If you are thinking about diversifying your income, you may be asking yourself, “How do I diversify my income?” It's actually pretty straight forward, and many of us already have multiple income streams, we just don’t realize it.

The goal of creating multiple income streams should be to maximize your potential in each category available to you. If you are just starting out, it really isn’t reasonable to expect you to generate tons of rental income.

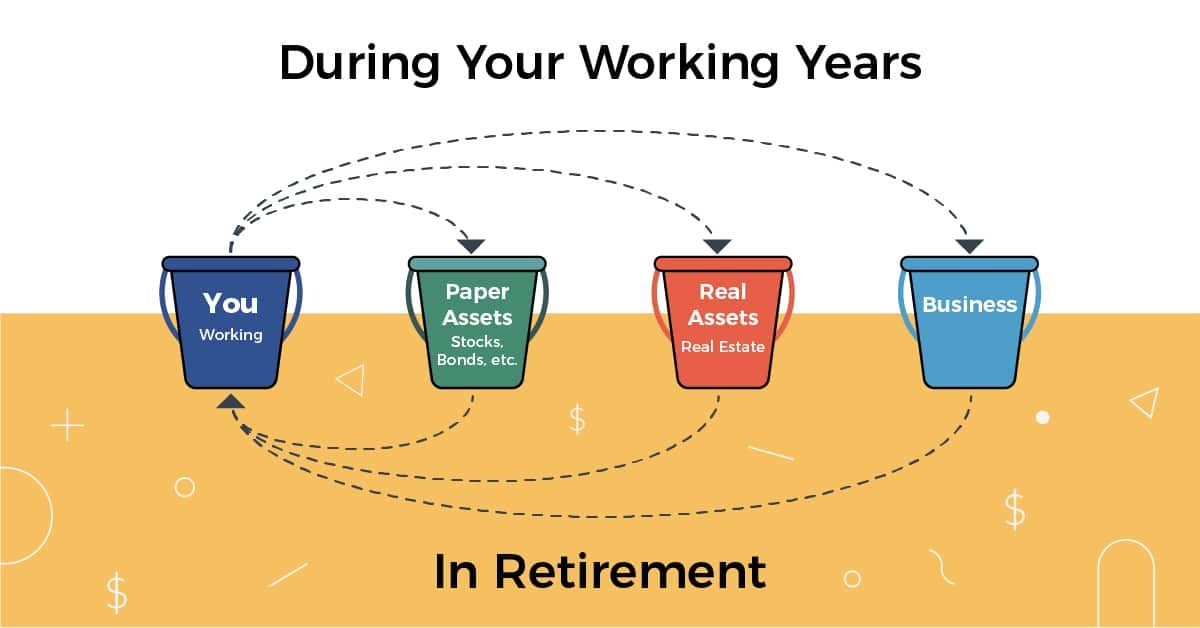

However, if you start maximizing your income generating potential through your primary salary, you will find yourself having excess income that you can reinvest to generate additional income streams use different buckets of assets.

Remember, the average millionaire has 7 different income streams. Seven! Here are the most common ones.

Primary Salary

For most people, their primary salary is their main income stream. In fact, I think everyone starts this way (if you didn’t, I’d love to hear your story!). The goal is to maximize your primary salary to a point where you are generating enough free cash flow to reinvest in secondary income streams.

How do you do this? Well, try to get the highest paying job you can! Ask for a raise! Utilize services, such as Glassdoor.com, to see how your salary competes with others in your same job. Some companies really force employees to leave to get a raise, and then come back for another raise. This industry jumping promotional strategy is very common and could work.

Or, there is another theory for your primary salary – generate enough to have a little excess cash flow, but do it at a place that you can work stress free and have time to dabble in other projects. A good friend of mine has this setup – he works 10-5 and makes $50,000 a year. This allows him to easily cover all of his expenses, but the shorter hours and flexibility in his job allows him to pursue his secondary income generating ideas!

Either way, the great thing about your primary salary is that you can usually get benefits, such as health insurance, that really protect you while you are pursuing your other ideas!

Secondary Salary/Spouse’s Salary

No matter what venture you undertake in life, you need a team. I’m a firm believer in team work, even if it is just to bounce ideas off of, or to have someone tell you that you are off track. For many individuals, this person is their spouse, who also brings some income diversity to the table. Just like I mentioned above, if your spouse has income, try to maximize it.

I would throw in some caution here: if your spouse works at the same company, or in the same industry as you, you are not diversified, and should something happen, you could be in a world of hurt. Companies do go out of business, companies do lay employees off. There is nothing wrong with working together, but realize that you are not diversified and you should be trying to maximize other income streams as a result.

Once you've maximized your salary and your spouse's salary, you can deploy that excess into other buckets to create more income streams.

Investment

After employment, I think that most individuals gain income diversification through investing. It is important to look at why we invest: because at some point we plan on using this money for something. For most, it is saving for retirement, and the investing is done through vehicles, such as a 401(k) or IRA. But investing is not just about stashing money away for a rainy day – that is what an emergency fund is for. Investing is about having enough capital to generate income.

Investing generates income through dividends, interest, and return of capital. You really want to maximize the first two, and stay away from the return of capital as much as possible.

Think about it. If you are saving for retirement, you are trying to save enough in investing to generate enough income to replace your primary salary. Let’s take my friend’s example above: $50,000 a year. To generate $50,000, you would need to have almost $1,700,000 saved, and be able to generate a 3% cash flow on that money (which is reasonable if invested in dividend paying stocks).

You could also draw down on your principal if needed, but this is a return of your invested capital, and if you continue this for a long period of time, you run the risk of exhausting your resources.

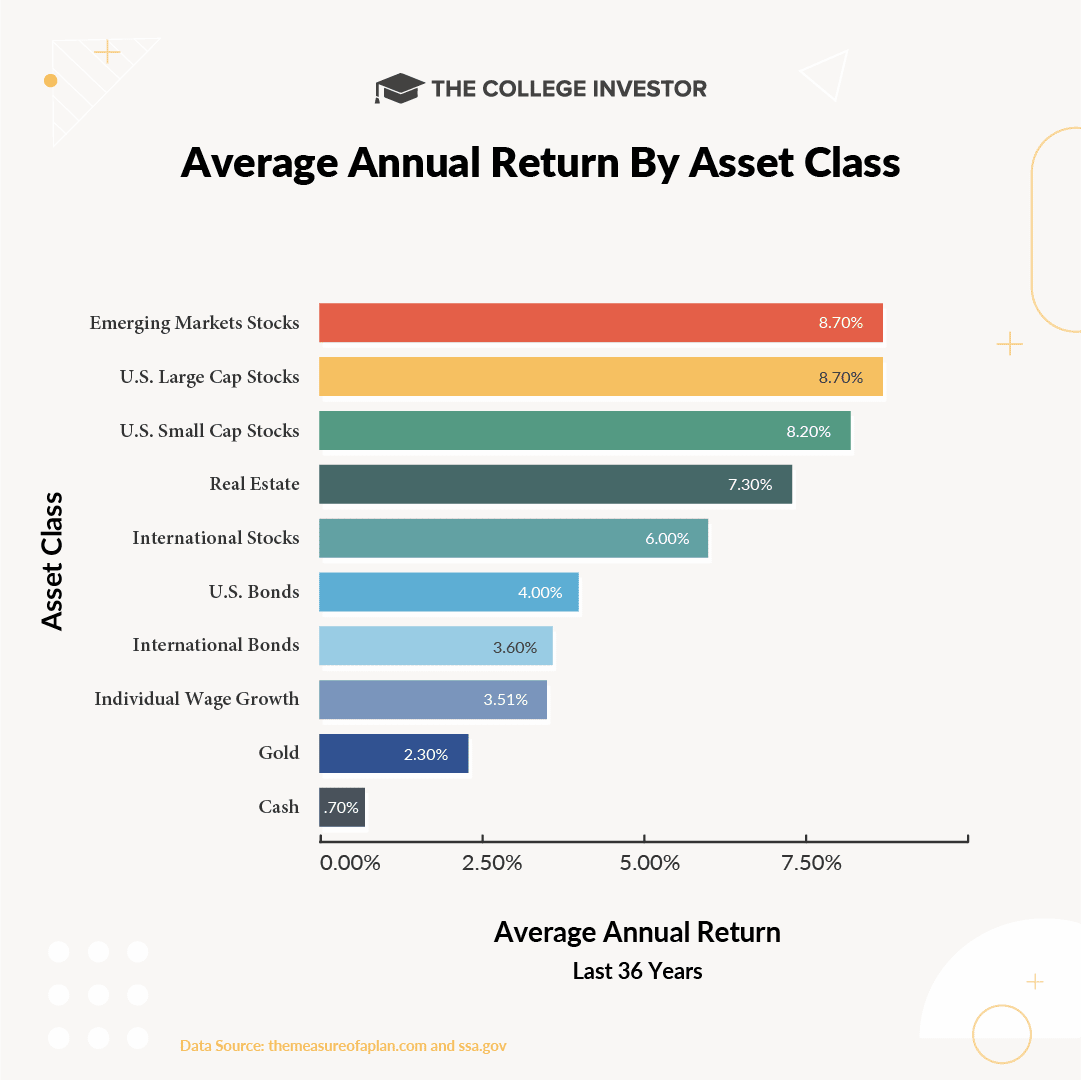

It's also important to invest vs. just saving because saving cash just won't grow fast enough to be useful to you. You need to invest in assets that will grow. See the average return by asset class below (and notice how your own wage growth doesn't keep up well either).

If you're ready to start investing, check out our list of the best places to invest!

Rental Property

Purchasing a rental property is another common way that individual generate an income stream. It is very similar to investing, in that you take a sum of money to purchase the property, and the property returns a cash flow – rent. You do have expenses related to this that are different from investing, such as a mortgage, utilities, property taxes, etc, which all must be taken into consideration when calculating a return on rental property.

Rental property does have tax advantages that investing doesn’t have, but I will touch on that at a latter time.

The problem with rental property is that initial capital outlay required to get started. Most people starting to diversify their income streams don’t have a 20% down payment to purchase an income property. That is why this is usually something that is done later in life, almost like an advance multiple income stream topic.

However, there are ways to do this earlier, such as getting started with real estate crowdfunding. With real estate crowdfunding, you can become a limited owner in real estate for a smaller amount of money. It's a great way to get started investing in real estate.

We recommend the following:

You can start investing in real estate for as little as $5,000 at platforms like RealtyMogul. They have different multi-family and commercial properties that you can invest in. See our full RealtyMogul review here.

Ark7 is an option in select states to buy fractional shares in income-generating rental properties across 10 states.

Another similar platform is Fundrise. They only have a $10 minimum to get started and offer a variety of options we love as well! Fundrise has really been a great performing passive income investment over the last year! You can read our full Fundrise review here.

If you have a little more to get started, check out Roofstock. With Roofstock, you can purchase single-family turnkey investment properties directly online! Check out Roofstock here >>

Finally, you could consider investing in US farmland. AcreTrader is a company that allows you to have ownership of farmland and collect rents, as well as appreciation. Check out AcreTrader here.

Online Business/Hobby Business

The final most common stream of income is creating a side business. This business could be online or offline, and I call it a “hobby business” because it usually takes a form that relates to the owners hobby.

For example, if you are tech savvy or enjoy working online, you may sell on eBay, or create a website (like I did), or promote your services through a site like Fiverr.

Our friend Julie Berninger sells Etsy printables to the tune of $1,000s of dollars per month - and she created an E-Printables course to show you how to do it as well! Check out her E-Printables Selling Course and learn how to create online items to sell on Fiverr and Etsy in your first day of this online course that's proven to work.

Don't know where to start?

Here's a list of 50+ Side Businesses You Could Start Today. Or, how about a list of 35 Different Passive Income Streams you can build.

Creating Multiple Income Streams

The point is that you can diversify your income in various ways. You can basically choose one of each from the categories above, and create a very diversified income portfolio.

The other point is that it is pretty easy to get started. You don’t need to be super rich, and you don’t need a lot of time to get started. To say it requires no time would be a lie, but you don’t need to make anything listed above your life. You can work at your job, invest your excess income, save to buy a rental property or rent out a room in your current house, and you start a side job online without breaking a sweat.

The reward from these activities will be financial freedom!

What do you think about the most common income streams? Have you started a second income stream yet?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak