Editor's Note: On April 22, 2024, Goldman Sachs announced that it was selling the Marcus Invest product to Betterment. Marcus will still operate as a banking and savings product, but all investments will migrate to Betterment.

Marcus Invest is a robo-advisor by Goldman Sachs.

Building and managing an investment portfolio that aligns with your financial goals can take time and effort. But with Marcus Invest, you can outsource that work to a streamlined robo-advisor.

Instead of constantly monitoring and self-adjusting your own portfolio, Marcus Invest allows you to use an automated platform that's backed up by the investing experts at Goldman Sachs.

Although there are plenty of good robo-advisors out there, Marcus Invest offers a few key features that set itself apart from the crowd. Let’s take a closer look at what Marcus Invest has to offer.

Marcus Invest Details | |

|---|---|

Product Name | Marcus Invest |

Min Invesment | $1,000 |

Annual Fee | 0.35% |

Account Type | Traditional IRA, Roth IRA, SEP IRA, Taxable |

Promotions | None |

What Is Marcus Invest?

Although Goldman Sachs has been around for over 150 years, it launched the Marcus platform more recently in 2016. Marcus Invest is one of the many offerings available through Marcus. You can also find savings accounts, personal loans, and credit cards.

When launched, Goldman Sachs stated that the goal of Marcus was to "help people find ways to make the most of their money." When you work with Marcus Invest, in particular, you should expect a hands-off investment experience that builds a portfolio with your goals in mind.

What Does It Offer?

The premise of Marcus Invest is simple — it's a robo-advisor designed to help you effectively manage your stock market investments. But let’s take a closer look at what it offers.

Multiple Investment Themes And Risk Profiles

With some robo advisors, you’ll find that your choices of investing strategies are relatively limited. That's not the case with Marcus Invest. You’ll have three different investment themes to choose from. These include:

- Core. The Core portfolio is a basic portfolio that's designed to follow the market's ups and downs.

- Smart Beta. The Smart Beta portfolio combines active and passive investing to align with your risk tolerance.

- Impact. If you want to support sustainable businesses and avoid investments that cause environmental or social harm, this socially-responsible investing option could be right for you.

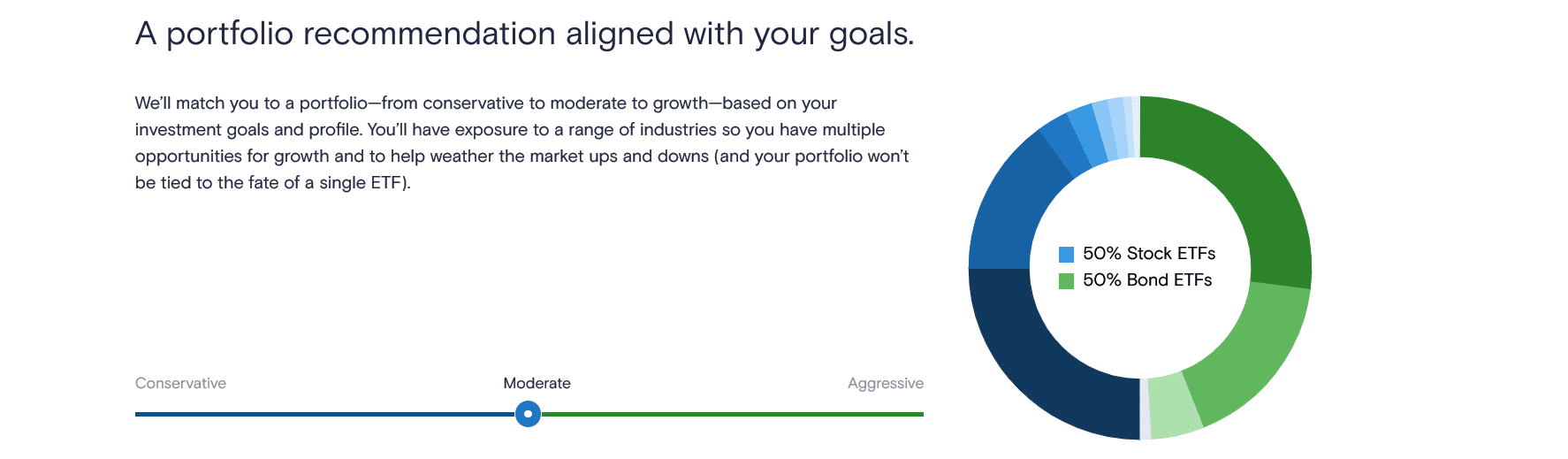

Within each of these theme, you'll also have the choice of three different risk profiles for your portfolio: Conservative (more bonds than stocks), Moderate (equal distribution of stocks and bonds), or Aggressive (more stocks than bonds).

Many Investment Account Types Available

The right investment account can make all the difference. Marcus Invest offers both retirement accounts and taxable investment accounts to suit your needs.

You can choose from an individual or joint option in taxable investment accounts. In terms of a retirement account, you can choose from an IRA, Roth IRA, and SEP IRA.

Many robo-advisors still don't offer SEP IRAs, so that will be a welcome inclusion for many self-employed workers. However, Solo 401ks aren't supported.

Relatively High Account Minimum

You’ll need to have at least $1,000 to open an account with Marcus Invest. That's a higher amount than you'll need to open an account with many of the other top robo-advisors. For a few examples, the minimum investment with Wealthfront is $500, it's $100 for Ally Invest's Robo Portfolios, and $0 with Betterment.

Automatic Rebalancing

Throughout the process of building your portfolio, Marcus Invest will take action to rebalance your investments automatically. The point of rebalancing is to keep your portfolio in alignment with your investment goals. But the automated feature takes the tedium out of this investment chore.

Are There Any Fees?

Yes, Marcus Invest charges a 0.35% advisory fee for accounts of all sizes. That's $3.50 per year if you have an average daily balance of $1,000.

How Do I Contact Marcus Invest?

You can reach out to Marcus Invest over the phone at 1-833-720-6468 Monday through Friday from 9 AM to 6:30 PM EST. Additionally, you can connect on Facebook or Twitter @marcus. Or on Instagram, YouTube, Twitter, or LinkedIn @marcusbygoldmansachs.

Based on the mobile app reviews, most customers seem satisfied with their experience. Currently, the Marcus app has earned 4.9 out of 5 stars on the Apple App Store and 4.4 out of 5 stars on the Google Play Store.

How Does Marcus Invest Compare?

As far as robo-advisors go, Marcus Invest's fee is middle-of-the-road. Betterment and Wealthfront both start at 0.25%, while Ally Invest starts at 0%.

And while we like that Marcus Invest offers socially-responsible investments, many of its competitors do too. However, you won’t find any access to human advisors and must come up with a relatively high initial investment.

Header |  | ||

|---|---|---|---|

Rating | |||

Annual Fee | 0.35% | 0.25% to 0.40% | 0.25% |

Min Investment | $1,000 | $0 | $500 |

Advice Options | Auto | Auto and Human | Auto |

Banking | |||

Cell | Cell |

How Do I Open An Account?

After providing some basic personal information, you’ll need to answer a few questions. Based on your answers, Marcus Invest will judge your risk tolerance and goals. With that information, Marcus will map out a timeline to help you reach your goals.

From there, you’ll fund your account and start building an investment portfolio.

Is It Safe And Secure?

Yes, Marcus Invest has several security measures in place to keep your information safe.

The platform requires users to access their portfolio with a secure browser, requires unique password information, and implements multi-factor authentication. It also uses an encrypted network.

Marcus is also a brand of Goldman Sachs, which is an SIPC member. That means your account will be protected by SIPC insurance up to $500,000 ($250,000 for cash).

How Do I Contact Marcus Invest?

You can reach out to Marcus Invest over the phone at 1-833-720-6468 Monday through Friday from 9 AM to 6:30 PM (EST). Additionally, you can connect on Facebook or Twitter @marcus. Or on Instagram, YouTube, Twitter, or LinkedIn @marcusbygoldmansachs.

Based on the mobile app reviews, most customers seem satisfied with their experience. Currently, the Marcus app has earned 4.9 out of 5 stars on the Apple App Store and 4.4 out of 5 stars on the Google Play Store.

Why Should You Trust Us?

I've been writing about investing and have reviewed brokerage firms since 2009. And since then, we've reviewed most robo-advisor platforms in the United States.

Since then, I've regularly updated and tested the new features that Wealthfront has launched. Wealthfront is also consistently voted on by our readers each year when we survey the best robo-advisors.

Finally, our compliance team regularly checks and updates the rates in this review as needed.

Who Is This For And Is It Worth It?

Marcus Invest by Goldman Sachs offers investors a hands-off experience that can be very attractive. It could be especially be worth considering if you're a fan of the Marcus brand of you're looking for a socially responsible investment option.

But Marcus Invest's investment minimum and advisory fees are both a bit higher than you'll find with other robo-advisor platforms and it doesn't offer access to any human advisors. If you aren’t sure that it's the right fit for you, you can check out our top robo-advisor picks here.

Marcus Invest Features

Account Types |

|

Minimum Investment | $1,000 |

Management Fees | 0.35% |

Average ETF Expense Ratio |

|

Socially Responsible Investments | Yes |

Access to Human Advisor | No |

Automatic Rebalancing | Yes |

Tax-Loss Harvesting | No |

Customer Service Number | 1-833-720-6468 |

Customer Service Hours | Monday - Friday from 9 AM to 6:30 PM (EST) |

Other Customer Support Options | Facebook or Twitter @marcus. On Instagram, YouTube, Twitter, or LinkedIn @marcusbygoldmansachs. |

Mobile App Availability | iOS and Android |

Promotions | None |

Marcus Invest Review

-

Commissions and Fees

-

Ease of Use

-

Customer Service

-

Portfolio Options

-

Minimum Investment

Overall

Summary

Marcus Invest offers a solid variety of custom robo-advisor portfolios, but its investment minimum and fees are both on the high side.

Pros

- Multiple investments themes and accounts types to choose from

- Socially-responsible portfolios available

Cons

- $1,000 minimum investment

- 0.35% AUM fee is relatively high

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller