TradeStation is a brokerage platform that's designed for active traders.

Active trading is a form of investing that allows investors to arbitrage values. By taking advantage of market mispricing, traders tilt statistical expectations in their favor.

Unfortunately, most active traders treat trading like a video game. Numbers flash on a screen while traders take unnecessary risks that expose themselves to losses.

In this day and age, it takes more than flashy software to be a successful active investor. It takes access to data, an investing strategy that gives you a slight edge, and a willingness to follow your own rules when your heart screams, “NO!” TradeStation can help you with the first two. As for following the rules, you’re on your own.

Here’s what you need to know about TradeStation before you consider opening an account.

TradeStation Details | |

|---|---|

Product Name | TradeStation |

Min Investment Amount | $0 |

Commission | Up to 10,000 shares: $0 Above 10,000 shares: $0.005 per share above 10,000 |

Investment Types | Stocks, Penny Stocks, Options, ETFs, Mutual Funds, Bonds, Futures, and More |

Account Type | Taxable, IRA (Roth and Tradition), Trusts, Custodial |

Promotions | Up To $3,500 |

What Is TradeStation?

TradeStation is a self-clearing broker/dealer and futures commission merchant (FCM) that offers one of the advanced suite of tools for active traders on the market today. The company has been serving traders for nearly 40 years and often wins awards for its platform technologies.

TradeStation allows traders to participate in a wide variety of asset markets. It also offers completely commission-free trading up to 10,000 shares per order and low per-share pricing after that. In November 2021, TradeStation announced that it plans to go public sometime in the first half of 2022 via the Quantum Fintech Acquisition Corporation (QFTA) SPAC.

What Does It Offer?

TradeStation offers several different types of accounts. In addition to taxable accounts, traders can open Traditional, Roth, SEP, and SIMPLE IRAS as well as a variety of entity accounts.

Its products and services are so expansive that it would be impossible to provide an in-depth review of each within the scope of this review. However, here's a brief overview of what TradeStation offers to its users.

Tradable Assets

Oftentimes, low-cost online brokers only offer access to a select few types of assets. With Robinhood, for example, you can't trade mutual funds, bonds, or futures.

With TradeStation, on the other hand, you can trade just about any type of stock market asset that you think of, including:

- Stocks

- ETFs

- Options

- Mutual Funds

- Bonds

- Futures

- Micro Futures

- Future Options

- IPOs

- Penny Stocks

However, it should be noted that one thing that you can't currently do with TradeStation is trade fractional shares of stocks.

Trading Platforms

TradeStation has X different trading platforms. Here's what they offer:

TradeStation Desktop: This is the company's premier equities trading platform. It's only available for Windows. Here are some of its notable features:

- Matrix: The Matrix is TradeStation's proprietary order entry and tracking system. It's precise and encourages speed trading through single click or drag-and-drop entries and exits.

- RadarScreen®: Allows real-time monitoring of up to 1,000 symbols in real-time using 180 customizable indicators.

- Back-Testing: Test your trading strategy against decades of historical data.

- EasyLanguage: This is TradeStation’s programming language that allows traders allows to build their own customer trading strategies and indicators.

- OptionStation® Pro: Allows traders to visual options chains strategies and quickly identify break-even points across expiration dates.

Desktop users can also download and install TradeStation apps from the App Store to add more indicators, charts, and strategies.

TradeStation Web: Offers the core of TradeStation's platform (including the Matrix) on any Mac or Windows computer with internet access. However, there's no way to modify the platform by adding apps.

TradeStation Mobile: Again, the core of TradeStation is baked into the company's mobile apps (which are available on iOS and Android) including the Matri and Hot Lists.

Futures Plus: Combines institutional-grade futures trading with free market data and no platform fees.

Tools & Resources

Here are some of the many technologies that you can benefit from as a TradeStation user:

Fast and reliable order routing: TradeStation says that it's order routing technology has yielded an average price improvement of $9.00 per order filled. It also says that the average trade on its platforms executes in 0.092 seconds.

TradeStation API: Allows those with coding experience to create web, mobile, or stand-alone trading applications that can be used with TradeStation accounts. TradeStation says that its API integrates with #, C++, Python, PHP, Ruby, or any other language that can access the Internet.

TradeStation App Store: There are hundreds of apps available on the TradeStation App Store that can be downloaded and added directly to the company's Desktop platform.

Paper trading: Traders can practice and test out new strategies by opening a TradeStation simulated trading account which comes with unlimited paper trading dollars.

Technical analysis: TradeStation has over 40 years of historical data (and up to 90 years for equities). You can backtest all sorts of strategies on the data. The access to data makes it easy to study technical trends.

Forum discussions: TradeStation has one of the most active forums in the trading world. Some of the discussions are helpful and constructive. Others quickly devolve into pissing contests. If you join the forums remember, it’s better to make money than to be right.

TradeStation Promotions

Right now, TradeStartion is offering up to $3,500 when you transfer funds into your TradeStation account.

The amount you receive is based on how much you transfer in.

Deposit Amount | Bonus |

|---|---|

$5,000 | $150 |

$25,000 | $300 |

$100,000 | $500 |

$250,000 | $1,000 |

$500,000 | $2,000 |

$1,000,000 | $3,500 |

Are There Any Fees?

For equities trading, TradeStation has two account tiers: TS Select and TS Go. Both offer commission-free trading of stocks and ETF orders of up to 10,000 shares. After that, you'll pay $0.005 per share above 10,000. It should be noted that mutual fund trades will always cost you $14.95 as TradeStation doesn't have any no-transaction-fee funds.

TS Go offers lower per-contract pricing on options and futures. However, TS Go's commission-free trading only applies to mobile and web orders. You'll be charged a $10 fee (per trade) if you use TradeStation Desktop while on the TS Go plan. Here's a closer look at how TS Go and TS Select compare:

TradeStation Equities Pricing | ||

|---|---|---|

Header | TS Go | TS Select |

Stock/ETF Trade Costs | $0 commission | $0 commission |

Option Trade Costs | $0 commission | $0 commission |

Futures Trade Costs | $0 commission | $0 commission |

Mobile Trading | Free | Free |

Web Trading | Free | Free |

Desktop Trading | $10 per trade | Free |

You could also pay a number of account fees, including a $35 annual fee if you hold your IRA at TradeStation and a $125 ACAT fee for outgoing account transfers.

How Does TradeStation Compare?

TradeStation offers more tradable assets and trading tools than most of its competitors. But the company doesn't support fractional share trading, offer any no-transaction-fee (NTF) mutual funds, and doesn't have any robo-advisor portfolio options.

If you're a day or swing trader, TradeStation could be exactly what you're looking for. But if you're more of a long-term investor who's looking to invest in mutual funds or managed portfolios, you'll want to choose a different broker. Here's a quick look at how TradeStation compares:

Header | |||

|---|---|---|---|

Rating | |||

Commissions | $0 up to 10,000 shares; $0.005 per share for all shares above 10,000 | $0 | $0 |

Min Investment | $0 | $0 | $0 |

Fee-Free | None | 3,400+ | 3,900+ |

Robo-Advisor Portfolios | |||

Fractional Shares | |||

Cell |

How Do I Open An Account?

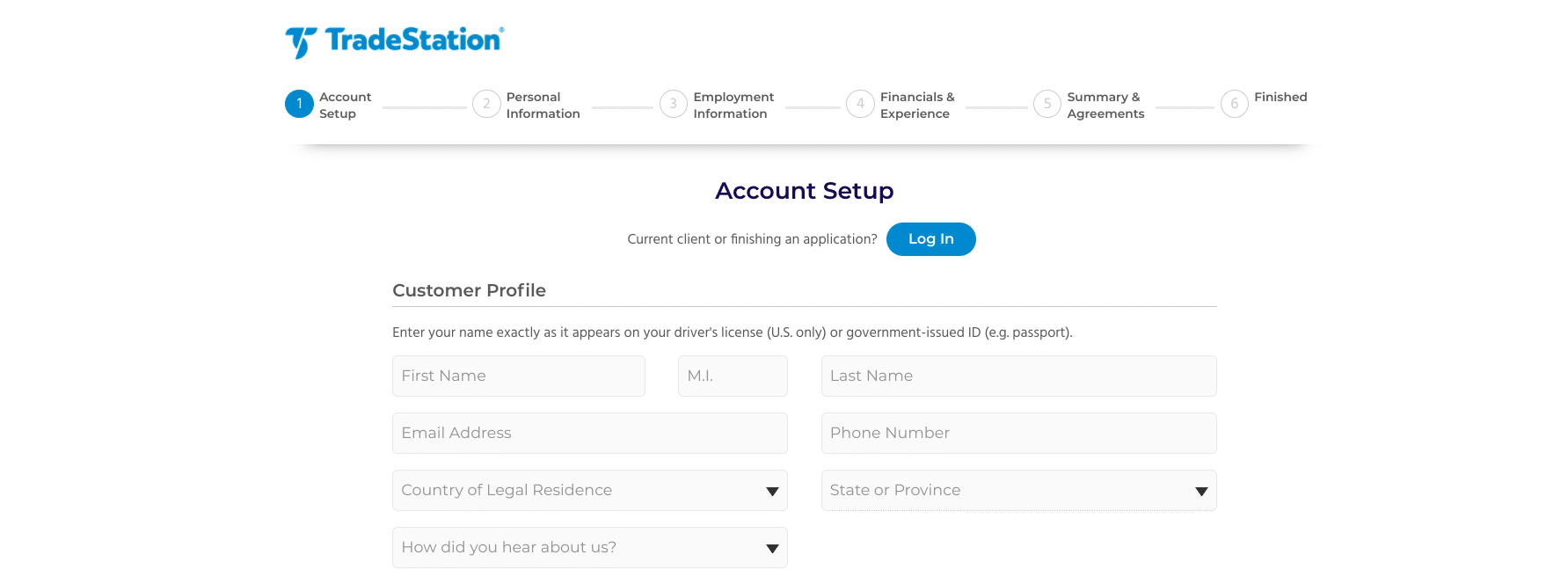

You can open a TradeStation account online in minutes. You'll start the process by visiting their website here and clicking the big blue "Open Account" button.

TradeStation's application includes six steps. To quickly complete the sign-up process quickly, be prepared to provide information related to your personal identity, employment, financials, and trading experience.

Screenshot of TradeStation's online application

Is It Safe And Secure?

Yes, TradeStation's U.S. accounts are protected by SIPC insurance up to $500,000 (250,000 for cash). And it protects its customer's private data by using 256-bit data encryption (TLS/SSL), advanced firewalls, and providing alerts whenever significant changes are made to accounts.

How Do I Contact TradeStation?

In addition to its resource-rich learning center, TradeStation offers phone and live chat support. For general requests, you can call 800-822-0512 (toll-free) or 954-652-7900 (direct) between Monday – Friday, 8:00 a.m. – 5:00 p.m. ET.

Futures trading support is available 24/7 at the same numbers as above. You can also schedule a time for TradeStation to call you.

Currently, TradeStation's customer reviews on Trustpilot are a bit discouraging. The majority are negative, leading to an average score of 1.5/5 from 115 reviews. The company does seem to be promptly responding to complaints, though, as it's rated A+ by the Better Business Bureau (BBB).

Why Should You Trust Us?

I have been writing about and reviewing investment firms and brokerages since 2009, and have reviewed almost every US-based investment firm open to individual investors. I have seen this space evolve from high cost to low cost options, and have seen the amount of investment tools grow for individuals.

Furthermore, we have been polling our audience for years to find out which investment firms they trust and use, and that's how we put together our annual rankings of the best investment companies.

Finally, we have our compliance team that regularly checks and updates the facts on our reviews.

Who Is This For And Is It Worth It?

Making money as a trader isn’t an easy option. Most active investors fail to beat their benchmark, and most fail because they don’t follow their own rules.

TradeStation makes it possible for everyday investors with just a few thousand bucks to find, test and implement new investing strategies. Yes, there is a learning curve. Yes, you have to learn a new programming language. But at the end of the day, you need those types of advantages if you’re going to make money as a trader.

If you’re committed to active trading, consider TradeStation as your first choice broker. They offer low fees and excellent software. Plus, they offer tons of educational seminars and resources that will hopefully help you learn the trading game. They can’t guarantee your success, but they can push you in the right (rules-based) direction.

TradeStation FAQs

Let's answer a few of the most common questions that people ask about TradeStation:

Does TradeStation work on Mac?

TradeStation doesn't currently have a dedicated Mac app. However, Mac users can use the TradeStation web-based platform or use a Windows emulator to run TradeStation on their computers.

Is TradeStation a direct access broker?

Yes, unlike traditional full-service brokerages, TradeStation provides direct market access which is a big advantage for speed traders.

Can you use TradeStation internationally?

Yes, TradeStation has partnered with Interactive Brokers to offers its trading technology worldwide through the "TradeStation Global" platform.

Does TradeStation have hotkeys?

Yes, traders can assign hotkey to a variety of common tasks on the platform such as Buy, Sell, Cancel Order, and more.

TradeStation Features

Account Types |

|

Tradable Assets |

|

Account Minimum | $0 |

Stock Commissions |

|

ETF Commissions |

|

Mutual Fund Commissions | $14.95 |

No-Transaction-Fee (NTF) Mutual Funds | None |

Options Costs |

|

Additional Fee For Customers On The TS Go Plan Who Use TradeStation Desktop To Execute a Trade | $10 per trade |

Basic Account Fee | $0 |

Robo-Advisor Portfolios | No |

Fractional Shares | No |

Margin Rates | 3.50% to 9.50% (as of January 2022) |

Banking Services | No |

Customer Service Number | Toll-Free: 800.822.0512 Direct: 954-652-7900 |

Customer Service Hours | Monday – Friday, 8:00 AM – 5:00 PM (ET) |

Mobile App Availability | iOS and Android |

Promotions | Up to $3,500 |

Tradestation Review

-

Commissions & Fees

-

Customer Service

-

Ease Of Use

-

Tools & Resources

-

Investment Options

-

Specialty Services

Overall

Summary

TradeStation is a direct access broker that includes a suite of smart technologies that are designed to benefit active traders. Learn more in this TradeStation review.

Pros

- Commission-free trading up to 10,000 shares

- Extensive asset list

- Many advanced trading tools are built-in and hundreds more can be added through the TradeStation App Store

- Offers free practice accounts

- High-quality order routing

Cons

- Some features require strong technical knowledge

- Doesn’t support fractional share trading

- No fee-free mutual funds available

- Commission of $0.005 per share for all shares in excess of 10,000 per order

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak