When it comes to investing, time is your friend. Why? Because over time, your investments will tend to grow at compounding rates - that's compound interest. That means the money that your money has already earned makes more money.

This is why Albert Einstein famously said, "Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it."

Here’s what you need to know about compounding and how it affects your investments.

What Is Compounding?

One of the most common pieces of financial advice is to invest $50,000 of your money in the stock market each year, and to not look at your balance for 40 years. On the dawn of your retirement, you’ll open up your portfolio with hundreds of thousands or even millions of dollars to your name!

How do you have so much money? The answer is compounding which is sometimes called compounding growth or compounding interest.

Compound growth is the concept where the initial investment grows (either through dividends, interest, or capital gains) each year. Then, provided that you don’t spend the growth, the next year, the earnings and the initial investment grow.

Even if the rate of return stays the same (say 5% each year), the total value of the investment goes up at a faster and faster clip each year.

Because humans tend to think linearly, it is very difficult (maybe even impossible) for us to truly grasp the concept of compound growth. That's why we have tools like the Rule of 72.

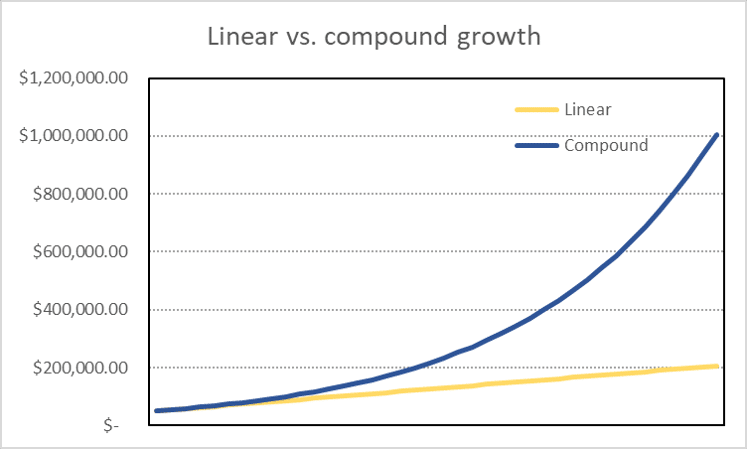

In the chart below, you can see the difference between a linear and a compound growth rate. In both examples, the initial portfolio had a value of $50,000. Both had a growth rate of 8%. However, the portfolio where growth compounded had a value over $1 million dollars after 40 years. The portfolio that experienced linear growth was just a hair over $200,000 after 40 years.

Many investments have historically shown returns that match compound growth patterns over a long period of time.

Want to see some really powerful compounding? Try this exercise: How much money do you think you would have if you doubled a penny every day for one month?

The answer is $10.7 million dollars. The higher your rate of return (in this case, daily doubling), the faster compounding starts to take effect.

Of course, finding investments that double daily is impossible, but the example also speaks to the importance of time.

Compounding Interest vs. Compounding Growth

When you’re talking about money growing on its own, you’ll almost always hear the word compounding. But you may hear it called compounding interest or compounding growth. Are they different, and does the difference matter?

Technically, compounding interest is where a principal investment and interest earned from the investment compound over time. For example, a certificate of deposit (CD), a bond, or a high-yield savings account earns interest. If you continue to reinvest the interest that you earn into the same investment, you’ll earn compounding interest.

Compound interest frequently works against people. For example, the interest on a debt compounds over time. If you aren’t making any payments on a loan, the interest that you’re not paying is added to the principal, and you must pay interest on the interest owed. When you’re not making payments on your student loans, the interest is compounding.

Compound growth is where the principal investment plus capital gains (such as rising stock or real estate prices) and dividends, rents, or interest compound over time. Since most investments don’t earn interest, the most accurate terminology is compounding growth.

That said, compounding interest is a colloquial phrase in the world of investing. If you talk about compounding interest in real estate, everyone will understand what you’re saying.

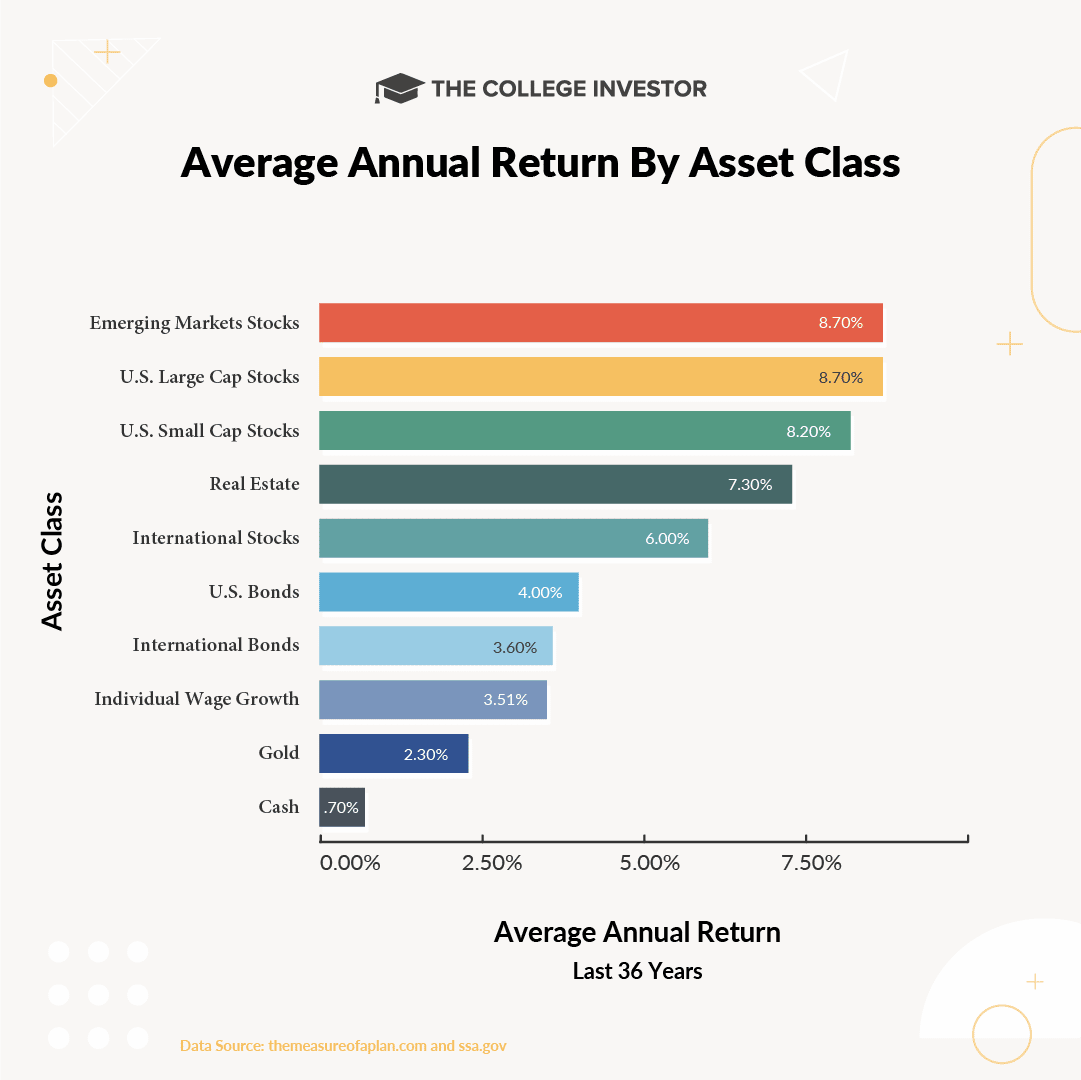

Compounding Rates of Return on Various Investments

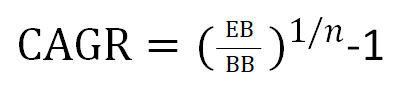

When it comes to calculating the compound annual rate of return (or the compound growth rate), you can use a very simple formula.

EB is the current (or ending) balance of a portfolio and BB is the initial (or beginning) balance of the portfolio.

The number of years that a portfolio has been invested is n.

Using this formula, we can calculate all kinds of growth rates for investments. The following are examples.

The Stock Market (S&P 500)

- Current value (January 2019): 2510

- Beginning value (January 1969): 102

- Number of years: 50

- CAGR = 6.7%

Over the past 50 years (as of the start of 2019), the stock market has returned a tremendous 6.7% compounding return. Of course, if you select a different time period than the one I selected, the return could be much better or much worse.

It’s worth noting that this actually understates the true compounding growth rate of the stock market since it doesn’t include dividend reinvestment.

The U.S. Real Estate Market (Single Family Homes)

Some people want to compare their investments in the stock market with the value in their homes. This calculation will show you the growth of median home prices over 40 years.

- Current value (Q1 2019): 313,000

- Beginning value (Q1 1969): 25,700

- Number of years: 50

- CAGR = 5.1%

Median home prices have gone up at a rate of 5.1% over the past 40 years.

What if you bought a home in Sunnyvale, California instead of somewhere in Middle America?

- Current value (Q1 2019): 450.87

- Beginning value (Q1 1976): 19.76

- Number of years: 43

- CAGR = 7.5%

While average home prices grew slower than the stock market, home prices in Sunnyvale actually outpaced it. I threw this example in to show that it can be tough to say whether you should invest in one investment or another. Knowing the average compound growth rate isn’t always helpful.

Inflation — When Compounding Works Against You

Of course, compounding doesn’t always work in your favor. When you have debt, the interest on the debt compounds.

If you’ve ever checked out a loan amortization schedule, you’ll notice that most of your early payments go toward interest, and very little goes toward the principal balance. That’s because you pay interest on the entire amount of loan that’s outstanding. The only way to cut back on interest you pay is to either pay extra towards principal or to lower your interest rate (or do both).

Even if you don’t have debt, compounding works against you through inflation.

One good measure of inflation is called the Consumer Price Index. This compares the cost of a “basket of goods and services” such as houses, cars, utilities, groceries, etc. over time. The growth rate in CPI is the inflation rate. It is the amount that inflation is working against you.

- Current value (January 2019): 252.67

- Beginning value (January 1969): 35.7

- Number of years: 50

- CAGR = 3.99%

Over the past 50 years, inflation has eroded wealth by 3.99% per year. I should mention that inflation has tended to be much closer to 0% to 2% over the past few years — the CAGR calculated here may overstate the reality. Nonetheless, it is important to note that your investments need to earn somewhere between 2% and 4% per year just to match inflation.

The Sooner You Start Investing, the Faster Compounding Can Work in Your Favor!

If you haven’t started an investment account, it’s time to get started.

Think about opening a Roth IRA (better yet, get the company match for your 401(k)). Invest the money, and keep your hands off of it. 40 years from now (or even less if you’re a super-saver), that sweet, sweet compounding will be spinning off enough money for you to live off of your investments.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Clint Proctor Reviewed by: Chris Muller