We love index fund, and we've recommended several in our Guide To Investing. However, there's a type of index fund that is gaining in popularity, and one that I think has a lot of merit - equal weighted index funds.

An equal weighted index fund is just like it sounds - everything inside the index fund is equally weighted. This differs from other index funds, in that most are capitalization-based, meaning stocks with higher market capitalization (or value) are held as a higher percentage of the fund.

Let's see how that really breaks down...

What Is An Equal Weighted Index Fund?

Let's use the S&P 500 for this example. You know that the S&P 500 is composed of the 500 largest stocks in the United States.

Right now, a standard S&P 500 index fund (let's use SPY), has the following Top 5 Holdings:

- Apple (AAPL) - 6.99%

- Microsoft (MSFT) - 5.63%

- Amazon (AMZN) - 3.32%

- Tesla (TSLA) - 1.96%

- Alphabet (GOOG) - 1.93%

- Berkshire Hathaway (BRK.B) - 1.54%

So, as you can see, there is a much larger percentage of the fund in several stocks (and if you notice, these are all technology stocks), which can skew returns if these stocks perform well or poorly. In fact, that happened with Apple - many broad index funds were up much higher than the market, simply because of the weighting of Apple and Microsoft in their portfolios. Just two years ago Apple made up just 5% of the S&P 500 index.

Let's look at what equal weighting does. One of the most popular equal-weighted funds is the Invesco S&P 500 Equal Weight ETF (RSP).

If you look at the holdings of RSP, all of the stocks in the fund are at 0.22%, since the fund is equal weighted. This changes the dynamic of the performance of the fund, since no single holding can overtake the others, and performance is equalized.

How Equal Weighted Index Funds Perform

The balance that you get with an equal weighted index fund really comes into play when you chart out performance over time.

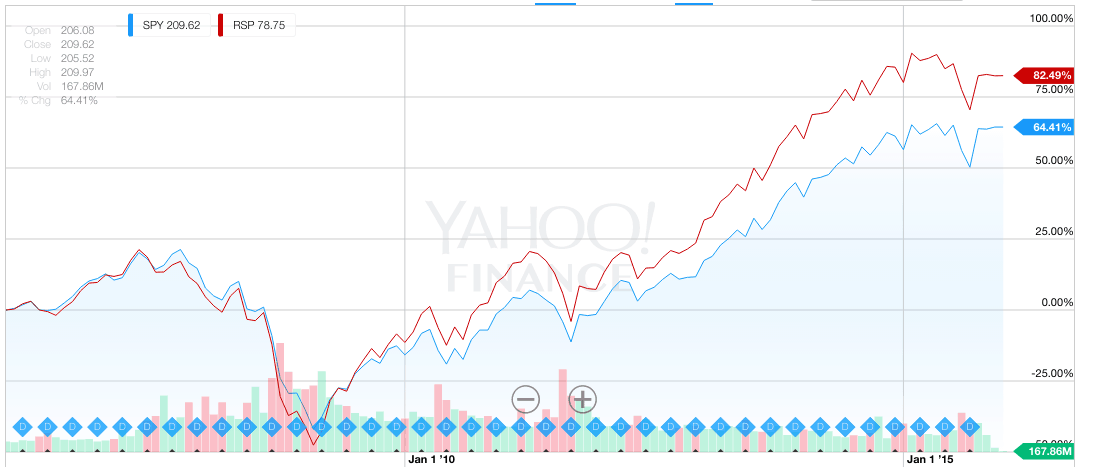

Here is a side-by-side comparison of SPY and RSP from 2005 to 2015.

The red line is RSP, the equal weighted portfolio, and the blue line is SPY, the standard capitalization weighted portfolio.

Over the this decade, RSP has returned 82.49% vs. 64.41% for SPY over the same period.

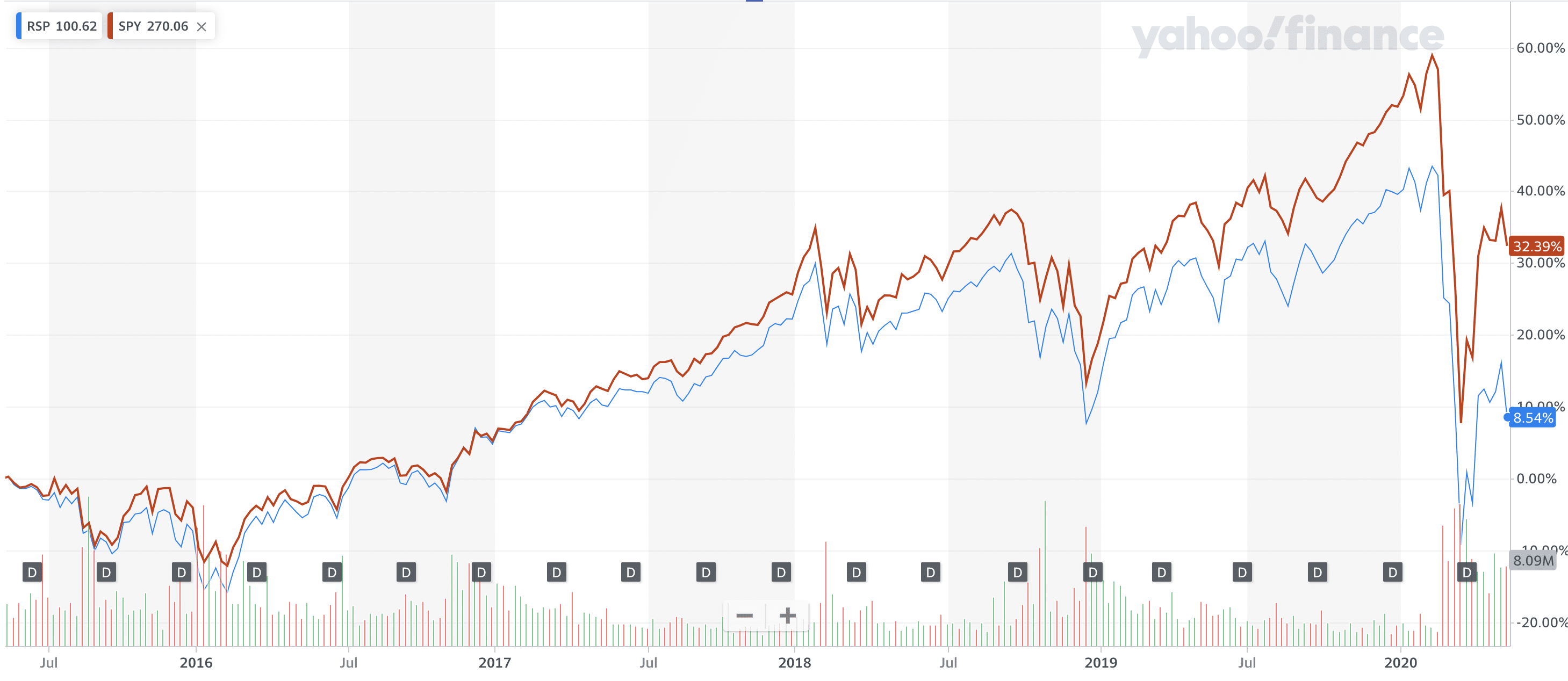

However, if you look at 2015 to 2020, this was arguably driven by technology stocks, and as such, the equal weighted fund underperformed the S&P 500:

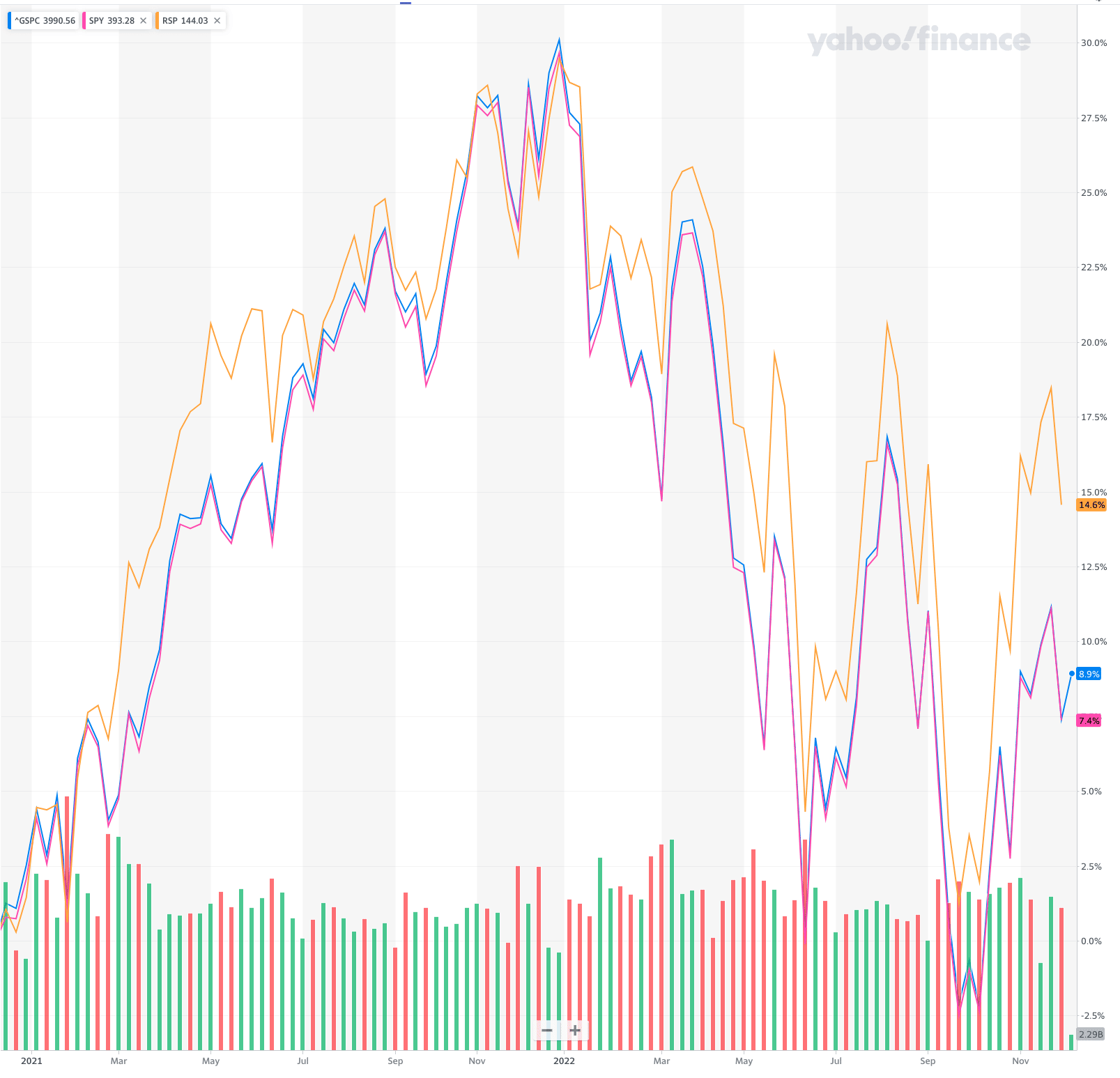

Finally, if you compare just the last two years (2000 through 2022), the equal-weighted fund significantly outperformed the capitalization weighted fund (14.6% return vs. 7.4% return):

The key to this success is balance. At the top, no single holding that may underperform can drag the portfolio down, while at the bottom, faster growing stocks get more weight than in a capitalization-based index - which worked out well for the last five years.

The key is that smaller stocks provide as much growth as bigger stocks - which can work well during some periods, and work against you in other periods.

Drawbacks to Equal Weighted Index Funds

The biggest drawback to equal weighted index funds are higher expense ratios. These funds have higher expenses because they have daily costs of maintaining balance in their portfolio. For example, the EWMC ETF has an expense ratio of 0.538% versus IWR, which has an expense ratio of 0.19%.

While an ETF like SPY will only trade when major changes happen, equal weighted funds have to continually trim overweighted holdings to maintain the balance. Think of it like a daily portfolio rebalancing act.

The second big drawback to equal-weighted funds is that the gap in performance vanishes as you move from large cap funds to mid and small cap funds. In fact, the equal-weighted index funds are basically even at the mid cap and underperform at the small cap level.

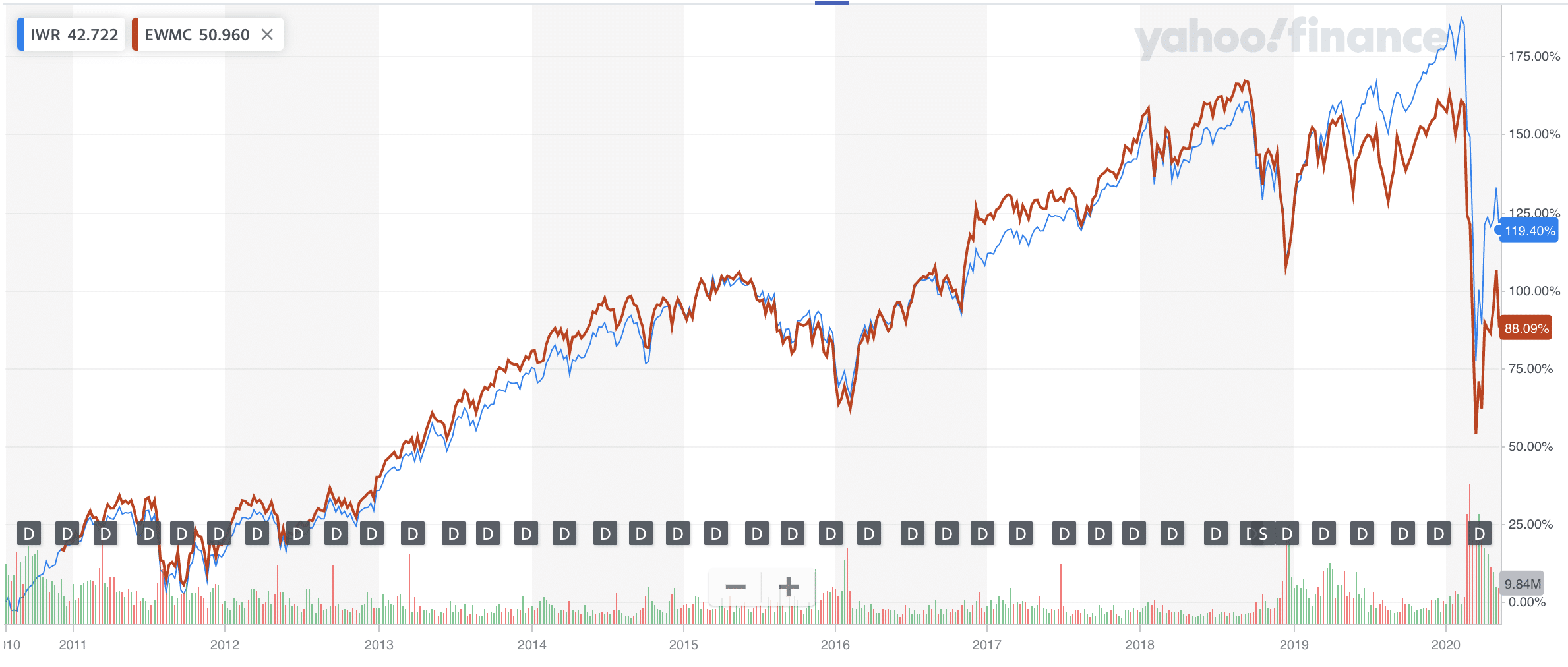

Mid Cap Equal Weighted Funds

Here, we look at the Invesco S&P MidCap 400® Equal Weight ETF (EWMC) vs. the iShares Russell MidCap ETF (IWR). You can see over the last 10 years (total time of fund's existence), performance of the two funds has basically been even, with a slight underperformance of the equal-weighted fund - which was magnified in the current crisis.

Over the period, EWMC returned 88.09% vs. 119.40% for IWR.

