RealtyMogul is one of the largest commercial real estate crowdfunding sites in the marketplace today. The site has allowed hundreds of thousands of investors add exposure to the real estate sector to their portfolio.

But is RealtyMogul the best way for you to invest in real estate? We explain what the site is, and who should consider investing through the platform.

If you want to jump in and see Realty Mogul for yourself, check it out here.

RealtyMogul Details | |

|---|---|

Product Name | RealtyMogul |

Min Invesment | $5,000 |

Annual Fee | 1% - 1.25% per year |

Open To Non-Accredited Investors | Yes |

Promotions | None |

What Is RealtyMogul?

Launched in 2013, RealtyMogul is a commercial real estate crowdfunding platform. Since 2014, the platform has allowed investors large and small to invest in privately held real-estate investment trusts (REITs). It also helps accredited investors take part in private deals.

Even though investors only have to invest at least $5,000 at a time, RealtyMogul makes it possible for its investors to fund deals worth millions of dollars. It opens up the world of commercial real estate to everyday investors.

Another one of RealtyMogul’s strengths is that it makes it easy to invest using a 1031 exchange. If you need to reinvest the proceeds after selling a rental property, you can invest in RealtyMogul and gain the benefits of a 1031 exchange. Basically, this means that you can defer capital gains on the transaction until you sell your RealtyMogul shares. This can be a great way for someone who wants to become a more passive real estate investor. Before engaging in a 1031 exchange, you should always consult a tax professional.

In some cases, you can invest in a self-directed IRA through RealtyMogul. But RealtyMogul doesn’t have a set partner for these investments.

Who Can Invest On RealtyMogul?

Unlike many commercial real estate crowdfunding sites, RealtyMogul is open to both accredited and non-accredited investors. Non-accredited investors can invest in the site’s proprietary REITs.

Accredited investors can invest in individual “equity opportunities.” Equity opportunities give investors the opportunity to buy a share of an LLC. The LLC then owns a specific property. These investments are highly illiquid. You should not expect to unlock your cash until the project is complete and the LLC is dissolved.

To be an accredited investor, you must meet one of the following criteria:

- You have an income over $200,000 for the last two years. (Or a joint income over $300,000 for the last two years.)

- You have a net worth exceeding $1 million (excluding the value of your personal residence).

- You have a trust with assets over $5 million.

What Does It Offer?

RealtyMogul offers several different ways to invest. If you're an accredited investor, you can invest directly in individual properties.

For non-accredited investors (and anyone else interested), you can invest in their REIT products. RealtyMogual has two private REITs - Income and Apartment Growth. Both have minimum investments of $5,000.

Below, we take a closer look at all three investment choices. We'll also discuss RealtyMogul's liquidity and automatic investing options.

Income REIT

RealtyMogul's Income REIT has a monthly distribution schedule. Currently, it has an annualized distribution rate of 6% and has paid investors 6% to 8% over the past 62 months. Since inception until now (ending June 30, 2023) it's delivered a total return of 7.81%.

Growth REIT

The Growth REIT focuses more on long-term capital appreciation than short-term cash flow. It pays distributions quarterly and, in 2022, has an annualized distribution rate of 4.5%. From inception to now (ending June 30, 2023), the Growth REIT enjoyed a total return of 6.40%.

Private Market Offerings

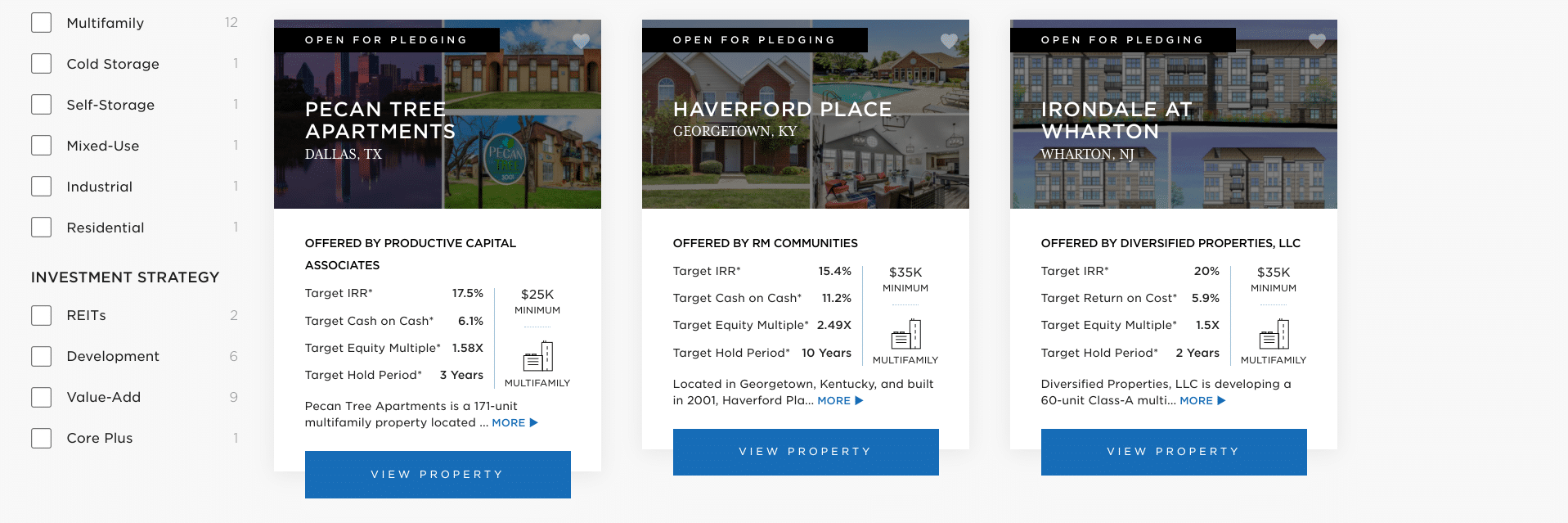

In terms of direct investments, RealtyMogul offers a range of offerings, from multi-family dwellings to commercial. You can invest via preferred equity investments or debt investments. These investments typically require you to be an accredited investor.

In October 2023, RealtyMogul had six deals that were open for pledging and two that were on a waitlist. You'll be able to find loads of information for each offering, including its target IRR, arget cash on cash, target equity multiple, target holding period, minimum investment, and more.

Automatic Investing

Once you've made your first investment in one of RealtyMogul's REITs, you can buy more shares on a recurring basis through its auto investment program. The minimum monthly recurring investment is $250. Participating in the auto investment program could be a great way to gradually increase your holdings in commercial real estate over time.

Moderate Liquidity

RealtyMogul's REITs are privately held and non-traded. Usually, that means your cash is locked up indefinitely.

However, RealtyMogul offers to buy back shares (at the current share price) once per quarter (after you’ve been invested for 12 months). The result is that these REITs have medium-term liquidity, but they're not liquid in the short-term.

It should also be pointed that you can't access 100% of your initial investment until three years have passed. The table below shows the various repurchase rates that you'll receive depending on when you redeem your shares.

- Less than 1 year: Not allowed

- 1 to 2 years: 98%

- 2 to 3 years: 99%

- At least 3 years: 100%

By comparison, Fundrise doesn't have a 1-year lockup period which is nice. But on the other hand, Fundrise will charge you a 1% early redemption fee if you buy back your shares any time before 5 years.

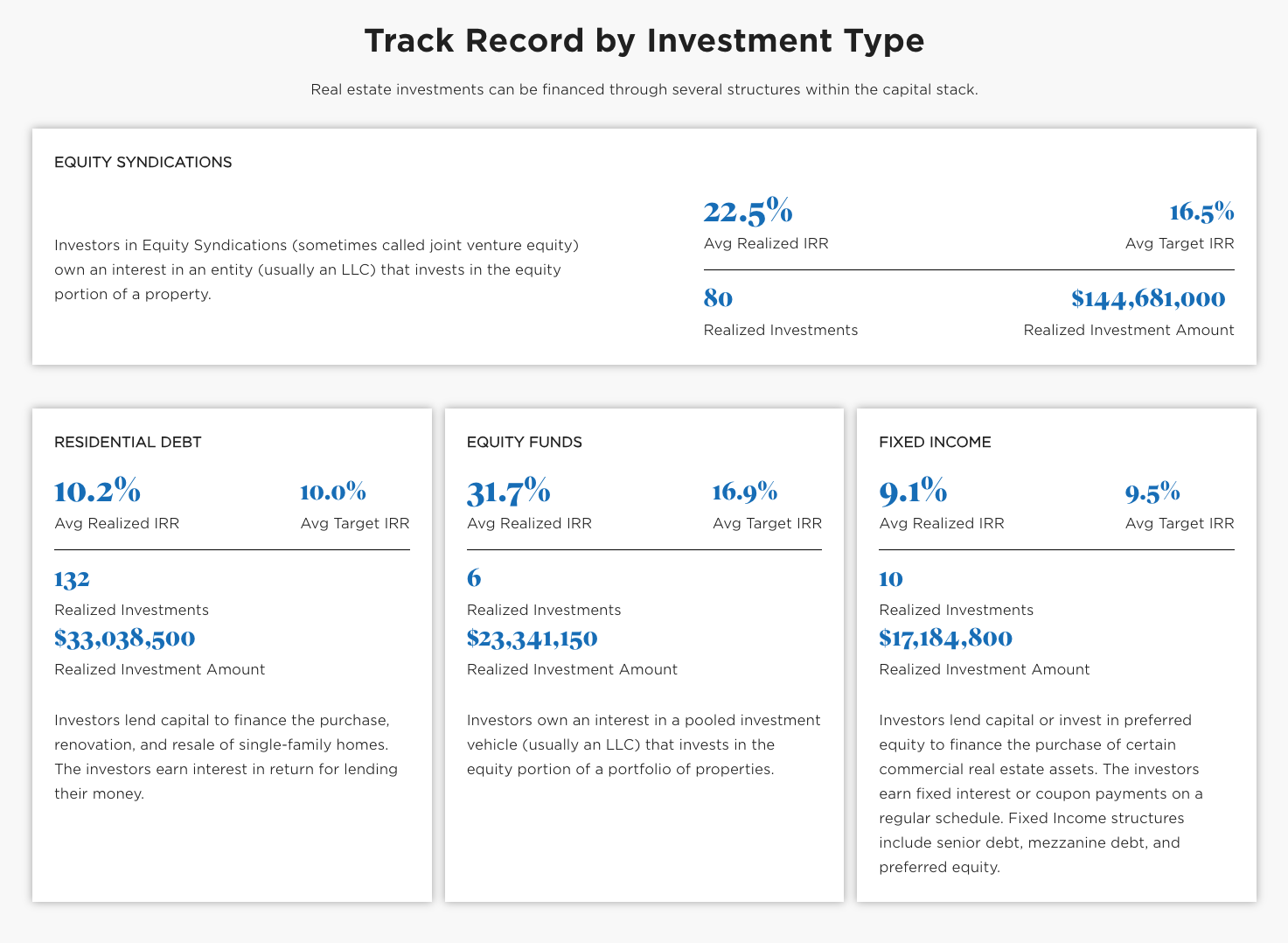

RealtyMogul Performance

One thing we love about RealtyMogul is their transparency on performance. As of November 2023, you can see their historical performance across all their investment types:

What Are The Fees?

For individual deals, you'll need to dig into the fine print on each deal to determine their costs. But here are the current asset management fees for Realty Mogul's REITs:

- Income REIT: 1%

- Apartment Growth REIT: 1.25%

RealtyMogul also says that it could take up to 3% of equity contributions to cover Organization, Offering and Other Operating Expenses.

How Does RealtyMogul Compare?

RealtyMogul is not the only real estate investment platform. In fact, over the last few years, a lot of competition has emerged in the space. However, RealtyMogul is consistently ranked well in the space.

Check out this quick comparison here:

Header |  | ||

|---|---|---|---|

Rating | |||

AUM Fees | 1%% to 1.25% | 1% | 2% |

Min Investment | $5,000 | $10 | $5,000 |

Open To Non-Accredited Investors? | |||

Cell |

How Do I Open An Account?

If you’re interested in investing in commercial real estate, you can open an account on the RealtyMogul website. Before you fund an account, you should watch at least a few of the videos that RealtyMogul has on its site.

If you’re looking at individual equity opportunities, you may want to speak with a customer service representative from RealtyMogul. They should help you find important resources that will help you better understand the investment.

How Do I Contact RealtyMogul?

For general inquires, you can call RealtyMogul at 877-977-2776 or email them at info@realtymogul.com. The company also has a separate Investor Relations team that can be contacted at 877-781-7062 or investor-help@realtymogul.com.

Is It Safe And Secure?

RealtyMogul's site is encrypted and it regularly undergoes internal and external reviews. That's great when it comes to data security. But as far your assets go, there's no FDIC insurance or SIPC insurance. So if RealtyMogul was to go belly-up, you could potentially lose 100% of your investment.

Thankfully, RealtyMogul has nearly a 10-year track record of sustainable success. Still, you shouldn't investment any money in the company's offerings that you can't afford to lose.

Why Should You Trust Us?

I have been writing about and reviewing investment firms and covering real estate investments for 10 years. I have personally owned single family, multi-family, real estate syndications, private partnerships, and more. I'm well versed in both the investment aspect and tax aspect of these products and services.

Furthermore, we have our compliance team that regularly checks and updates the facts on our reviews.

Who Is This For And Is It Worth It?

If you’re an everyday investor looking to gain exposure to commercial real estate, I think the Income REIT and Apartment Growth REIT make a lot of sense. They aren’t completely liquid, but you can sell your shares back to the company after you’ve owned them for one year. This is much more appealing than most non-traded REITs that aren’t offering quarterly liquidity opportunities.

If you have no exposure to real estate (including owning rental properties or publicly traded REITs), consider how a RealtyMogul REIT could fit into your portfolio. Of course, do your research on the product, as it won’t be the right fit for everyone.

In terms of the individual investing opportunities on RealtyMogul, accredited investors need to do their homework. These investments are illiquid and risky. You won’t be able to take the cash out of the investment until it pays off (or flops). Accredited investors should be sure to compare RealtyMogul to other crowdfunding sites such as Equity Multiple, or CrowdStreet before committing to any particular site.

RealtyMogul FAQs

Let's answer a few of the most common questions that people ask about RealtyMogul:

Who started RealtyMogul?

Jilliene Helman and Justin Hughes founded RealtyMogul in 2013.

Can sponsors white label RealtyMogul's technology?

No, the company does not allow white labeling.

Are RealtyMogul's REITs publicly-traded?

No, while the REITs that RealtyMogul offers are public, they're non-traded.

Is RealtyMogul better than Fundrise?

It depends on your needs. Fundrise has a much lower minimum to get started which is great if you're investment capital is limited. However, RealtyMogul will repurchase your shares with no discounts after three years, whereas Fundrise's early redemption penalty lasts for five years.

RealtyMogul Features

Account Types | Taxable only, but you can invest in RealtyMogul's offerings through any self-directed IRA |

Minimum Investment | $5,000 |

AUM Fees | 1% to 1.2% |

Target IRR/LTM | Varies by offering |

Target Annualized Distribution Rate |

|

Investor Requirements |

|

Investment Options |

|

Fund Transparency | High -- fund financials are filed publicly with the SEC |

Investment Term | Varies by investment. REIT shares must be held for three years in order to receive a 100% repurchase rate on shares |

Share Redemption Program | Yes. Redemptions can be requested on a quarterly basis after a one-year lockup period. Redemptions that take place between years 1-3 are repurchased at a 1% to 2% discount. |

Automatic Investing Program | Yes, $250 monthly minimum |

Secondary Market | None |

General Customer Service Phone Number | 877-977-2776 |

General Customer Service Email Address | info@realtymogul.com |

Mobile App Availability | iOS and Android |

Web/Desktop Platform Access | Yes |

Promotions | None |

Realty Mogul Review

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Products and Services

-

Diversification and Risk Mitigation

Overall

Summary

RealtyMogul is a real estate investing platform that allows for both direct investment and offers multiple REITs to non-accredited investors.

Pros

- Individual deals as well as REITs

- Consistent cash flow on REITs

- Options for non-accredited investors

- AUM fees lower than industry average

Cons

- Not as much deal flow for individual deals compared to other platforms

- The 1.25% fee for the Apartment Growth REIT is on the high side

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett