Hanover Bank is a traditional brick-and-mortar bank based in New York. It offers online banking to customers in New York, New Jersey, Connecticut, and Pennsylvania. Accounts are available to consumers and businesses, with a wide range of banking and lending products supported.

Hanover Bank could be a good choice if you’re looking for a new bank and live in the Northeast. Plus, they offer some competitive annual percentage yields (APY) on their savings and money market products.

Keep reading for an in-depth look at how Hanover Bank works in our detailed Hanover Bank review.

Hanover Bank Details | |

|---|---|

Product Name | Hanover Bank MMA |

Account Types | Money Market |

Monthly Fee | $0 |

Opening Deposit Requirement | $1 |

APY | 5.30% |

What Is Hanover Bank?

Hanover Bank is a personal and business bank in the Northeast U.S. It operates physical branches in New York City, Long Island, and New Jersey and offers online banking to clients in Connecticut and Pennsylvania.

Hanover Bank features several consumer checking and savings account options, including accounts with no recurring monthly fees and competitive savings account interest rates.

The bank was founded in 2009 and operates nine branch locations. Hanover Bank is a member of the FDIC and offers more than 40,000 free ATMs through the Allpoint network.

It’s a publicly traded company, so financials are public for anyone to view. You can find it on the NASDAQ with the ticker symbol HNVR. As of the end of the second quarter of 2023, the bank held $1.59 billion in customer deposits with more than $2 billion in total assets.

What Does It Offer?

While businesses can find most banking needs met by Hanover Bank, we’re focused on consumer banking for individuals. Here’s a look at what Hanover Bank offers.

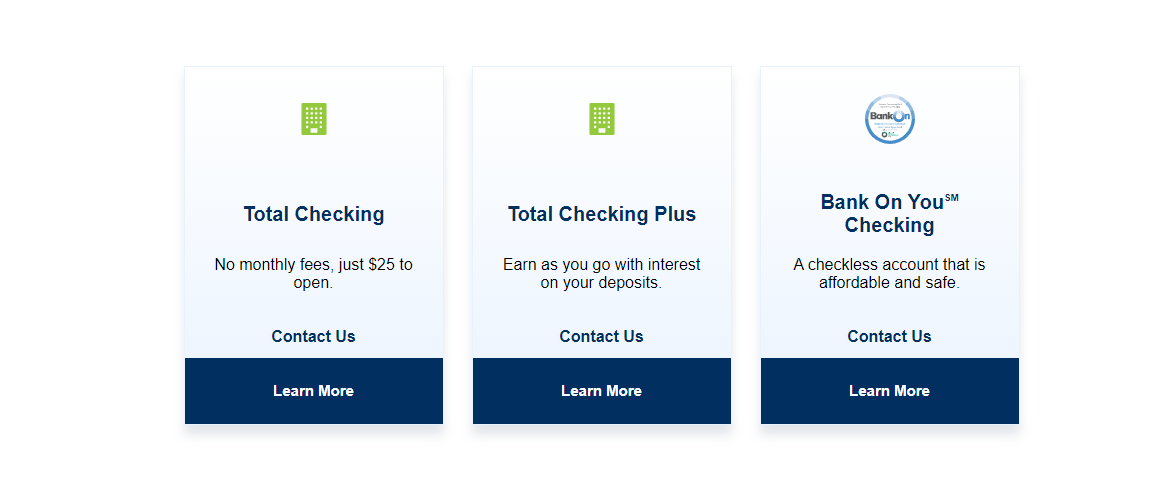

Checking

Hanover Bank has three personal checking accounts with varying minimum balance requirements and features.

- Total Checking: The basic checking account has no monthly fees or minimum balance requirements. It has a $25 minimum opening balance requirement.

- Total Checking Plus: Total Checking Plus features the ability to earn interest from your checking account balance. It has a $300 minimum opening balance and a $300 minimum daily balance requirement to avoid the $5 monthly service fee.

- Bank On You Checking: Bank On You Checking has a $25 minimum to open a new account with no monthly fees or minimum balance requirements thereafter. This account is electronic only, with no check-writing privileges.

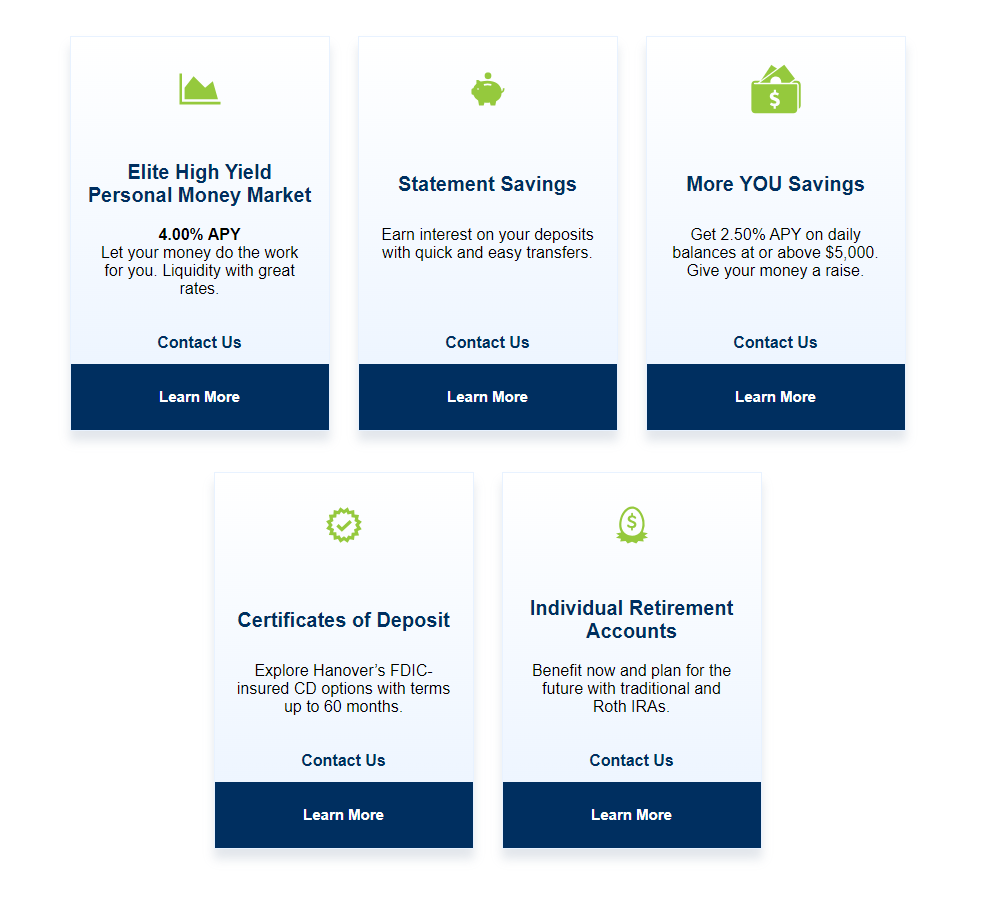

Savings

As with checking accounts, Hanover Bank features several savings options, including traditional savings, CD, and money market savings accounts.

- Statement Savings: The Statement Savings account has a much lower $100 daily balance requirement to avoid a $5 monthly service fee. It does earn interest but the rate is not disclosed online.

- More YOU Savings: This savings account earns an APY of 2.50% on balances over $5,000. Balances under $100 don't earn any interest and balances between $100 and $5,000 earn 0.01%. It requires a $100 minimum daily balance to avoid a $5 monthly service charge.

- Certificates of Deposit (CDs): Hanover Bank CDs come with terms of three months to 60 months. Interest rates vary by term, but some are very competitive, ranging between 3.00% and 5.35% APY. You’ll need at least $500 to open a new CD.

- Individual Retirement Accounts (IRAs): You can open a savings account as an IRA, though you’re likely better off with an IRA with full brokerage features.

Money Market

Hanover Bank is currently known for its online money market account that's offered in partnership with Raisin. This account is currently earning 5.30% APY, with just a $1 minimum deposit to open.

Home Loans

Lending programs include traditional mortgages, residential investment mortgage loans, foreign national investment mortgages, and home equity lines of credit (HELOCs). Rates and terms vary based on your credit history and other factors.

Are There Any Fees?

Hanover Bank offers accounts with no monthly fees and accounts where monthly fees apply if you don’t meet minimum daily balance requirements. Monthly fees are generally lower than many other banks, with $5 to $10 service charges depending on the account.

Keep an eye out for transactional charges for less common banking activities outside monthly fees.

How Does Hanover Bank Compare?

For online-only banking, which works well for anyone who doesn’t get paid in cash, consider banks such as Ally or SoFi. Both of these banks have checking and savings accounts with competitive interest rates, no monthly fees, and no minimum balance requirements.

If you need branch banking, consider Chase Bank, with branches in nearly all corners of the U.S. While interest rates are not great and you may encounter fees if you dip below the minimum balance requirement, Chase customer service is generally excellent and branches are easy to find.

Header |  | ||

|---|---|---|---|

Rating | |||

Online Only | No - branches in the Northeast | Yes | Yes |

APY On Savings | 5.30% | 4.20% | 4.60% |

Monthly Fee on Checking | $0 | $0 | No |

Fee-Free ATMs | Yes - Allpoint ATMs | Yes - Allpoint ATMs | Yes - Allpoint ATMs |

Cell |

How Do I Open An Account?

The easiest way to open an account with Hanover Bank is to visit a branch and open your account in person. Branches are located in Manhattan, Brooklyn, Queens, Long Island, and New Jersey.

If that’s inconvenient or you live in Connecticut or Pennsylvania, you can open select accounts online. Total Checking, Elite High Yield Personal Money Market, and 13-month CDs are available to open online. Other accounts are only offered in branch locations.

You can open the money market account in partnership with Raisin here >>

Is It Safe And Secure?

Hanover Bank is an FDIC-insured institution, so the national government protects your funds. Even if Hanover Bank goes out of business, which is unlikely, you’re guaranteed by the FDIC to get your money back, up to $250,000 per account type, per depositor.

As with any financial account, using a unique password and following cybersecurity best practices, such as updating your computer and phone, is critical. Never click links or open attachments in suspicious emails. Also, install quality antivirus software (even on Mac computers and smartphones) and turn on auto-updates.

How Do I Contact Hanover Bank?

You can reach Hanover Bank for customer service by phone, email, or in person at any branch. The phone number for Hanover Bank is 516-548-8500. There is also a contact form on their website.

Is It Worth It?

Hanover Bank is a reasonably good regional bank, with accounts offering competitive fees and interest rates. If you live near a branch or in one of the four states served by Hanover Bank, it’s worth considering for your checking and savings needs.

There’s stiff competition, however, from online-only banks offering features like ATM fee rebates and nationwide coverage. Check out our list of the best banks to compare and decide which makes the most sense for your unique banking needs.

Hanover Bank Features

Account Types |

|

Minimum Deposit |

|

Minimum Balance Requirements |

|

Monthly Fees |

|

Paper Statements | $2.00 per month |

Personal Credit Cards | No |

Online Banking | Yes |

Bill Pay | Yes |

Mobile Deposit | Yes |

Physical Branches | Yes, in the Northeast only |

ATM Availability | Yes, Allpoint ATMs |

Customer Service Number | 516-548-8500 |

Customer Service Hours | Monday through Friday 9 AM to 5 PM EST |

Mobile App Availability | Yes, iPhone and Android |

Web/Desktop Account Access | Yes |

Direct Deposit | Yes |

FDIC Insurance | Yes |

Promotions | No |

Hanover Bank Review

-

Interest Rates

-

Fees

-

Products and Services

-

Access

Overall

Summary

For those living in New York and New Jersey Hanover Bank offers banking products with low fees and competitive APYs.

Pros

- Competitive interest rates with flagship checking and savings accounts.

- Accounts with no minimum balance to avoid fees are available.

- Get in-person customer service if you live near a branch.

Cons

- It is only available in four states, with branches only around the New York City area.

- Some accounts have minimum balance requirements to avoid fees and earn the top interest rates.

- Only a few accounts are available to open online.

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Ashley Barnett Reviewed by: Robert Farrington