Small Cap Equal Weighted Funds

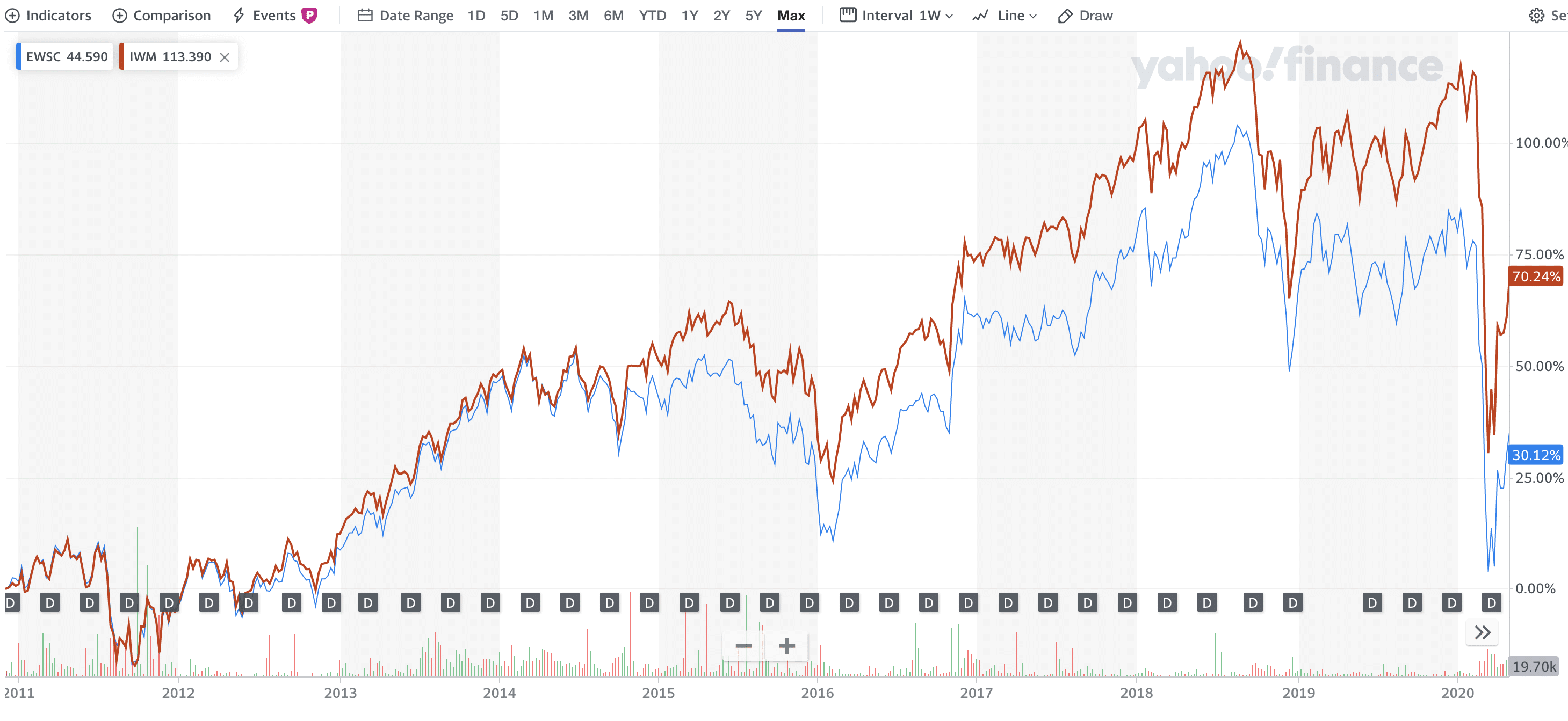

Here, we look at S&P 600 Small Cap Equal Weight ETF (EWSC) vs. the iShares Russell 2000 ETF (IWM). You can see that the equal weighted fund actually underperformed the benchmark index in this case.

Over this period, ERWS returned 30.12% vs. 70.24%% for IWM. That is over 40% underperformance, not including the higher expense ratio.

Lessons on Equal Weighted Index Funds

The biggest lesson learned is that, if you're looking for a large cap index fund, you should consider an equal weighted fund - especially if you're concerned about technology performance. These funds are great for large cap investors because:

- It dampens underperformance of top holdings

- It increases performance of "smaller cap" holdings

- It has a bias towards growth stocks because of the equal weighted

Second, we learned that these rules don't apply to mid cap and small cap index funds for the same reasons. Equal weighted funds are not good investments at the small cap level because:

- Small caps have a tendency towards extreme growth, and you lose that with equal weighting

- Larger holdings in small cap funds are the ones you want to hold, but you lose exposure to

Finally, it's important to keep in mind the higher expenses when investing in equal weighted index funds.

Popular Equal Weighted Index Funds

Here are the most popular equal weighted index funds, in case you're interested in investing.

Large Cap

- RSP - Invesco S&P 500 Equal Weight ETF

- QQEW - First Trust NASDAQ 100 Equal Weight Index ETF

Mid Cap

- EWMC - Invesco S&P MidCap 400 Equal Weight ETF

Small Cap

- EWSC - Invesco SmallCap 600 Equal Weight ETF

Sector ETFs

- Basic Materials - RTM - Invesco S&P 500 Equal Weight Materials ETF

- Consumer Discretionary - RCD - Invesco S&P 500 Equal Weight Consumer Discretionary ETF

- Consumer Staples - RHS - Invesco S&P 500 Equal Weight Consumer Staples ETF

- Energy - RYE - Invesco S&P 500 Equal Weight Energy ETF

- Financial Services - RYF - Invesco S&P 500 Equal Weight Financial Services ETF

- Health Care - RYH - Invesco S&P 500 Equal Weight Health Care ETF

- Industrials - RGI - Invesco S&P 500 Equal Weight Industrials ETF

- Technology - RYT - Invesco S&P 500 Equal Weight Technology ETF

- Utilities - RYU - Invesco S&P 500 Equal Weight Utilities ETF

What are your thoughts on equal weighted index funds? Do you invest in these in your portfolio?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor