With college costs and student debt on the rise, students and their parents need to think about ways to cut the overall cost of higher education.

Even if a student wants to attend a four-year university, starting at a two-year university can conservatively lead to five-figure savings. Students who decide against earning a bachelor’s degree can gain a credential (associate’s degree) while spending less time and money than they would in a traditional public university.

Whether a student’s goal is to start a career as soon as possible or to earn a bachelor’s degree and beyond, using community college to save money and get ahead can be a smart move. In fact, attending a two-year college may be the most broadly-accessible method to reduce costs while still getting a head start on education.

How Much Can Community College Students Save?

Community college students have three financial advantages compared with students who spend all four years attending a university.

Lower Cost Of Tuition

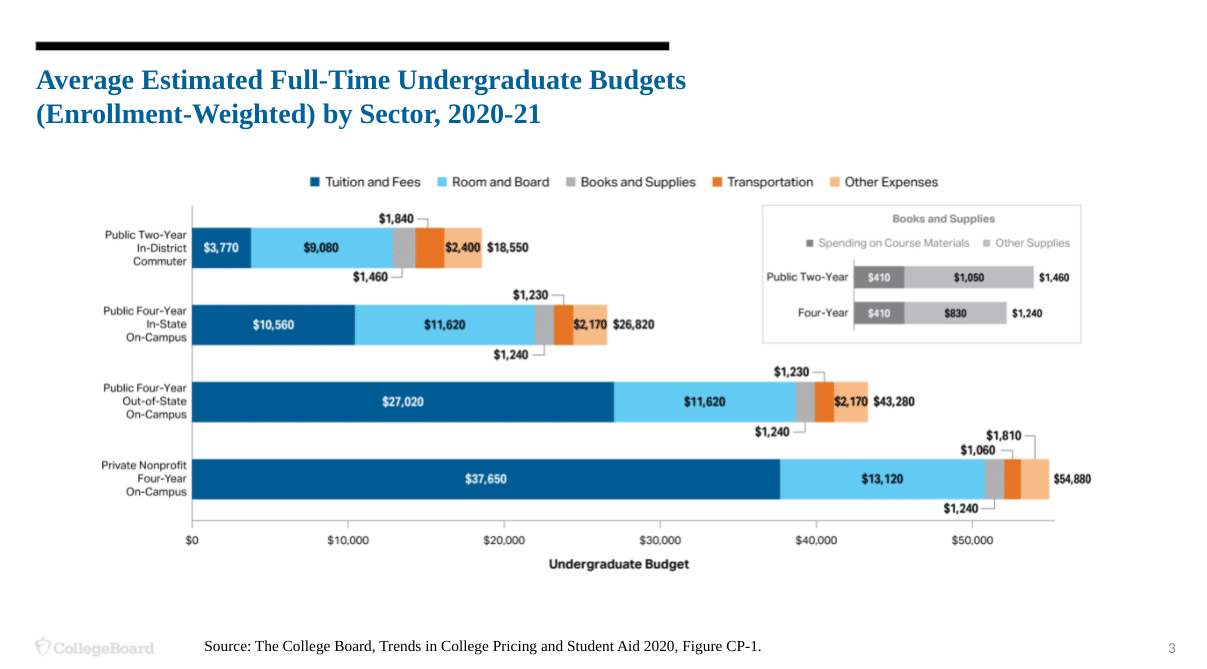

The average cost to attend an in-state community college is $3,770. according to the College Board. That's nearly an $6,800 savings compared to the cost of tuition at a typical public university ($10,560). Multiplied over two years, community college students save more than $13,000 during their first two years.

Lower Cost Of Living

Both community college and university students have variable costs of living, but community college students may have more opportunities for saving. Many community college students will live with their parents or family members during school. On top of that, some of the “luxury expenses” associated with university attendance may be reduced. For example, you may not pay to eat out when you can cook at home. Or you may avoid expensive spring break trips when most of your classmates have to work just like you.

Increased Opportunity To Earn Money

Community colleges work with many non-traditional students, including adult students who work full-time jobs. Attending a school that is used to accommodating work schedules is important if you hope to work one or more jobs during school. According to the Community College Research Center (CCRC), 80% of all two-year college students work during school.

Of course, your circumstances may not allow you to take advantage of all of these potential savings and earnings opportunities. You may have to pay for most of your living expenses, or you may have commitments preventing you from working full-time.

But even the lower cost of tuition will help most students save over $13,000 compared to university students. Plus, students from lower-income families may be able to cover all their school expenses using a Pell Grant or even local scholarships.

Do Community Colleges Offer A Solid Education?

While most students who start at a community college want to transfer to a four-year school following graduation, only about a third of community college students successfully transfer within six years of starting according to the National Student Clearinghouse Research Center. While that's a small percentage, it doesn't indicate that community college is an inferior education.

Four-year universities may boast about world-class facilities and faculty. But freshman and sophomores at these schools are still focused on the basics. Most community colleges have high-quality faculty who can prepare students for higher-level courses. In many cases, students at a two-year college will have more one-on-one attention with a qualified professor compared with university students attending “stadium” style classes.

Community college isn’t just about “knocking out a few classes." Your education should be high quality and you can expect to find many excellent opportunities. In fact, half of all people who ultimately earn a bachelor’s degree attended a two-year school at some point in the previous decade.

On top of the low-cost “bachelor’s prep” education, many two-year schools offer career-focused education. Some community college students may discover that they want to work in the trades while they are in school. In those cases, an associate’s degree is enough to launch them into a career.

Which States Offer Free Community College?

Community college is already very affordable compared to the cost of a four-year school. But many states are making community college even more accessible.

Right now, 20 states have programs that offset tuition costs. In many cases, these grants ensure that low-income students can receive free tuition at a two-year college (when combined with other forms of financial aid).

Most of these programs (listed below) use the family income to determine eligibility. However, some have additional requirements such as the location of the school you’ll attend.

Community College As A High Schooler

High schoolers have traditionally been encouraged to take AP classes to get ahead while in high school. However, dual enrollment in a local two-year college may be better for helping students gain high school and college credits simultaneously.

Many states offer free “Post-Secondary Enrollment Options” (PSEO) or other dual enrollment options that allow high-school upperclassmen to attend high school and college simultaneously. As of the 2017-2018 school year, 82% of public high schools had some students participating in dual enrollment programs according to CCRC.

If you’re able to handle the academic rigors of a community college, this can be the ultimate way to save money.

Transferring From A Community College

Two-year college students who want to earn a bachelor’s degree need to plan ahead. Every school has different transfer eligibility criteria. Students need to work with their current school and their future school to maximize the likelihood that they receive course credit when they transfer. This can keep them from repeating coursework and extending their time in university.

Flagship Universities

Most state universities have explicit transfer agreements with the two-year colleges in their state. This makes it relatively easy for students to transfer to the “flagship” university in their state if they are accepted into the school. For example, in the University of California school system, 92% of transfers are from California community colleges.

If you hope to transfer to a flagship school be sure to look up the minimum transfer requirements during your first year in community college. You don’t want to be caught without the minimum requirements.

Additionally, most students should consider honors coursework and taking up leadership roles on campus to boost their prospects of admittance. Elite flagship schools generally have difficult admittance criteria. Even potential transfer students need to consider the strength of their application during their years at a community college.

Elite Private Schools

Elite private schools generally accept far fewer transfer students than public flagship schools. Princeton, Harvard, and Stanford, for example, accept less than 1% of all transfer students.

As a community college student, you'll be at a disadvantage if you’re hoping to attend one of these schools. However, you shouldn't completely rule them out if you’re an excellent student who has an otherwise strong application. Depending on the school’s rules, you may only qualify to gain admission as a freshman, but your credits may qualify towards matriculation.

If your heart is set on one of these elite schools, ask specific questions to an admissions counselor. Those counselors, along with financial aid specialists can help you understand whether the school is a realistic (and affordable) option.

State Colleges And Universities

Just like flagship universities, most public colleges and universities have robust transfer programs. Three-quarters of all community college students who transfer to a four-year school transfer to a public state university.

As a transfer student, you should be able to avoid retaking classes as long as you plan ahead. Many two-year colleges have “college prep” degrees, so take advantage of those during your year or two at community colleges. Make sure to speak with your educational counselor to get their take as well.

Schools Specializing In Transfer Students

Many public four-years schools specialize in returning adult students and community college transfers. For example, Western Governors University has a generous transfer policy, so most students don’t have to retake classes following the transfer.

Students who are working full time should strongly consider public universities that are specifically geared towards transfer students.

Final Thoughts

College costs are on the rise. But community college allows many families to combat these high costs without taking on debt or sacrificing educational quality. Students who go on to earn a bachelor’s degree won’t have a “watered down” degree by attending community college first.

Those who decide to exit school with an associate’s degree will both save money and have a credential to show for it. Unless you and your student have a specific plan to avoid student loan debt, a local community college should make your “priority” school list. The significant savings make it worthwhile for almost all students.

Related: Here's Why You Should Treat College As An Investment

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller