NelNet Bank is a private lender that offers student loan refinancing. As a bank, they also offer a high-yield savings account and CD products.

The student loan lending landscape is full of government and private funding options with all sorts of terms, conditions, fees, and varying interest rates.

The sheer number of choices can make shopping around for the best rates very time-consuming (which is why a comparison-shopping service like Credible can be so helpful).

A new entrant was added to the list — Nelnet Bank. You're probably more familiar with Nelnet as a federal student loan servicer. But the company also provides student loan refinancing and will soon be offering in-school private student loans and banking products as well.

To help you figure out if Nelnet Bank is worth considering, we've scoured it's website for the most important refinancing information. Continue reading our full Nelnet Bank review to learn more about what it has to offer.

Nelnet Bank Details | |

|---|---|

Product Name | Nelnet Bank |

Min Loan Amount | $5,000 |

Max Loan Amount | $125,000 - $500,000 |

Fixed Rate APR | 4.24% - 15.47% |

Variable Rate APR | 6.30% - 15.52% |

Loan Terms | 5 - 25 years |

Promotions | None |

Who Is Nelnet Bank?

Nelnet Bank is an online-only bank that offers student loan refinancing. Its CEO is Andrea Moss. Nelnet Bank was formed in November 2020. It operates as an internet bank franchise and is a subsidiary of Nelnet, Inc. It is based in Salt Lake City, UT. Nelnet Bank was funded with $100 million from Nelnet.

In a press release, Moss said, "At Nelnet Bank, our mission is to help families achieve their dreams with financial knowledge and access to education. Nelnet Bank will allow us to meet the changing and diverse needs of the higher education market."

Banking

While NelNet is mostly known as a student loan lender, they are also a bank - and as a bank they offer key banking products. The currently offer business CDs and a high-yield savings account.

Their high-yield savings account is offered in partnership with Raisin. It currently earns 5.22% APY, with just a $1 minimum to open. You can open a savings account here >>

Student Loans

Currently, Nelnet Bank only offers student loan refinancing. It will soon offer private student loans and high-yield CDs as well. Here are the key details that you should know about NelnetBank before you apply with them:

Rates And Terms

Nelnet Bank offers both fixed-rate and variable-rate loans. Here are their current rates:

- Variable: 6.30% - 15.52% APR

- Fixed: 4.24% - 15.47% APR

If you sign up for auto-debit, Nelnet Bank will reduce your interest rate by 0.25%.

Loan terms are available for 5 to 25 years. In general, the shorter the loan term, the lower your interest rate will be. However, your monthly payment will also be higher.

There are limits on the amount that can be refinanced with Nelnet Bank. The minimum loan amount for all borrowers is $5,000. The maximum you can borrow will depend on the type of degree you hold, as the table below shows.

Undergraduate | $125,000 |

Graduate, Doctorate, MBA, or Law | $175,000 |

Graduate Health Professions | $500,000 |

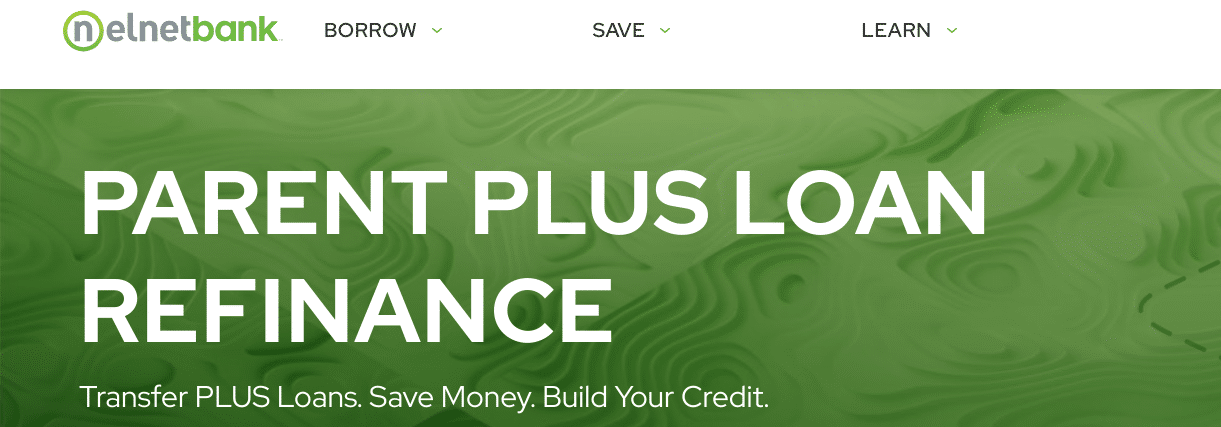

Parent Plus Refinancing

Nelnet Bank recently added "Parent Plus Refi" to its list of products. Not only will they refinance Parent Plus Loans, but they'll also allow the loans to be transferred into the child's name.

Of course, you'll need to meet Nelnet Bank's loan eligibility criteria on your own in order to assume ownership of your parents' loans.

Cosigners And Cosigner Release

If you don’t meet the credit score or income thresholds, your cosigner must meet them. Cosigners are not required but can help you get the best rate. And non-residents can become eligible for refinancing by applying with a cosigner who is a creditworthy U.S. citizen or permanent resident.

Nelnet does have a cosigner release option after 24 consecutive, on-time payments of principal and interest have been made within 15 days of their due date. To release a cosigner, the borrower must meet the latest credit underwriting eligibility requirements.

Are There Any Fees?

While there are no origination or application fees, there is a 5% late fee if you're 15 days late. The fee is applied to the payment amount. This fee cannot be more than $25. You're not charged any fees for paying your loan off early or making extra payments.

How Does Nelnet Bank Compare?

Nelnet Bank's interest rate ranges are competitive. And we love that they'll accept cosigner release requests after just 24 months. But they aren't currently offering any cash bonuses and it's too early to know what level of customer service they'll provide.

To get the best rate on student loan refinancing, it's important to shop around with multiple lenders. Check out this quick comparison:

Header |  |  | |

|---|---|---|---|

Rating | |||

Variable APR | 6.30% - 15.52% | 5.28% - 9.99% | 5.28% - 8.99% |

Fixed APR | 4.24% - 15.47% | 4.99% - 9.99% | 5.48% - 8.69% |

Bonus Offer | None | Up to $500 | Up to $1,100 |

Cell |

What Borrower Protections Are Available?

When we first reviewed Nelnet Bank, it was offering up to 24 months of hardship forbearance on its refinance loans. And, at the time, we praised Nelnet bank for this forbearance period which was one of the longest that we'd seen.

However, Nelnet Bank has since changed its forbearance policy. Now the maximum amount of time that you can pause payments is 12 months. Twelve months of forbearance is still better than some lenders offer. But it's still disappointing to see that 24 months is no longer being provided.

It's unclear if Nelnet Bank offers death or disability discharge. We also couldn't find any written guidelines regarding active-duty military deferment or deferment for going back to school.

How Do I Apply?

You can visit the Nelnet Bank website to apply. There are three steps in the application process:

- 1Complete application

- 2Review loan offers

- 3Accept loan offer

To qualify for refinancing with Nelnet Bank, you’ll need to meet the following criteria:

After getting approved, you’ll need the most recent student loan or payoff verification statement. Proof of income is also required, which can be your two most recent pay stubs.

How Do I Contact Nelnet Bank?

Nelnet Bank customer service is available from 7 a.m. – 8 p.m. (CT) Monday through Friday. They can be reached at 800-446-4190 or Loans@NelnetBank.com.

As of September 2021, there are no customer service reviews of Nelnet Bank on Trustpilot. It also hasn't received any reviews and is not yet accredited with the Better Business Bureau (BBB).

Why Should You Trust Us

I am America’s Student Loan Debt Expert™ and have been actively writing about and covering student loans since 2009. Myself and the team here at The College Investor have been actively tracking student loan providers since 2015 and have reviewed, tested, and followed almost every provider and lender in the space.

Furthermore, our compliance team reviews the rates and terms on these listing every weekday to ensure they are accurate. That way you can be sure you're looking at an accurate and up-to-date rate when you're comparison shopping.

Who Is This For And Is It Worth It?

Nelnet Bank has the resources and experience of Nelnet, Inc (which has been part of the student loan industry for 30 years) at its disposal. In theory, that could result in knowledgeable service and solid benefits.

But, at the end of the day, it all comes down to fees and interest rates. There are no fees with Nelnet Bank, but you’ll have to shop around to see if they offer the best rate.

We can help you with that. Check out our post on the best places to refinance student loans. It’s great for helping you compare rates and terms from multiple lenders.

Nelnet Bank FAQs

Let's answer a few common questions people ask about Nelnet Bank:

Is Nelnet Bank legit?

Yes, Nelnet Bank is owned by Nelnet, Inc. which has been involved in the student loan industry for 25 years. However, the jury's still out regarding whether Nelnet Bank will be able to provide stellar customer service to its private loan borrowers.

Are Nelnet Bank student loans forgiven?

No, while Nelnet, Inc. services federal student loans (which can be forgiven under certain circumstances), Nelnet Bank loans are private and, thus, don't qualify for federal forgiveness programs.

When will my first student loan payment with Nelnet Bank be due?

In most cases, first payments are due about 45 days after loan disbursement.

Does Nelnet Bank offer any bonuses?

Not currently, but we'll make sure to update this review if Nelnet Bank decides to add a cash bonus promotion in the future.

Nelnet Bank Features

Min Loan Amount | $5,000 |

Max Loan Amount | Undergraduate: $125,000

Graduate health professions degree: $500,000 |

Soft Credit Check | Yes |

Auto-Pay Discount | 0.25% |

Loan Terms | 5 - 25 years |

Origination Fees | None |

Prepayment Penalties | None |

Forbearance Length | Up to 12 months |

Late Payment Fee | 5% of payment amount (max of $25) |

Cosigners | Allowed |

Cosigner Release | Can be requested after 24 consecutive, on-time payments |

Graduation Requirement | Yes, must have at least a bachelor's degree |

Customer Service Phone Number | 1-800-446-4190 |

Customer Service Email | loans@nelnetbank.com |

Customer Service Hours | Mon-Fri, 7 AM - 8 PM (CT) |

Mailing Address | Nelnet Bank 13907 S. Minuteman Dr., Ste. 250 Draper, UT 84020 |

Promotions | None |

Nelnet Bank Review

-

Rates and Fees

-

Application Requirements

-

Customer Service

-

Products and Services

Overall

Summary

Nelnet Bank, a subsidiary of Nelnet (the federal loan servicer), provides student loan refinancing and has a high-yield savings account.

Pros

- No origination or application fees

- Low rates for qualified borrowers

- Allows Parent Plus Loan transfers

- Cosigner release as soon as 24 months

Cons

- No refinance bonus offers

- Won’t lend to borrowers with credit scores below 680

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller