Student loan borrowers are officially set to resume payments on Federal student loans in October 2023. By the time repayment restarts in October 2023, the payment pause and interest waiver will have lasted a total of 42 months (counting March 2020 as a full month).

During this time, the original payment pause and interest waiver was extended a total of 8 times in order to allow student loan borrowers to be more financially ready to resume payments after the effects of the Covid-19 pandemic rippled through the economy.

But the real question is: are student loan borrowers really financially able to resume payments? And has this changed since our survey last year before the payment pause was extended? Here's what we found out.

Key Findings

We asked 1,200 student loan borrowers about how their income and expenses have changed since March 2020 (the start of the Covid-19 pandemic in the United States) and how ready these borrowers are to resume making student loan payments when they unpause in 2023.

Here's what we found:

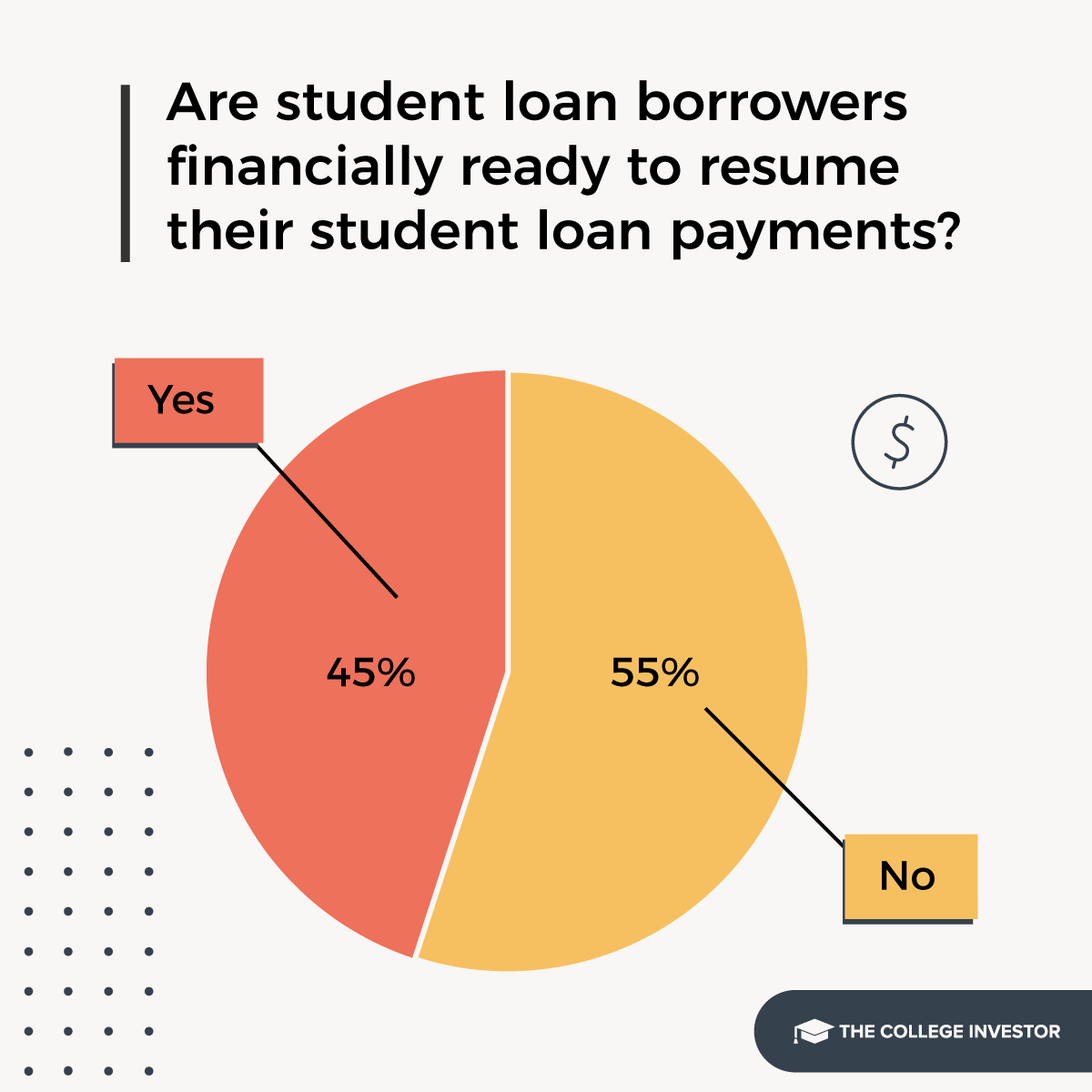

- 55% of student loan borrowers don't feel ready to resume payments in 2023. This is a significant increase from 2022 when only 29% of borrowers didn't feel financially ready.

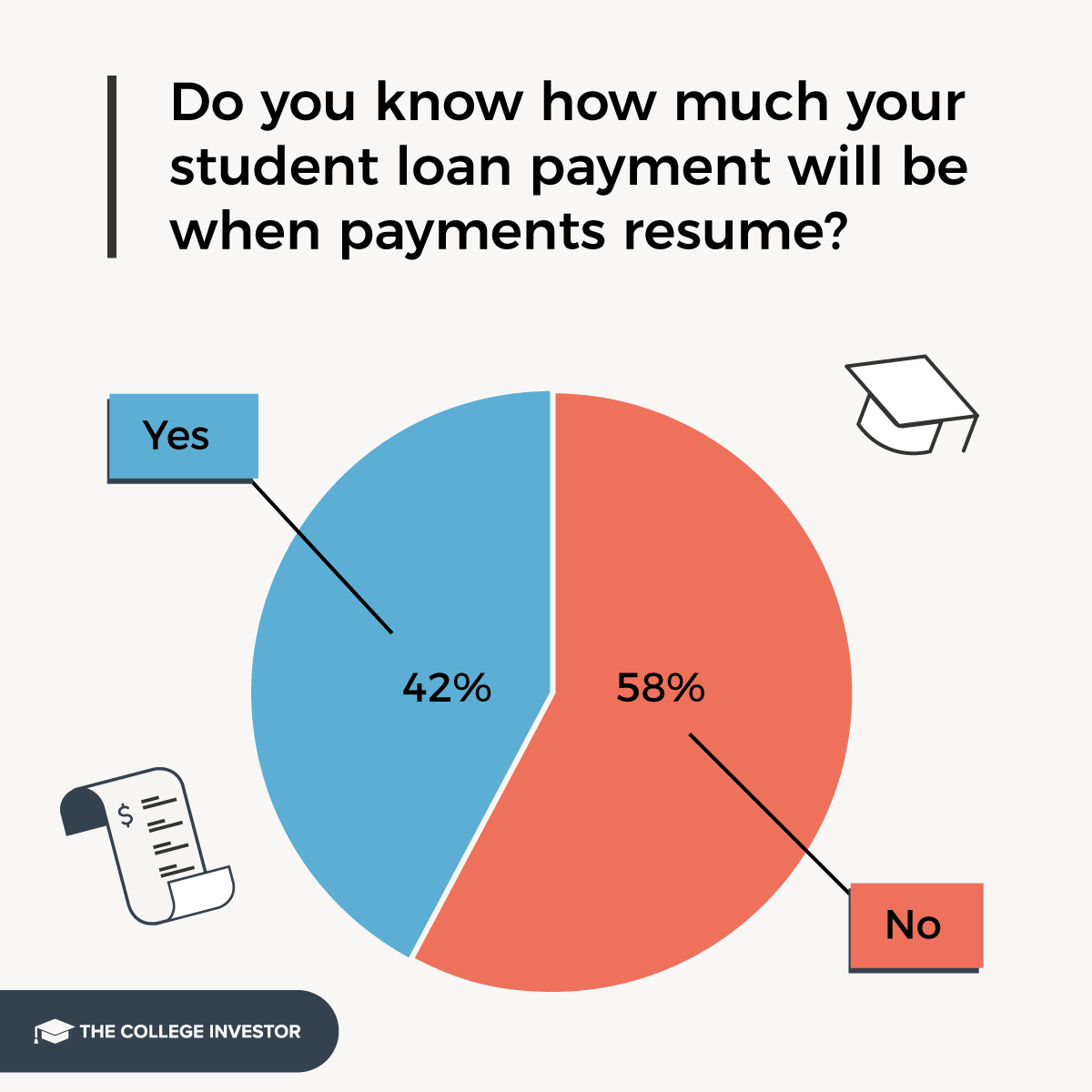

- Only 42% of borrowers know exactly what their monthly payment is going to be when repayment restarts. This highlights a big lack of communication between borrowers and the Department of Education and the various student loan servicers. It also is adding to student loan borrower anxiety.

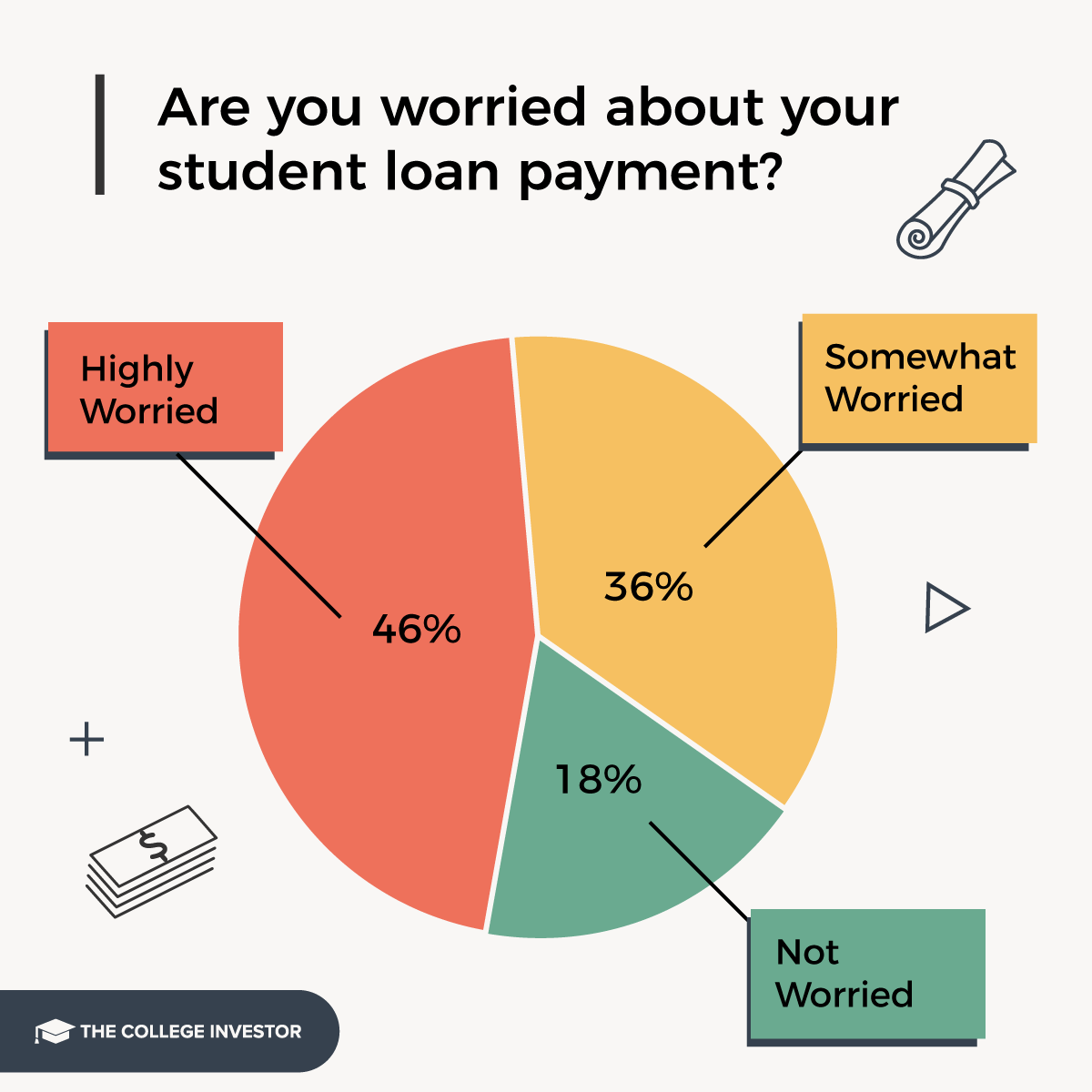

- As a result, 82% of student loan borrowers are worried about their loan payments.

So what's changed for borrowers since March 2020?

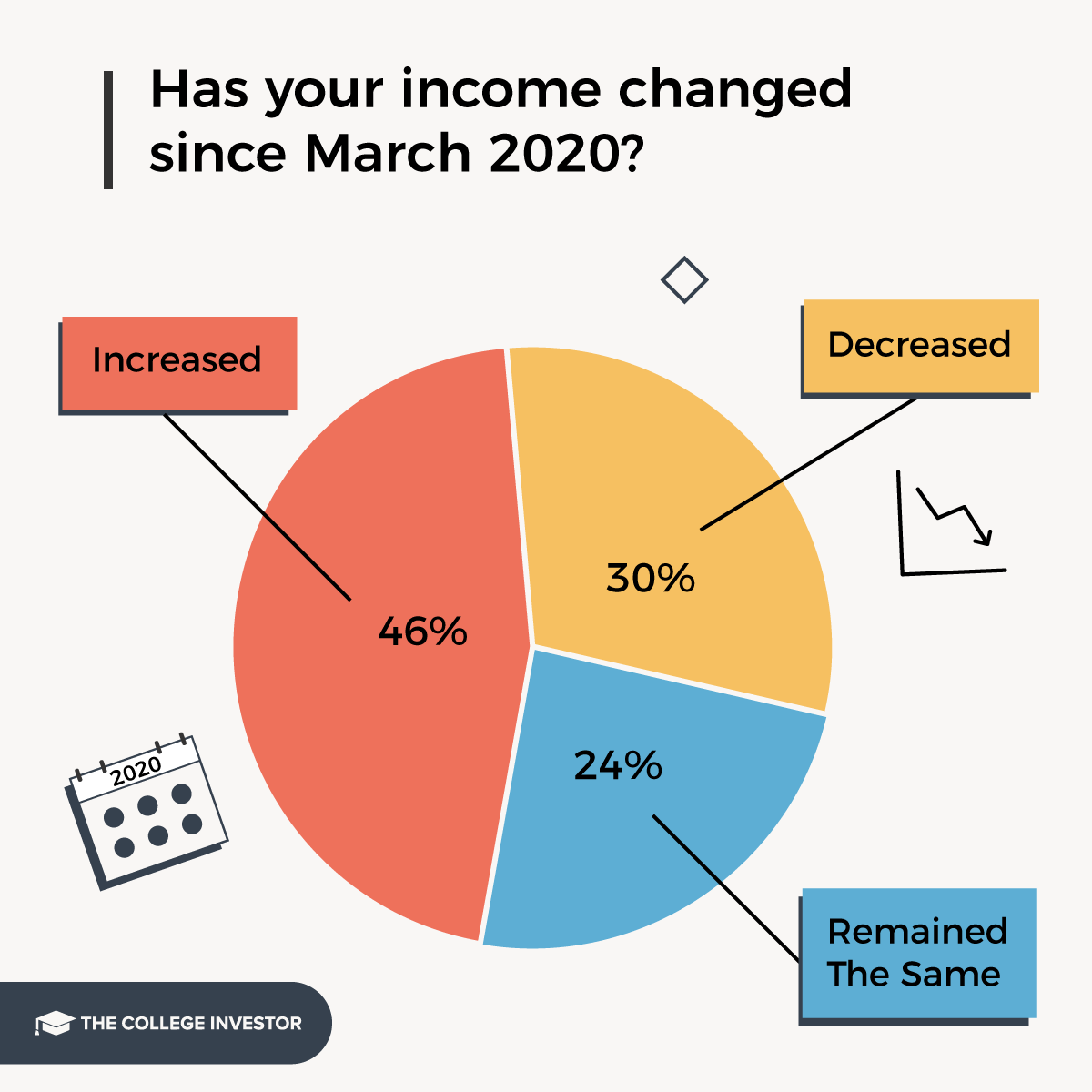

- 46% of student loan borrowers reported their income increased, but the remainder either had their income decline or stay the same.

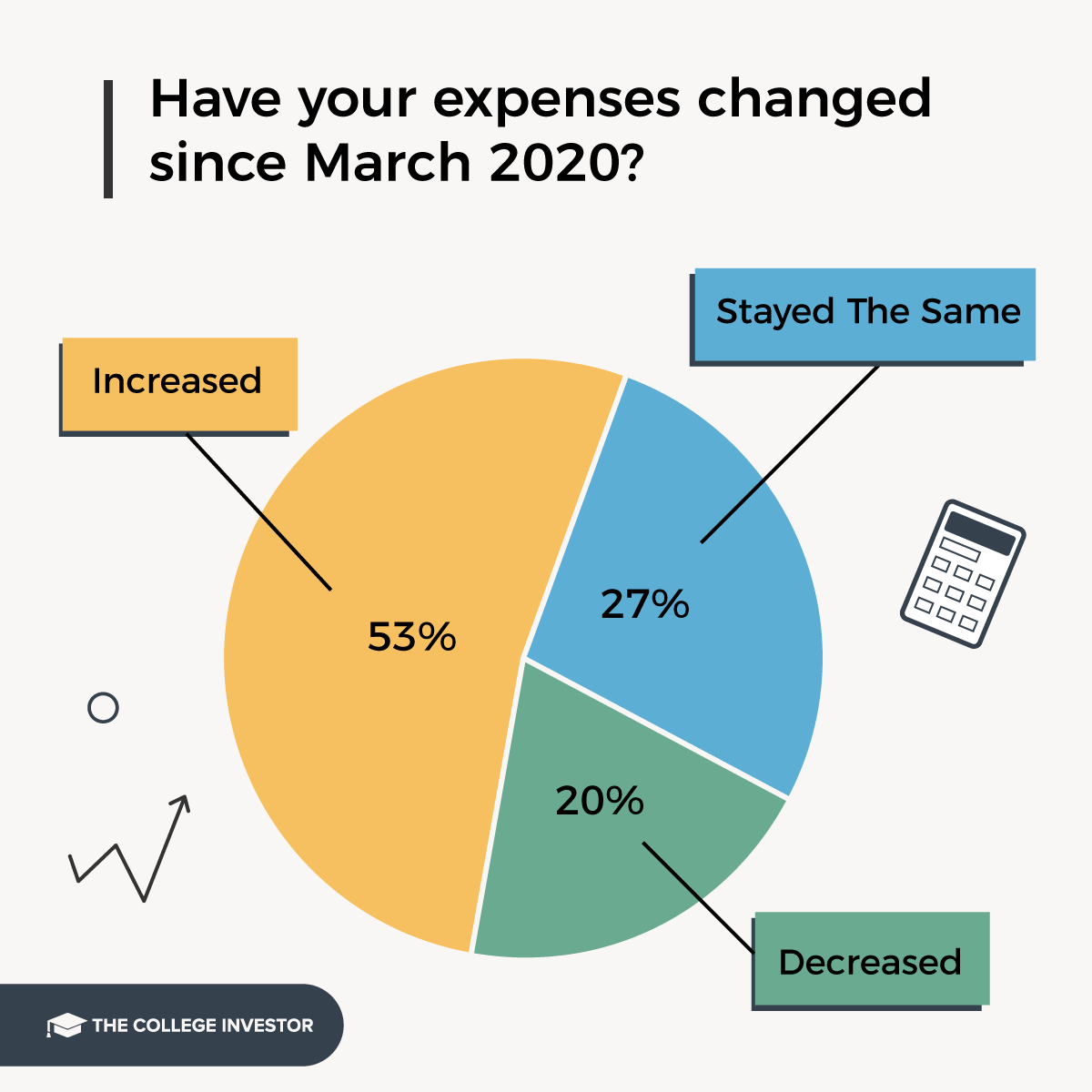

- At the same time, 53% of student loan borrowers have reported their monthly expenses increasing since March 2020.

- As a result, 57% of student loan borrowers report using their savings from not making student loan payments to simply cover essentials like food and housing costs.

Are Borrowers Able To Resume Student Loan Payments?

Student loan payments are set to resume in October 2023. Interest on Federal student loans will be to accrue in September 2023. Given it's been over 3 years since borrowers had to make a student loan payment (and roughly 20% of all student loan borrowers have never had to make a loan payment due to graduating during the pandemic payment pause), we wanted to know how borrowers felt about resuming their loan payments.

While nobody wants to restart their loan payments, we found that 55% of student loan borrowers don't feel ready financially to resume their student loan payments.

Borrower Knowledge About Their Student Loans

Beyond the individual financial issues facing borrowers, we wanted to know how well borrowers even knew what was happening with their student loans. We've been hearing and reading about a lot of issues borrowers are facing in terms of tracking down their loans, finding their student loan payment, or even knowing what programs they qualify for.

So when it comes to restarting student loan payments this fall, we wanted to see what borrowers knew about their loans (it was a bit shocking).

First, only 42% of student loan borrowers even know what their payment is going to be when student loans restart. That means 58% of borrowers don't even know what their loan payment will be!

As a result, 82% of student loan borrowers are worried about their loan payments.

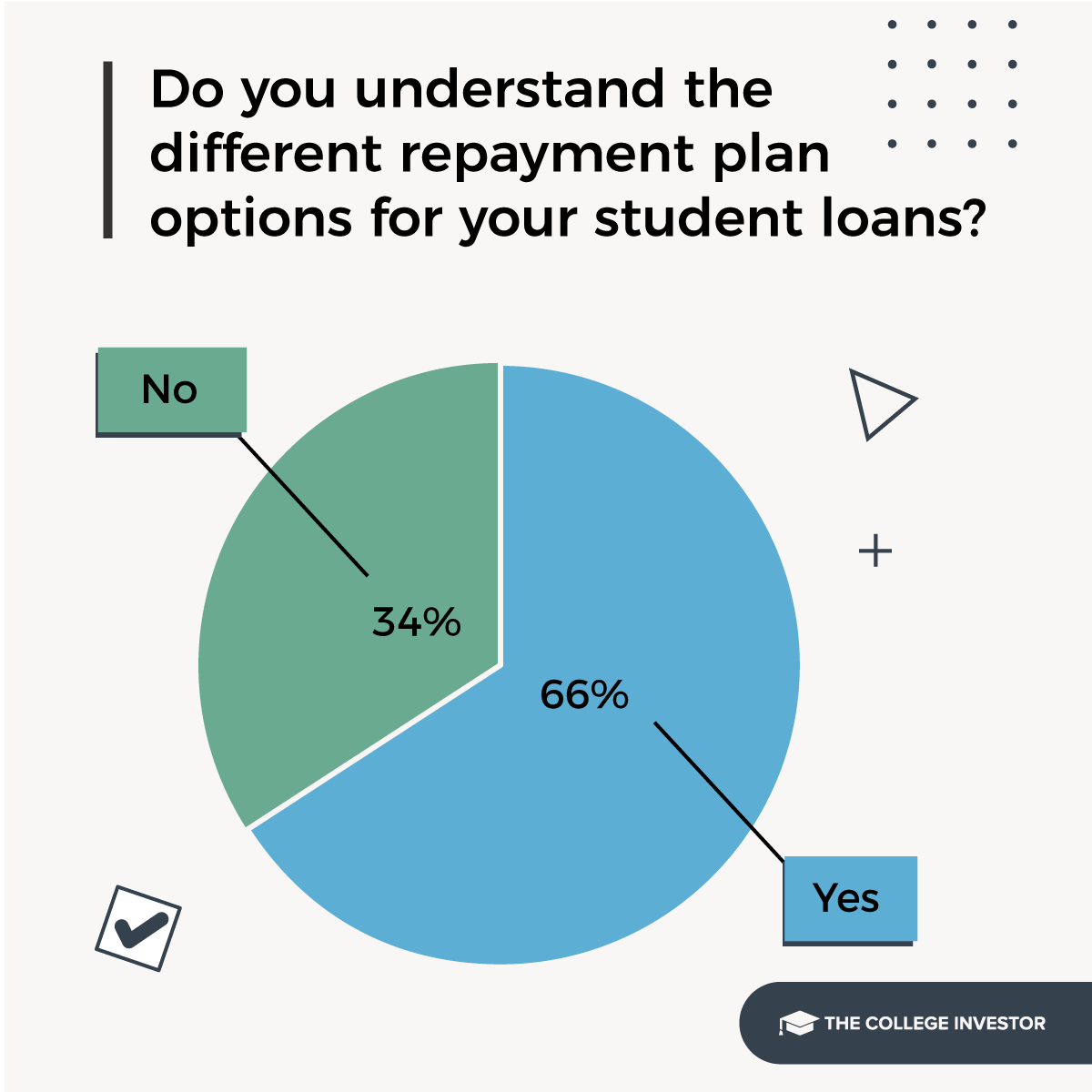

Given that the best way to manage student loan repayment is to select a student loan repayment plan you can afford, we wanted to assess borrower knowledge of different repayment plans. We found that one-third of borrowers didn't know there were different repayment plan options for their student loans.

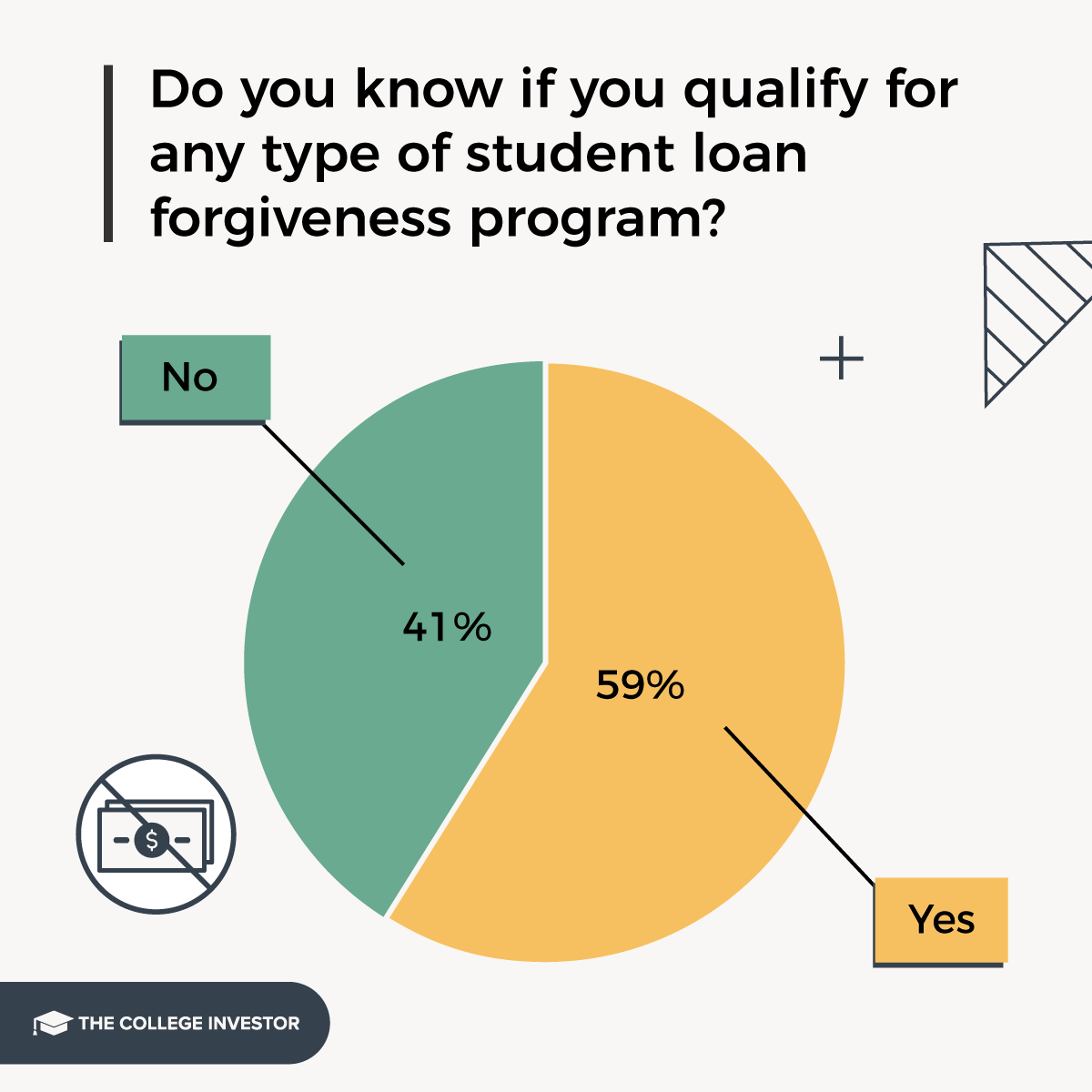

Along those same lines, we wanted to know if borrowers understood whether they may qualify for student loan forgiveness programs to see if they can eliminate their student loans. Shockingly, only 59% of student loan borrowers knew if they qualified for any type of student loan forgiveness program.

How Have Borrowers' Finances Changed During The Pandemic?

Repaying your student loans relies on you being able to afford your student loan payment. One of the biggest reasons for the payment pause and interest waiver was due to the harm caused by the Covid-19 pandemic to an individual's income. And the extensions were justified by the lasting damage done to people's income (and lately, expenses due to rising inflation).

Let's start with income. 46% of student loan borrowers reported that their income has increased since March 2020. At the same time, 30% of borrowers reported their income decreasing, while the rest remained the same.

When it comes to expenses, 53% of borrowers reported that their monthly expenses have increased since the start of the pandemic.

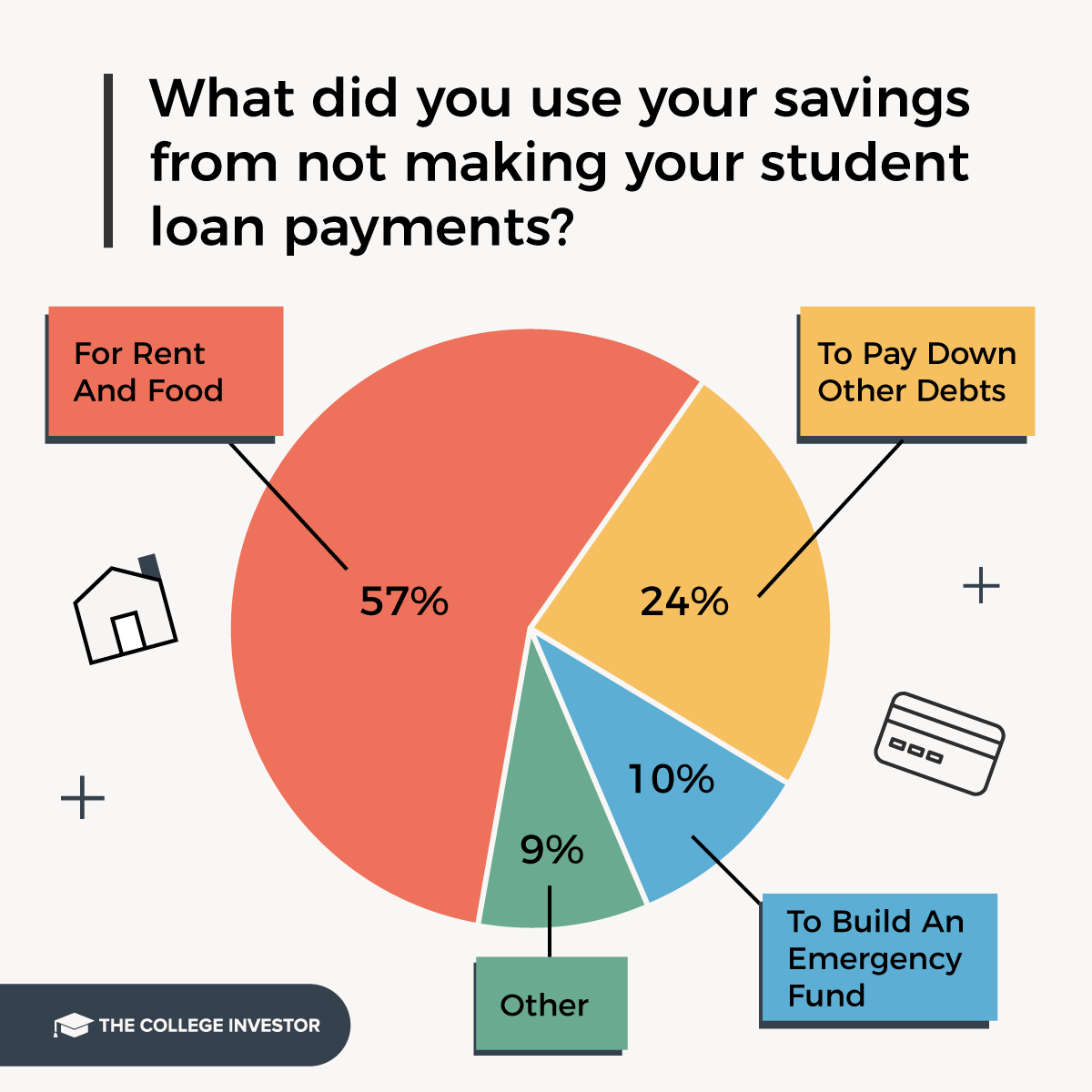

Given that there were significant savings due to the student loan payment pause, we were curious how borrowers were spending that money in general. We found that 57% of borrowers were using the savings to cover necessary living expenses like rent and food. The next category was 24% of borrowers using the savings to pay down other debts, like credit cards. The third most common response was 10% using the money to fund their emergency funds.

Finally, we asked a more subjective question as to why borrowers don't feel financially ready to resume their student loan payments. It's more subjective because borrowers may not "want" to do something but are actually able to do it.

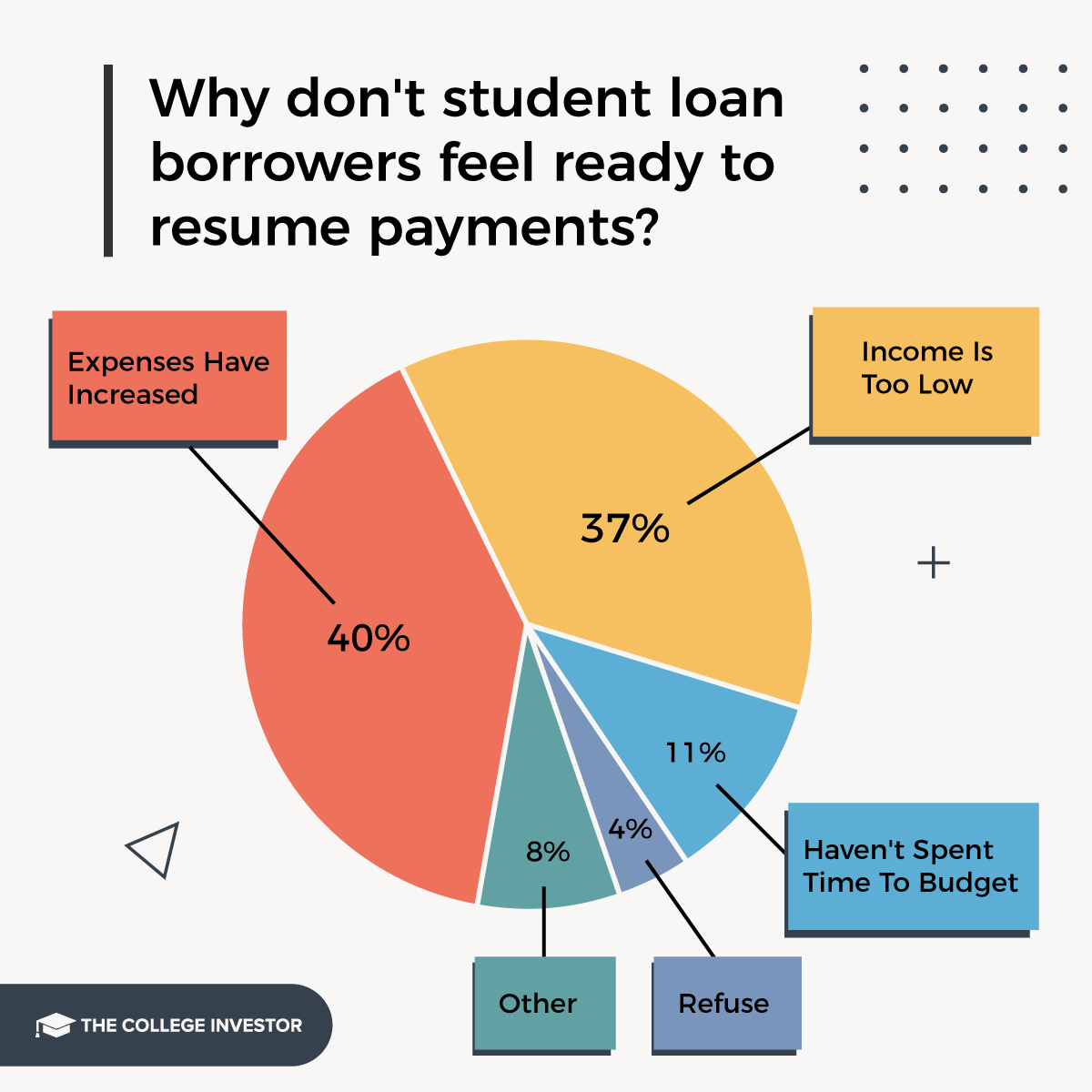

When it comes to why borrowers don't feel financially ready to resume payments, 40% said their expenses have increased, and adding back in student loan payments is unaffordable. Another 37% said that even on the lowest monthly payment repayment plan, their income is too low.

Another 11% said they simply haven't spent the time to figure out whether they're financially able to resume their payment. And 4% said they just don't want to resume payments - there's no true financial reason as to why.

Final Thoughts

It was interesting to see a significant decrease in the percentage of Americans with student loans who feel ready to resume payments in 2023. When we surveyed 1,200 borrowers in 2022, 71% felt financially ready to resume payments. That number has decreased to only 45% feeling financially ready.

It's also concerning how few borrowers understand what their loan payments will be - with only 42% feeling confident in knowing exactly what their payment will be. Furthermore, one-third didn't know they had alternative student loan repayment plan options, and 41% didn't know about loan forgiveness options. All of these signs point to a failure in communication from the Department of Education and its loan servicers.

Of course, borrowers won't feel financially ready when they don't know what to expect and what their options are. It's likely a big driver as to why 82% of student loan borrowers are worried about their loan payments.

Methodology

The College Investor commissioned Pollfish to conduct an online survey of 1,200 Americans who had student loan debt as of the date of the survey. The survey was fielded June 16, 2023.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Colin Graves Reviewed by: Chris Muller