This is one of the toughest questions I get asked: I can't afford my private student loans and I don't see any options to get out of it - what do I do?

It's estimated that over 1.4 million borrowers have private student loan debt, with an outstanding balance of over $130 billion in loans. And the tough part is many of these borrowers took out the private loans without fully understanding what they were getting into.

The fact is, private student loans function much more closely to a car loan or mortgage. They typically have a set repayment plan, and failure to repay that amount send it into delinquency and default. And since the collateral for student loans is your earnings, the lender could take you to court and get a judgement against you.

Not pretty.

So, what can you do if you can't afford your private student loans? Here are your options.

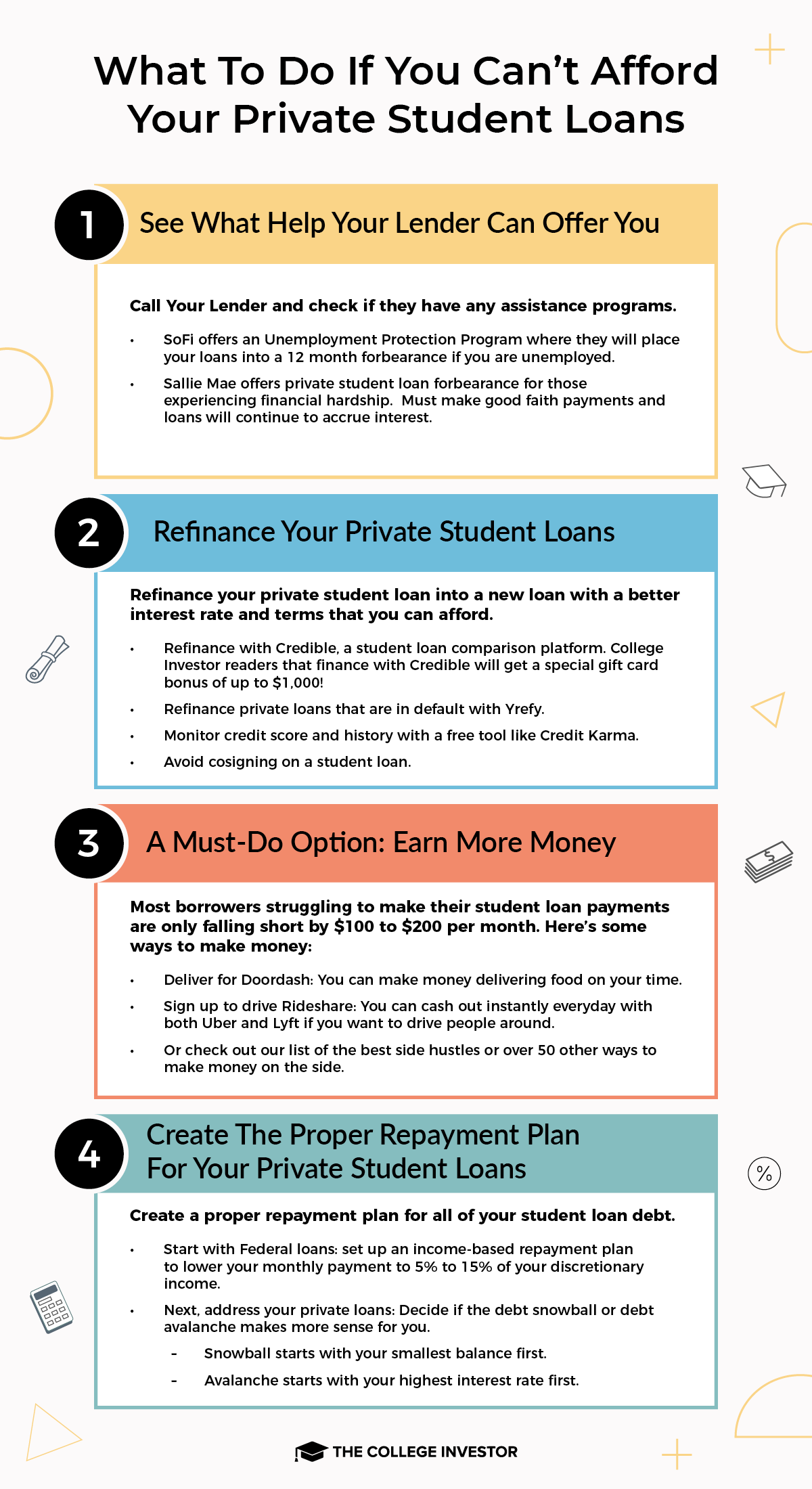

The Best Option: See What Help Your Lender Can Offer You

If you can't afford your loans, the first thing you need to do is call your lender and see if they can help you. Some private lenders (not many, but some), do offer assistance programs that can potentially help you stay current with your loans.

For example, SoFi has a Unemployment Protection Program where they will place your loans into a 12 month forbearance if you are unemployed. You have to show proof of your unemployment (by showing your eligibility for unemployment benefits) and you also need to work with their Career Strategy department to help you get a job.

Another example is Sallie Mae. They offer private student loan forbearance if you are experiencing a financial hardship. However, in order to qualify, borrowers must make a good faith payment of $50 for each loan (up to $150 per account) to put the loan into forbearance. And borrowers need to remember that interest will continue to accrue on the loan.

Remember, this are not designed to be complete solutions to affording your private student loans, but they can offer you some relief until you can figure out a way to afford your private student loans.

The Second Best Option: Refinance Your Private Student Loans

The next best option is to refinance your private student loan into a new loan - hopefully with a better interest rate and terms that you can afford.

To refinance, we recommend that borrowers try Credible. Credible is a student loan comparison platform that allows you to easily see in just 2 minutes what you would qualify for. If you think one of the options makes sense for you, it only takes about 5 more minutes to apply - super easy. Plus, College Investor readers will get a special gift card bonus of up to $1,000 when they refinance!

Checking your rates and seeing what you might qualify for doesn't impact your credit score, so give it a try: Credible Refinancing. It honestly takes about two minutes.

If you're not having luck with Credible, you can check out Yrefy. Yrefy is a specialized lender that focuses on refinancing private student loans in default. Check out Yrefy here.

There are two main challenges that most people will encounter when it comes to refinancing your private student loans:

- Not having a good enough credit score or history

- Needing to have a cosigner to qualify

Unlike Federal student loans, private student loans rely on a borrowers' credit score (among other factors) to make a decision. Given that most borrowers who can't afford their private student loans typically struggle to make payments on time, or may have other credit factors negatively impact them, having a poor credit score could be a challenge.

We recommend that anyone with student loans should be monitoring their credit score and history with a free tool like Credit Karma. If you have less than perfect credit, Credit Karma will also give you suggestions to improve your credit, which in turn will help you qualify to refinance your student loans.

The other big challenge is that many lenders require a cosigner to qualify - even if you've improved your credit or have great credit. In many cases this is due to borrowers being young and not having a robust credit history. The challenge with getting a cosigner is that there is huge risk for the cosigner, and many people (including myself) recommend people to never cosign a student loan.

A Must-Do Option: Earn More Money

No matter what your student loan situation is, every borrower should focus on earning more money. But this is especially true if you can't afford your private student loans.

The simple fact is, there are 168 hours in each week. You might work 40-50 hours at your day job. You sleep 7 hours per night, so a total of 49 hours per week. For simplicity, let's call that 100 hours. What are you doing with the remaining 68 hours each week?

For too many people, they are spending money they don't have. Whether they are at home watching TV (and paying for cable and Netflix), or out to dinner with friends or family (spending on food an alcohol), they are wasting money.

But I'm not here to tell you to budget more to afford your loans - you probably already know that. I'm here to tell you that you can also earn more money. Most borrowers I see struggling to make their student loan payments are only falling short by $100 to $200 per month.

In the big picture, $100 or $200 per month is really not a lot of money. $200 per month is $2,400 per year. Anyone who really tries could earn that extra money.

Here two some examples to earn $200 per month right now:

- Deliver for Doordash: You can make money delivering food on your time.

- Sign up to drive Rideshare: You can cash out instantly everyday with both Uber and Lyft if you want to drive people around.

Here's a list of the best side hustles.

The fact is, many people will complain about not being able to afford their private student loans, but few will actually take action to change their situation. If you're ready to change and earn more, here is another list of over 50 ways to make money on the side.

Create The Proper Repayment Plan For Your Private Student Loans

If you have private student loans, the key to making them affordable is to create the proper repayment plan for all of your student loan debt. This isn't always easy, and each person will have a different preference, but here's how to think about it.

First, handle your Federal loans. These loans typically have more repayment options, and you might benefit from setting up an income-based repayment plan. These plans will lower your monthly payment to 5% to 15% of your discretionary income. That can be a huge help in being able to afford your student loans.

Once you're set on your Federal loans, move to your private loans. For your private loans, you need to decide if the debt snowball or debt avalanche makes more sense for you. Remember, the snowball is about starting with your smallest balance first. The avalanche is about starting with your highest interest rate first.

Mathematically, the highest interest rate first is usually better. But mentally, getting rid of some small private student loans first can be a huge early win.

The Worst Option: Default And Attempt To Settle Your Debt

The worst option for your private student loans is default. Defaulting on any type of student loans can wreck your credit, prevent you from getting future student loans, and could even cost your job.

The sad part is I see too many borrowers get caught up in the student loan scam that is private student loan debt settlement. This is a scam where a company (or even sometimes a law firm) will encourage borrowers to stop making payments on their student loans, and instead make payments to the student aid company or law firm. Over time, the borrower's student loan goes into default, trashing their credit score. Meanwhile, the aid company is taking in their payments happily.

However, the whole scam falls apart in the end - the lender doesn't have to agree to any settlement, and will likely tack on fees for the defaulted loan. The borrower is out all of the money they paid the aid company, and they will still owe the student loan. It's lose-lose all around.

Finally, it's important to remember that your lender can sue you if you default. And private student loan default can lead to costly litigation - you're going to have to pay a lawyer to defend you, and then you'll still owe on the judgement in the end.

The only guarantee with student loan default is wrecked credit and harassment from debt collectors. That's why, as a general rule, we believe you should avoid default if at all possible.

Final Thoughts

While there are no amazing repayment options or forgiveness programs for private student loans, there are simple actions you can take if you can't afford them.

These options aren't glamorous, and most require work, but you can work to make your private student loans more affordable.

And remember, it's universally a good idea to focus on earning more money to get out of student loan debt.

Are you struggling to afford your private student loans?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller