Is investing hard? Not really. At The College Investor, we believe that lazy investors grow rich. Investors rarely need to learn about anything beyond basic asset allocation. Once you figure out some jargon and automate a habit of sensible investing, you’re set.

But what if you'd rather on even have to worry setting up your own diversified portfolio and rebalancing it over time. Well, that's where robo-advisor platforms come in. They can manage your investments for you automatically and for a fraction of what you'd normally in advisory fees if you hired a human financial advisory.

If you live in Canada, Wealthsimple is a popular automated investing platform that has slowly, but surely, added to its list of available products. Now clients can also trade stocks on their own, invest in cryptocurrency, send money to friends, and even file their taxes. Keep reading our full review to learn more. Or check out Wealthsimple here.

Note: Wealthsimple is no longer offering investment services in the United States and is focusing exclusively on Canada. In March 2021, it was announced that Betterment had acquired Wealthsimple's U.S. book of business and would be assuming the servicing of those accounts in the proceeding months.

Wealthsimple Details | |

|---|---|

Product Name | Wealthsimple |

Min Invesment | $0 |

Annual Fee (For Managed Portfolios) | 0.40% to 0.50% |

Commissions (For Self-Directed Trades) | Stocks and ETFs: $0 Crypto: 1.5% to 2% |

Promotions | $50 Bonus With a Minimum Initial Deposit of $500 |

Who Is Wealthsimple?

Wealthsimple is a fintech company that's based in Toronto, Canada. When co-founders Michael Katchen and Rudy Adler started the company in 2014, it focused exclusively on automated investing. But it's since expanded to become more of a one-stop-shop for financial services.

In addition to its managed portfolios, Wealthsimple supports self-directed trading, has a peer-to-peer cash transfer app, and allows users to buy and sell cryptocurrencies. It also recently launched Wealthsimple Tax following its acquisition of SimpleTax.

Today, the platform has over 1.5 million clients and manages over $10 billion in assets. In March 2021, it was announced that Wealthsimple had raised $610 million at a valuation of $4 billion. Meritech and Greylock led the round, but well-known Canadian celebrities such as Drake, Ryan Reynolds and Michael J. Fox participated as well.

What Does It Offer?

Here's a closer look at all of the financial products that Wealthsimple offers to its clients:

Wealthsimple Invest

Like most robo-advisors, Wealthsimple emphasizes the four pillars of modern portfolio theory:

- Low Costs

- Broad Market Index Funds

- Asset allocation

- Automated Rebalancing

You can transfer money into your Invest account on a manual basis. Or you can set up weekly, bi-weekly, or monthly auto-deposits.

Your money will be put into cost-efficient ETFs. ETFs have tax advantages for people not investing in retirement accounts and have extremely low fees. Wealthsimple clients also get unlimited access to human advisors (CFPs, CIMs, or CFAs).

Membership Plans

Wealthsimple Invest has three membership tiers:

- Basic (up to $100k)

- Black ($100k to $500k)

- Generation ($500k+)

In addition to the benefits already mentioned, Wealthsimple Black clients get a financial planning session and they're enrolled in tax loss harvesting. Tax loss harvesting won’t make you rich. But people with non-retirement portfolios may see a few basis points of improvement when it’s implemented.

Clients on the Generation plan are assigned a dedicated team of financial advisors. They also receive personalized portfolios and financial reports and can get 50% off a Comprehensive Health Plan from Medcan.

Values-Based Investing

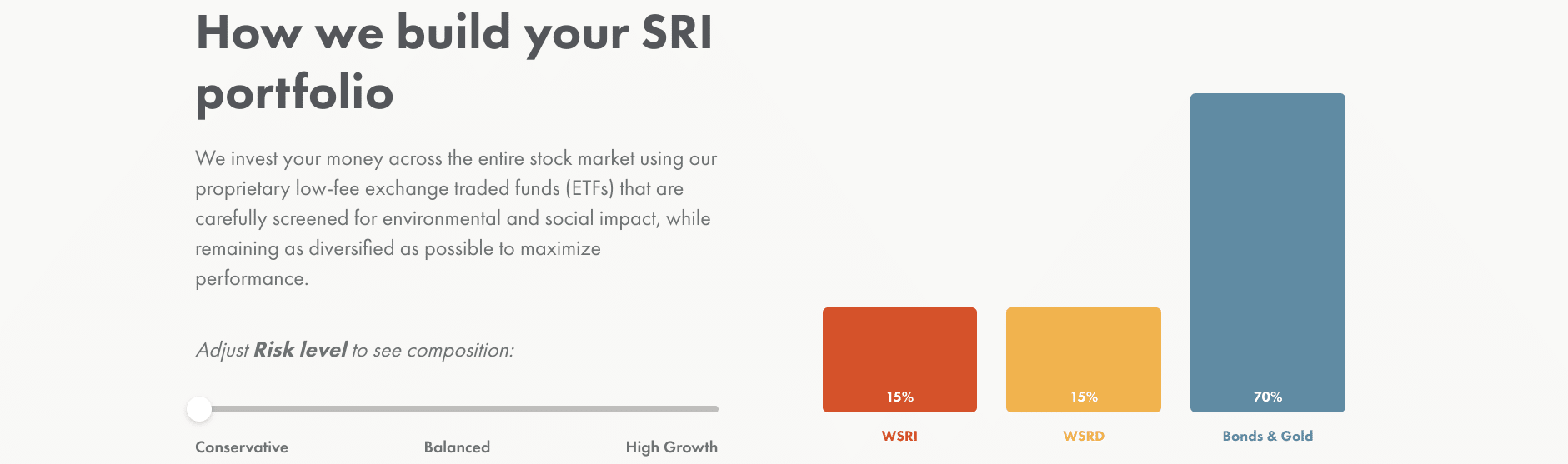

Wealthsimple differentiates itself from other investors by offering multiple values-based portfolios.

First, it offers a socially responsible investing (SRI) portfolio that invests in companies that have a clear commitment to promoting social good. Examples include companies that promote global environmental causes, reduce corruption and gender inequality, and promote higher standards of living globally. Learn more about SRI investing.

Wealthsimple also offers a Halal Investing portfolio. This portfolio includes the company's recently-launched Shariah-compliant ETF: the Wealthsimple Shariah World Equity Index ETF (WHSR). Note that you can also invest in WHSR by simply purchasing shares of the ETF inside a Wealthsimple Trade account or with virtually any other stock broker.

The ETFs for Wealthsimple's values-based portfolios tend to have higher expense ratios than those of other funds. However, they might be worth the extra cost if it means that your investments will line up with your ethical and moral guidelines.

Wealthsimple Trade

In August 2018, Wealthsimple Trade announced - it was intended to challenge the multiple companies that now offer commission-free trading. Now users are able to buy and sell whole or fractional shares of stocks and ETFs.

There's no account minimum, you'll get unlimited commission-free trades, and instant deposits of up to $250. But if you trade frequently, you might want to consider upgrading to Wealthsimple Trade Premium ($3/mo) which adds real-time quotes and up to $1,000 in instant deposits.

Wealthsimple Cash

U.S. residents have access to several peer-to-peer payment apps such as Venmo, Cash App, and Zelle. But unfortunately none of these apps are available in Canada.

If you live in Canada and want to the ability to send money quickly to friends and family or split bills, the Wealthsimple Cash app may be what you're looking for. There are no fees for sending or receiving money and deposits and withdrawals are free too.

You'll also earn 0.50% APY on your cash deposits. Check our the best high-yield savings accounts available right now.

Wealthsimple Crypto

You can also buy and sell cryptocurrency 24/7 with Wealthsimple. Currently, the company supports 24 cryptocurrencies including Bitcoin, Ethereum, and Dogecoin. And it recently added support for limit orders on crypto trades.

Note that you'll pay an Operations Fee of 1.5-2% per crypto transaction (applied through the spread). That's not terrible, but it should be noted that many platforms that use a maker/fee structure charge less than 0.50%.

Wealthsimple Tax

Most recently, Wealthsimple Tax was launched following the company's acquisition of SimpleTax. The company's tax product is CRA and Revenue Quebec certified. And instead of charging a flat fee, it allows you to choose what you pay — even $0.

Related: Best Free Tax Software

Are There Any Fees?

Yes, clients on the Basic plan (account balances up to $100k) pay an annual fee of 0.50%. Clients that are on the Wealthsimple Black ($100k to $500k) or Generation ($500k+) plan pay slightly less at 0.40% per year.

You won't pay any commissions for stock and ETF trades. But you can pay $3 per month to upgrade to Trade Premium to get real-time quotes and up to $1,000 of instant deposits. Crypto trades are charged an Operations Fee of 1.5% to 2%.

Beyond these fees, you shouldn't face any unexpected costs with Weathsimple. It doesn't charge any account maintenance fees. And you won't be charged an ACAT fee if you decide to transfer your funds to a different broker or robo-advisor down the road.

How Does Wealthsimple Compare?

When comparing Wealthsimple to other robo-adivsors, it's important to consider where you live. If you live in the United States, you'll need to go with another robo-advisor as Wealthsimple no longer operates in the U.S.

But if you live in Canada, Wealthsimple will be hard to beat. It's rare to find a robo-advisor that even supports self-directed stock trading much less crypto trading. Check out this quick comparison chart:

Header |  |  | |

|---|---|---|---|

Rating | |||

Annual Fee | 0.40% to 0.50% | 0.35% to 0.60% | 0.25 to 0.40% |

Min Investment | $0 | $1,000 | $0 |

Advice Options | Auto and Human | Auto and Human | Auto and Human |

Self-Directed Trading | |||

Canada Availability | |||

U.S. Availability | |||

Cell |

How Do I Contact Wealthsimple?

In addition to providing access to human financial advisors, Wealthsimple also has a customer service team that's available Monday through Friday, 8 AM to 8 PM (ET).

To get in touch with a support member over the phone, you can call 1-855-255-9038. You can also chat with a representative online or send an email via the company's contact form.

Wealthsimple's customer service ratings are currently rather lackluster. It's rated 3.4/5 on Trustpilot and it has an F rating on the Better Business Bureau (BBB).

Is It Worth It?

Yes, Wealthsimple is one of the most robust investing platforms available to Canadians today. By joining, you'll get access to socially responsible portfolios, self-directed trading, peer-to-peer cash payments, crypto investing, and more.

Wealthsimple also has no minimum investment requirements. But keep in mind that if you make an initial deposit of at least $500, you'll get a $50 bonus. If you live in Canada and you're looking for a robo-advisor, stock broker, and crypto exchange rolled into one, give Wealthsimple a try.

Disclaimer: The College Investor has entered into a referral and advertising arrangement with Wealthsimple US, LTD and receives compensation when you open an account or for certain qualifying activity which may include clicking links. You will not be charged a fee for this referral and Wealthsimple and The College Investor are not related entities. It is a requirement to disclose that we earn these fees and also provide you with the latest Wealthsimple ADV brochure so you can learn more about them before opening an account.

Wealthsimple FAQs

Here are a few of the most common questions that we hear about Wealthsimple:

Does Wealthsimple offer IRAs?

No, since Wealthsimple is no longer doing business in the United States, it doesn't allow clients to open U.S. retirements accounts like IRAs or 401(k)s. However, it does allow its Canadian clients to invest inside registered retirement savings plan (RRSP) accounts.

Can you file your taxes with Wealthsimple?

Yes, Wealthsimple acquired SimpleTax in 2019 and rebranded the product as Wealthsimple Tax in 2021. Today, Wealthsimple Tax offers fast online tax filing for Canadian residents.

Who owns Wealthsimple?

Wealthsimple's financing rounds have been led by Power Financial Corporation but many other notable investors have been involved including celebrities such as Ryan Reynolds, Drake, and Michael J. Fox.

Does Wealthsimple offers any bonuses to new clients?

Yes, if you make an initial deposit of at least $500, you can receive a cash bonus of $50.

Wealthsimple Features

Account Types |

|

Tradable Assets |

|

Minimum Investment | $0 |

AUM Fees (For Managed Portfolios) |

|

Commissions (For Self-Directed Trades) |

|

Average ETF Expense Ratio | 0.20% |

Socially Responsible Investments | Yes |

Access to Human Advisor | Yes, included with all membership tiers |

Automatic Rebalancing | Yes |

Tax-Loss Harvesting | Yes, but only for Black and Generation clients |

Customer Service Number | 1-855-255-9038 |

Customer Service Hours | Monday-Friday: 8 AM - 8 PM (EST) |

Other Customer Support Options | Online live chat Contact form Help Center |

Mobile App Availability | iOS and Android |

Promotions | $50 bonus with a minimum initial deposit of $500 |

Wealthsimple Review

-

Commissions & Fees

-

Customer Service

-

Ease Of Use

-

Tools & Resources

-

Investment Options

-

Specialty Services

Overall

Summary

Wealthsimple is a Canadian financial services company that offers robo-advisor portfolios, stock trading, crypto investing and more.

Pros

- SRI and Halal Investing Portfolios

- Commission-free stock and ETF trades

- Crypto investing (20+ cryptocurrencies)

- Instant and fee-free cash transfers

Cons

- Not available in the U.S.

- Management fees are middle-of-the-road

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak