As someone who has suffered through more than a decade of paying student loans, I think President Biden’s decision to cancel $10,000 of student debt is a good thing.

As The College Investor’s editor-at-large, I thought it would be interesting to see how others felt about it.

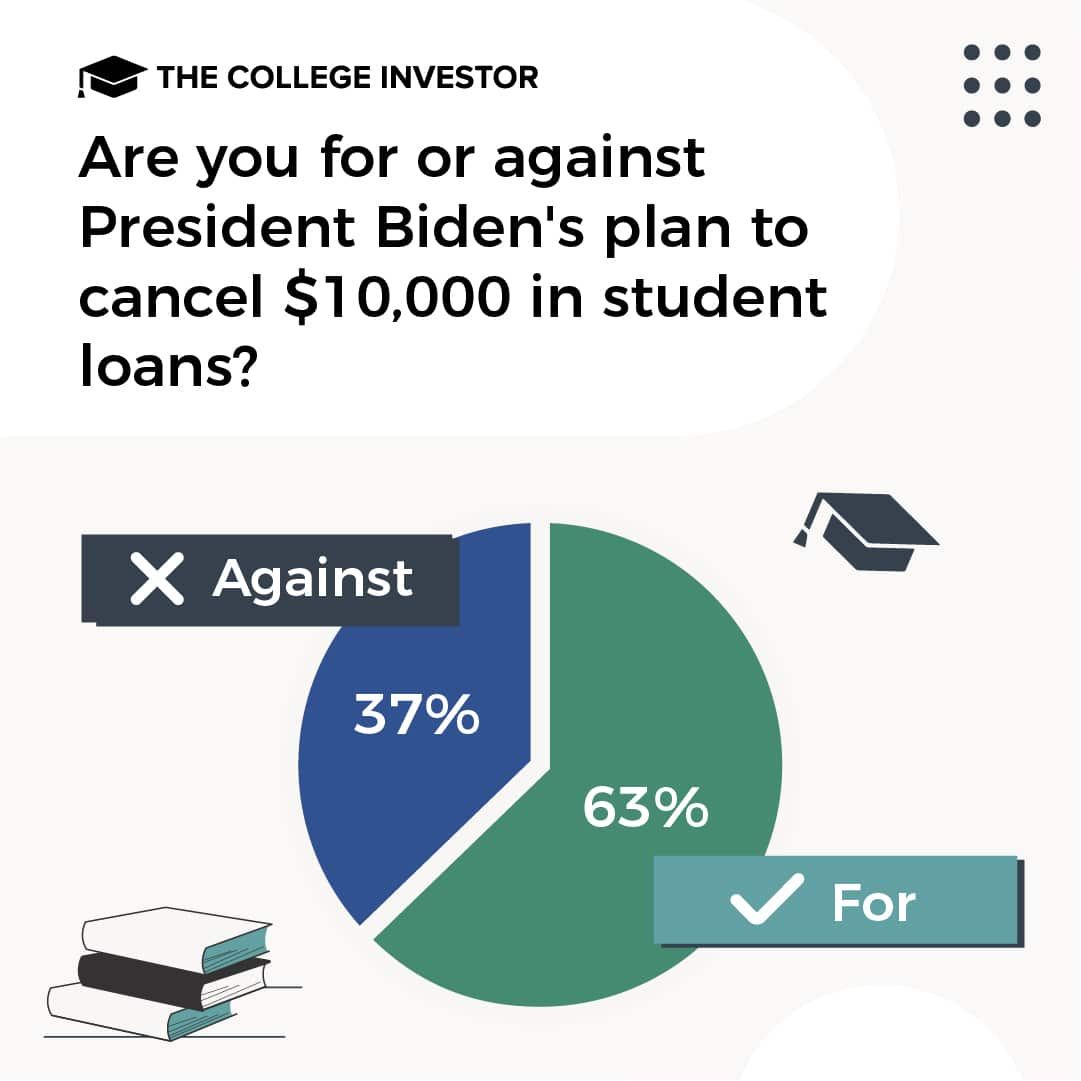

So, we polled 600 people—roughly one-third who had student loans, and the remaining respondents either paid them off or never had them to begin with. Sixty-three percent said they support Biden’s decision to forgive student loans.

My 10 Long Years Of Paying My Student Loans

I was both surprised at this debt cancellation plan and happy for the low- to mid-income borrowers whose debt loads would suddenly be $10,000 lighter (or $20,000 if they have Pell Grants). Selfishly, I wished I was one of them. I thought about the decade I was bogged down with my own student debt.

Upon graduation, I became a public school teacher, so basically, I was poor. For years, I was only paying the minimum monthly amount—a few hundred—to cover the interest on my $25,000 principal balance. This is why it took me a decade, and trust me, I had a lot of time to regularly daydream about being debt-free and how it would affect my life. I could set up an emergency fund or use that money to start investing. But let’s be real, I was young, so I mostly wanted the extra funds for traveling and buying things.

By year 10, just when I couldn’t stomach the thought of this debt following me around for one more month, I saw I was approaching the final payments. It was the homestretch. I still remember sitting in front of my laptop on the day I made my last payment. After clicking “Pay Now” for the last time, I felt an emotional confetti sprinkling down from above, showering me with a newfound sense of freedom and elation.

I would imagine it’s the same sort of feeling when borrowers had when they first learned about Biden’s plan. Despite this win for them, not everyone is so enthusiastic.

The Naysayers, And What About Rising Inflation Rates?

We’re now seeing inflation rates at a 40-year high, but experts can’t even give a definitive answer on whether we’re actually in a recession. Short answer: we’re likely not in a recession now, but is there one ahead?

With all this uncertainty, it’s no surprise not everyone is jazzed about Biden’s plans. An initial report said Biden’s student loan cancellation will cost taxpayers around $400 billion, or just over $2,000 per taxpayer.

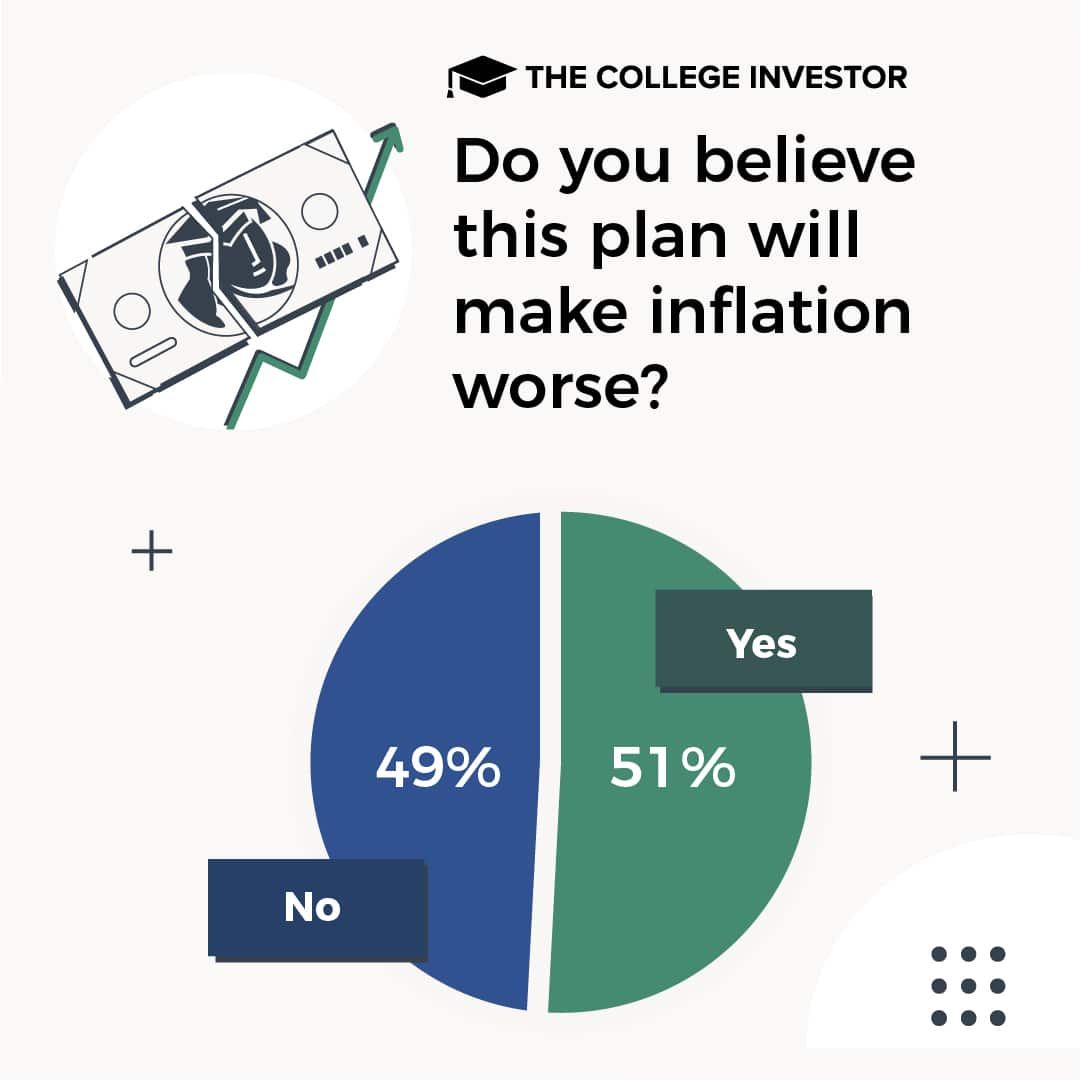

Despite these projections, our survey respondents were split on whether they expected a negative impact on inflation—51% believed debt cancellation wouldn’t make inflation worse, while 49% thought it would.

Is Student Debt Cancellation Just A Bandaid?

Inflation aside, critics argue Biden’s plan is only addressing symptoms of an antiquated (and incredibly expensive) university infrastructure that tips in the favor of the privileged.

It leaves many of us asking:

- Why and when did it get so pricey to get a degree?

- Should colleges be held accountable when students go through the university system and aren’t able to secure a job?

- How can we make higher education more widely accessible, financially?

- What are we doing for future loan borrowers? Roughly $90 billion in new student loan debt was originated in this year alone.

While the President says he remains focused on keeping costs for college under control, we still have a long way to go to fully address these questions or come up with viable solutions. Colleges like Purdue are recognizing this need for students to be debt-free upon graduation. In lieu of paying for tuition, students pay the school a percentage of their post-grad income. The more the grad makes, the more Purdue gets.

It’s not perfect, but helps ensure new grads aren’t crushed under a mountain of debt upon entrance to the working world. It’s an alternative option to cover the cost of education. When I was in school, I wished I had more of these types of options, outside of loans or a job. (Of course, I also wish I could’ve watched $10,000 suddenly disappear from my loans back then!)

So, What Now?

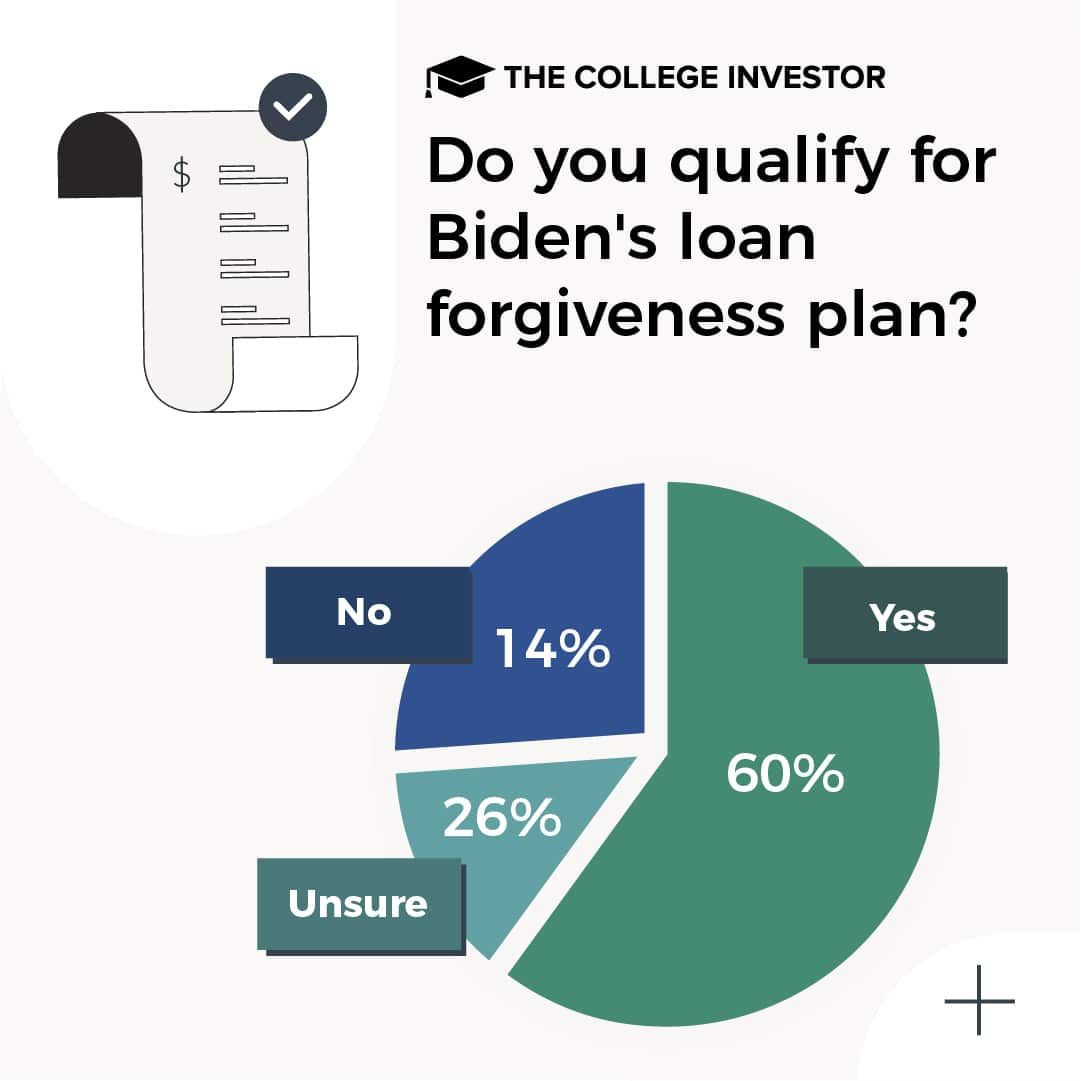

Before you get too excited, make sure you actually qualify—almost 26% of our survey respondents said they weren’t even sure if they did. Your income can’t be higher than $125,000 or if you’re married, $250,000. Don’t miss our in-depth article that explains the nuts and bolts of qualifying and applying.

While some borrowers can expect automatic cancellation of this debt from their overall student loan balances, most will have to apply. After you do, the Education Department expects it will take four to six weeks for the $10,000 to be canceled from your loan balance. (Or if you have Pell Grants, up to $20,000.)

Officials are encouraging borrowers to submit the application no later than Nov. 15, 2022, but technically, you have until Dec. 31, 2023.

Subscribe to the U.S. Department of Education so you know when the student loan forgiveness application is ready.

For more on student loan forgiveness, see our post on Student Loan Forgiveness Programs.

Claire Tak is an editor, content strategist, and writer with a specialty and passion for personal finance and tech. Her experience in finance spans from working at San Francisco-based startups like Credit Sesame and Upstart to large institutions such as Wells Fargo. Her work has been published in FOX Business, Bloomberg, and Forbes.

Claire believes financial stability is created through education, long-term investing, and saving. She’s fascinated by the connection between money and happiness and how human behaviors play into achieving financial success.

Besides her enthusiasm for personal finance, she loves snowboarding and traveling. You can learn more about Claire at clairetak.com.

Editor: Robert Farrington