Dividend aristocrats are companies that have increased their dividends consecutively for the last 25 years or more.

If you're interested in dividend investing, you've likely heard about the dividend aristocrats. These are a special breed of dividend paying stocks that have not only paid their dividends consistently over time, but have also increased their payouts as well.

If you're interested in dividend growth investing, these are companies that need to be on your radar.

But who are the companies? How are they selected?

Here's everything you need to know about the dividend aristocrats.

What Are The Dividend Aristocrats?

The Dividend Aristocrats are a group of S&P 500 companies that have increased their dividends consecutively for the last 25 years. The Dividend Aristocrats index was created and is maintained by the S&P Dow Jones Indices, which uses a specific methodology for determining which companies fit into the index.

The index is rebalanced each January. New companies may enter the index and others, that no longer qualify, are dropped.

To qualify, companies must also meet the following four criteria, which is specified in the above-linked methodology guide:

- Be a member of the S&P 500.

- Have increased total dividend per share amount every year for at least 25 consecutive years.

- Have a minimum float-adjusted market capitalization (FMC) of at least US$ 3 billion as of the rebalancing reference date.

- Have an average daily value traded (ADVT) of at least US$ 5 million for the three months prior to the rebalancing reference date.

Dividends must also be cash payments rather than issued in stock or as special dividends. Currently, the minimum number of stocks in the index is 40. In some cases, there may not be enough stocks that meet the annual criteria to be included in the index. When that happens, stocks that have paid dividends for 20 consecutive years are considered.

What Companies Are Included?

As of January 2024, there are 67 companies included in the index. From Wikipedia, they are:

Company | Ticker |

|---|---|

3M Company | MMM |

AbbVie Inc. | ABBV |

Abbott Laboratories | ABT |

AFLAC Inc. | AFL |

Air Products and Chemicals Inc | APD |

Albemarle Corp. | ALB |

Altria | MO |

Amcor PLC | AMCR |

A.O. Smith | AOS |

Archer Daniels Midland | ADM |

Atmos Energy | ATO |

Automatic Data Processing | ADP |

Becton Dickenson | BDX |

Brown & Brown Inc. | BF.B |

Brown-Forman | BF-B |

Cardinal Health Inc. | CAH |

Caterpillar Inc. | CAT |

Chevron | CVX |

C.H. Robinson | CHRW |

Chubb Limited | CB |

Church & Dwight Co. | CHD |

Cincinnati Financial Corp | CINF |

Cintas Corp | CTAS |

The Clorox Company | CLX |

The Coca-Cola Company | KO |

Colgate-Palmolive | CL |

Consolidated Edison | ED |

Dover Corp | DOV |

Ecolab Inc | ECL |

Emerson Electric | EMR |

Essex Property Trust | ESS |

Expeditors International of Washington | EXPD |

Exxon Mobile Corp | XOM |

Federal Realty Investment Trust | FRT |

Franklin Resources | BEN |

General Dynamics | GD |

Genuine Parts Company | GPC |

Hormel Foods Company | HRL |

IBM | IBM |

Illinois Tool Works | ITW |

J.M. Smucker Company | SJM |

Johnson and Johnson | JNJ |

Kenvue, Inc | KVUE |

Kimberly Clark | KMB |

Linde PLC | LIN |

Lowe's Companies | LOW |

McCormick and Company | MKC |

McDonald's | MCD |

Medtronic | MDT |

NextEra Energy | NEE |

Nordson Corp | NDSN |

Nucor | NUE |

PPG Industries | PPG |

Pepsico | PEP |

Pentair | PNR |

Proctor & Gamble | PG |

Realty Income | O |

Roper Technologies | ROP |

S&P Global | SPGI |

Sherwin-Williams | SHW |

Stanley Black & Decker | SWK |

Sysco | SYY |

T. Rowe Price | TROW |

Target Corporation | TGT |

W.W. Grainger | GWW |

Walmart | WMT |

West Pharmaceutical Services Inc. | WST |

How To Invest In The Dividend Aristocrats?

One of the simplest ways to invest in the Dividend Aristocrats is through a fund that mimics index, which has the ticker symbol SPDAUDP.

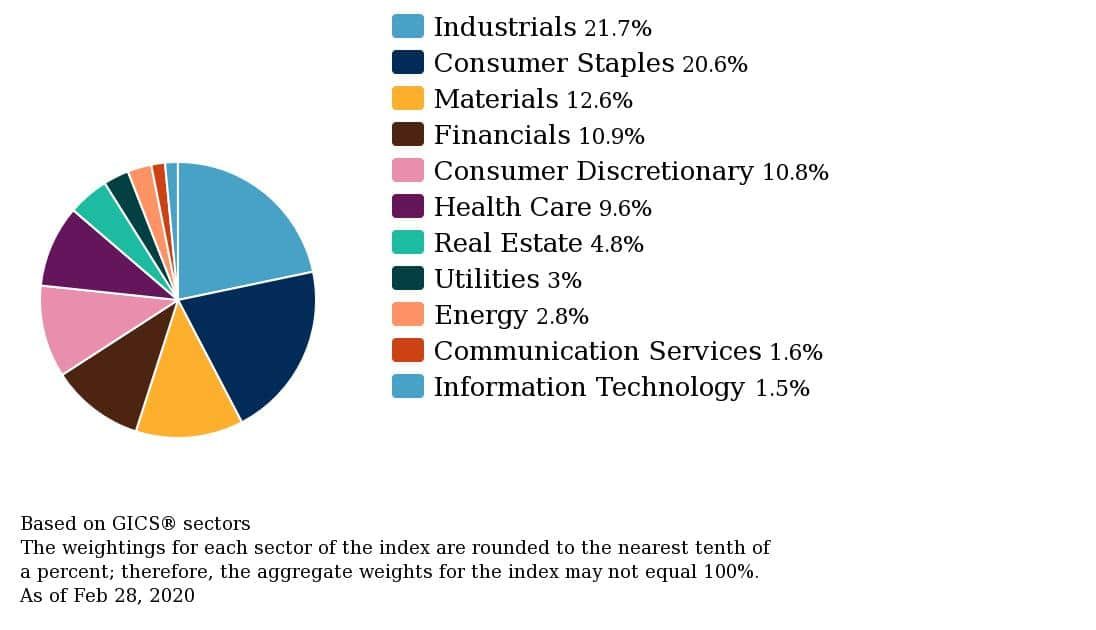

The index is made up of 11 sectors:

Source: https://eu.spindices.com/indices/strategy/sp-500-dividend-aristocrats

Here are several funds and ETFs that track the Dividend Aristocrat index:

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

- iShares Selected Dividend Index (DVY)

- SPDR S&P Dividend (SDY)

An alternative approach is to simply own all companies in the index directly. That may seem challenging, but using a service like M1 Finance (which offers commission-free investing) makes it really easy. A benefit to this is that you can easily equal-weight the index, versus capitalization weight which most funds use.

You might prefer this option because equal-weighted indexes have a tendency to outperform.

Final Thoughts

Fundamental and technical analysis both help in deciding which stocks are a good choice to invest in. If you’ve narrowed your choice down to only those in the Dividend Aristocrats index, you have less work to do when researching potential candidates.

Good companies are generally those that have positive income, growing revenues and earnings, and good management. But your research shouldn’t stop there. If researching a stock seems intimidating, going with the SPDAUDP index will ensure diversification across all of the Dividend Aristocrats stocks.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Ashley Barnett Reviewed by: Colin Graves