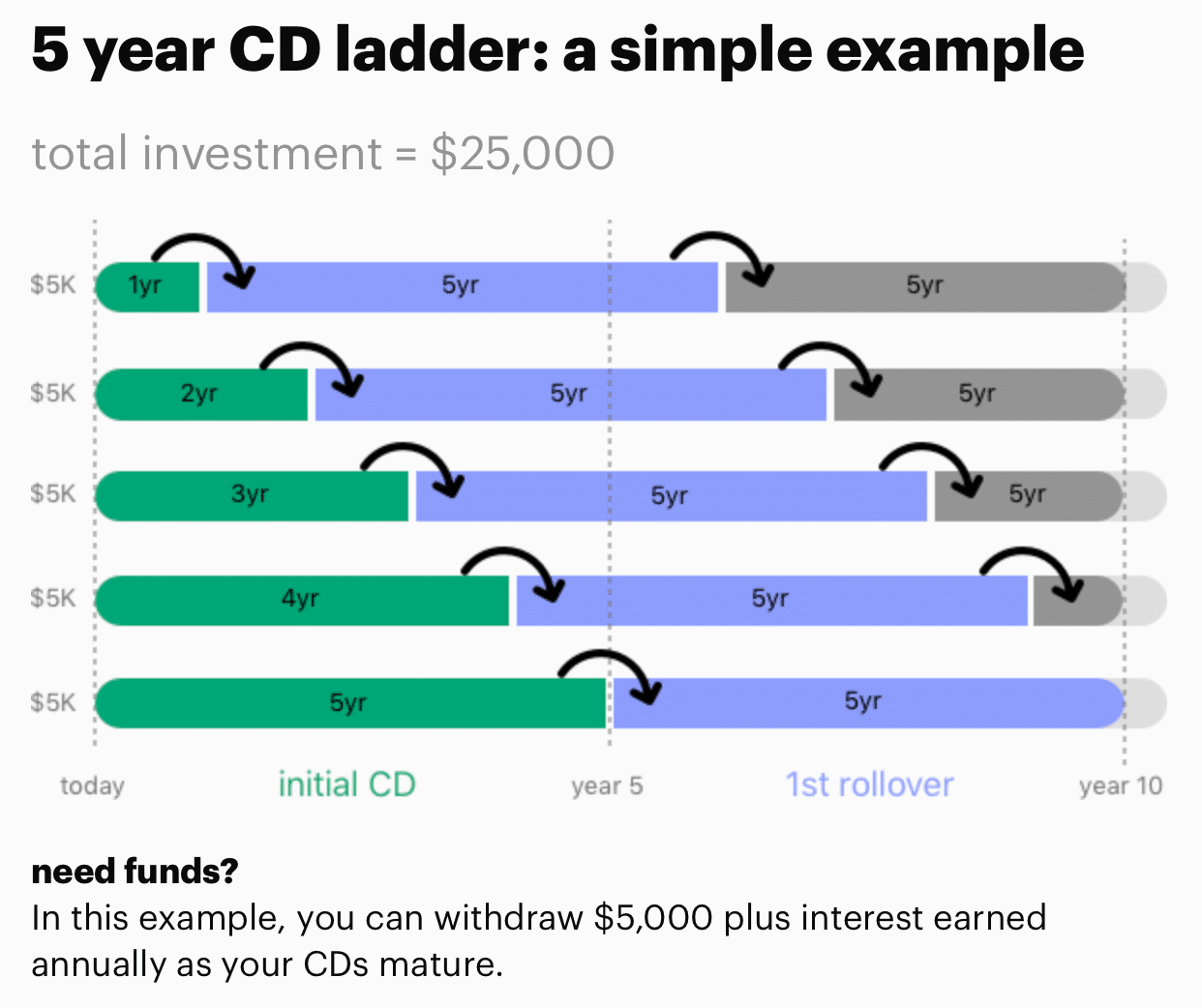

The next product is the CD Ladder, which takes varying CD durations and stacks them. Using this technique means you’ll have a CD maturing every year for the duration of the ladder. Below is a screenshot of what the ladder looks like.

Source: Citizens Access Bank

To build the above ladder, buy five CDs with different maturities — 1yr, 2yr, 3yr, 4yr, and a 5yr.

As each CD rolls off, replace it with another longer-term CD. This creates stacked maturities that expire each year, allowing you to take advantage of liquidity and changing rates.

Custom Service

Customer service is available by phone every day of the week, although Saturday and Sunday are shorter days. Once your account is opened, you can also contact them through secure messaging. Responses are within 24 business hours.

Mobile Access

Citizens Access Bank does not have a mobile app at this time. However, the website is fully mobile compatible so you can access it through your smartphone’s web browser. Mobile check deposits are available through the mobile website.

Are There Any Fees?

Nope. Citizens Access Bank charges absolutely fees.

How Do I Open An Account?

Accounts can be opened online only. You can open your account at CitizensAccess.com.

Is My Money Safe?

Yes — Citizens Access Bank is FDIC insured and uses bank-grade encryption throughout its website.

Is It Worth It?

If you have $5,000 to deposit, the rates that Citizens Access Bank are posting are certainly worth it. Plus, there are zero fees on their savings and CD products — an extremely rare feature in the banking world. Additionally, they have great customer service.

However, since they doesn't offer checking accounts or ATM withdrawals, you'll need another existing bank account in order to access your funds via electronic transfer. If you're looking for an online bank that can offer instant cash withdrawals, check out our full list of the top online banks for your money.

Citizens Access Bank Review

-

Interest Rates

-

Fees and Charges

-

Customer Service

-

Ease of Use

-

Tools and Resources

-

Products and Services

Overall

Summary

Citizens Access Bank is a fully-online bank that offers high-yield savings accounts, no-penalty CDs, and CD ladders with no fees.

Pros

- Typically offers top interest rates on savings and CDs

Cons

- Online only

- Doesn’t offer a full range of banking options

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Richelle Hawley