Since 1957, the S&P 500 has been the benchmark of the American Economy. The index, which tracks the valuations of approximately 500 of the largest U.S.-based companies, is so well-respected that it’s used as an economic indicator in The Conference Board Leading Economic Index.

When it was first founded, the S&P 500 had little practical use. It served as a bellwether for the stock market and provided a glance into the inner workings of the economy. The impracticality of the index changed in 1975 when Vanguard Founder Jack Bogle popularized the index fund. Bogle marketed the first publicly available index fund that passively tracks the S&P 500.

To this day, many index fund investors own S&P 500 index funds because they tend to be low-cost and representative of a large segment of the stock market.

What Is The S&P 500?

The S&P 500 is commonly thought of as an index fund that tracks the performance of the 500 largest companies in the U.S. When people discuss the U.S. stock market, it’s often about the performance of the S&P 500 as a proxy for the overall market’s performance.

The criteria for selecting the approximately 500 companies on the S&P 500 list isn’t exclusively about the size of the companies. Companies on the list are chosen by a committee at S&P Global Ratings, and they must meet certain financial criteria, and the index as a whole must represent major economic sectors in the United States.

The S&P 500 index assigns each company a weighting according to its value in the market. Apple (APPL) currently has a value, called a market capitalization, of $2.77 Trillion. Its weight in the index is more than 6%. As of this writing, the smallest company in the S&P 500 is Embecta (EMBC), which has a market cap of $1.66 Billion. Its weight is .0005% of the index.

The S&P 500 is considered a self-cleaning index. When a company’s market capitalization falls too low, the company drops out of the index. It is replaced by a company with a higher capitalization.

How To Buy An S&P 500 Fund

Before you can buy an S&P 500 Index Fund, you’ll need to open an investment account. Opening an investment account may sound intimidating, but it’s a straightforward process.

Investing apps are making it easier than ever to invest commission-free. Check out our picks for the 5 Best Investment Apps to make investing a little bit easier.

If your employer offers an employer-sponsored retirement investment account, you can open an account through work. Not all employers may not offer this, so if this is the case for you, select a brokerage and open an account.

Deciding what type of account is best for your situation may be the hardest part of the process. A regular brokerage account is just fine to get started but keep in mind there are tax advantages to investing through a retirement account (if you're eligible).

What Type Of Investment Account Do I Open?

- Brokerage accounts can be used to deposit and withdraw funds whenever you want.

- Retirement accounts have restrictions and can usually only be withdrawn upon in retirement. See which one is best for you.

Once you have an account, buying the S&P 500 is just one trade away. Most brokerages allow you to fund your account with a direct transfer from your bank account. Once the money settles in the account, you can place a trade order for your S&P 500 fund.

Below you’ll see the ticker symbols for the major S&P 500 funds. These are mutual funds and ETFs that passively track the S&P 500 Index. They use the same weightings as S&P, so the performance of the funds exactly matches the performance of the index. The funds listed below also have the advantage of being low-cost funds.

You can buy either an ETF or a mutual fund. You may consider ETFs because the trade settles very quickly, so this provides peace of mind that the trade completes. Or you may prefer to buy mutual funds.

Header | Mutual Fund | ETF |

|---|---|---|

Charles Schwab | SWPPX (.02% Expense Ratio) | N/A |

BlackRock | WFSPX (.03% Expense Ratio) | IVV (.03% Expense Ratio) |

Vanguard | VOO (.03% Expense Ratio) | |

State Street Global Advisors | SPY (.0945% Expense Ratio) | |

Fidelity | FXAIX (.015% Expense Ratio) | N/A |

After your trade is complete, you are the owner of shares of the S&P 500. If you’re ready to invest regularly, you could set up an automated investment plan to pull money out of your checking account each month with an amount you choose.

Is The S&P 500 The Best Index Fund?

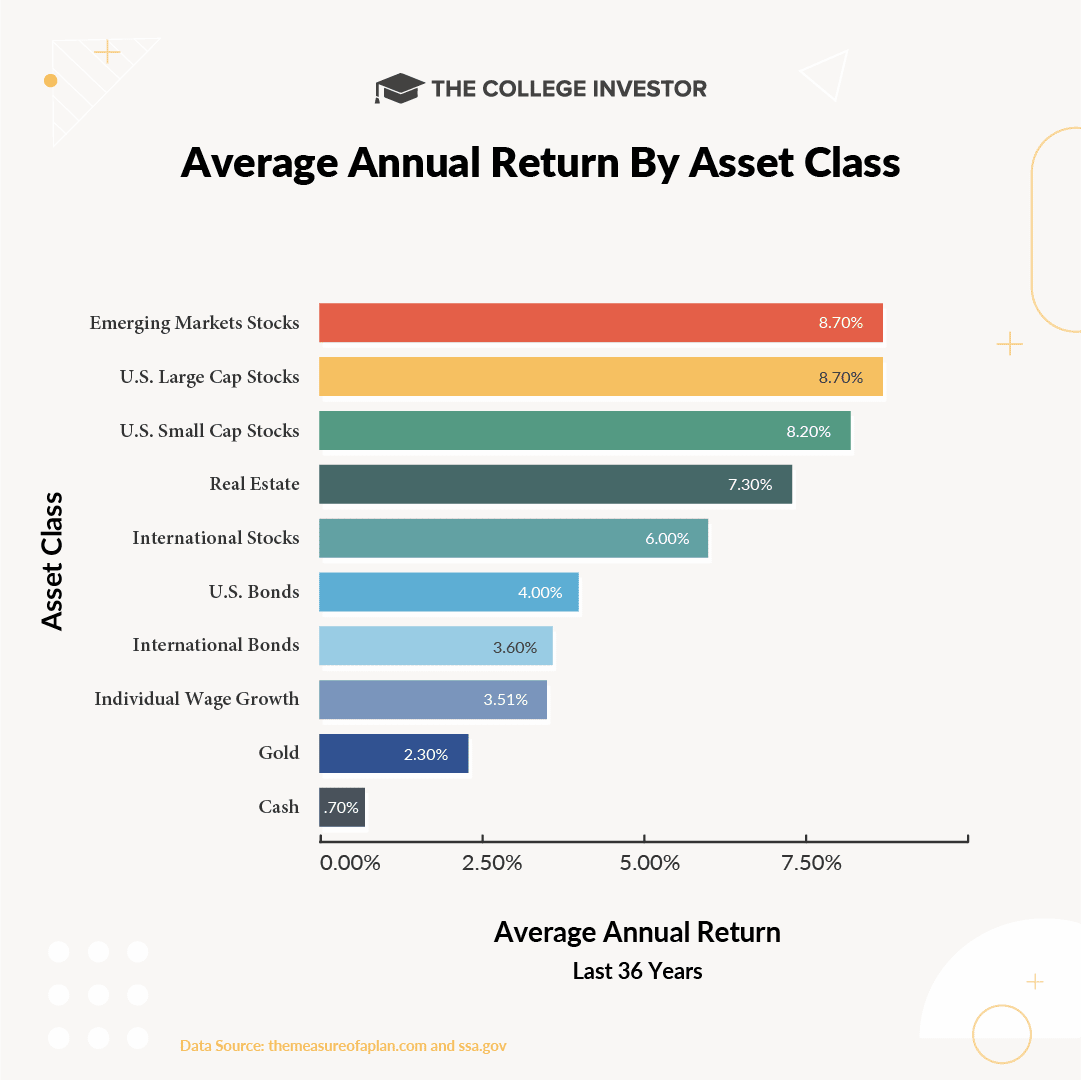

Over the past 36 years, large caps stocks tied emerging markets as the top-performing asset class. In the past 10 years, large-cap stocks consistently performed very well until the most recent bear market.

While the S&P 500 has been a driver of portfolio growth recently, it is not necessarily the best index fund. It has wild swings, and has had some years with double digit, negative growth.

Due to the volatility, many investors want to diversify beyond a single index fund. Investing in multiple indexes gives investors a diverse asset allocation. A diverse portfolio may smooth out investment returns, increase returns, or both.

The S&P 500 index is a good place to start, but you’ll want a few more funds to round out your portfolio. These may include:

- Small-cap funds

- International funds

- Alternative investments such as real estate and precious metals

Some investors may opt for total market indexes in lieu of S&P 500 funds. Total market indices track all publicly-traded companies rather than just the largest companies.

To illustrate the importance of investing in multiple asset classes, author Ben Carlson keeps an updated asset allocation performance chart that looks like a quilt. Or, you can check out our basic chart here:

Large Cap domestic stocks topped the chart but they aren't alone. Depending on the individual year, emerging markets, small caps, REITs, and even cash top the list. But it's important to remember that your portfolio is for the long run - so you want to focus on returns over time.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington