Investing in the stock market can be difficult when you're doing it alone and just starting out. But what if you could have someone experienced provide a few tips and guidance?

That's different from taking an online stock investing course. While those can certainly be helpful, you won't usually have the option to reach out to anyone for advice and ideas. But Tornado is trying to change that by making it easier for ordinary investors to learn from thought leaders in the investing space.

On the Tornado platform, you can interact with other members about potential investment ideas. You also get to see what top investors like Warren Buffett and Bill Ackman are doing. There's a lot more to go over too, including top-notch research, so let's jump right into our full review of the Tornado platform.

Tornado Details | |

|---|---|

Product Name | Tornado |

Min Invesment | $0 |

Membership Fee | $7.99/Month |

Trade Commissions | 40 Free Trades Per Month For Members $4.50 Per Trade For All Other Trades |

Account Type | Taxable |

Promotions | Up to $1,000 free cash for new members |

Who Is Tornado?

Tornado (Nvstr Financial LLC.) is a broker and social investing platform. Bernard George is the co-founder and CEO. The company was founded in April 2015 and is based in New York City.

“...The idea for Tornado really came out of our collective realization that there’s just a massive divide between the tools and the technology and the investment processes that sophisticated institutions have versus what’s available to your regular retail investors and individual investors,” said George in an interview with Sure Dividend.

The Tornado leadership team has a lot of experience in the investing space. George himself managed fundamental and quantitative analysis strategies at hedge funds and major banks such as J.P. Morgan and Credit Suisse. And his co-founder Patrick Aber previously designed investment strategies at Tower Research Capital and The Carlyle Group.

It recently raised $10 million from famous investors like Alex Rodriguez, Marc Lore, and Dave Portnoy.

What Do They Offer?

Tornado means invest better together, which is a reference to the social aspects of its platform. It costs $5.99 per month to access all of Tornado's tools.

There's no minimum to get started with Tornado. If you're just starting with investing or want to try out Tornado, you can use the simulated trading feature before committing real money. Simulated trading also provides access to the portfolio optimizer.

Which Style Of Investor Are You?

Tornado has three investing styles to choose from — hands-on, semi-automated, and social.

Hands-on is for those who want to do all the research and pick their own trades. Social means interacting with other Tornado members to get trade ideas.

Semi-automated is for those who want someone to tell them how much to invest in certain trades. This is done through the portfolio optimizer tool (more on that later).

What Can You Trade?

Currently, clients are able to trade three types of securities on the Tornado platform:

However, several asset types are not yet supported, including:

Tornado also doesn't currently offer retirement accounts. Margin accounts are available but you’ll need at least $3,000 in your account.

Research And Perspective

Tornado has excellent research tools. S&P Capital IQ provides research on company financials and fundamentals. If you want to use S&P Capital IQ as a stand-alone tool, it will cost $10,000 per year. But you get access to it at no additional charge with Tornado.

Other members and experts also provide useful stock information. Tornado's full range of social investing features includes community thought leaders, experts, viewpoint contributors, and investment ideas. Experts receive compensation from Tornado. Tornado must approve every expert.

Using the thought leader feature, you can browse top investor portfolios, including:

- Warren Buffett of Berkshire Hathaway

- David Tepper of Appaloosa Management

- David Einhorn of Greenlight Capital

- Bill Ackman of Pershing Square

Tornado gets this data from US Securities and Exchange Commission (SEC) filings, news reports, and other financial data sources. Finally, Tornado provides a stock and ETF screener to help you quickly find securities that meet the criteria you set.

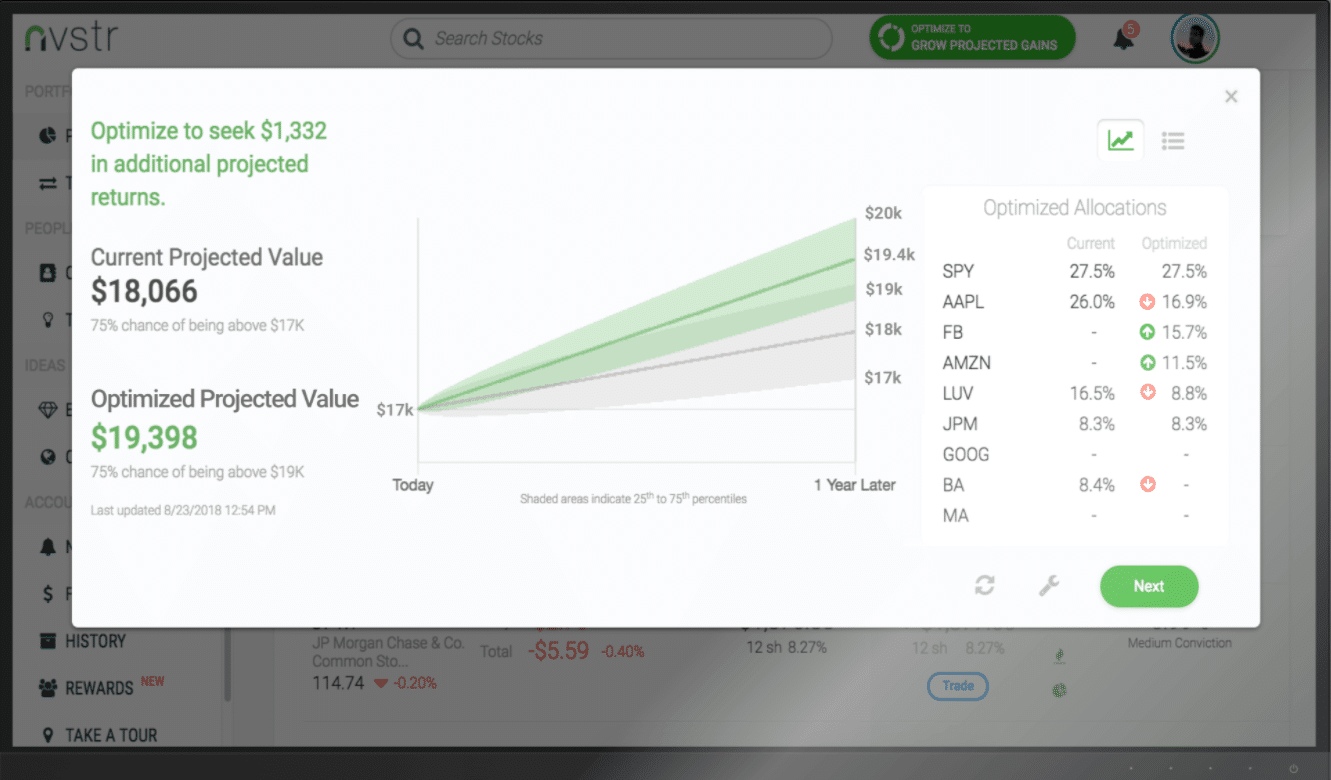

Portfolio Optimization

Tornado's 1-click portfolio optimizer uses Modern Portfolio Theory (MPT) to determine the right amount of risk and return for your profile. It essentially works like a robo-advisor for your stock holdings (most robo-advisors use ETFs to build their portfolios).

The optimizer doesn’t place trades for you. Rather, it adjusts the sizing of each of your stock positions. You’ll need an account with at least $3,000 to use the optimization tool. But if you meet that requirement, Tornado's 1-click optimizer can instantly help you find ways to improve your asset allocation.

New Member Bonus

For a limited time, Tornado is offering a signup bonus of up to $1,000 for new subscribers. The table below shows the maximum deposit you could earn depending on your deposit size.

Deposit Size | Maximum Funding Bonus |

|---|---|

$50 | $5 |

$100 | $15 |

$1,000 | $75 |

$10,000 | $150 |

$100,000 | $300 |

$1 million | $1,000 |

To avoid forfeiting your bonus, you can't withdraw your funds for one year and you must place at least one trade within a month of opening your account.

Customer Service

There is no publicly-listed customer service number to be found on Tornado's website. It's possible that you might get access to more support options after creating an account and logging in. But if you want to ask questions before signing up, you'll need to reach out via email at support@tornado.com.

Are There Any Fees?

Yes, Torando offers a membership subscription that costs $7.99/mo. For that membership fee, you get 40 "free" trades per month. All trades above the 40 per month limit (or those placed without a subscription) cost a whopping $4.50 per trade.

If you have a large asset balance and make less than 40 trades per month, Tornado's fee structure could be affordable. For a $50,000 account, for example, Torando's $7.99 membership fee ($96 per year) would translate to an annual advisory fee of 0.19%.

However, for a $5,000 account, Tornado's flat fee structure equates to a 1.9% annual fee. That's higher than what most robo-advisors charge and, even, many human advisors. Also, Tornado's $4.50 commission on trades (other than the 40 per month that are included with membership) virtually makes it a non-starter for high-volume traders. See Tornado's full fee schedule here.

Note: Users who joined prior to May 2022 will be grandfathered in at their previous $5.99/mo plan.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Account Fee | $7.99/month (for subscribers) | $0 | $20/year (waived if you sign up for e-delivery service) |

Free Trades | 40 per month (with subscription) | Unlimited | Unlimited |

Min Investment | $0 | $0 | $0 |

Simulated Trading | |||

Retirement Accounts | |||

Cell |

How Do I Open An Account?

You can visit the Tornado website to get started. You can create an account in minutes by simply providing your name, email and a password.

Keep in mind that in order to qualify for a new member cash bonus you'll need to transfer your funds and make at least one trade within a month of account opening. Also, the bonus offer doesn't apply to simulated trading accounts.

Is My Money Safe?

Brokerage assets are not FDIC-protected. However, your account will have up to $500k in SIPC protection, including $250k cash. There’s also an additional $37.5 million of insurance provided by Lloyd's of London.

Is It Worth It?

If you have an orientation towards social investing or want access to research provided by S&P Capital IQ, Tornado can be worth it. It's one-click optimization tool could also be a great way to improve your asset allocation without giving up any control of your portfolio.

Tornado would likely appeal most to individual stock investors who make a few trades per month and would like to leverage technology and social cues to build better portfolios. But passive investors may be better served by a robo-advisor. And highly active traders will want to opt for one of the many stock brokers that offer unlimited free trades.

Tornado FAQs

Here are a few of the most common questions we see people asking about Tornado:

Did Tornado used to be called Nvstr?

Yes, Nvstr rebranded itself as Tornado in July 2021.

Can Tornado clients receive advice from humans?

Yes and no. While you can interact with thought leaders on Tornado's social network, the company doesn't offer one-on-one consultations with financial advisors.

Is Tornado expensive?

For smaller account balances, Tornado's subscription fee will be higher than what you'd pay to most robo-advisors that use an assets under management (AUM) pricing model. Its pricing could make sense for larger accounts, but only if you make 30 or less trades per month.

Does Tornado place trades for you?

No, while it can suggest diversified portfolios that align with your risk tolerance and goals, you'll still need to initiate every trade yourself.

Is Tornado offering any bonuses for new clients?

Yes, you can receive a bonus of $15 to $1,000 depending on the size of your initial deposit.

Tornado Features

Account Types | Taxable |

Investment Options |

|

Minimum Deposit | $0 |

Minimum Account Balance For Optimizer | $3,000 |

Membership Fee | $7.99 per month |

Trade Commissions |

|

Account Activity Fees |

|

Margin Interest Rate | 6.50% per year |

Research Tools |

|

Access to Human Advisor | No |

Paper Trading | Yes |

Automatic Rebalancing | No |

Tax-Loss Harvesting | No |

Customer Service Number | None listed |

Customer Service Email | support@tornado.com |

Mobile App Availability | iOS and Android |

Promotions | Up to $1,000 free cash for new members |

Tornado Review

-

Commissions and Fees

-

Ease of Use

-

Customer Service

-

Tools & Resources

-

Investment Options

-

Specialty Services

Overall

Summary

Torando is a stock broker that offers portfolio optimization, simulated trading, and investing ideas from famous investors and other members.

Pros

- 1-click portfolio optimization

- Social learning and collaboration

- Paper trading

- High-quality research data and tools

- $0 account minimum

Cons

- $5.99 monthly fee for subscribers

- Subscribers only get 30 free trades (all other trading costs $4.50 per trade)

- Can’t trade mutual funds or options

- Retirement accounts not yet supported

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak