Prodigy Finance offers student loans to students at over 1,600 schools in more than 150 countries. It offers student loan refinancing to international workers who graduated from top master’s degree programs living in the U.S. or in the U.K.

International graduate students and U.S. non-citizen residents often face many challenges when it comes to taking out and refinancing their student loans. However, Prodigy Finance is a company that's been working for over a decade to change this.

But are these private student loans worth the cost? This is what you need to know before you borrow money from Prodigy Finance.

Prodigy Finance Details | |

|---|---|

Product Name | Prodigy Finance |

Min Loan Amount | $10,000 |

Max Loan Amount | 80% to 100% of Cost of Attendance |

APR | As low as 10.8% APR |

Rate Type | Variable |

Origination Fee | Up to 5% |

Promotions | Variable and Fixed |

What Is Prodigy Finance?

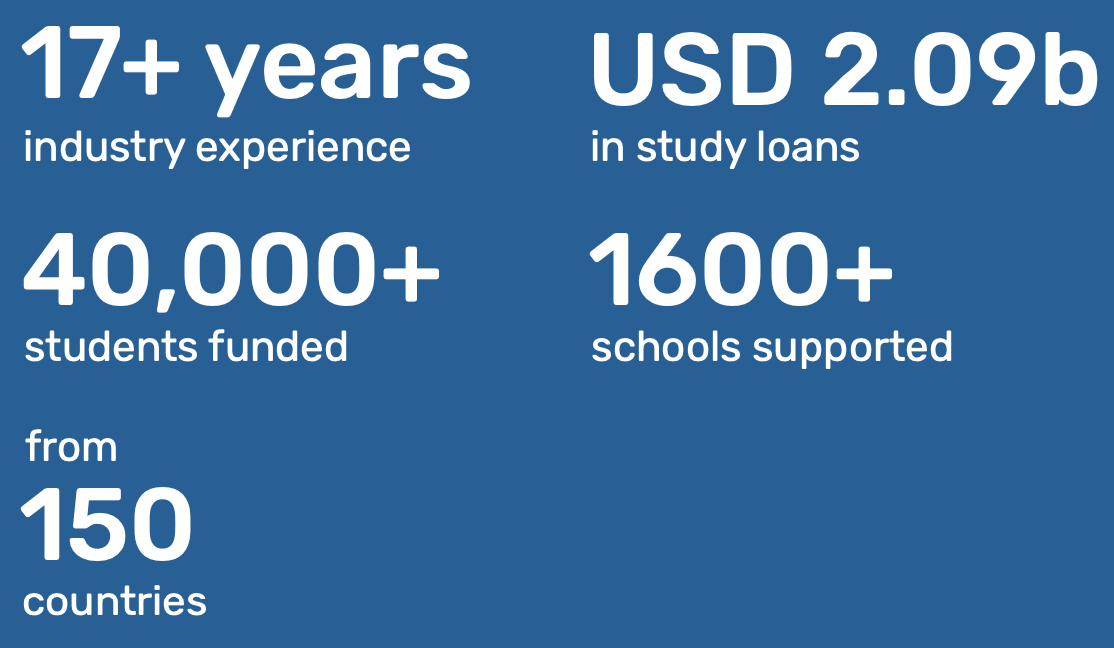

Prodigy Finance is a company that extends student loans to international graduate students in over 150 countries and 1,600 schools (see their supported programs here).

With rates as low as 10.8% (as of June 2024), these can be some of the most affordable student loans for international students who do not qualify for U.S. Department of Education loans. Students going for STEM Courses in the USA with top universities are eligible to get the most competitive rates.

Most loans are underwritten based on your credit score and current income. However, Prodigy Finance underwrites its loans based on your expected future income.

In one sense, that's a good thing because it enables Prodigy to offer financing to students who don't U.S. credit reports. However, you'll want to be careful because there's the potential to over-borrow if you aren't able to earn the expected salary right out of school.

What Are The Interest Rates And Terms?

Unlike most student loans, the loans offered by Prodigy Finance are variable interest rate loans. The monthly loan payment may adjust as often as every three months, since the rates are determined by the three-month U.S. LIBOR plus a base rate. At the time of writing, Prodigy says that the minimum possible APR you could be offered is 11.18%, with an average APR of 14.88%.

While a variable rate may not be a big problem in the short term, many of Prodigy Finance’s loans amortize over 20 years. That means that you could be subject to dramatically higher payments later on in the life of your loan.

Borrowers can borrow funds for terms ranging from 7 to 20 years. Prodigy doesn't require any payments while you're enrolled full-time in your masters program. There's also a 6-month grace period after you leave school before your monthly payments begin.

The minimum loan amount is $10,000, but the upper limit will depend upon the cost of attendance at the school in question. For some programs, Prodigy Finance extends loans up to 100% of the cost of attendance. For other programs the maximum loan amount is 80% of the program’s cost.

Are There Any Fees?

Yes, unlike most traditional private student loan lenders, Prodigy Finance does charge an origination fee that it calls its "Admin Fee." The fee will vary based on your loan type and amount, but it can be as high as 5%.

