There are many ways to choose a good strike and expiration (i.e., expiry) for an option. Much of it also has to do with the option strategy you’re using, meaning single or multi-leg (i.e., iron condor, calendar spread, etc.).

To keep things simple, we’ll focus on single-leg strategies.We’ll also look to avoid assignment.

Some traders use options as a way to enter a stock while collecting premium. We simply want to profit from the option without being assigned (i.e., take the money and run). Here's how to choose the right strike price and expiration date that gives you the best chance of achieving that goal.

Buying Options (Calls Or Puts)

Buying options, either calls or puts, is a directional strategy. In other words, the stock has to move up or down respectively for the option to make a profit.

When buying a call, we want the stock price to increase. If the stock price moves very little or goes down, our option will lose value.

Now let's take a look at an example of how to find the right strike price for buying a call. Note that it was May 14th when we went through the steps outlined below.

Related: Options Trading 101

How To Choose The Right Options Strike Price

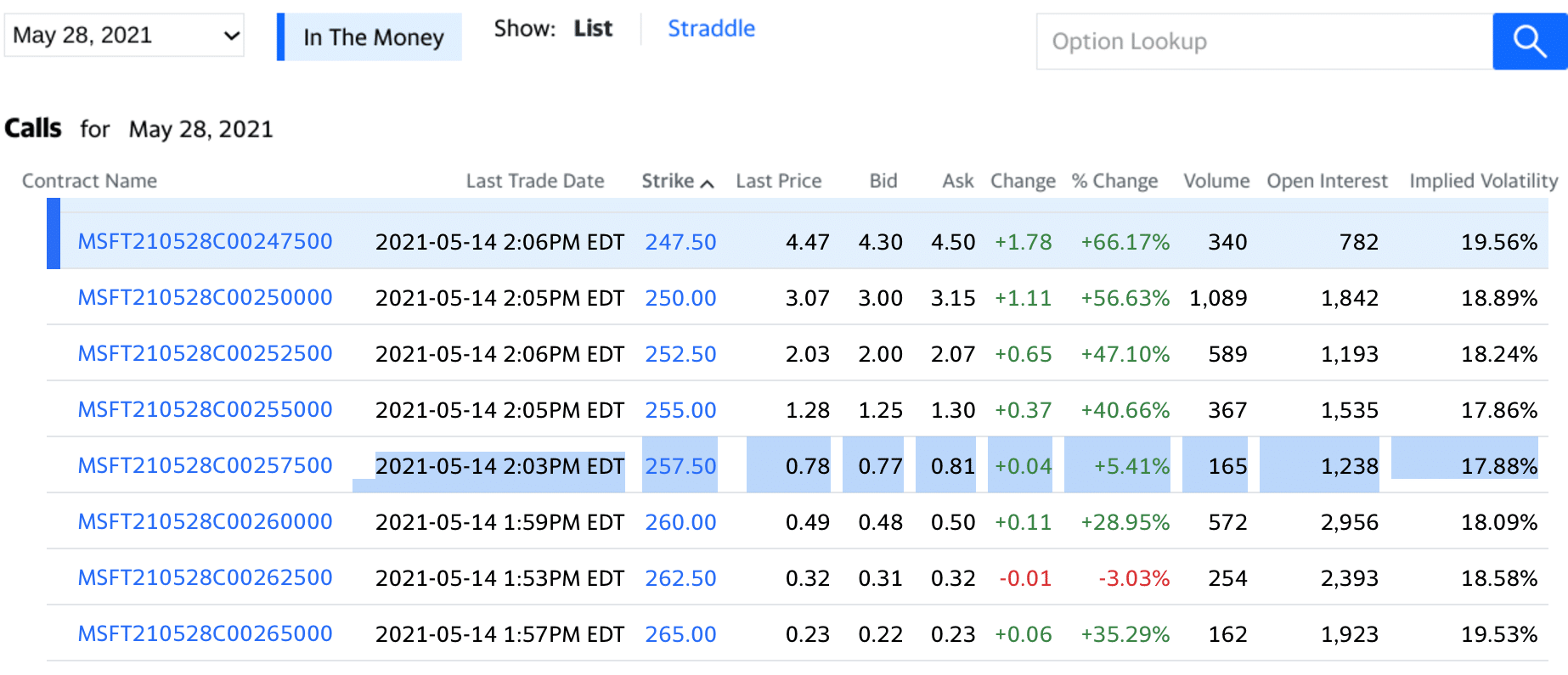

We’ll use MSFT as an example. The latest earnings for MSFT have already passed, so we don’t need to worry about the risk associated with an earnings announcement. MSFT is currently trading at 248.75. We believe there’s a chance that it can make another high. The high sits at 261.97.

To be on the safe side, we’ll choose the May 28 257.50 strike. It has a bid x ask of 0.77 x 0.81. By choosing a strike that is just under the high, we avoid a breakout that fails.

By a "failed breakout," we mean that he stock might go over 262 (maybe to 265) then fall back under that level. Had we chosen 260 or 265, our option would have had a difficult time increasing in value. The stock would likely need to go to 270 for those strikes to make money.

(source: Yahoo Finance)

At 257.50, a move to 260 or above should be enough to generate a profit, even on a failed breakout. Of course, if the breakout fails, it means we’d need to close out the option fairly quickly to capture profits.

How To Choose The Right Options Expiration Date

Now that we’ve outlined our reasoning behind the strike, why did we choose the May 28 expiry? This expiry was chosen to give MSFT some time to work higher. It’s also close to a holiday weekend. The week before and after a holiday weekend can see a quiet period where the market slowly moves higher (and hopefully our stock with it).

The closer to the current date that expiry is, the more we get into day trading. Also, the quicker the premium on the option will burn. Premium is the option price, which in this case is 0.77 x 0.81.

Time is always working against option buyers. Time decays option premium. But premium will begin decaying at a faster rate once we are within 30 days of the option's expiry. Of course, we're already buying the option within 30 days of its expiry. But there is still a couple of weeks worth of time to burn off.

If time burns off premium, why not choose an option a few months out? Mainly because the further out you go, the more difficult it is to determine where the stock price might be.

Selling Puts

Selling puts means opening a position by selling it and closing it later by buying it back. This might sound like shorting a stock. However, it's different.

When shorting a stock, the stock price must go down to make a profit. Also, there is an unlimited risk if the stock price keeps going up. There's also unlimited risk if you sell a naked call.

Selling a put doesn't mean you're short the stock. Instead, you are short the option premium, which means that the position profits as the option's premium goes down. There isn't unlimited risk with put selling since we're not short the stock. However, we could still lose a significant amount of money if the stock was to fall far below our strike price before we close our position.

Put selling has a neutral to a bullish bias. As a result, the stock can remain static, go up, or even go down a little, and the position can still make a profit. This is very different from how a profit is generated when buying options.

How To Choose The Right Options Strike Price

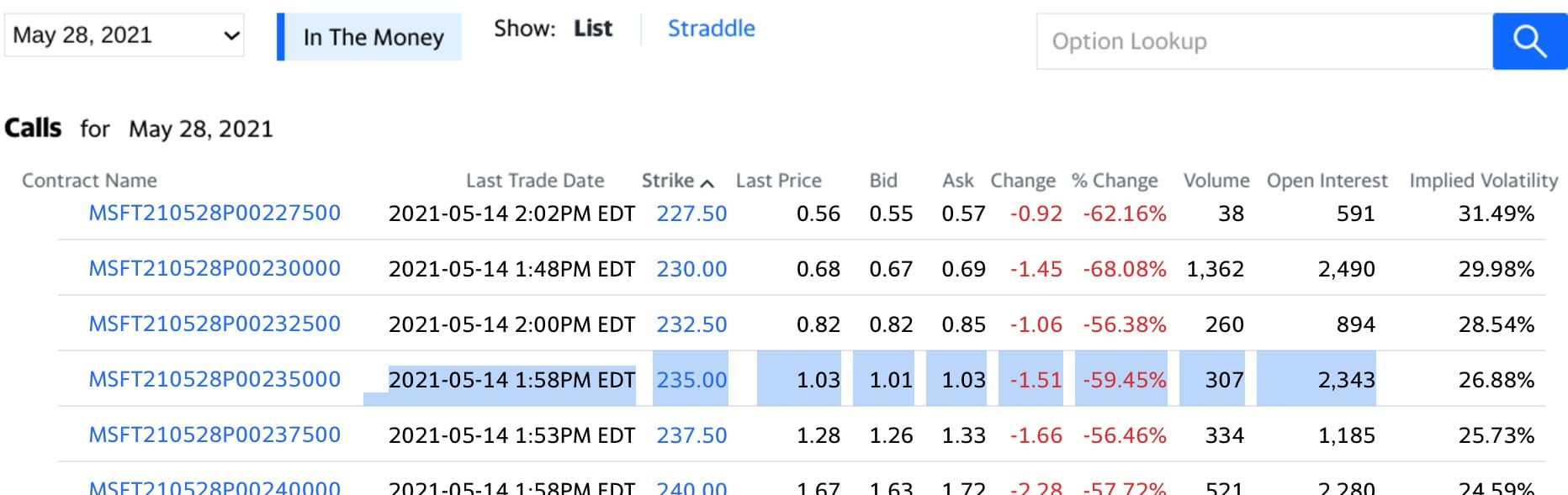

Let’s go back to MSFT. We still believe MSFT will go up. It seems to have support at 240. With support at 240, we’ll choose the May 28 235 put, trading at 1.01 x 1.03.

This puts the strike 13.75 below the current price. That gap will only widen as MSFT goes up. Additionally, the premium will keep decaying because of time and because the stock price is moving up.

(source: Yahoo Finance)

How To Choose The Right Options Expiration Date

Remember, we're selling a put. Puts decrease in value as the stock price rises and increase as the stock price goes down. So even if MSFT remains around 248 until May 28, the time component will continue to decay premium on the put option.

The further an expiration is out into the future, the slower the time decay. That's good for option buyers, but bad for sellers. That's why shorter expiration dates are generally best for sellers.

But if you choose an expiration date that's soon (i.e. a few days), you may not receive enough of a premium to meet your profit goals. For these reasons, many put sellers feel that an expiration date of two to four weeks provides a good balance of total premium and speed of time decay.

If we buy the option back at any price below 1.01, the trade will profit (not factoring in options commissions). MSFT can even decline and the trade will still make a profit just as long as the price remains above 235.

Related: Analyzing And Trading Options 101

Final Thoughts

Choosing the right strike price and expiration for options is a matter of determining where you believe the stock will go by a certain date. The further out you go, the more difficult that can become.

When buying options, you take a directional view, and there is little room for error. Meanwhile, selling puts allows the stock to move more while still being able to generate a profit. If you're looking to get involved with buying or selling options, check out our favorite platforms for options trading.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller