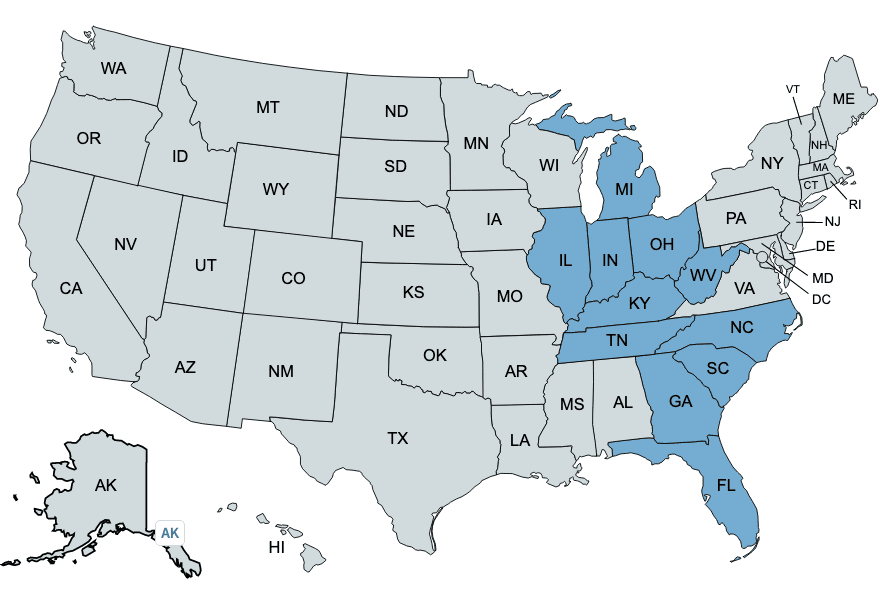

Fifth Third Bank is a regional bank with a strong brick-and-mortar presence with branches across 11 Central and Southern states. However, if you don’t reside in one of the states with a Fifth Third Bank, you can still reap the benefits of having a streamlined online banking experience.

If you are looking for a reliable bank with free checking, then Fifth Third Bank might be a good fit. Let’s explore what this bank has to offer so you can decide whether or not it’s the right choice for your banking needs.

Promo: Right now, you can get a $250 bonus when you open an eligible checking account and complete qualifying activities. Learn more here >>

Fifth Third Bank Details | |

|---|---|

Product Names | Fifth Third Bank Momentum Banking |

Min Initial Deposit | $0 |

Monthly Fee | $0 |

Savings Reward | None |

Promotions | $250 Bonus |

What Is Fifth Third Bank?

Fifth Third Bank came across its relatively unusual name through a merger between Fifth National Bank and Third National Bank. Since 1858, Fifth Third Bank has grown from a bank in Cincinnati to serve 11 states. Currently, Fifth Third Bank is available to customers in the following states:

Across the 11 states, you’ll find 1,079 branches and over 2,200 Fifth Third branded ATMs. Plus, Fifth Third Bank customers have access to over 54,000 fee-free ATMs across the nation.

As of December 2022, Fifth Third Bank had $211 billion in assets.What Does It Offer?

Fifth Third Bank offers banking services to individuals and businesses. But in this review, we will focus on the individual banking features.

Here’s a closer look at what Fifth Third Bank has to offer:

Checking Account

Fifth Third Momentum Checking is this checking account option through this bank. When using this account, you won’t need to maintain a minimum balance or run into any hidden fees. The built-in fraud protection should give you extra peace of mind.

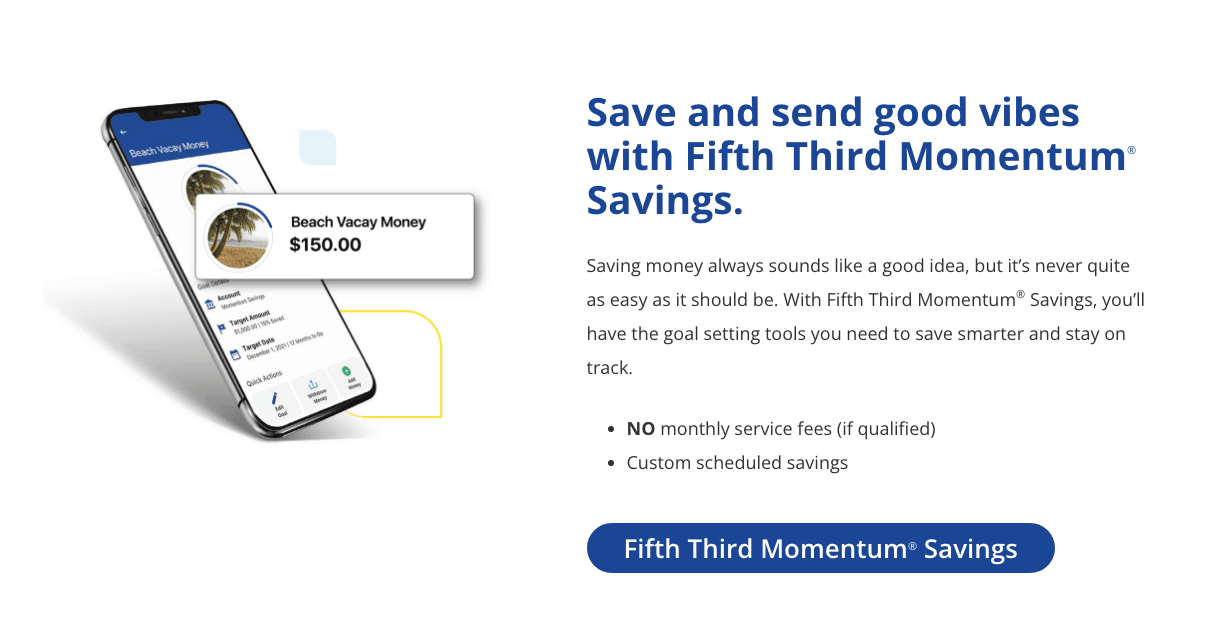

Goal-Focused Savings Account

Savings goals are an important part of a healthy financial picture. Luckily, Fifth Third Momentum Savings is designed with your savings goals in mind.

With this account, you can use a savings calculator to map out progress towards your savings goal. After creating the goal, you can take advantage of automatic savings features to build your savings on a regular basis.

You can crest up to four savings goals at a time. This is a useful opportunity to save for multiple expenses without opening multiple accounts.

Certificates Of Deposit (CDs)

A certificate of deposit (CD) can be a useful way to grow your savings in a risk-free way. Although Fifth Third Bank does offer CDs with a variety of terms, the rates aren’t very impressive.

You’ll need to deposit a minimum of $5,000 to open a CD with this bank. But you should only expect to earn 0.05% or less.

Are There Any Fees?

The type of account you open with Fifth Third Bank will impact the fees you encounter.

The Fifth Third Momentum Checking doesn’t come with a monthly fee. But there are overdraft fees. Luckily, the bank gives you some Extra Time to deposit funds in your account to avoid an overdraft fee. You’ll have until midnight to make a deposit and avoid an overdraft fee.

The Fifth Third Momentum Savings account comes with a $5 monthly fee. But you can avoid the $5 monthly fee if you have a Fifth Third checking account, maintain an average monthly balance of $500 or more, are under 18, or are enrolled in the military banking options.

There are over 54,000 fee-free ATM options. But if you aren’t able to find a fee-free ATM, then you’ll have to pay an out-of-network ATM fee.

Momentum Checking | Momentum Savings | CD | |

|---|---|---|---|

Minimum Deposit | $0 | $500, to avoid fees | $500-$5,000, depending on what kind of CD |

Yield | N/A | Varies, depending on where you live | 0.05% or less |

Monthly Fees | $0 | $5, unless you meet one of their requirements | $0 |

Other Benefits | No fees at over 54,000 partner ATMs nationwide Get your paycheck up to 2 days early when you sign up for direct deposit. | No extra fees for extra withdrawals or overdraft transfers |

How Does Fifth Third Bank Compare?

Fifth Third Bank has a significant footprint across the Central and Southern U.S. If you are looking for a bank with a strong physical presence, there are other options.

Chase Bank is another top option for in-person service. But if you are looking to avoid the fees and capitalize on higher APYs, then Axos Bank is a better fit.Header |  |  | |

|---|---|---|---|

Rating | |||

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $0 | $0 | $0 |

ATM Access | 54,000+ Free ATMs | 60,000+ Free ATMs | Unlimited |

FDIC Insured | |||

Cell |

Fifth Third Promotions

Right now, Fifth Third has one promotion for checking accounts:

You can earn a $250 cash bonus when you open an eligible Fifth Third checking account by September 30, 2024 and complete qualified activities.

To qualify, you must do the following:

- Open a new checking account by September 30, 2024.

- Make direct deposits totaling $2,000 or more within 90 days of account opening.

Your $250 cash bonus will be deposited into your account within 10 days of meeting requirements.

How Do I Open An Account?

If you are ready to work with Fifth Third Bank, there are two ways to open an account. First, you could head down to your local branch to handle the documents.

The second option is to open an account online. It’s typically the more efficient choice. Simply head to your account of choice and select “open an account.” Be prepared to provide your Social Security Number, driver's license, and current bank information. Also, you’ll need a smartphone to take pictures of your information.

If you have the information ready, you can finalize the process in just 5 minutes.

Is It Safe And Secure?

Fifth Third Bank is FDIC insured. With that, the funds in your deposit accounts are protected for up to $250,000. Beyond this peace of mind, the bank offers regular fraud monitoring to help prevent identity theft.

How Do I Contact Fifth Third Bank?

Fifth Third Bank offers over 1,000 physical branch locations. So, if you want an in-person experience, that’s definitely an option.

But otherwise, you can send a message to the bank through your online account.

- Live agents can answer your questions Mon. through Fri. from 6 a.m. to 9 p.m. EST and Sat. and Sun. from 8:30 a.m. to 5 p.m. EST.

- You can also call 1-800-972-3030 between Mon. and Fri. from 8 a.m. to 6 p.m. EST or Sat. from 10 a.m. to 4 p.m. EST.

The customer reviews are mixed. On Trustpilot, the bank has received 2.1 out of 5 stars. But with just 36 reviews, it’s difficult to get a clear picture of the customer experience. However, an A+ Better Business Bureau accreditation does give the bank a boost.

Why Should You Trust Us?

The College Investor has been actively tracking the best savings account rates since 2018, with a daily updated list that monitors roughly 50 banks and credit unions that have a history of great rates. But we also are always scouting out other banks that may compete on this list.

Unlike other well-known companies who create "best savings account rate lists", we strive to put out rates in order highest to lowest so that you can know you're actually getting the best rate. And if you don't make the cut, too bad. You can find the full list of our bank review here.

Who Is This For And Is It Worth It?

Fifth Third Bank’s hallmark feature is its extensive physical presence. If you are someone that prefers an in-person banking option, then the accounts offered by this bank have the right perks.

But if you don’t mind giving up an in-person option, then you can look elsewhere for higher APYs and lower fees. Take a look at our top bank picks if Fifth Third isn’t the right fit for you.Fifth Third Bank Features

Account Types |

|

Minimum Deposit | $0 |

APY | Varies by ZIP |

Maintenance Fees (If Waiver Requirements Are Not Met) |

|

Overdraft Fees | $37 |

Foreign Transaction Fee | 3% |

Branches | 1,000+ Nationwide |

Mobile Check Deposits | Yes |

Cash Deposits | Yes, at hundreds of ATM locations |

Checkbook Support | Yes |

Early Direct Deposit | Up to 2 days early, as long as you sign up for Fifth Third Momentum Checking |

ATM Availability | 54,000+ Nationwide |

Customer Service Number | 800-972-3030 |

Customer Service Hours | Monday-Friday 8 a.m.-9 p.m. (EST) Saturday-Sunday 8:30 a.m.-5:30 p.m. (EST) |

Mobile App Availability | iOS and Android |

Bill Pay | Yes |

FDIC Certificate | |

Promotions | $250 Bonus |

Fifth Third Bank Review

-

Interest Rates

-

Customer Service

-

Tool and Resources

-

Fees and Charges

-

Ease of Use

Overall

Summary

Fifth Third Bank offers a solid basic checking account and has branches in 11 states and over 1,000 locations. The bank can help you focus on specific savings goals and avoid overdraft fees with their Extra Time feature.

Pros

- An extensive network of physical branches

- Easily save for multiple goals

Cons

- Low APYs

- Branches not available in every state

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Colin Graves Reviewed by: Robert Farrington