In addition, when a student's application is matched to available funds (on reaching loan approved stage) a prepaid fee of $100 is charged. You can get a provisional offer for free.

However, there are no prepayment penalties with Prodigy. And it appears that they don't charge fees for late payments either.

How Does Prodigy Finance Compare

Before you apply with them, you'll want to compare their rate, terms, and fees with a few other lenders that provide international student loans. Check out this quick comparison chart:

Header |  |  |  |

|---|---|---|---|

Rating | |||

U.S. Cosigner Required | No | Yes | No |

Origination Fee | Up to 5% | None | 5% |

Rate Type | Variable | Variable and Fixed | Fixed |

Terms | 7 to 20 Years | 5 to 15 Years | 10 Years |

Cell |

Who Is Eligible To Apply With Prodigy Finance?

To borrow from Prodigy Finance you must be an international masters student in select schools across the world. Undergraduate students will not qualify for loans from Prodigy Finance.

You must be accepted into a supported graduate school to qualify for the loans from Prodigy. In addition to being accepted into an eligible school, you must have proof of income, a credit report from your home country (or the country where you currently live), and proof of savings.

Prodigy Finance has no U.S. credit score requirements to apply for a loan. You also won't need a cosigner or collateral to qualify for financing.

What Borrower Protections Are Available?

Typically, we recommend that borrower max out their federal student loan options before turning to student loans due to the extra borrower protections. For example, only federal borrowers can join income-driven repayment plans and can apply for federal forbearance and deferment periods.

However, if you're looking for international student loans, it's likely because you don't qualify for federal loans anyway. Still, Prodigy lags behind other private student loan lenders in that it doesn't have any formal forbearance or deferment policies.

You might be able to pause your student loans to financial hardship or for other reasons (such as going back to school), but there are no guarantees. Prodigy examines all forbearance and deferment requests on a case-by-case basis.

How Do I Contact Prodigy Finance?

Due to the variety of geographies that Prodigy serves, it has several available contact phone numbers. These are:

- Global: (+44) 20 3900 3535

- India: 000 800 9190 242

- UK: 0800 368 8766

- US: 866 533 3304

- Brazil: 11 3197 8763

You can also reach out via email at info@prodigyfinance.com. The customer service team is available Monday - Friday during the following hours:

- GMT: 6 AM - 10 PM

- EST: 2 AM - 6 PM

- IST: 11:30 AM - 3:30 PM

Is It Worth It?

If you’re an international student who needs money for graduate school, Prodigy Finance may offer the best possible rates for you. However, you should carefully consider whether you can realistically afford the monthly payments upon graduation.

International students who need to refinance their loans should shop around carefully. Many banks will refinance student loans for borrowers who are legal residents of the United States, so borrowers may find better interest rates and terms elsewhere.

Consider comparing rates and options at Credible to find the best rates for your situation.

Prodigy Finance FAQs

Let's answer a few common questions about Prodigy student loans:

How is Prodigy's admin fee charged?

The admin fee is added to your loan amount rather than being structured as an upfront cash charge.

What documents will I need to provide to Prodigy?

Prodigy will ask you to submit documents related to: proof of identity, proof of address, credit report, proof of income, proof of admission, proof of savings (if applicable), proof of scholarship (if applicable).

Does Prodigy offer scholarships?

In previous years, Prodigy has provided high-potential students with $10,000 to study abroad through its Prodigy Finance Global Scholarship.

Is Prodigy Finance legit?

Yes, Prodigy has been around since 2007 and has already provided financing to over 20,000 international students.

Prodigy Finance Features

Min Loan Amount | $10,000 |

Max Loan Amount | 80% to 100% of cost of attendance |

Prepaid application fee | $100 |

Variable APR | Starting at 10.8% |

Pre-Qualified Rates (Soft Credit Check) | No |

Autopay Discount | 0.50% |

Loan Terms | 7 to 20 years |

Origination Fee | Up to 5% |

Prepayment Penalty | No |

In-School Payments | Full deferment |

Late Payment Fee | None listed |

Cosigners Allowed | No |

Cosigner Release | N/A |

Grace Period | Yes, 6 months |

Forbearance Period | No formal policy |

Residency Deferment | No |

Eligible Schools | 1,600 graduate schools worldwide across business, engineering, law, public policy, and medical |

Enrollment Status (For Student Loans) | Full-time (or part-time in certain instances) |

Customer Service Phone Number |

|

Customer Service Hours | Monday - Friday:

|

Loan Servicer | Prodigy Finance |

Address For Sending Payments | N/A (only accepts electronic payments) |

Promotions | None |

Prodigy Finance Review

-

Rates and Fees

-

Application Process

-

Customer Service

-

Products and Services

Overall

Summary

Prodigy Finance provides international private student loans that don’t require cosigners, collateral, or U.S credit scores.

Pros

- Lends to students in 150+ countries

- No cosigner or collateral requirements

- Flexible repayment terms of 7-20 years

Cons

- Origination fee of up to 5%

- Only offers variable-rate terms

- No formal forbearance policy

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller