Choosing a real estate crowdfunding platform can seem like trying to find a unique red ball in a sea of red balls. That’s because most of these crowdfunding platforms look very similar.

However, as you browse through different platforms, you’ll begin learning which features you find most appealing in real estate investment deals. It might be that you prefer equity over debt, a specific fee structure, platforms with long track records, etc.

Holdfolio is a real estate crowdfunding platform that has a unique offering. It invests in each deal with its investors. That means Holdfolio is putting up its own money with yours. For some investors, that can be an attractive advantage. Let’s check out what a Holdfolio deal looks like and why someone might want to invest with them.

Quick Summary

- Open to accredited and non-accredited investors

- $20,000 minimum investment

- Deal sponsors invest in each deal

Holdfolio Details | |

|---|---|

Product Name | Holdfolio |

Min Invesment | $20,000 |

Annual Fee | 2% AUM |

Account Type | Taxable or IRA |

Promotions | None |

Who Is Holdfolio?

Holdfolio is a real estate crowdfunding platform. Jacob Blackett is the CEO. Holdfolio was founded in 2014 and is based in Indianapolis, Indiana.

On the company's website it says its mission is "To create profitable and innovative partnerships through real estate investing...while strengthening local communities."

Holdfolio offers completely passive investments opportunities for its investors. In addition to its investing arm, its vertical integrations include a construction company and a property management company.

What Do They Offer?

Holdfolio provides both accredited and non-accredited investors with passive real estate investment opportunities through its crowdfunding platform. Holdfolio deals are equity-based, providing potential upside in addition to cash flows.

Holdfolio invests in multifamily value-add properties. It says that the properties it offers are typically apartment complexes with at least 80 units. Each property is described in detail when it becomes available as an investment deal on the platform.

An advantage of Holdfolio is that they invest alongside their investors. Holdfolio invests between 4-10% in each deal. With the sponsor investing in each deal, they have less incentive to push risk since they could potentially lose their own money. Some crowdfunding platforms do not put their own money into deals. This can lead to deals showing high returns but also being higher risk.

While investor deals are equity-based, Holdfolio may acquire a loan for some deals. Any debt is disclosed. Holdfolio doesn’t wait until it has a certain number of investors before acquiring a loan. It acquires and pays notes on the loan before investors become involved.

The Holdfolio website allows investors to log in to their dashboard to view financial statements and performance updates. While not real-time, stats are updated at least once per quarter. Holdfolio currently invests in properties located in Indiana, Ohio, Kentucky, Texas, Florida, and South Carolina.

Returns

Holdfolio targets double-digit returns, which means at least 10% per year. It says that its average investor return is 18.87%. Distributions are paid out quarterly. Before investing in any property, you can read about its potential returns.

Investment properties listed on Holdfolio display their cash on cash return as well as the IRR (Internal Rate of Return). The cash on cash return is cash flow divided by your initial investment. In other words, it compares cash flow to the cash you put into the investment.

IRR calculates an annual return against actively invested money. It's also useful for investments with inconsistent cash flows. IRR allows you to compare investments with different holding periods as well.

Selling Your Interest

While there isn’t a secondary market to sell your shares before the investment holding period ends, Holdfolio can assist in trying to find a buyer. It will shop your shares to other investors in the private Holdfolio network.

Holdfolio also holds a first right of refusal to purchase any ownership that is for sale. Note that selling your shares before the investment term is up will likely mean a net loss plus high associated closing costs.

Investing With Your IRA

Not everyone has $20,000 sitting on the side ready to invest. Another option is to invest money in your IRA. You can invest directly into Holdfolio using something called a self-directed IRA.

A self-directed IRA allows you to move IRA money from your current financial institution to a self-directed IRA custodian. Self-directed IRA fees are higher, on average, than mainstream IRAs. Expect to pay a few hundred dollars per year. Check out our favorite self-directed IRA providers.

Customer Support

You can contact Holdfolio by phone at (775) 762-6884, email at info@holdfolio.com, or by submitting a request through their contact form.

Are There Any Fees?

Yes, fees are specific to each deal. Generally, you should expect an acquisition fee of between 1-2% and an ongoing asset management fee of 2%.

Header |  | ||

|---|---|---|---|

Rating | |||

AUM Fees | 2% | 1% | 1 to 1.25% |

Min Investment | $20,000 | $500 | $1,000 |

Open To Non-Accredited Investors? | |||

Cell | Cell |

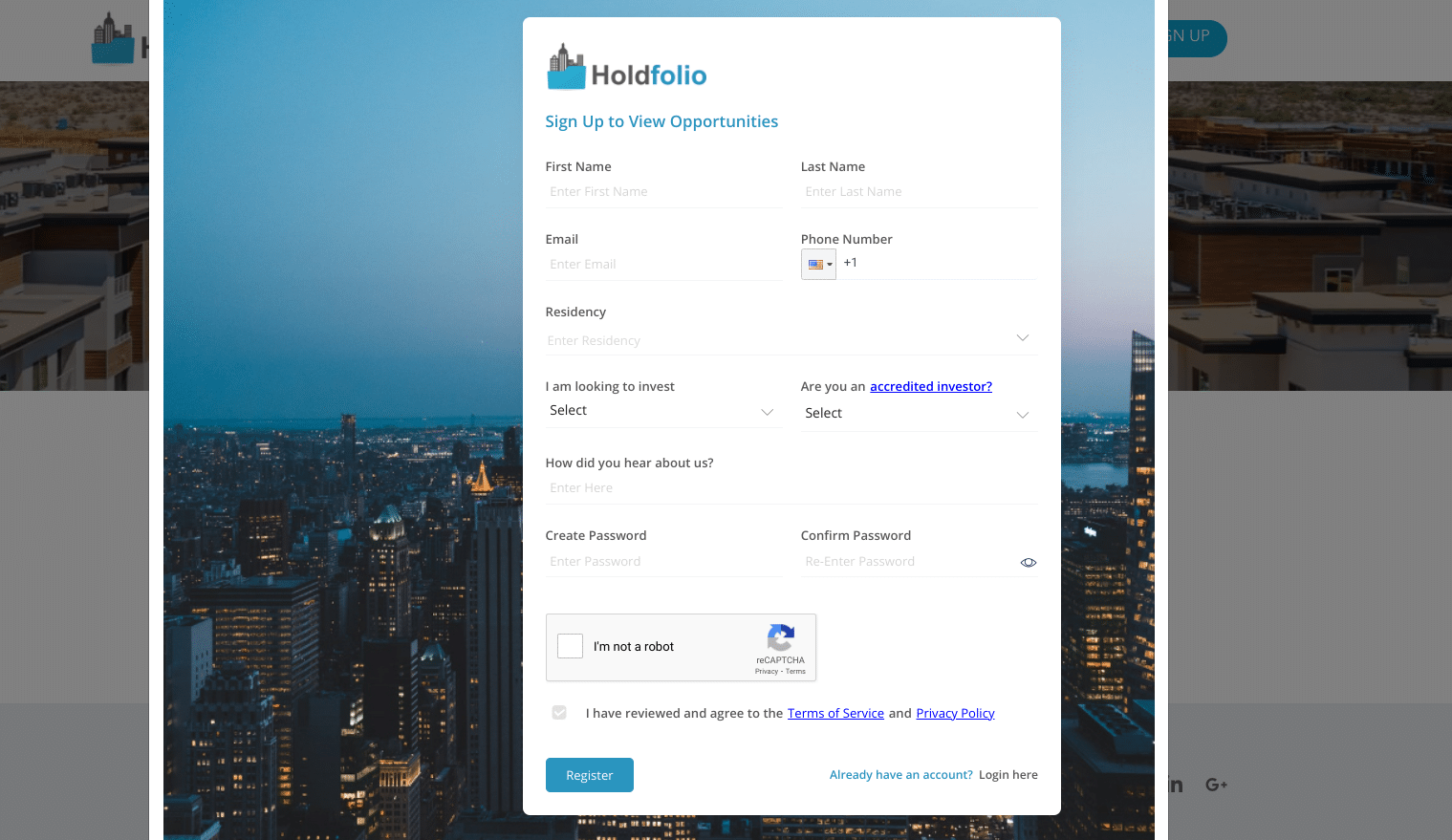

How Do I Open An Account?

You can visit the Holdfolio website to sign up. Creating an account is fee and you'll need to do so to view any of the available properties. Holdfolio's application includes a few simple questions and should only take a couple of minutes to complete.

Is My Money Safe?

All real estate crowdfunding platforms are high-risk. With each, there is a real possibility that you could lose your entire investment and Holdfolio is no different. Unlike with registered banks or stock brokers, there are no FDIC or SIPC protections.

Is It Worth It?

For investors with a high-risk tolerance and who want exposure to multifamily properties without having to manage them, Holdfolio may provide the right opportunities. Having the deal sponsor investing alongside you is a plus and a competitive advantage for Holdfolio.

Beyond that, there aren't really any features that stand out when compared to other real estate crowdfunding platforms. The minimum investments and fees are both on the high side. And it's worth pointing out that Holdfolio doesn’t have a long-term track record. Compare real estate crowdfunding sites >>>

Holdfolio Features

Account Types |

|

Minimum Investment | $20,000 |

Acquisition Fee | 1%-2% |

Management Fee | 2% |

Target IRR | 10% or higher |

Distribution Schedule | Quarterly |

Investor Requirements | None |

Investment Options | Multifamily real estate properties |

Fund Transparency | High -- The details for each property are made available online and investors can visit properties onsite. |

Investment Term | Typically 3-7 years |

Share Redemption Program | None |

Secondary Market | None, but Holdfolio promises to assist in matching sellers with prospective buyers |

Customer Service Number | 1-775-762-6884 |

Customer Service Email Address | info@holdfolio.com |

Mobile App Availability | None |

Promotions | None |

Holdfolio Review

-

Pricing & Fees

-

Ease of Use

-

Customer Service

-

Products & Services

-

Diversification

-

Liquidity

Overall

Summary

Holdfolio is a real estate crowdfunding platform that focuses on multifamily properties such as apartment complexes.

Pros

- Provides quarterly cash flow

- Platform incentives are aligned with investors

- Open to non-accredited investors

- Double-digit target returns

Cons

- Long investment terms (typically 3-7 years)

- No public market to sell your ownership

- Platform has a relatively short track record

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller