Found is a financial technology company that offers banking and bookkeeping services for small business owners.

If you run a one-person business, finding the right small business banking solution can be difficult because your needs are unique to running your business, solo. You likely need more than a personal checking account to manage your day-to-day and keep track of expenses, for example. You crave the robustness of a bank that caters to businesses, but may not be keen on paying the fees that come with it.

Found offers a solution for freelancers and other self-employed individuals through its business banking options. For anyone running a business by themselves, Found is worth taking a closer look at because it’s tailored specifically for what you need and what you don’t.

Let’s explore what Found has to offer.

Found Details | |

|---|---|

Product Name | Found |

Account Types | Business Checking |

Min Deposit | $0 |

Monthly Fees | $0 |

Promotions | None |

What Is Found Business Banking?

Found is a fintech that launched in 2019 to provide a freelancer-friendly banking experience.

Importantly, Found itself isn’t a bank. Instead, the fintech works with Piermont Bank, which provides the banking side of its services and issues it's debit card.

⚠︎ This Is A Banking Service Provider, Not A Bank.

Found is a financial technology company, not a bank. While it uses partner banks to provide banking services, your FDIC-insurance protection may be limited. Read this article from the FDIC to understand the risks of using a non-bank company.

What Does It Offer?

Throughout the platform, you’ll find features designed to make running a one-person business easier. Below is a closer look at those features.

Business Checking

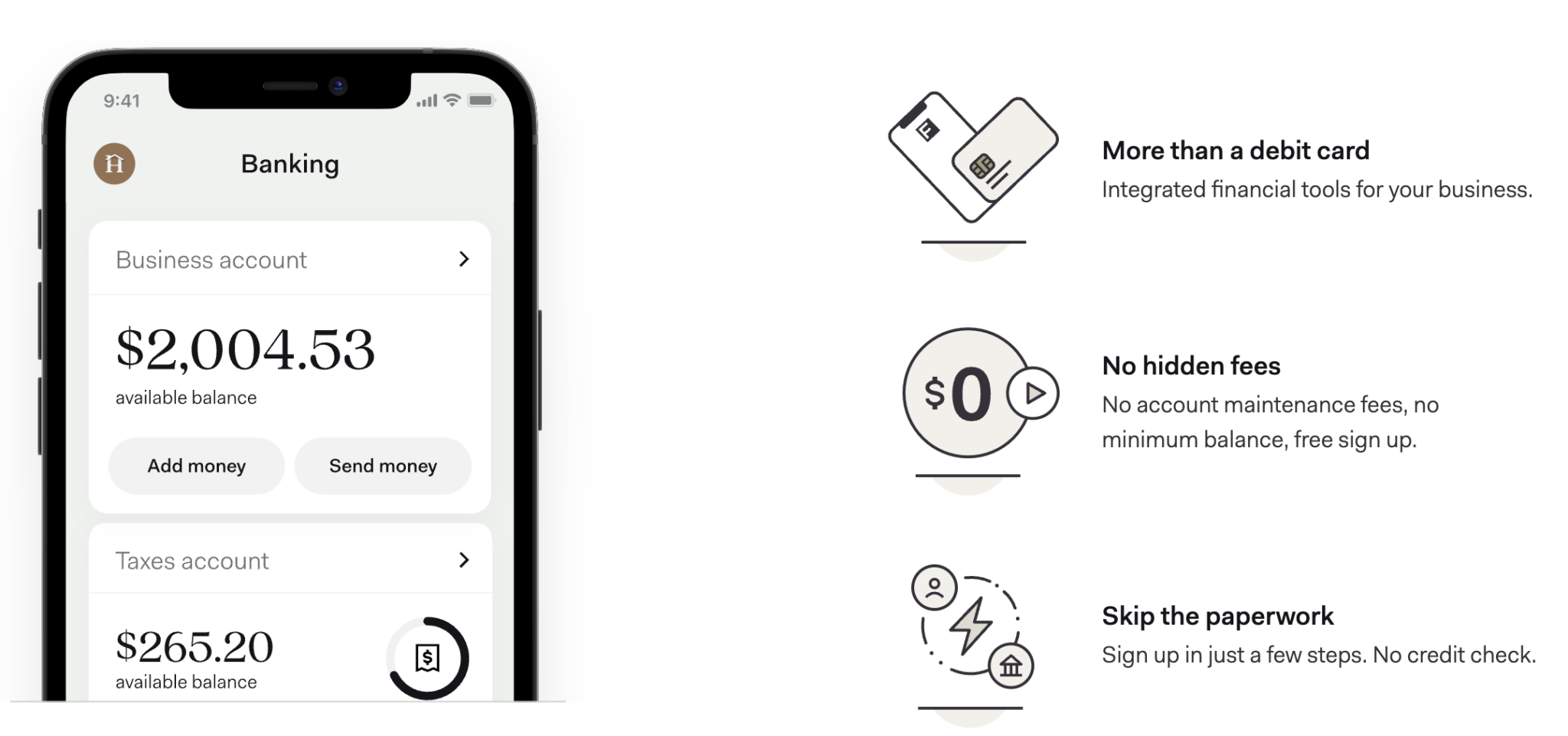

You can sign up for Found’s business checking account without meeting a minimum deposit requirement or passing a credit check. Once your account is set up, it supports an unlimited number of transactions.

The account comes with a Found business debit Mastercard. You have the option to use this physical card or spend with a virtual card. You can also manage your account from a desktop platform, or through the iOS and Android apps, which is convenient.

As a freelancer, a big part of running your business is getting paid on time. That often means providing a convenient method of payment for your customers.

Found connects to a wide range of apps, like Venmo, Cash App, or PayPal to offer streamlined payment solutions.

In addition to accepting direct deposits into your account, Found now accepts cash and check deposits. To deposit cash, click the "Add Money" button in the Found app, and select "Cash". You can then obtain a unique barcode and a cashier at a participating retail location can deposit your cash.

To deposit a check, click the "Add Money" button and select "Deposit a Check". Funds are available after 5 business days.

Bookkeeping

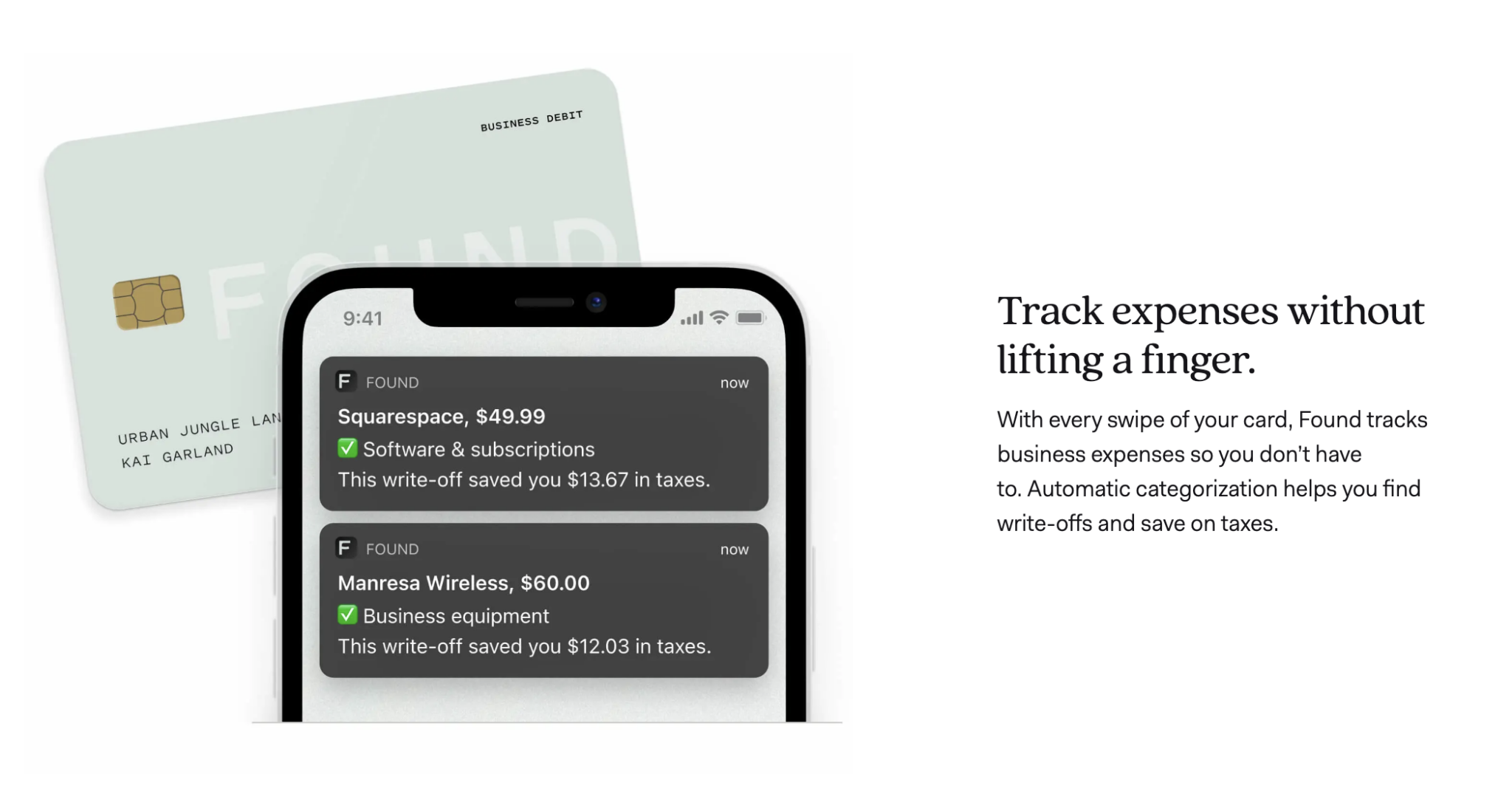

Bookkeeping is a sometimes tedious part of running a small business. Found offers a way to make your bookkeeping process easier.

The account will automatically track your expenses and allow for receipt capture. When you need to take a look at your expenses, you can tap into the helpful reporting tools that provide better visuals on the state of your business.

As a business owner, the best part is that you can handle your bookkeeping and banking in a single place. You don’t have to manage multiple apps to monitor your financial situation.

Taxes

When you’re self-employed, your tax bill is likely one of your biggest concerns. It’s critical to save throughout the year to cover your taxes. But it’s not always clear how much you should set aside. Found solves this pain point for freelancers.

Found will automatically set aside money for taxes in a separate savings account. Each time you get paid, the money you owe the IRS will be set aside. This automation is convenient and helps you to avoid accidentally spending more than you should because the money for taxes is already put aside.

Throughout the tax period, the Found app offers an estimate of your tax bill. The estimate can help you avoid any expensive surprises. Plus, Found will automatically generate a Schedule C form and help you pay your taxes right in the app.

This key business budgeting tool can help you stay on track to pay your taxes.

Invoices

Last but not least, Found gives you access to unlimited professional invoices. While you can draw up your own invoice, Found eliminates one more step in the process of running your business.

After sending the invoices, Found helps you keep track of their status. For example, you can see when your invoices are viewed and paid. If a reminder is required, Found will automatically send payment reminders to your clients.

Are There Any Fees?

Found doesn’t charge a monthly fee for its banking services. You’ll also avoid any ATM fees by sticking to in-network ATMs.

Although there are no fees, there is also no APY attached to this account, which means you won’t earn any extra money on your account.

Found Plus is an optional paid subscription service that gives customers access to advanced tools to power their business. For $19.99/month or $149.99/year, customers get access to the following features:

- 1.5% APY on balances up to $20k (as of Aug 1/23)

- Unlimited category rules

- Custom bookkeeping categories

- Custom transaction tags

- Photo receipt capture

- Export bookkeeping details

- Pay your quarterly taxes through Found

- Priority customer support

How Do I Contact Found Business Banking?

You can get in touch with Found by emailing help@found.com. Based on the positive Trustpilot rating, you should expect a good experience.

The Found app has also earned 4.7 out of 5 stars in the Google Play Store and 4.8 out of 5 stars in the Apple App Store.How Does Found Business Banking Compare?

Found isn’t the only banking experience that caters to freelancers and self-employed individuals.

Lili is another option for freelancers. It offers different levels of banking, some of which come with a monthly fee. But if you opt to pay a monthly fee of $9, you can tap into an interest-bearing opportunity. Lili also works as a useful business budgeting tool.

Novo is another banking platform that caters to freelancers. Through this bank account, freelancers can harness the power of algorithms to handle their finances efficiently.Header |  |  |  |

|---|---|---|---|

Rating | |||

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $0 | $0 | $0 |

ATM Access | Free (but some ATMs may come with their own fees) | 32,000+ Free ATMs | Unlimited (via Reimbursement) |

Mobile App | |||

Desktop Access | |||

FDIC Insured | |||

Cell |

How Do I Open An Account?

Want to work with Found? It should only take a few minutes to open an account.

Start by entering your email address and providing a password. After that, you’ll need to share information about your business.

Be prepared to share your name, your business name, your business entity type, your business address, and more. You’ll also need to share your Social Security Number but you will have the option to add an EIN for your business later.

If you want to fund your account, have the funding account information available.

Is It Safe And Secure?

When you open a Found account, your deposits are FDIC-insured for up to $250,000 through Piermont Bank. This means your funds are protected within this account.

Is It Worth It?

Found offers a business banking experience that is tailored to the needs of freelancers and self-employed individuals. You’ll find a single platform to send invoices, collect payments, pay your taxes, and monitor your business's financial situation.

Be sure to see what other options are available for your needs. Here are our picks for the best business checking accounts and top online banks for your consideration.

Found Features

Account Types | Business checking |

Minimum Deposit | $0 |

APY | 1.5% on balances up to 20k (Found Plus plan only) |

Maintenance Fees | $0 |

Branches | None (online-only bank) |

Debit Card | Found business debit Mastercard |

ATM Availability | Free withdrawals, but keep in mind some ATMs may come with their own fees. |

Accepts Cash or Check Deposit? | Yes |

Ability To Earn Interest On Checking? | No |

Ability To Write Checks? | No |

Amount Of Transactions | Unlimited |

Ability To Invoice | Unlimited, included |

Taxes | Automatically save for your tax bill through Found |

SSN Required | Yes |

EIN Required | No |

Customer Service Number | None listed |

Customer Service Email | |

Desktop Access | Yes |

Mobile App Availability | |

FDIC Certificate | 59154 (through Piermont Bank) |

Promotions | None |

Found’s core features are free. Found also offers a paid product, Found Plus

Found is a financial technology company, not a bank. Banking services are provided by Piermont Bank, Member FDIC. The Found Mastercard®️ debit card is issued by Piermont Bank pursuant to a license from Mastercard Inc.

Found Business Banking Review

-

Fees and Charges

-

Tools and Resources

-

Ease of Use

-

Products and Services

-

Ability to Deposit Cash or Checks

Overall

Summary

Run a one-person business? Found is a compelling business banking alternative with no hidden fees, tax calculators, and more.

Pros

- No monthly fee

- Built-in invoices features

- Streamlined bookkeeping and tax features

Cons

- Can only deposit cash at certain locations

- No physical branches

- Cannot add partners to your account

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak Reviewed by: Robert Farrington