Some people want to save on investment advice by using free or low-cost services such as robo advisors. There’s nothing wrong with that.

But if you want to speak with a human, financial advisor, that will cost more. If you want to be able to step into your local advisor’s office, where you deal with the same advisor on every visit, that will cost still more.

For the latter, there is Edward Jones. Edward Jones gets a lot of negative reviews on its fees. Is it really a terrible deal? In this article, we’ll go over who Edward Jones is really for, and if the high fees and bad reviews are justified.

Quick Summary

- Local offices for an in-person experience

- High fees in exchange for high level of service

- Best for people who want completely hands-off investing

Edward Jones Details | |

|---|---|

Product Name | Edward Jones |

Min Investment | $0 |

Trade Transaction Fee | $4.95 |

Trade Commissions | Up to 2.50% |

Management Fee | 0.50% to 1.35% |

Account Type | Roth, Traditional, SEP, SIMPLE, 529, Taxable |

Promotions | None |

Who Is Edward Jones?

Edward Jones provides investment services to individuals of all sizes and small businesses. It was established in 1922. Edward Jones serves nearly 7 million investors and has the largest retail footprint of any financial services company in America. It also serves clients in Canada.

The CEO of Edward Jones is Penny Pennington. She is also the sixth managing partner. "Edward Jones was built for our clients, and our purpose is to make a difference in their lives and the lives of their families" said Pennington on the Edward Jones History page.

What Do They Offer?

Edward Jones (EJ) is a full-service investment brokerage firm. That means it does estate planning, financial planning, retirement planning, 529 plans, life insurance, long-term care planning, and annuities. EJ is available to investors of any net worth.

This article will focus on the many bad reviews that EJ gets and the perception that it has high fees. High fees are relative; but those that EJ charge are undoubtedly higher than online-only discount brokerages or robo advisors. Even compared to some financial services companies that provide human, financial advice, EJ’s fees are still higher.

What’s going on here? Are they simply scamming people? In short - no. We need to dig a little deeper to understand what’s going on.

High Fees

Some of the products Edward Jones sells come with high fees, such as life insurance and annuities. But that will be true at any other firm for those same financial products.

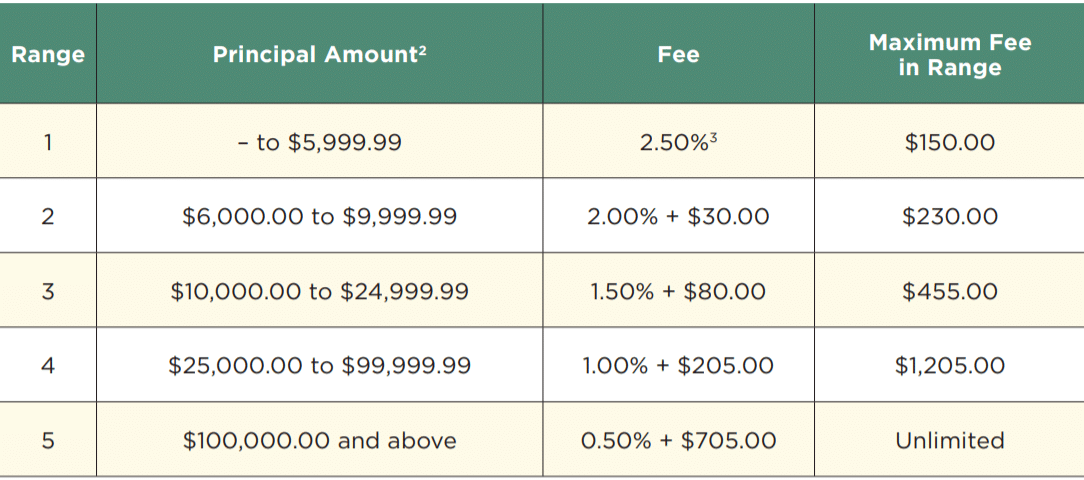

What about trading stocks? If you're comfortable with self-directed trading, you probably don’t need a full-service firm. But should you choose EJ and you open a "Select Account," you’ll certainly pay a high price. In addition to a $4.95 trade transaction fee, you'll pay the following commissions:

EJ says that 36% to 40% of these commissions go straight to the advisor. It should be noted that you can avoid paying the trade commissions above by choosing one of EJ's five asset-based fee pricing models. However, as we'll see later, the percentage of assets under management that you must pay in order to avoid these hefty trade commissions is also high.

It's clear that EJ is solely intended for people who want hands-off financial and investment management. Meaning, these people don’t have the time to research stocks, rebalance their portfolios, or even know how to manage their portfolios. EJ can do all of this for them.

Additionally, EJ provides human interaction that is much different than what other firms offer. At many firms, you’re limited to speaking on the phone with an advisor, or in the best case, you can video conference with your advisor. But you may also not work with the same advisor every time, leaving little chance to build rapport.

Edward Jones is much different in its approach to human interaction. While you can certainly call your EJ advisor on the phone, you can also go into their local office and sit down with the advisor. As well, this is the same advisor every time. The EJ model allows its advisors to build rapport and establish long-term relationships with a small group of clients.

Related: Best Free Investing Apps

Poor Reviews

You can read a large number of poor reviews about Edward Jones from across the web. Most people complain about the high fees, losing money, and not getting anything in return for what they are paying.

The common thread with poor reviews seems to come from people who compare EJ management fees to that of robo advisors. But it's important to point out that these are two completely different services for two very different types of investors. In other words, a comparison between the two isn't really "apples to apples."

Other customers complain about the commissions and fees that EJ charges for stock trades. To be clear, Edward Jones is not a good fit for DIY investors. It exists for people who want an advisor they can sit down with in-person who can help them preserve capital and hopefully generate a decent return.

Account Types

Edward Jones offers six different account levels. See a quick comparison of the account minimums, investment choices, and support levels of each in the chart below.

Investment Minimum | Investment Choices | Who Makes Final Trade Decisions? | Advisor Compensation | |

|---|---|---|---|---|

Select Account | $0 | Stocks, bonds, CDs, mutual funds, ETFs, annuities | You | Commission |

Guided Solutions Fund Account | $5,000 | Mutual funds, ETFs | You | Asset-Based Fee |

Guided Solutions Flex Account | $25,000 | Stocks, bonds, CDs, mutual funds, ETFs | You | Asset-Based Fee |

Advisory Solutions Fund Models | $25,000 | Portfolio models (Mix of mutual funds and/or ETFs) | Advisor | Asset-Based Fee |

Advisory Solutions UMA Models | $500,000 | Portfolio models (Mix of mutual funds, ETFs, and/or separately managed allocations) | Advisor | Asset-Based Fee |

Edward Jones CD Rates

Edward Jones is a popular broker for certificates of deposit (CDs). However, like most Edwards Jones products, you may pay a fee for investing in a CD. So while Edward Jones does offer great rates on CDs, the realized rate may be lower due to the fee structure.

You may want to compare Edward Jones to some of the top bank CD rates currently available. They may net you a better return overall.

Are There Any Fees?

For "Select Accounts," you only pay trade commissions whenever you buy or sell investments. For all other accounts, Edward Jones will charge a percentage of assets under management that varies by account size.

Value of Assets | Advisory Fee |

|---|---|

First $250,000 | 1.35% |

Next $250,000 | 1.30% |

Next $500,000 | 1.25% |

Next 1,500,000 | 1.00% |

Next 2,500,000 | 0.80% |

Next 5,000,000 | 0.60% |

Over 10,000,000 | 0.50% |

For EJ's two highest account tiers (Advisory Solutions Fund and UMA Models), it also charges a "Portfolio Strategy Fee." Again, this fee varies by account size as shown below.

Value of Assets | Advisory Fee |

|---|---|

First $250,000 | 0.09% |

Next $250,000 | 0.09% |

Next $500,000 | 0.08% |

Next 1,500,000 | 0.07% |

Next 2,500,000 | 0.06% |

Next 5,000,000 | 0.05% |

Over 10,000,000 | 0.05% |

You'll pay a $40 annual fee for your first retirement account with Edward Jones and $20 for additional IRAs (waived for account values above $250,000). Retirement accounts are also charged dividend reinvestment and dollar-cost averaging fees. See the full retirement account fee schedule.

Header |  |  | |

|---|---|---|---|

Rating | |||

Trade Fees | $4.95 | $0 | $0 |

Advisory Fee | Up to 1.35% AUM | Up to 1.50% AUM | 0.30% AUM |

Min Investment | $0 | $250,000 | $50,000 |

Banking | |||

Cell | Cell |

How Do I Open An Account?

You can visit your local Edward Jones branch to open an account. Using their "Find a financial advisor" tool, you can search by zip code to find the closest EJ office to you.

Is It Worth It?

There's no question that Edward Jones charges some hefty fees. But again, it offers an experience that you can't get at every firm. If you prefer working with a single advisor who can build a long-term, in-person relationship with you, EJ could be worth considering.

When choosing a financial advisor, it’s often best to get references from trusted friends and colleagues. If such people in your inner circle use EJ and are happy with it, that might work for you. Just know that there may be other local fiduciary financial advisors near you that charge lower fees.

If you're comfortable with having your investments managed by a computer algorithm, it's absolutely true that most robo-advisors are significantly cheaper than EJ. And, finally, if you want the freedom to make your own trade decisions, you should probably compare discount stock brokers instead.

Edward Jones Features

Account Types |

|

Minimum Investment |

|

Management Fees |

|

Portfolio Strategy Fees |

|

Trade Transaction Fee | $4.95 |

Trade Commissions |

|

Access to Human Advisor | Yes |

Automatic Rebalancing | Yes, for Advisory Solutions accounts |

Tax-Loss Harvesting | Yes, on Advisory Solutions UMA Models accounts |

Customer Service Number | 1-800-441-2357 |

Customer Service Hours | Mon-Fri, 7 AM – 7 PM (CT) |

Mobile App Availability | iOS and Android |

Promotions | None |

Edward Jones Review

-

Commissions and Fees

-

Ease of Use

-

Customer Service

-

Tools and Resources

-

Investment Options

-

Specialty Services

Overall

Summary

Edward Jones is a full-service brokerage that charges hefty fees in exchange for the in-person support that it provides from local advisors.

Pros

- Dedicated support from local financial advisors

- Wide variety of financial planning services offered

Cons

- Commission-based advisor compensation for “Select Accounts”

- Expensive management fees for asset-based fee accounts

- Additional fees for retirement accounts

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller