It’s time to start thinking about taxes. Yay. Just like last year, we polled 1,200 Americans to get the latest on what tax software they used and how much they paid to prepare their taxes in 2022.

One of the surprises in the last 12 months that no taxpayer can escape is inflation. It increased 7% in the last few years, compared to just 1.4% in 2021.

With higher costs for everyday items from gas to milk, stressed-out Americans are looking for a side hustle or cutting expenses where they can. But what about paying for their taxes?

Here’s what we discovered.

Key Findings

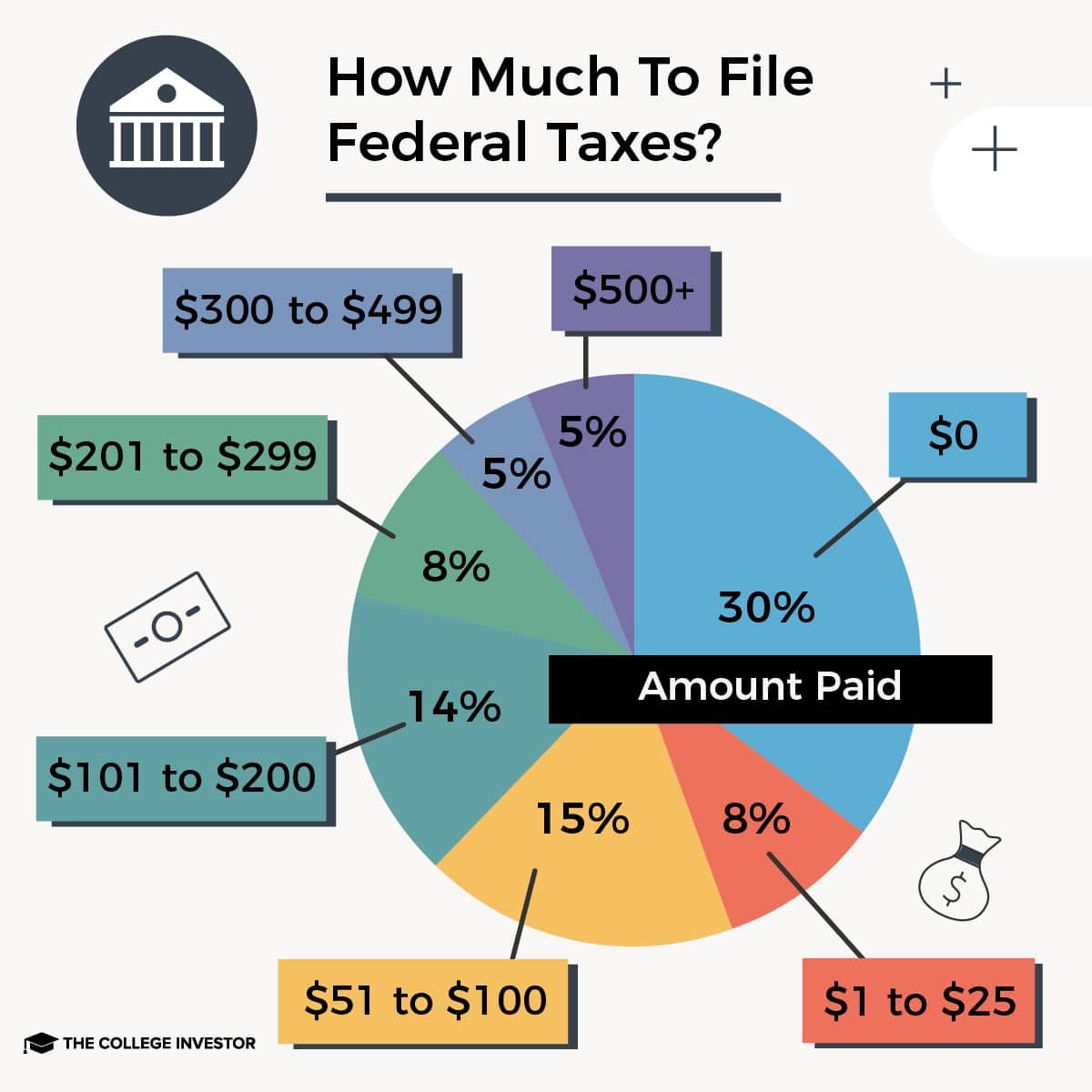

- Cost To File Federal Tax Return: 30% paid $0, while 5% paid over $500

- DIY vs. A Tax Professional: 45% used tax software to file on their own

- We reveal the most popular tax software: 59% used it (sorry, you have to scroll down and see the answer)

- Self-Employed vs. Employee: 60% filed as a W-2 while 27% were self-employed

How Much Americans Paid To File Their Federal Tax Return

The cost of preparing your taxes can vary wildly. Some can file for free every year while others with more complicated financial situations feel more comfortable if they hire a tax professional.

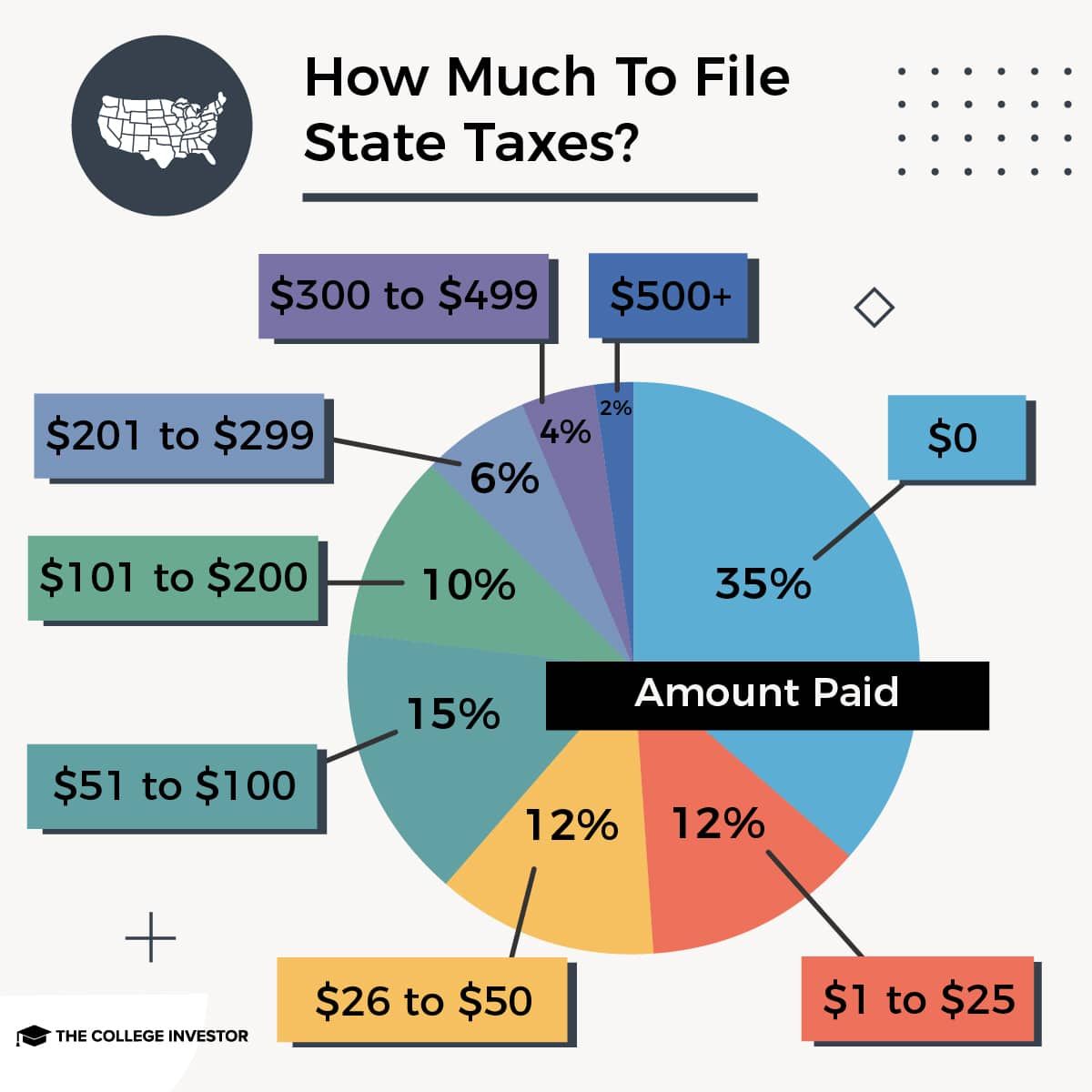

Here’s what we discovered for how much people paid for both federal and state taxes.

The cost to file a federal tax return:

How much does it cost to file a state tax return:

How People File Their Taxes

Our survey found that 45% of people filed their taxes using a DIY method with TurboTax, H&R Block online, FreeTaxUSA, and Cash App Taxes, to name a few.

- From these companies that also offer full-service virtual help, 11% took advantage of it

- 27% used a full-service accountant or CPA.

- Surprisingly, 15% took to pen and paper to get their taxes done.

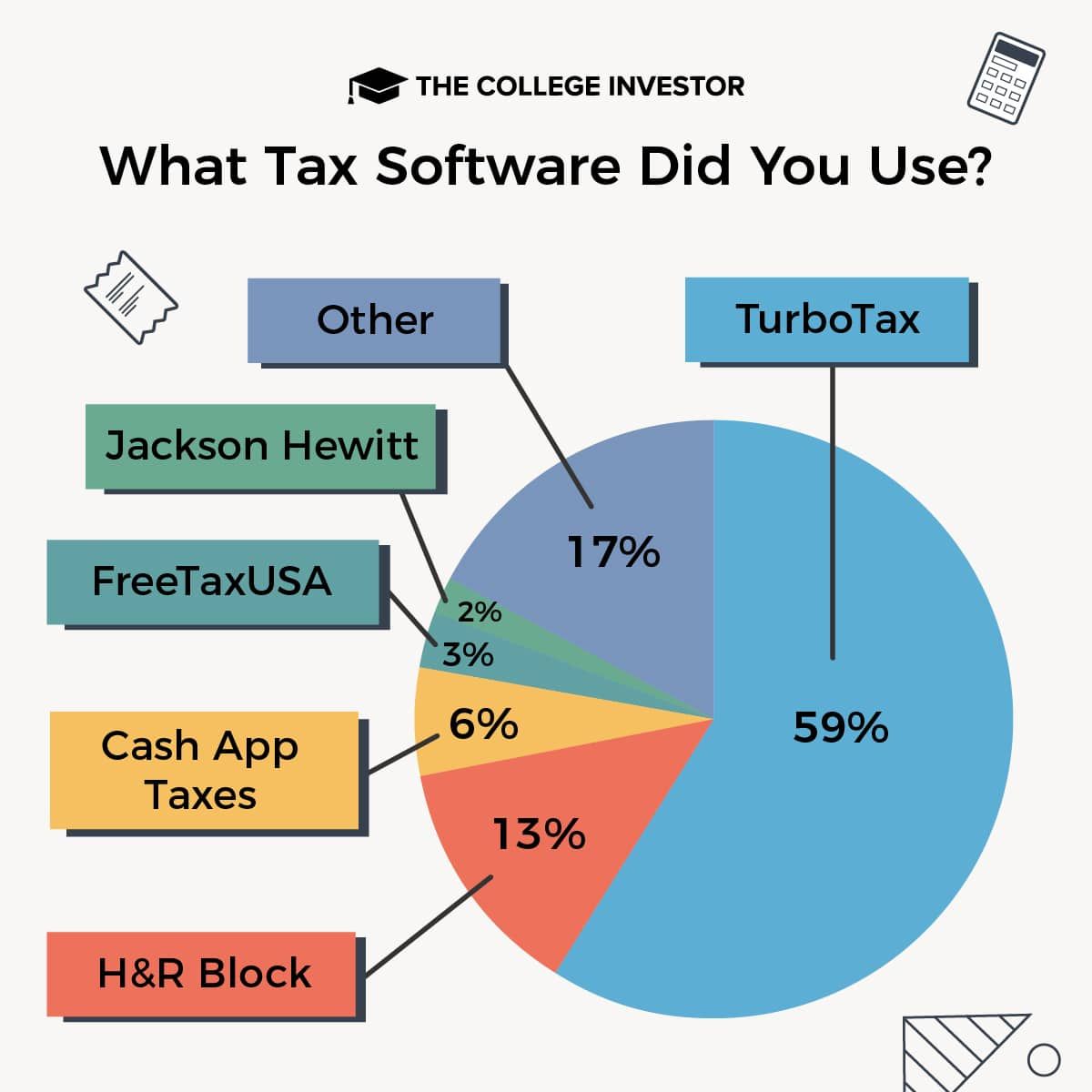

What Tax Software Did Americans Use?

There are so many options—don’t forget that we have extensive reviews of many of them on The College Investor. Here are reviews for The Best Tax Software and Free Tax Software.

So which one did our respondents use?

- TurboTax—a whopping 59%

- H&R Block came in second place, with 13%

- Cash App Taxes at 6%

- FreeTaxUSA at 3%

- Jackson Hewitt at 2%

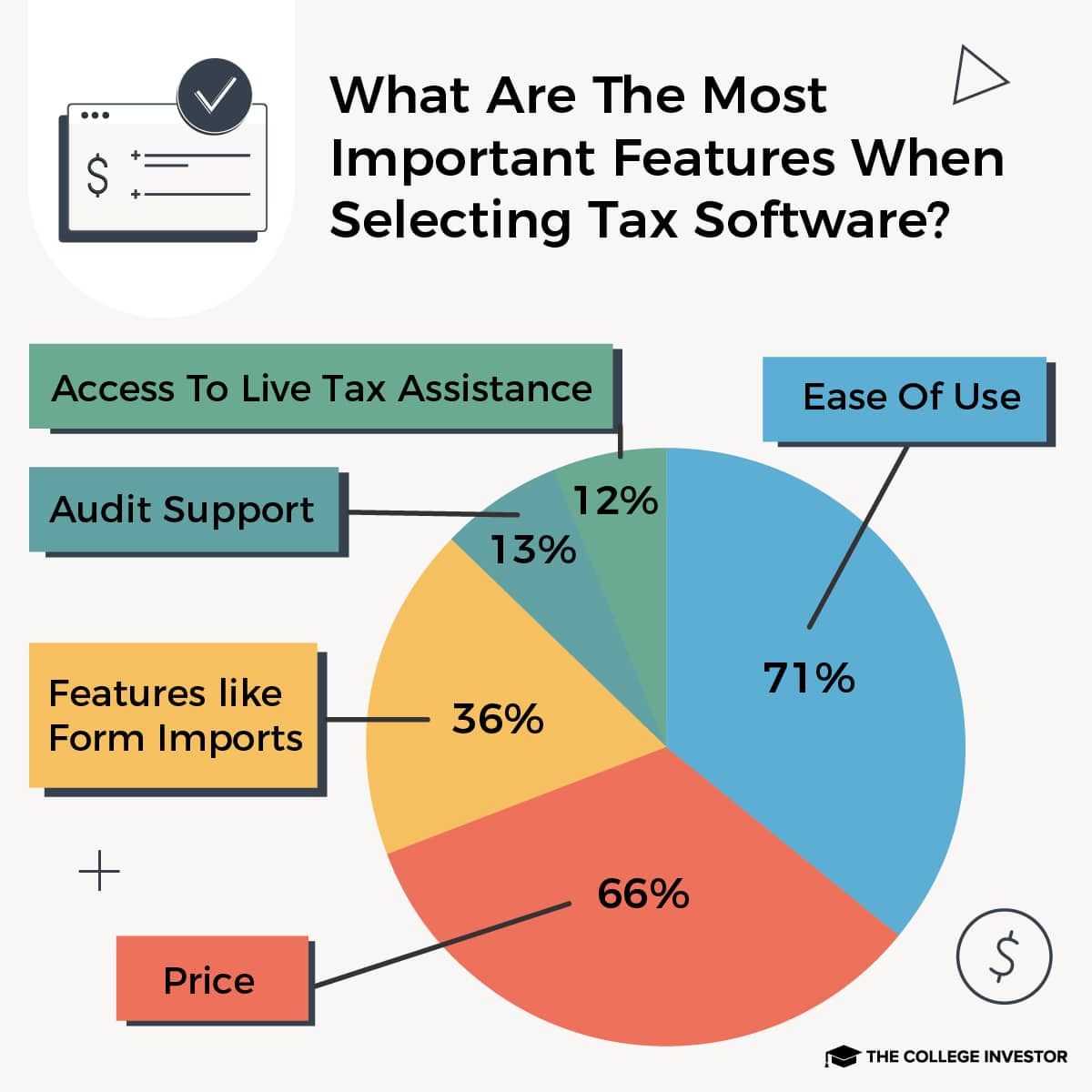

What Matters Most When Selecting Tax Software?

So what’s so great about TurboTax and why did 59% choose it?

The number one reason people choose one tax service over the other is due to ease of use. An overwhelming 71% of respondents said this was the most important factor when choosing one tax software over the other.

This finding stayed consistent with last year’s survey. When asked if they were going to use TurboTax again for their taxes in 2022, 83% said they would.

Just like last year, 66% said that price was the second most important reason when picking a specific software.

How Did Americans Receive Their Tax Refunds?

Direct deposit was the most popular method (73%) of how respondents said they prefer to receive their refunds. It’s the easiest and quickest way to get your money. All you have to do is select it as your refund method through the tax software.

Then, provide your bank account number and routing number. Or if you’re using a tax service, tell your tax preparer you want direct deposit.

Eleven percent of filers chose to get their refunds by waiting on a paper check in the mail while another 11% preferred their refund in the form of a prepaid debit card.

When asked why this group doesn’t use direct deposit, 14% said they don’t have a checking account while 56% said they simply prefer a prepaid debit card.

Surprisingly, 21% admitted they didn’t know direct deposit was an option.

How Did Americans Prepare Their Taxes?

From our survey, 14% filed as head of household, 52% filed as single, while 27% filed as a married couple.

Only 5% are married, filing separately. A benefit of going this route is if there's a big disparity in a couple’s incomes. For example, if the spouse who doesn’t make as much is eligible for a lot of itemizable deductions, it could be worth going this route.

If you’re married, you can use a higher standard deduction, which is twice the amount of a single person's deduction. For 2021, the married standard deduction was $25,100. (In 2022, it increased to $25,900.) This is the amount you can deduct from you and your spouse’s income.

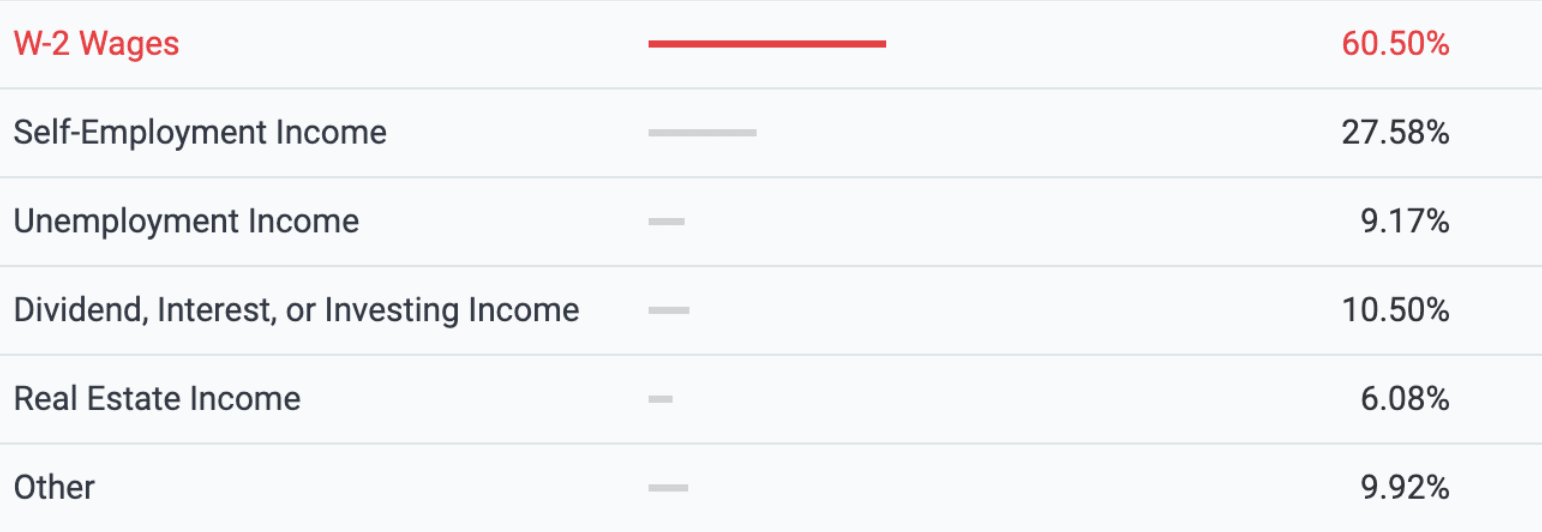

Income Sources and Claims

Income sources are also an important part of tax filing costs and is the foundation for the way tax software sets their pricing structure. For example, if you have self-employment income, or investment income, you could be forced to use a "higher tier" of tax software.

The majority, 60%, had W-2 wages while 27% identified as self-employed. Remember, self-employment also applies to side hustle income.

Being claimed as a dependent on someone else’s taxes (like your parents), can also affect your taxes. From our survey, 68% said they would not be claimed as a dependent, while 31% said they would.

‘Free’ Tax Software Isn’t Really Free

With inflation on the rise, it makes sense to want to cut costs where you can, but be careful when it comes to your taxes. While many tax companies such as TurboTax and H&R Block offer free or low-cost options for filing, not everyone qualifies.

You may start off using the free version, but then quickly realize you need to upgrade in order to complete your taxes.

The only fully-free software for filing your taxes is Cash App Taxes, previously known as Credit Karma Taxes. However, there are limitations. The IRS also has a free way to file, as long as you have a total adjusted gross income of $73,000 or less.

Use Direct Deposit And Open A Checking Account If You Don’t Have One

This year’s survey revealed a few shockers, including 21% saying they did not know direct deposit was an option. The other surprise was that 14% completely lacked a checking account.

Perhaps this is the year to open a checking account, there are so many free options to choose from. There’s absolutely no reason to have to wait around for a paper check in the mail when you could receive your refund lightning fast from direct deposit. These are our best picks for free checking accounts.

Don’t forget to check out the best tax software from The College Investor—where we review TaxAct, TaxSlayer, Cash App Taxes, FreeTaxUSA, Tax Hawk, and more.

The College Investor commissioned Pollfish to conduct an online survey of 1,200 Americans. The survey was fielded on December 22, 2022.

You can find our previous poll here: How Much Americans Pay To File Their Taxes In 2021.

Claire Tak is an editor, content strategist, and writer with a specialty and passion for personal finance and tech. Her experience in finance spans from working at San Francisco-based startups like Credit Sesame and Upstart to large institutions such as Wells Fargo. Her work has been published in FOX Business, Bloomberg, and Forbes.

Claire believes financial stability is created through education, long-term investing, and saving. She’s fascinated by the connection between money and happiness and how human behaviors play into achieving financial success.

Besides her enthusiasm for personal finance, she loves snowboarding and traveling. You can learn more about Claire at clairetak.com.

Editor: Robert Farrington