Student loan borrowers are set to resume their monthly student loan payments in September 2022, after over two full years of payments and interest being paused.

In March 2020, President Trump paused all Federally-held student loan payments, and set the interest rate to 0%, to help borrowers navigate Covid-19. This pause is set to expire in mid-2023.

During this time, both President Trump and President Biden have improved student loan forgiveness for certain subsets of borrowers, but Biden's blanket promise of some loan forgiveness does not appear to be on the horizon (although our past survey has shown it as being popular).

With this looming event approaching for millions of Americans, we wanted to see how student loan borrowers were doing financially - and if they were ready to resume making student loan payments.

Editor's Note: The dates of the student loan pause in the introduction were changed to reflect the latest extension of the student loan moratorium until mid-2023. However, given the survey asked specifics about resuming payments in February, those dates were not changed.

Key Findings

We looked at how student loan borrowers' income and expenses have changed since March 2020 (the start of the Covid-19 pandemic in the United States), and how ready these borrowers are to resume making student loan payments in 2023.

Here's what we found:

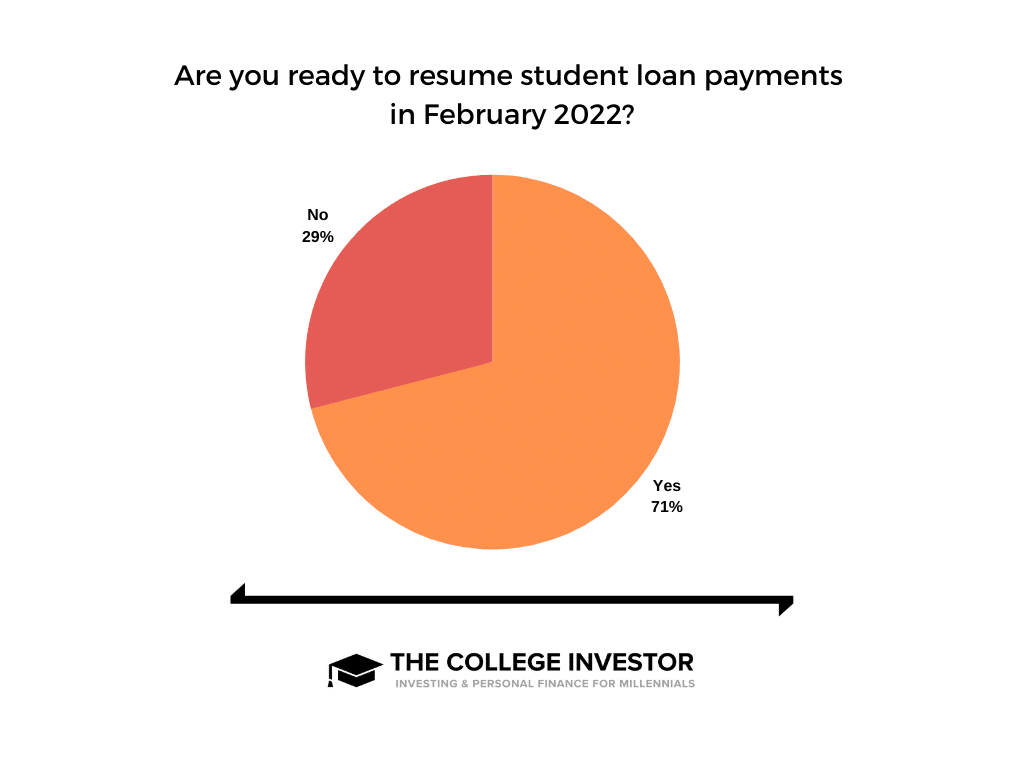

- 71% of borrowers surveyed feel financially ready to resume making their student loan payments in February 2022. Only 29% said they did not feel financially ready to start making payments on their student loans

The Department of Education has been receiving criticism about the lack of communication around student loan payments resuming - and the borrowers we surveyed are feeling that:

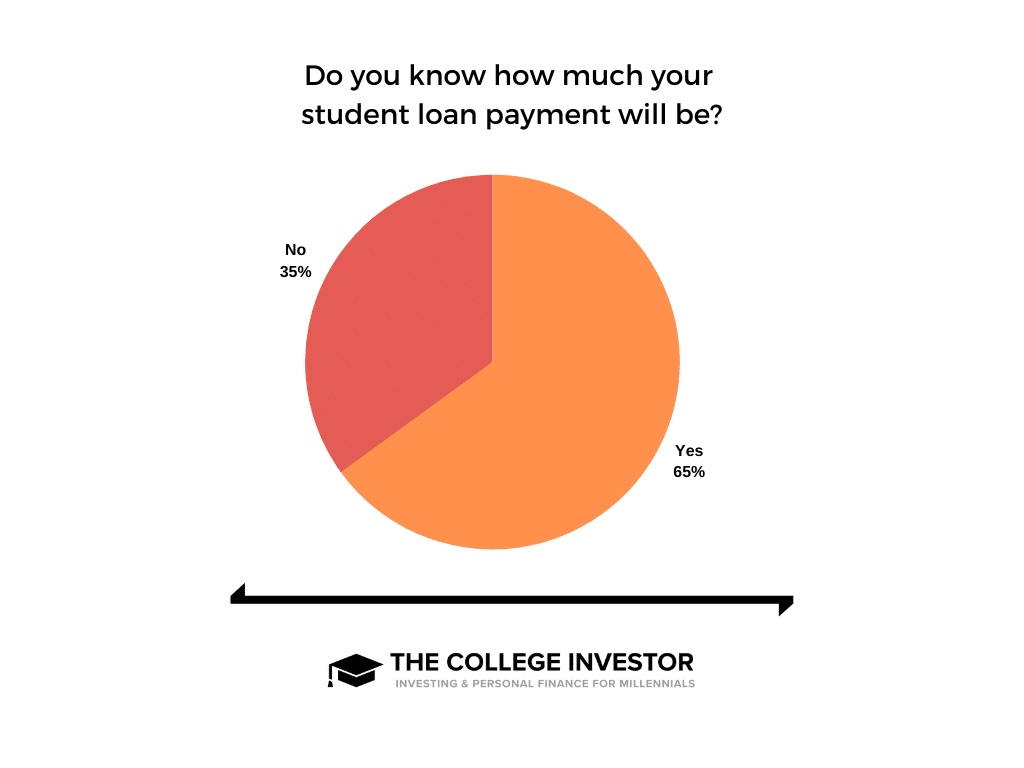

- Only 65% of borrowers know what their student loan payment is going to be when it resumes.

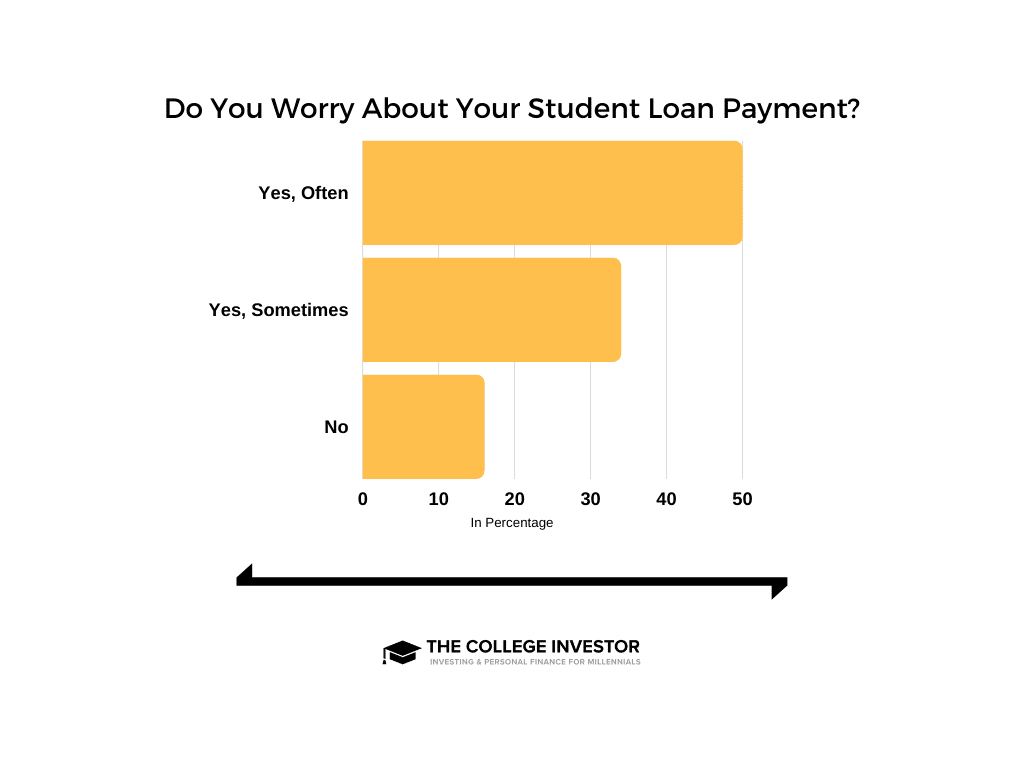

- 84% of student loan borrowers worry about their student loan payment, with 50% worrying about their loans "often".

We also wanted to see how student loan borrowers' income and expenses have changed during Covid-19. We found:

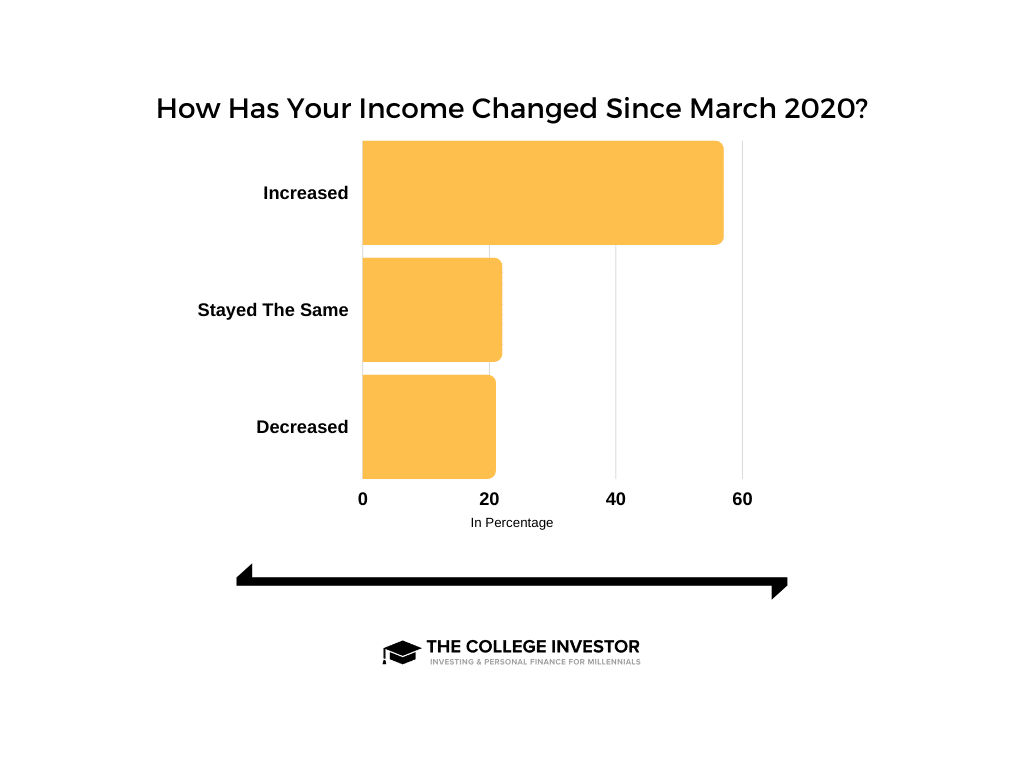

- 57% of borrowers surveyed said their income has increased since March 2020. 22% reported their income staying the same. Only 21% reported their income decreasing during this period of time.

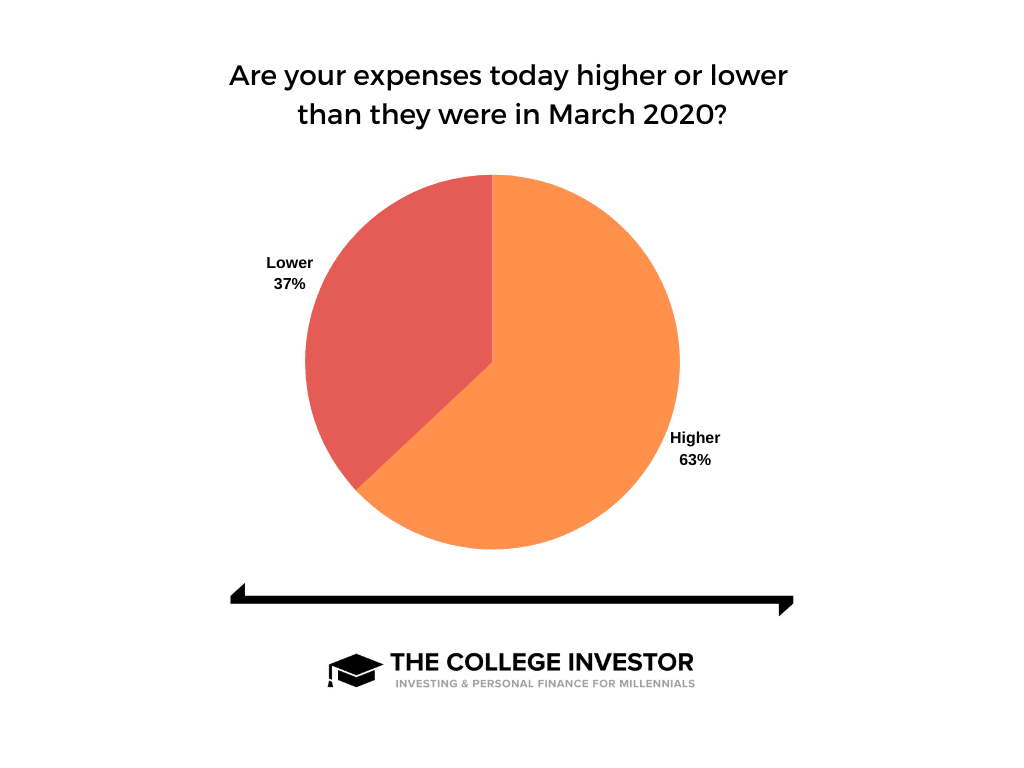

- 63% of borrowers reported that their monthly expenses are higher today, despite not having a monthly student loan payment.

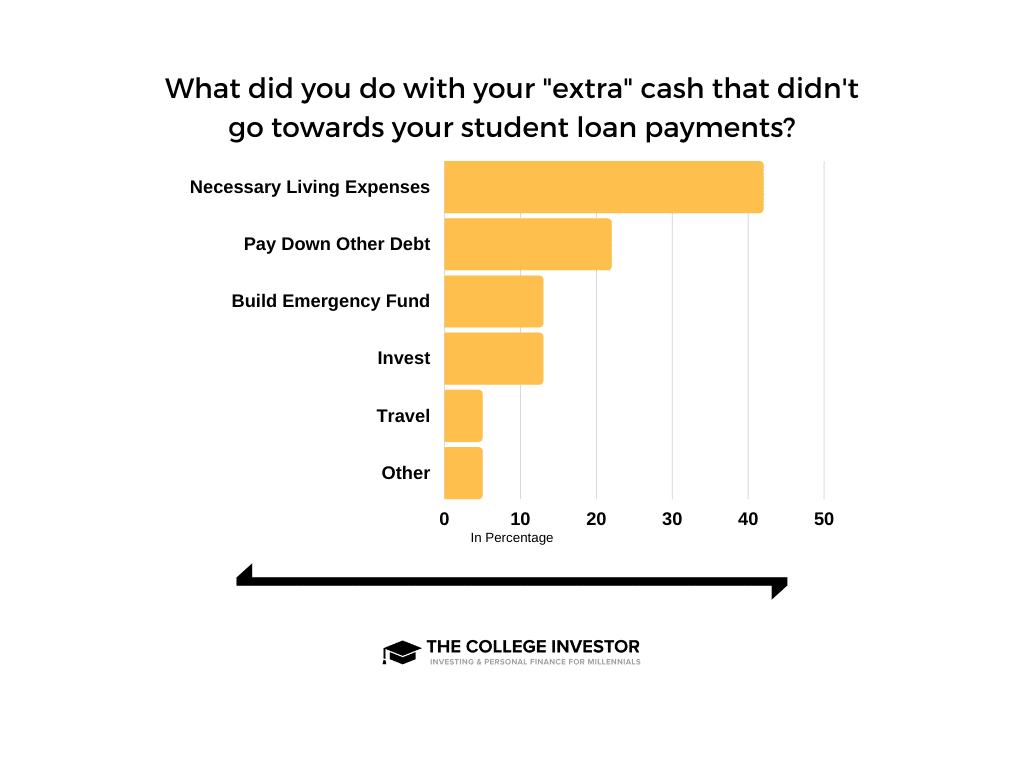

- 42% of borrowers said they were using the extra cash saved by not having a student loan payment for "necessary" expenses like food and housing.

Average Student Loan Payments

With those findings in mind, it's important to take a look at what the student loan debt crisis looks like today.

Right now, there is $1.7 trillion in outstanding student loan debt. This is owed by 45 million Americans. It's important to note that there is also another $132 billion in private student loans. These private loan borrowers did not see their payments or interest paused during Covid-19.

As sub-set of Federal loans, known as FFEL and Perkins Loans, also did not have their student loan payments paused.

In March 2020, all federally-held student loans (Direct Loans, some FFEL and Perkins Loans), were provided with various relief through both executive action and legislation. This relief included: no student loan payments, no interest accruing, no collection activity (wage garnishments and tax offsets), payments paused during this time counting towards Public Service Loan Forgiveness, and an extension of income-driven repayment certification. You can learn more about the Covid-19 Student Loan Assistance Programs here.

With that in mind, here's what the individual borrower will owe:

- Average Student Loan Debt: $32,731

- Median Student Loan Debt: $17,000

- Average Student Loan Payment: $393

- Median Student Loan Payment: $222

You can find more statistics on student loan debt here: Average Student Loan Debt by Graduating Class and What Is The Average Student Loan Payment.

Are Borrowers Ready To Resume Student Loan Payments?

Student loan payments are set to resume in February 2022. Given it's been almost two years since borrowers had to make payments, we wanted to know how ready borrowers felt - from both their personal ability to make payments to the information they're receiving about making payments.

And while nobody wants to start making payments if they don't have to, we found that 71% of student loan borrowers are ready to resume payments after the payment pause ends:

Borrower Knowledge Of Their Student Loans

However, while most borrowers are ready to resume payments, there is clearly a knowledge gap surrounding each borrowers' obligations and student loan debt.

The Department of Education has been criticized for failing to clearly communicate with borrowers, share updates, or even put together a cohesive plan to help borrowers resume payments.

So, when it comes to restarting payments, we wanted to know how much borrowers knew about their upcoming loan payment, any student loan forgiveness programs they may qualify for, and how much they worry about their student loans.

For example, only 65% of student loan borrowers surveyed knew exactly how much their upcoming student loan payment would be.

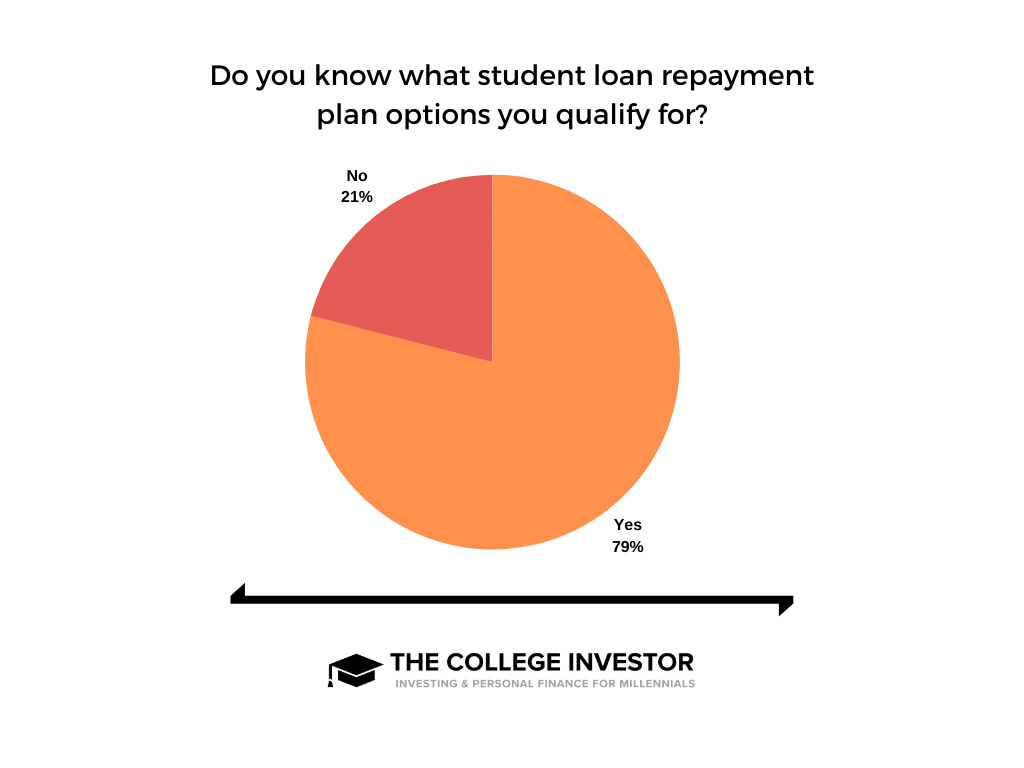

With that in mind, we also wanted to know how many borrowers knew about different repayment plan options - such as income-driven repayment. We found that 79% of borrowers we surveyed knew what repayment plan options they qualified for.

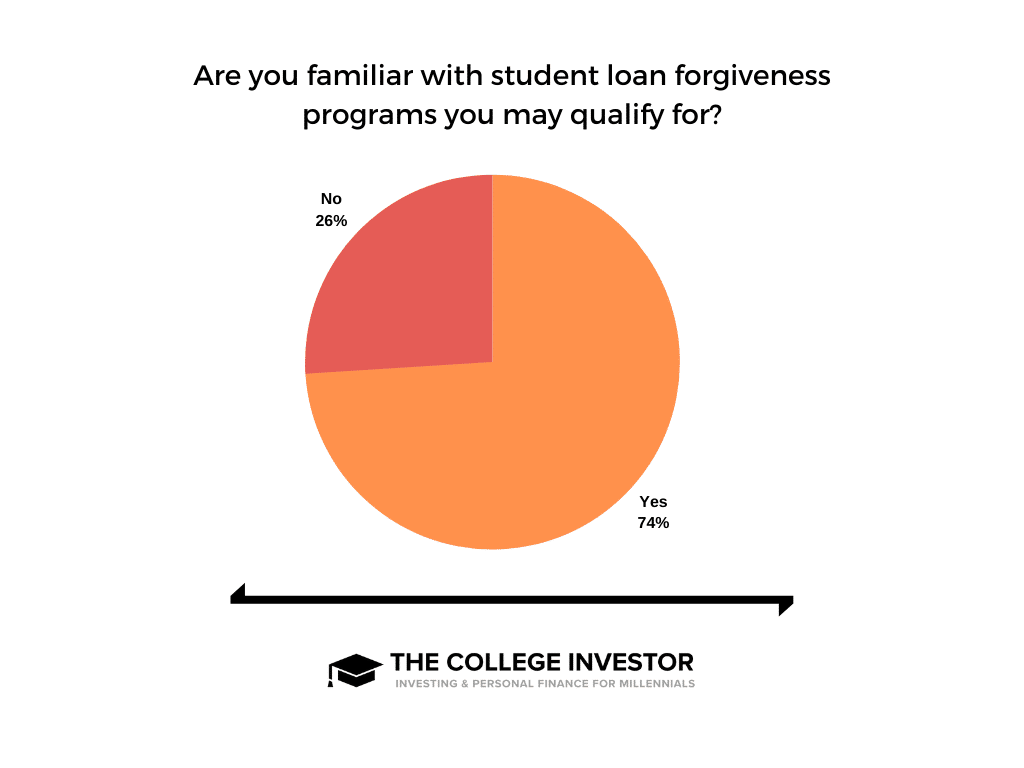

Given the recent Public Service Loan Forgiveness reforms, we also wanted to know how many borrowers understood if they were eligible for any type of loan forgiveness. We found that 74% of borrowers were knowledgeable about loan forgiveness programs they may qualify for.

The lack of clear information about student loan repayment restarts is creating concern for borrowers. Our survey found that 84% of borrowers are worrying about their student loan payment, with 50% saying they worry about it "often".

How Have Borrower Expenses Changed During Covid-19?

Connecting directly with making student loan payments is borrower income and expenses. The premise of the student loan pause was to give borrowers relief during the uncertain economic times that Covid-19 created. For a moment, we experienced the highest unemployment rate in history, and while the economy has recovered by many metrics, it may not have impacted every group the same.

Furthermore, given it's been almost 2 years without a student loan payment, many borrowers' financial lives may be significantly different than before the pause. For younger Americans, 2 years is a lifetime in terms of earning, career prospects, and more. Plus, younger Americans were significantly impacted by Covid-19.

We found that 80% of those surveyed experienced some type of Covid-19 related economic injury. The most common responses were:

- 42% were laid off directed because of the pandemic

- 40% had to take on an additional job

- 38% were forced to work less hours or take a pay cut

- 38% took on gig work such as delivering food

However, it was interesting to see that, overall, a majority of those surveyed are making more money today than they were before the pandemic. In fact, 57% reported that their income has increased during the last two years. 22% reported their income staying the same. Only 21% reported their income decreasing during this period of time.

Given that the majority of student loan borrowers saw their income increase, we also expected borrowers to see their expenses rise as well. And our study saw that - 63% of those surveyed said their monthly expenses are higher today, despite the student loan payment pause.

How Did Borrowers Use Savings From The Payment Pause?

We were also curious to see how student loan borrowers were using the savings they received from not having to make student loan payments.

The most common answer (with 42% of those surveyed) was using it to cover necessary living expenses like food and housing. That was followed up with 22% saying they were using the funds to pay down other debt - such as credit cards.

Other popular uses included:

- 13% using it to build up an emergency fund

- 13% using it to invest

- 5% using it to travel or take advantage of leisure opportunities

A small amount of borrowers elected to keep making voluntary payments on their student loans.

Final Thoughts

When given a choice between making student loan payments and NOT making student loan payments, of course nobody wants to make payments when they don't have to. However, it was interesting to see that 71% of borrowers feel financially ready to resume paying on their student loans in February 2022.

However, it was concerning that 84% of borrowers are worried about making their first payment, and 35% of borrowers don't even know what their payment will be in February. That's a big gap that the Department of Education and Federal Student Aid need to close in the next 60 days. There needs to be a cohesive media plan with mass marketing and communication, and a focus on connection with all student loan borrowers.

The Department of Education already has systems in place to get borrowers from not making payments to making payments - they do it every year when students graduate college (think of the 6 month grace period and communication period). However, that seems to have been ignored when restarting payments for everyone.

Finally, it was interesting to see that most student loan borrowers saw their incomes increase over the last 22 months. I think sometimes we see a narrative that every student loan borrower is struggling, but that's simply not the case. Only a minority have seen their incomes decrease during Covid-19.

I think it's important to be aware of these numbers as payments resume next year. We will see how smooth this transition will be.

Methodology

The College Investor commissioned Pollfish to conduct an online survey of 1,200 Americans who had student loan debt as of the date of the survey. The survey was fielded October 15, 2021.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.