Over the last few months, the idea of "blanket" student loan forgiveness has been pushed by Senators Elizabeth Warren and Bernie Sanders. Now President-Elect Biden has even supported up to $10,000 in student loan forgiveness.

It's also safe to say that Biden has the most conservative plan for fixing the student loan debt crisis - with other Democrats wanting to see $50,000 in loan forgiveness or even total elimination of student loan debt.

However, these proposals aren't without controversy. While 45 million Americans have student loans, not all of them are struggling to pay them - and many of these borrowers are in the top 10-20% of income earners in the country. Furthermore, that's only about 30% of Americans. So many people will say, "what about us?"

It's a fair question. And we wanted to know what they thought. So our survey of 2,000 Americans included three cohorts: those with student loan debt, those who've had student loan debt (paid off, forgiven, or eliminated by other means), and those who've never had student loans.

Here's what we discovered.

Key Findings

We looked at how Americans feel about various proposals of student loan cancellation, and examined it overall and by cohort. Here's what we found:

- Overall, 73% of Americans surveyed were in support of forgiving $10,000 in student loan debt. Even 53% of individuals who never had student loans still supported this.

- Overall, 63% of Americans surveyed were in support of the larger $50,000 in student loan forgiveness. This proposal still had a slim majority of 51% of individuals who've never had student loans support it.

- 60% of Americans surveyed were in support of total elimination of student loan debt. For those who never had student loans, only 44% supported this proposal.

We also wanted to see how people felt about the "fairness" of this type of program. We looked at two metrics:

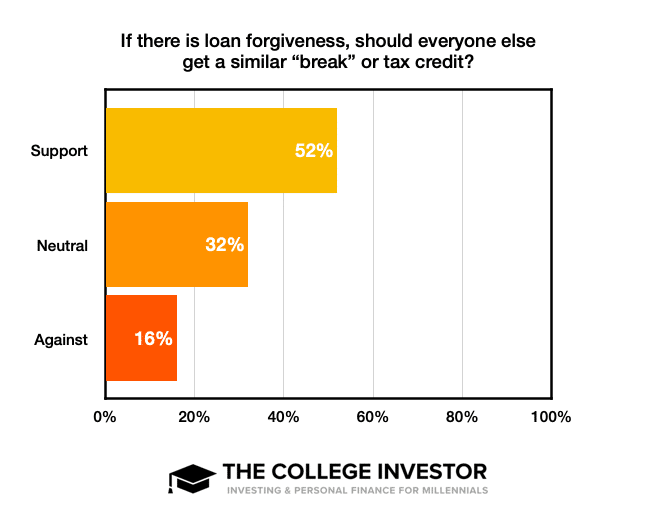

- 52% of those surveyed believe there should be an equal tax break or program of the same value for those who don't have student loans.

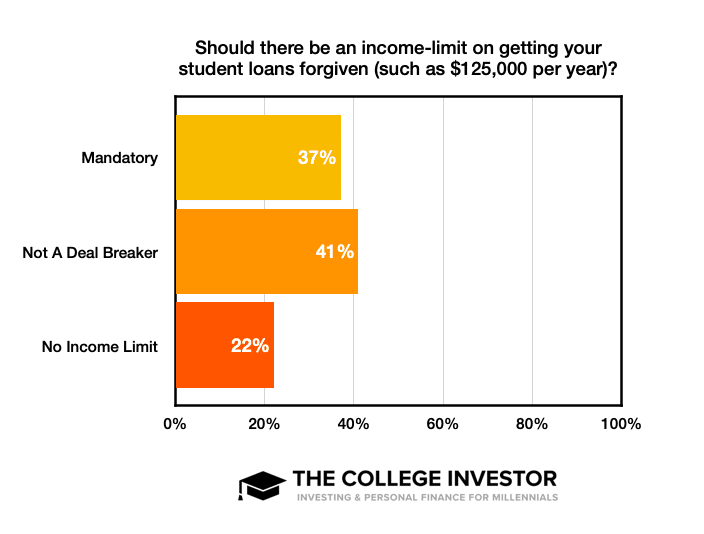

- Only 37% of those surveyed felt there should be an income limit on loan forgiveness. The majority were indifferent to income limits or believed that loan forgiveness must be extended to all who have loans.

What The Student Loan Debt Crisis Looks Like

With those findings in mind, it's important to take a look at what the student loan debt crisis looks like today.

Right now, there is $1.6 trillion in outstanding student loan debt. This is owed by 45 million Americans.

It's important to note that there is also another $132 billion in private student loans. The proposals above will only impact Federal student loans, so even if anything is cancelled, this amount would likely remain.

With that in mind, here's what the individual borrower will owe:

- Average Student Loan Debt: $32,731

- Median Student Loan Debt: $17,000

- Average Student Loan Payment: $393

- Median Student Loan Payment: $222

You can find more statistics on student loan debt here: Average Student Loan Debt by Graduating Class and What Is The Average Student Loan Payment.

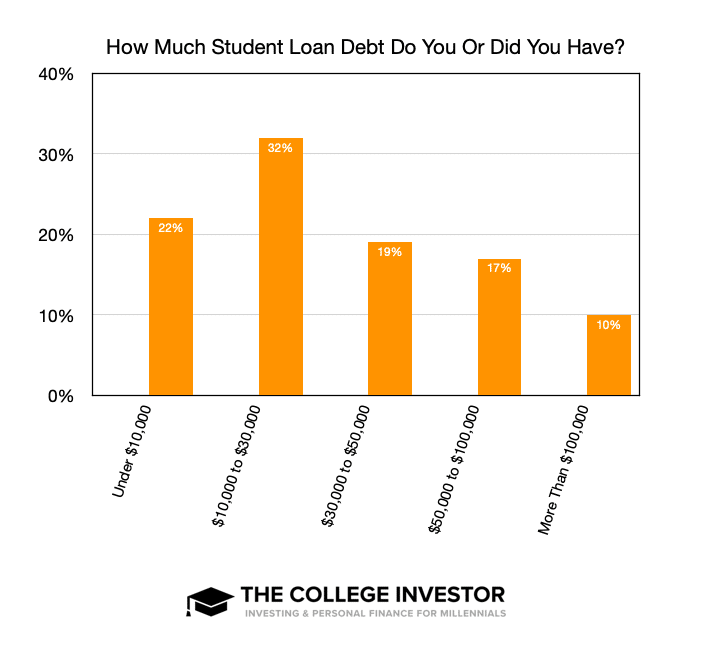

In our survey, here is how much debt was reported:

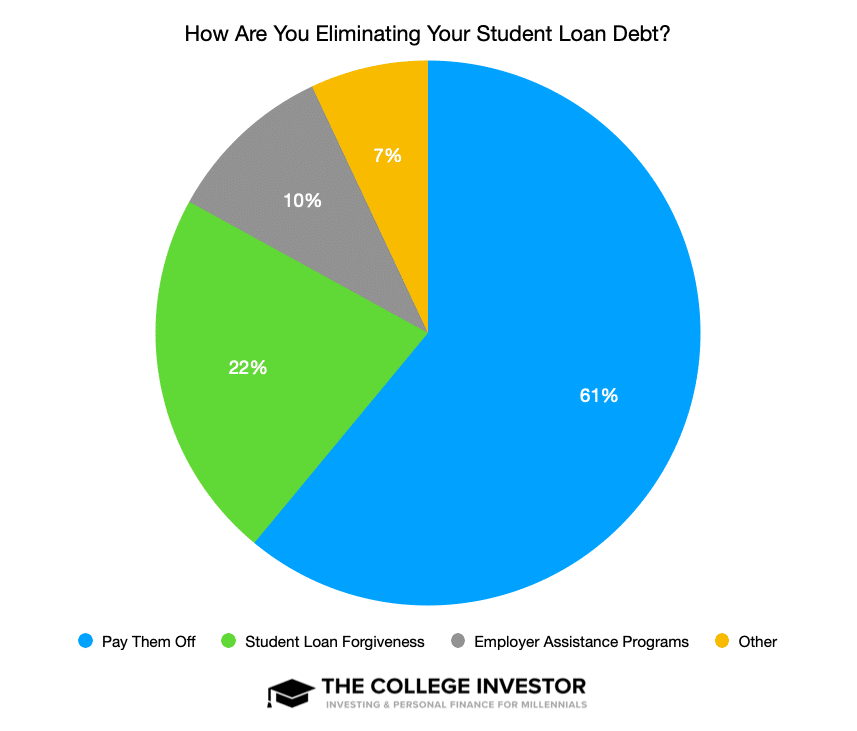

And when it came to how they were working towards eliminating their debt, 61% of those with debt in our survey were paying them off. 22% said they were currently working towards a student loan forgiveness program. 10% said they were receiving some type of employer repayment assistance to help them eliminate their loans. The remaining 7% were struggling through default, forbearance, or other situations.

Knowledge Of Existing Loan Forgiveness Programs

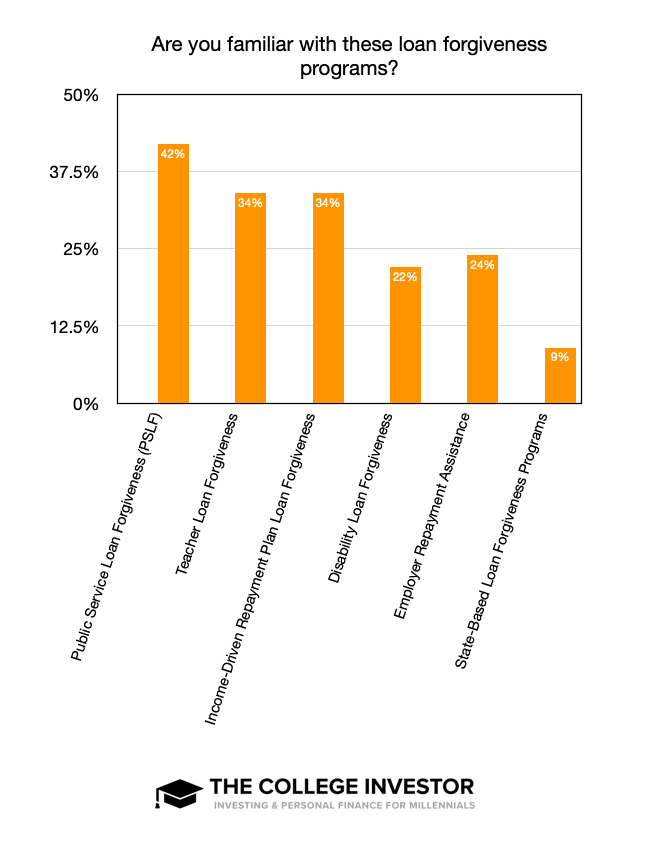

As of today, 50% of student loan borrowers likely qualify for some type of student loan forgiveness program. This could be popular programs like Public Service Loan Forgiveness (PSLF), or more vague ones like state-based repayment assistance programs.

However, even though these programs exist today, most borrowers don't know they exist. Sadly, only 34% of those surveyed knew about how many loan forgiveness options there were. PSLF was the most well-known loan forgiveness program, but sadly not even a majority knew it existed.

What The Critics Say

With these numbers in mind, critics of student loan forgiveness will argue the following. First, only about 30% of Americans even owe student loan debt.

Second, college graduates, on average, earn much more than non-college graduates - to the tune of about $1 million more over their lifetime (see study). That's about $32,000 more per year.

Third, college graduates have a 3.5x lower poverty rate than those who haven't gone to college. Along these same lines, college graduates are 47% more likely to have health insurance, and 73% more likely to have an employer who helps pay for those health benefits.

With that in mind, any loan cancellation initiatives would clearly benefit a minority of Americans, who, on average, do better than most.

Finally, what would you say to the high school student today - looking at paying for college next year. Did this young adult just miss the boat on loan forgiveness?

That's not to say there are exceptions - it's an average after all. And not all who have student loans have graduated college as well.

But when crafting large-scale policy initiatives, it's important to keep these figures in mind.

$10,000 In Student Loan Forgiveness

President-Elect Biden has proposed canceling up to $10,000 in federal student loans for borrowers who meet certain criteria.

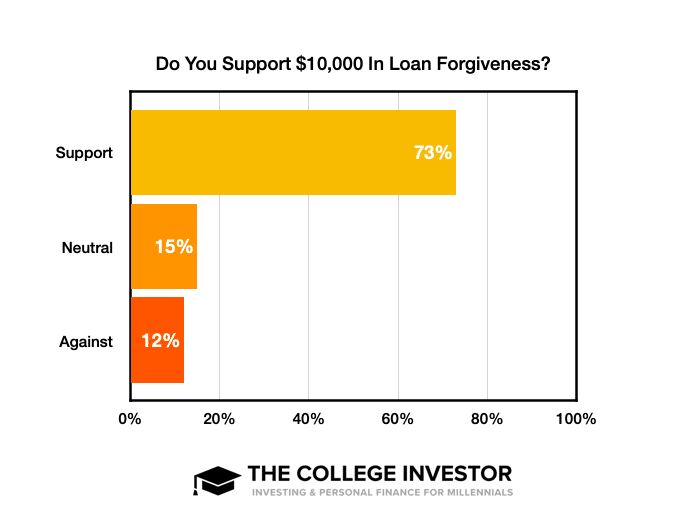

Overall, we found that 73% of Americans surveyed were in support of Biden's plan to forgive $10,000 in student loan debt. Only 12% of respondents were against it.

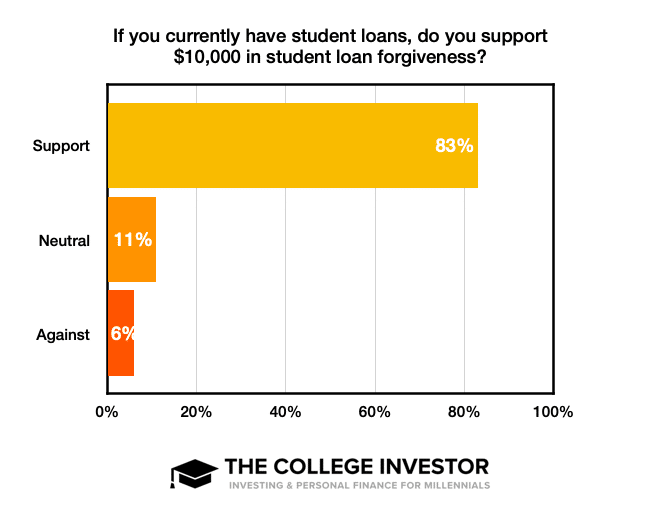

Of course, 83% of those who currently have student loan debt support the plan to forgive $10,000 in student loans.

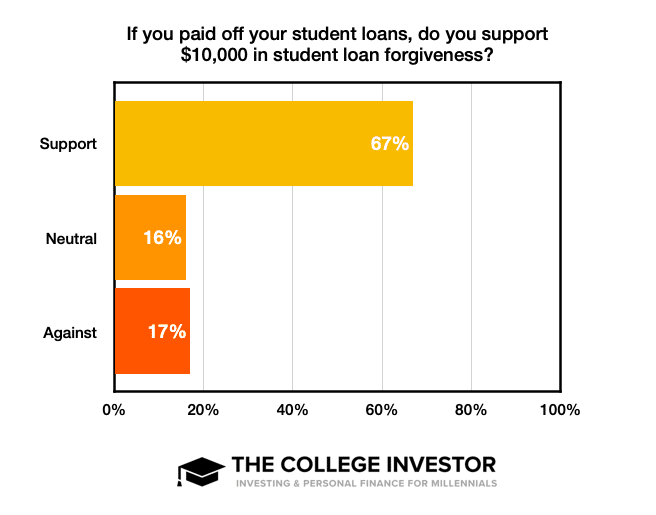

For those that had student loans but have already paid them off, 67% still supported forgiving $10,000 in student loan debt.

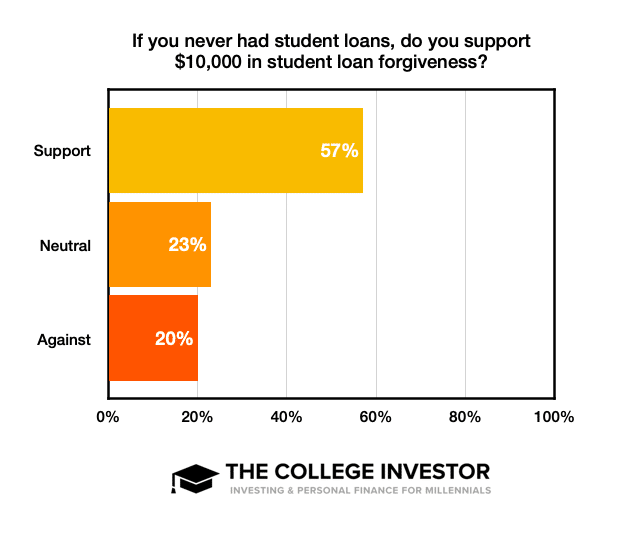

Finally, when asking those who never had student loan debt whether they would support the proposal to cancel $10,000 in student loans, 57% were still in support of it. 20% were against, and 23% were neutral on the idea.

$50,000 In Student Loan Forgiveness

Senate Minority Leader Chuck Schumer and Senator Elizabeth Warren have been pushing a plan to cancel $50,000 in student loan debt.

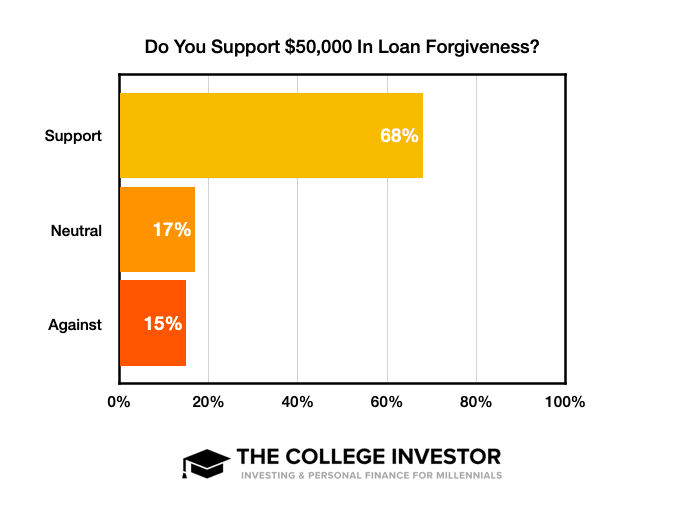

Overall, we found that 68% of Americans surveyed were in support of a plan to forgive $50,000 in student loan debt. Only 15% of respondents were against it.

This plan saw a roughly 5% decrease in favorability across all cohorts.

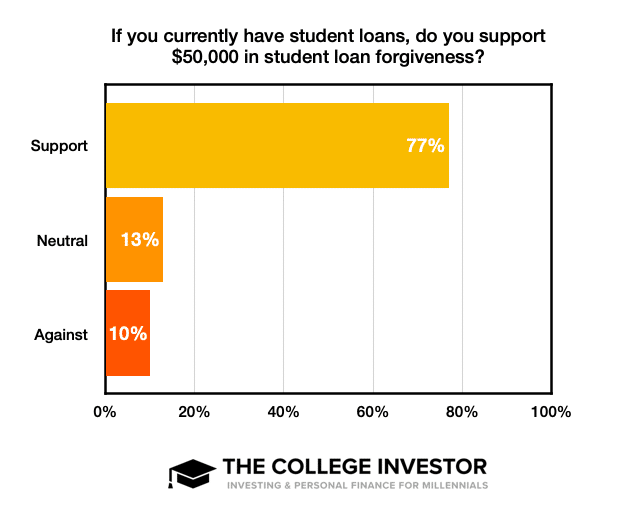

77% of those who currently have student loan debt support the plan to forgive $50,000 in student loans.

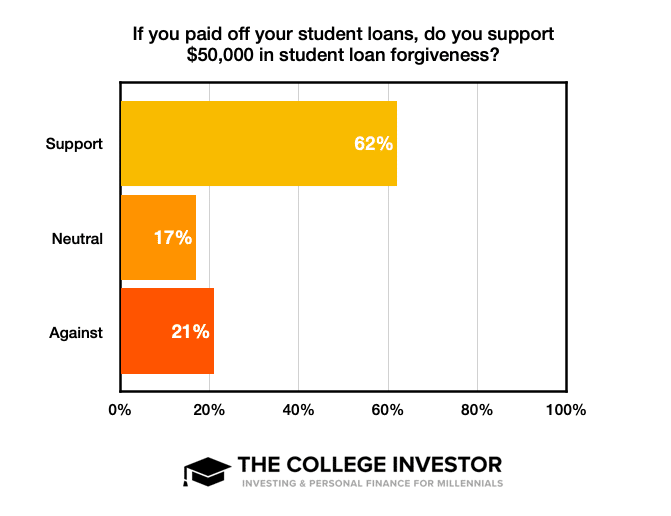

For those that had student loans but have already paid them off, 62% still supported forgiving $50,000 in student loan debt.

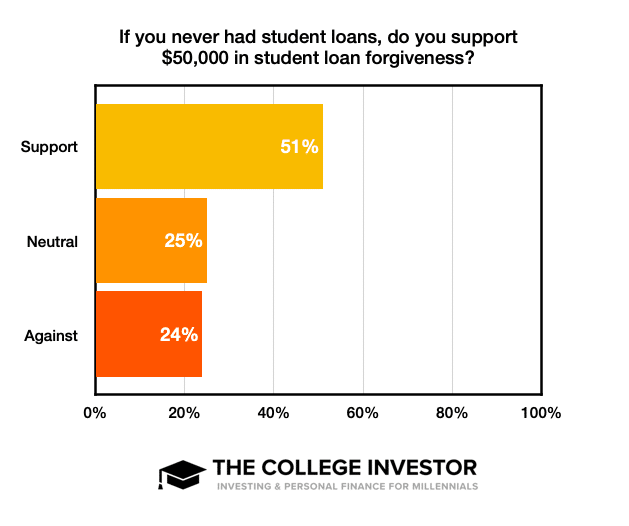

Finally, when asking those who never had student loan debt whether they would support the proposal to cancel $50,000 in student loans, 51% were still in support of it. 24% were against, and 25% were neutral on the idea.

Total Elimination Of Student Loan Debt

While there hasn't been a serious proposal made to eliminate all student loan debt, there has been talk of it.

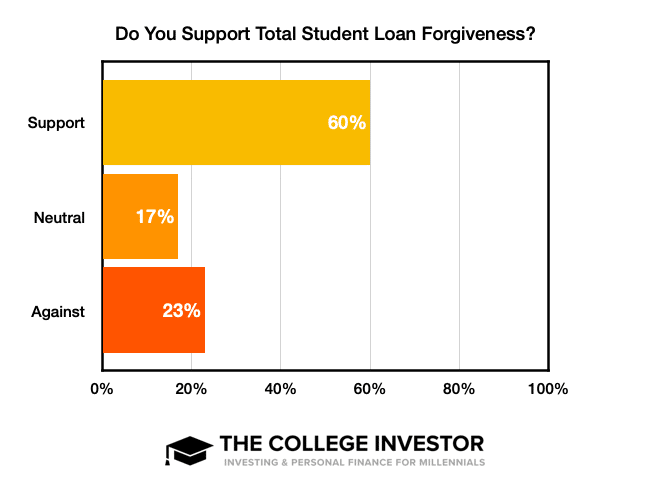

Overall, we found that 60% of Americans surveyed were in support of a plan to forgive all student loan debt. We found that 23% of respondents were against it and 17% were neutral.

What's interesting here is that support is lower, in some cases significantly, and the amount of people against has grown sizably.

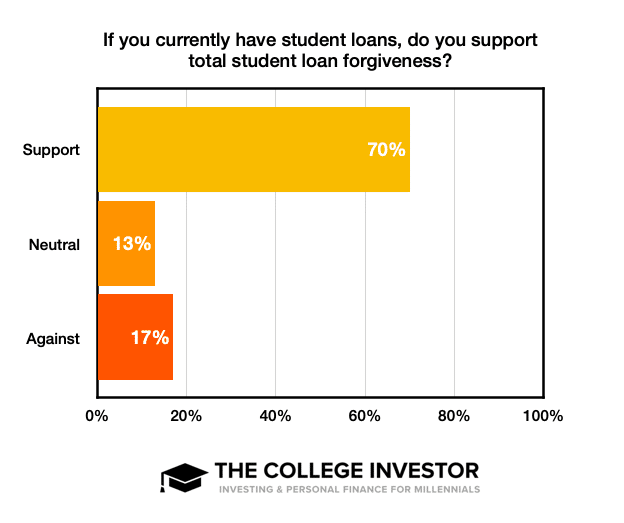

70% of those who currently have student loan debt support the plan to forgive all student loans.

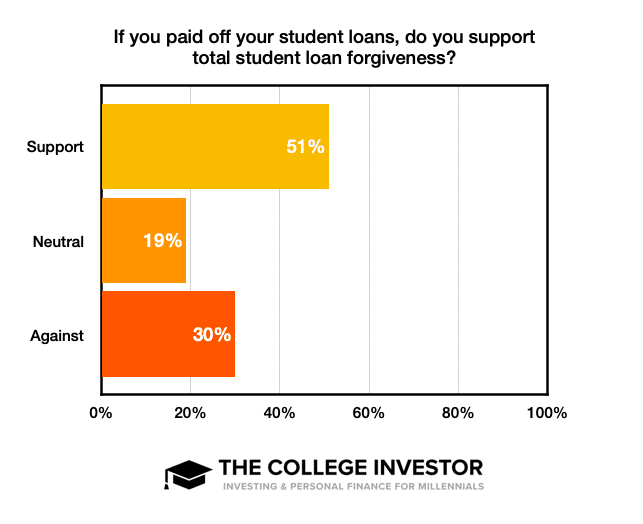

For those that had student loans but have already paid them off, 51% still supported forgiving all student loan debt. However, in the group, 30% were against it.

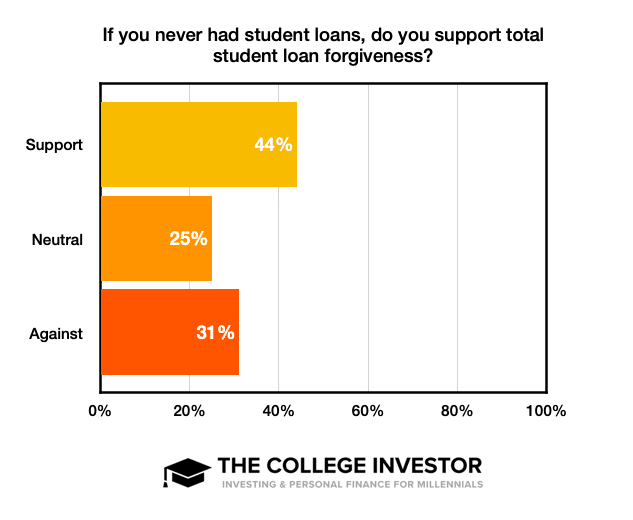

Finally, when asking those who never had student loan debt whether they would support the proposal to cancel all student loan debt, 44% were in support of it. 31% were against, and 25% were neutral on the idea.

Fairness And Limits

One of the big arguments against a blanket loan forgiveness program is that it's rewarding a minority of people, who will likely be in the upper half of earners in the United States. With that said, we wanted to see how Americans felt about some type of mutual benefit to those who may not have student loan debt.

For example, Andrew Yang mentioned a tax credit for those who don't have loans forgiven, so they would still get the same amount of benefit/money in the end.

52% of Americans surveyed were in support of this type of tax credit or break. Only 16% were against it.

Along the same lines of fairness, we were curious about how Americans viewed income limits on these types of programs. For example, Biden has proposed capping those who are eligible for loan forgiveness at only making $125,000 per year.

I think many Americans find these arbitrary numbers hard to swallow, and would like something all or nothing. For example, a doctor who just graduated but is in training (a resident) would likely be earning about $55,000 per year - and could see upwards of $150,000 in student loan debt forgiven. Meanwhile, someone who's been struggling with debt for a decade, but suddenly had a good income year and is finally making progress, would see nothing.

In fact, only 37% of Americans felt there should be a mandatory income limit.

Final Thoughts

It was interesting to see such wide-ranging support for student loan forgiveness, especially from those who've paid off their student loans, or who never had student loans to begin with. It was also clear that there is much more support for a small amount of forgiveness versus larger amounts, or total forgiveness.

My big concern with any blanket loan forgiveness program is that it won't solve the root cause of the problem - it's just a band-aid. In fact, if we only cancel $10,000 in student loans, without any other reforms, it's likely we will be back in this same place in just 3-5 years.

Student loan reform and potential forgiveness needs to be combined with addressing the rising cost of college.

For example, we could broaden a program like Public Service Loan Forgiveness to include every borrower (all loan types, all jobs, all payment plans). Simply make 10 years of payments while working, and the balance is forgiven. But what if the government, instead of just paying that balance, charged that balance back to the college or university where the loan was from?

Now, colleges would be extremely incentivized to both reduce costs and also improve graduate employment - since any debt left over would come out of their pocket.

Regardless, there does seem to be strong support to do something to address the student loan crisis.

Methodology

The College Investor commissioned Pollfish to conduct an online survey of 2,000 Americans. The survey was fielded December 10-11, 2020.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller