When Juno (formerly OnJuno) first launched, it mostly focused on offering attractive high-yield checking and cash back options. And those options are still available.

For example, Juno is currently offering a whopping 5.00% interest rate on checking accounts and 5% cash back at select merchants when you spend with cash and 10% back when you spend with crypto. With those kind of interest and cash back rates, Juno even offers better returns than many savings accounts.

But high-yield checking isn't all that Juno is known for anymore. Over the past year, the company has been shifting heavily into crypto banking and has added some truly unique and noteworthy products in that space. Let’s take a closer look at what Juno has to offer.

Editors Note - May 15, 2024: Juno has been impacted by the financial troubles of a couple of its financial technology and banking partnerships, namely Synapse and Evolve Bank & Trust, the latter of which provided banking services to Juno.

While the company has yet published any updates on its website regarding the status of its accounts, Juno reported on Twitter on May 13th that the company was experiencing service disruptions to its banking and card services, with a promise to update users as soon as possible.

The situation appears to be continually evolving, so we will provide further updates on this review post as details become available.

Juno Details | |

|---|---|

Product Name | Juno |

Min Deposit | $0 |

APY | Up to 5.00% |

Cash Back | Up to 10% |

Account Types | Checking |

Promotions | $10 bonus on first crypto trade or min $50 deposit $50 bonus with first direct deposit of at least $250 |

Who Is Juno?

Juno (legal name CapitalJ Inc.) is an online-only banking service that makes it easy to manage your cash and crypto assets all in one place. Its co-founders are Varun Deshpande, Ratnesh Ray, and Siddharth Verma. It is based in Bengaluru, Karnataka, India, with offices in San Francisco, CA, and Singapore. Juno was founded in 2019 and has raised $3 million in a seed round.

⚠︎ This Is A Banking Service Provider, Not A Bank.

Juno is a financial technology company, not a bank. While it uses partner banks to provide banking services, your FDIC-insurance protection may be limited. Read this article from the FDIC to understand the risks of using a non-bank company.

What Do They Offer?

Juno is not actually a bank. It's a fintech and provides banking services through its partner bank Evolve Bank and Trust. Juno offers two different high-yield checking account options, with its premium "Metal" account paying a 5.00% annual percentage yield (APY) bonus up to certain amounts.

It also offers a 5% cashback bonus on certain debit card purchases when you spend with cash, and up to 10% when you spend with crypto. Coupled together, these features can make Juno a very attractive checking product. It also allows customers to get paid in crypto, instantly convert crypto to cash.

Juno uses Allpoint or a MoneyPass for its ATM network (85,000+ locations). The Juno card is compatible with contactless mobile payments such as Apple Pay, Google Pay, and Samsung Pay.

Basic Checking

The lower tier checking product is the Basic. It has the following features:

The 5% rate only applies to the first $10,000 of deposits. Also note that the spending limit for the 5% cashback is $500 per year for Basic and $6,000 per year for Metal, which is not as common with some of the top cashback credit cards.

Metal Checking

Metal Checking is the highest tier checking account with Juno. To upgrade an account to the Metal plan, you need to set up a direct deposit of $250 or more per month. Once the direct deposit is settled, the account will be automatically upgraded to the Metal plan.

It has the following features:

Note that Juno does not currently offer joint checking accounts on either of its plans.

Cashback

The Juno cashback program works differently from other banks. Rather than cashback on certain categories of spending, you receive cashback when spending at five partner retailers of our choosing.

You can currently get up to 5% cash back when you spend with cash, and up to 10% when you spend with crypto.

There are 30+ brands to choose from for the bonus cashback. These include Amazon, Walmart, Netflix, DoorDash, Netflix, Target, Dunkin Donuts, and many more household names.

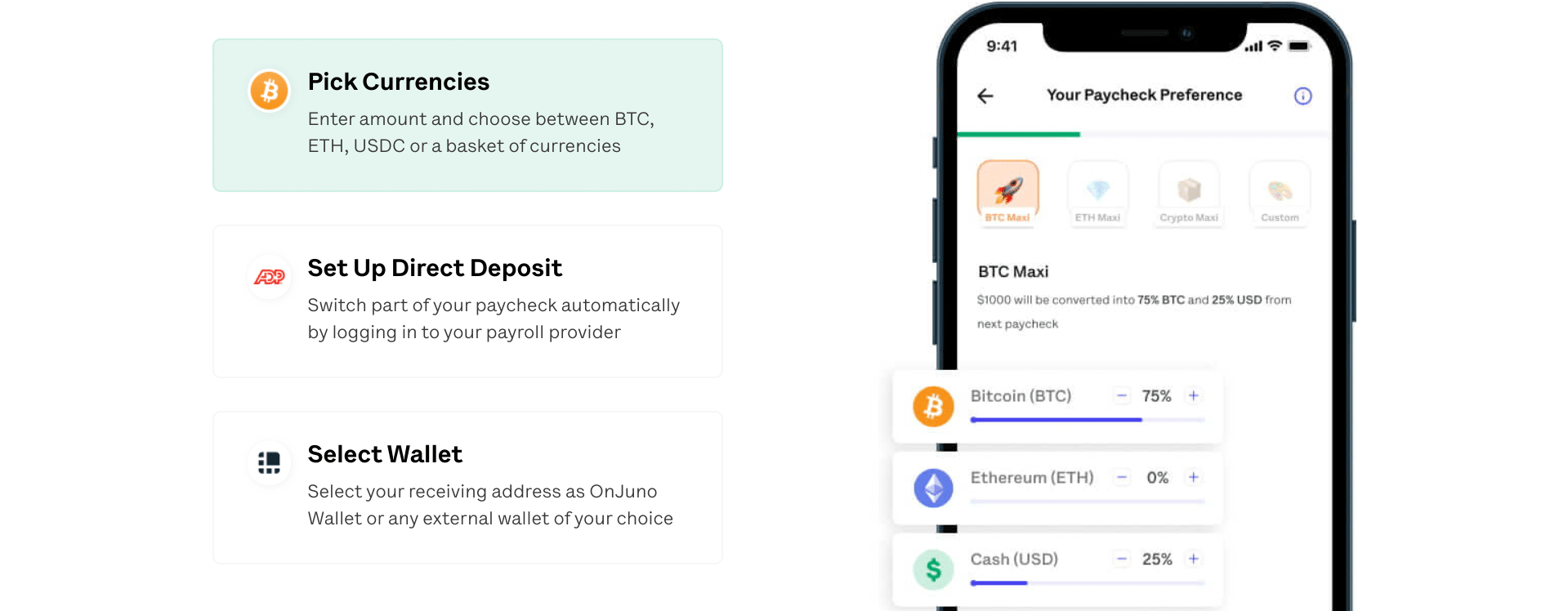

Crypto Paycheck

With Juno, you can receive part of your paycheck in crypto. You can choose BTC, ETH, USDC, or a basket of currencies. For example, you could tell Juno that you want to be paid 50% in Bitcoin, 25% in Ethereum, and 25% in cash.

Juno has partnered with ZenGo to offer a secure wallet for Juno users to store their crypto. The two companies are offering a $50 BTC or ETH bonus (via the referral code ZENGO) to customers who set up their ZenGo wallet with Juno and receive their first direct deposit of at least $250 or more.

Instant And Free Crypto Cashouts

When you liquidate crypto assets, it can sometimes take days for the cash to arrive in your bank account. And many exchanges charge crypto withdrawal fees.

Juno eliminates both of these pain points. Crypto cashouts arrive instantly in your Juno checking account. And at least right now, you can sell (or buy) crypto at any time for free.

International Transfers

Juno offers a competitive international money transfer service that's powered by Wise. It supports near-instant transfers (about 5 minutes) to 30+ different countries. And Juno says that its fees are significantly lower than what you'll pay with most standard banks or PayPal.

Mobile App

Juno's mobile app is available on both iOS and Android. It makes it easy to manage your account and can connect to over 3,800 third-party financial apps. Prominent app integrations include: Apple Pay, Google Pay & Samsung Pay, Venmo, Cash App, Robinhood, Acorns, and Coinbase.

Are There Any Fees?

Juno does not have any monthly fees.

The following transaction-related fees will apply to both accounts:

Juno is currently running an early access promotion for its crypto paycheck product. Through Dec. 31, it isn't charging any fees for buying and selling cryptos. This limited-time fee waiver is capped at $250,000 of transaction volume. After that, you'll pay 0.95% per order.

Juno also doesn't charge any extra fees for depositing or withdrawing cryptos to and from external wallets. However, Bitcoin and Ethereum network fees will still be charged.

How Does Juno Compare?

Juno offers some of the best interest and cashback rates that you can find right now. But when we first reviewed Juno, we were disappointed to find that both of those earnings opportunities have fairly strict limits on the Basic Checking plan.

Basic customers only earn 5% APY on up to $5,000 of deposits. And 5% cashback on total annual spends of $500 when they pay with cash or crypto.

However, the Metal Plan has much higher limits ($100,000 for interest; $3,000 for cashback). Juno is truly able to compete with the online banking heavyweights. Here's a quick look at how it compares.

Header |  | ||

|---|---|---|---|

Rating | |||

APY | Up to 5.00% | 0.50% | Up to 1.00% |

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $0 | $0 | $50 |

ATM Access | 85,000+ Free ATMs | 38,000+ Free ATMs | 91,000+ Free ATMs |

FDIC Insured | |||

Cell |

How Do I Open An Account?

You can visit the Juno website to open an account. You'll be asked to provide the following during your application:

- Name

- Mobile number

- Home address

- Social security number

- Documents to verify your identity (driver license, passport, or legal Identification)

Once Juno has verified your information, you can make your initial deposit and will have immediate access to your virtual card.

Is My Money Safe?

Yes - Juno uses encryption on their website, and cash deposits are FDIC insured up to $250,000 through their partner bank Evolve Bank and Trust. The debit card includes Mastercard's Zero Liability policy, protecting you from unauthorized transactions.

How Do I Contact Juno?

Juno offers both phone and live chat support. You can call their support team at 1-415-969-5775. Their phone lines are open Monday through Friday, 9 AM to 6 PM (PST).

You can start a chat with an Juno team member from their website. Chat support is available every day from 5 AM to 6 PM (PST).

Juno's Trustpilot rating is "Great," at 3.9/5 from 309 customer reviews. However, the company isn't accredited with the Better Business Bureau (BBB) and, as of writing, has failed to respond to the 17 complaints that have been filed there.

Why Should You Trust Us?

The College Investor has been testing and reviewing checking accounts for over 10 years. I personally have been actively writing about banking products and the need for free checking since 2009.

In creating this guide, we've looked at our extensive list of bank reviews, our knowledge of the banking industry, and compared at least 50 of the top banks in the United States to see which free checking accounts are the best for consumers.

Furthermore, our compliance team checks the accuracy of any rates on this list every weekday, to ensure that you're getting the most accurate information we can create.

Who Is This For And Is It Worth It?

If you're looking for a banking solution that can take care of your cash and crypto management needs all under one roof, Juno is one of the best options available today. And even if you're not really into crypto, the 5.00% rate that you can earn is hard to beat.

But that high APY is limited to your first $5,000 with Basic Checking. It extends to your first $100,000 with Metal Checking, but it requires a direct deposit of $250 or more per month.

If you'd rather find a bank that offers a high yield on all balances with no direct deposit requirements, check out these alternatives.

Juno FAQs

Let's answer a few of the most common questions that people ask about Juno:

Is Juno a real bank?

Juno itself is a fintech. However, it runs its banking service through Evolve Bank & Trust which provides FDIC insurance on cash deposits.

Are cryptocurrencies held with Juno insured by the FDIC?

No, the FDIC only insures cash deposits of U.S. legal tender (i.e. dollars and cents).

Do you get a physical debit card with Juno?

When you sign up for an account, you'll immediately be issued a virtual card that can be added to digital wallets like Apple Pay, Google Pay, and Samsung Pay. However, if you want a physical card as well, you can contact Juno customer support to request a plastic card (for Basic customers) or metal card (for Metal customers) to be shipped to you.

Does Juno have a signup bonus?

Yes, you can receive a $10 bonus on first crypto trade or a minimum deposit of $50. You can also score a $50 bonus on your first direct deposit of at least $250.

To receive the bonus, you'll need to make the qualifying deposit within 30 days of opening your account and you'll need to a keep minimum account balance of at least $200 for 30 days after the deposit.

Juno Features

Account Types | Checking |

Minimum Deposit | $0 |

APY | Up to 5.00% |

Cashback |

|

Monthly Fee |

|

Activity Fees |

|

Branches | None (online-only bank) |

ATM Availability | 85,000+ fee-free ATMs nationwide within the Allpoint and MoneyPass ATM networks |

Out-Of-Network ATM Reimbursements |

|

Customer Service Number | 415-969-5775 |

Customer Service Hours | 9 a.m. to 6 p.m. (PST) |

Mobile App Availability | iOS and Android |

Direct Deposit | Yes |

Bill Pay | Yes |

FDIC Certificate | 1299 |

Promotions for New Users |

|

Juno Review

-

Interest Rates

-

Rates and Fees

-

Customer Service

-

Products and Services

Overall

Summary

Juno’s digital checking accounts come with interest and cash back rates that rival even the best savings accounts.

Pros

- Up 2.15% APY on deposit

- Up to 5% cash back when you spend with cash and up to 10% cash back when you spend with crypto

- Large fee-free ATM network

- Get your paycheck in crypto

Cons

- Metal plan requires a direct deposit of $250 or more per month

- No branch locations

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett